Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hey Ltd leased a building from There Ltd on 1 July 2020. The building is in the records of There Ltd at its fair

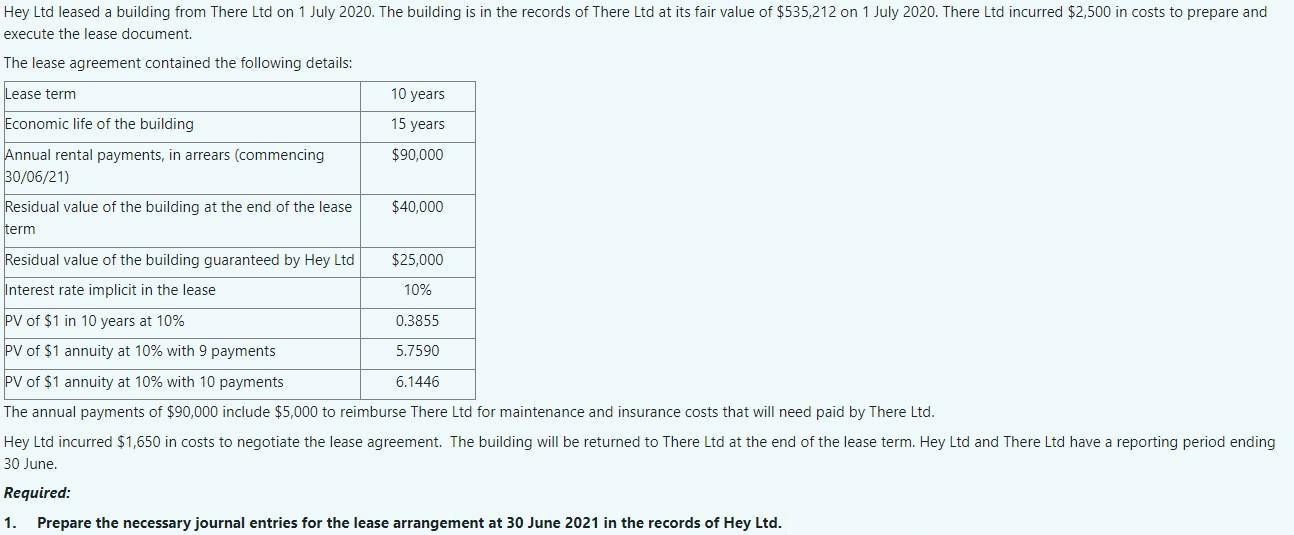

Hey Ltd leased a building from There Ltd on 1 July 2020. The building is in the records of There Ltd at its fair value of $535,212 on 1 July 2020. There Ltd incurred $2,500 in costs to prepare and execute the lease document. The lease agreement contained the following details: Lease term 10 years Economic life of the building 15 years Annual rental payments, in arrears (commencing 30/06/21) $90,000 Residual value of the building at the end of the lease $40,000 term Residual value of the building guaranteed by Hey Ltd $25,000 Interest rate implicit in the lease 10% PV of $1 in 10 years at 10% 0.3855 PV of $1 annuity at 10% with 9 payments 5.7590 PV of $1 annuity at 10% with 10 payments 6.1446 The annual payments of $90,000 include $5,000 to reimburse There Ltd for maintenance and insurance costs that will need paid by There Ltd. Hey Ltd incurred $1,650 in costs to negotiate the lease agreement. The building will be returned to There Ltd at the end of the lease term. Hey Ltd and There Ltd have a reporting period ending 30 June. Required: 1. Prepare the necessary journal entries for the lease arrangement at 30 June 2021 in the records of Hey Ltd.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

lease term 10 years Economic life of bulding 15 years Annual rental Payments 90000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started