hey team i need help eith questions 1 and 6 please thank you

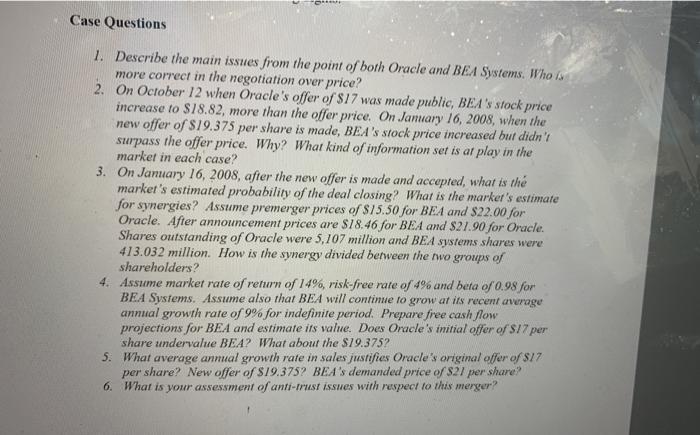

On October 9, 2007, Oracle Corp. made an unsolicited bid to acquire its competitor BEA Systems, Inc. for $6.7 billion cash. The offer valued BEA Systems at $17.00 per share, which represented a 21% premim on the closing price on the day before the offer However, the board of directors of BEA Systems quickly rejected the offer claiming that it significantly undervalued the company. In its statement, the board indicated that BEA Systems would consider every strategic option to maximize shareholders' wealth. That meant BEA System was open to be acquired if it got the right price. The board's statement also stated that BEA Systems was worth $21 per share. Oracle rejected the $21 per share counter offer as too high On October 12, the day the offer was made public, BEA shares jumped to as high as $18.94 and closed at $18.82. The fact that the price jumped above the offe price of $17.00 indicates that the market was anticipating a bidding war that might ubsequently increase the value of BEA, BEA hinted at secking other suitors Other potential suitors include Oracle rivals such as SAP, International Business Machines (IBM) and Hewlett- Packard. In the subsequent months, there were several exchanges of communication between the two companies. BEA was also under pressure from activist invest Carl Icahn, who owned about 13% of its shares, to accept the Oracle offer or get higher bid from others. Oracle on its part indicated that it would not engage in proxy war by taking the offer directly to the shareholders. It stated that if BEA board rejected the offer Oracle would look for other suitable targets In its October 23 letter, Oracle gave an ultimatum to BEA board to accept the offer for otherwise the offer would expire on October 28. In the letter Oracle urged BEA board to sign an acquisition agreement and present to the shareholders for a vote. See Exhibit for Oracle's letter. BEA Systems board responded the same day (Exhibit 2) reiterating its Tejection of the offer and suggesting that Oracle could take the offer directly to the Nhurcholders. Such exchange of letters and public statements continued for the Icahn, who owned about 13% of its shares, to accept the Oracle offer or get a higher bid from others. Oracle on its part indicated that it would not engage in proxy war by taking the offer directly to the shareholders. It stated that if BEA board rejected the offer, Oracle would look for other suitable targets. In its October 23 letter, Oracle gave an ultimatum to BEA board to accept the offer for otherwise the offer would expire on October 28. In the letter Oracle urged BEA board to sign an acquisition agreement and present to the shareholders for a vote. Sve Exhibiti for Oracle's letter. BEA Systems board responded the same day (Exhibit 2) reiterating its rejection of the offer and suggesting that Oracle could take the offer directly to the shareholders. Such exchange of letters and public statements continued for the subsequent days, weeks and months. BEA's stock price declined as the deadline of October 28 came and passed. See Exhibit 3 for stock price reactions to the offer and subsequent communications, Larry Ellison, Oracle CEO, made a public statement in November in which he stated that if BEA wanted to stay independent, they did a good job. He further stated that should Oracle make another attempt to buy BEA, it would be at a lower offer price than the original $17 per share. He claimed the fact that no other company showed interest indicated the Oracle offer of $17 per shure was generous Carl learn also stepped up his pressure on BEA. He threatened to start a proxy warto replace the board of directors or even bring class action against the company. He demanded that BEA accept Orucle's offer or find a better offer from other suitors. BEA offered Icalin to examine its books under confidentiality agreement without offering the same to other shareholders. Icahn sobered up after secretly examining the books. This gave hope and credence to BEA's insistence on S21 per share. Many analysts also expected Oracle to come back with a higher offer, even if it might not be as high as $21. Compounding the problem for BEA was that it was not current in its reporting requirements. It was supposed to file all quarterly and annual reports with the Securities und Exchange Commission by the end of December 2007. BEA requested an extension to the first week of the New Year. The SEC threatened penalty and delisting from stock exchanges if the company would fail to be current by the end of January 2008. BEA filed its reports and became current in January. There was no surprise in the reports. BEA adjusted past reports as far back as 2005. With the new information and behind the curtains negotiations, Oracle made a new cash offer of $19.375 per share on January 16, 2008. BEA accepted the offer and its stock price jumped from $15.58 on 1/15/08 to close at S18.46 on 1/16/08. Shortly afterwards, the two companies entered into a mandatory definitive agreement to scal the deal. The party that might withdraw from the deal would pay a penalty of $250 million 1.21 BEA Systems Business Description! BEA Systems was incorporated in 1995. Its primary SIC code is 7372 (prepackaged software) and secondary SIC code is 7371 (computer programming services) BEA Systems engaged in enterprise application and service infrastructure software. Its BEA Tuxedos product family, which is an application infrastructure platform for large transactional processing systems for C.CH and COBOL systems, and BEA WebLogic product family, which consists of application infrastructure software for Java applications, perform functions such as transaction processing, clustering, caching. Ioad balancing, failover, security, integration and management features, all of which provide high levels of reliability, availability, scalability and performance for enterprise applications BEA's product focus has three main elements: (1) selling a broad application infrastructure platform, with the individual elements tightly integrated into a single product, but also available for purchase as individul units, (2) extending application infrastructure into emerging use cases, and selling a broad service infrastructure platform, with the individual elements tightly integrated into a single platform, but available for purchase as individual units. The company's modular but tightly integrated approach allows it to service the application and service infrastructure markets by enabling customers to buy just the modules needed for a specific project then to casily unify and extend those modules into a platform as they deploy subsequent projects, or to huy the entire platform at once. manufacturing, retail, airlines, pharmaceuticals, package delivery and insurance. Its products serve as a platform for systems such as billing, provisioning, customer service, electronic funds transfer, ATM networks, securities trading and settlement, online banking, Internet sales, inventory management, supply chain management, enterprise resource planning, scheduling, logistics and hotel, airline and car rental reservations. In addition, BEA offers associated customer support, training and consulting services, Financially, BEA Systems has been successful. I expanded globally through both internal growth and series of acquisitions. Its compound average annual revenue growth rate over the past five years is 9%. The services revenue grew faster than the license fees revenue and the trend seem to continue for the foreseeable future. BEA does not pay dividends See Exhibit 4 for BEA's financial statements. Exhibit presents BEA'S competitors and their revente market share. The dominant company in the sub-industry is EDS (Electronic Data Systems) with market share of 61% followed by Perot Systems Corp with 7% and Cognizant Technology Solutions Corp (CTS) with 69market share BEA holds fourth place with market share of 4% Oracle Corporation Oracle was founded in 1977 and has more than 30 years of operating history by 2007 Like BEA Systems it grew internally as well as externally through a series of acquisitions. Its more recent acquisitions included loopleSoft, Sichel, and SPL World Group. Larry Ellison, CEO, and his management team are reputed for successful acquisitions and integrations. Many consider the merger of BEA Systems with Oracle perfect match Oracle Corporation, an enterprise software company, engages in the development manufacture, distribution, servicing and marketing of database, middleware, and application software. The company operates in five moments New Software License Software license Updates and Products Support Consulting, On Demand, and Education. The New Software Licenses ciment provides licemes for database and middleware software, including database management software, application server software, analytics, development tools, and collaboration software and applications software, which provides enterprise information for the financials, human resources, maintenance management, manufacturing, marketing product lifecycle management, procurement, projects, and supply chain planning sectors. The Software License Updates and Products Support segment provides customers with rights to specified software product upgrades and maintenance releases and Internet access to technical content, as well as Internet and telephone access to technical support persoanel. The Consi sement design, implements, deploys, and upgrades database, middleware, and application software. The On Demand segment provides multifcatured software and hardware management, and maintenance services for clients deploying itsuse middleware, and application software. This segment also provides support assistance, technical account management, configuration and performance analyse personalired support, malon-site technical services, and other related series The Education scient offers online courses and sell puced media training on CD-ROM The company distributes its products and services to resellers, system integrators/implementers, consultants, education providers, Internet service providers, network integrators, and independent software vendors. Oracle's primary SIC code is 7372 (prepackaged software) and secondary SIC codes are 7373 (computer integrated systems design), 5045 (computers, peripherals & software) and 6719 (holding companies, nec). The major competitors and their revenue market share are presented in Exhibit 6. Oracle is second with 20% market share after the industry giant, Microsoft Corporation with 55% market share. CA, Inc. is a distant third with market share of 4%. Acquisition of BEA is expected to strengthen Oracle's position in the industry. Although Oracle and BEA Systems have some overlaps in products, there is significant difference in their markets. Still there was a concern that they may face tough antitrust case against their merger. Oracle has been in sound financial condition. Its annual revenue was around $20 billion It also had a load of cash in its balance sheet. In spite of the economic slowdown, Oracle beat Wall Street expectations in its fourth quarter report and lifted the tech sector. In spite of these, it would issue a $5 billion note to finance the acquisition of BEA Systems See Exhibit 7 for Oracle's financial highlights. Case Questions 1. Describe the main issues from the point of both Oracle and BEA Systems. Who is more correct in the negotiation over price? 2. On October 12 when Oracle's offer of $17 was made public, BEA's stock price increase to $18.82, more than the offer price. On January 16, 2008, when the new offer of $19.375 per share is made, BEA's stock price increased but didn'! surpass the offer price. Why? What kind of information set is af play in the market in each case? 3. On January 16, 2008, after the new offer is made and accepted, what is the market's estimated probability of the deal closing? What is the market's estimate for synergies? Assume premerger prices of $15.50 for BEA and $22.00 for Oracle. After announcement prices are $18.46 for BEA and $27.90 for Oracle Shares outstanding of Oracle were 5,107 million and BEA systems shares were 413.032 million. How is the synergy divided between the two groups of shareholders? 4. Assume market rate of return of 14%, risk-free rate of 4% and beta of 0.98 for BEA Systems. Assume also that BEA will continue to grow at its recent average annual growth rate of 9% for indefinite period. Prepare free cash flow projections for BEA and estimate its value. Does Oracle's initial offer of $17 per share undervalue BEA? What about the $19.3752 5. What average annual growth rate in sales justifies Oracle's original offer of $17 per share? New offer of $19.375? BEA's demanded price of $27 per share! 6. What is your assessment of anti-trust issues with respect to this merger? On October 9, 2007, Oracle Corp. made an unsolicited bid to acquire its competitor BEA Systems, Inc. for $6.7 billion cash. The offer valued BEA Systems at $17.00 per share, which represented a 21% premim on the closing price on the day before the offer However, the board of directors of BEA Systems quickly rejected the offer claiming that it significantly undervalued the company. In its statement, the board indicated that BEA Systems would consider every strategic option to maximize shareholders' wealth. That meant BEA System was open to be acquired if it got the right price. The board's statement also stated that BEA Systems was worth $21 per share. Oracle rejected the $21 per share counter offer as too high On October 12, the day the offer was made public, BEA shares jumped to as high as $18.94 and closed at $18.82. The fact that the price jumped above the offe price of $17.00 indicates that the market was anticipating a bidding war that might ubsequently increase the value of BEA, BEA hinted at secking other suitors Other potential suitors include Oracle rivals such as SAP, International Business Machines (IBM) and Hewlett- Packard. In the subsequent months, there were several exchanges of communication between the two companies. BEA was also under pressure from activist invest Carl Icahn, who owned about 13% of its shares, to accept the Oracle offer or get higher bid from others. Oracle on its part indicated that it would not engage in proxy war by taking the offer directly to the shareholders. It stated that if BEA board rejected the offer Oracle would look for other suitable targets In its October 23 letter, Oracle gave an ultimatum to BEA board to accept the offer for otherwise the offer would expire on October 28. In the letter Oracle urged BEA board to sign an acquisition agreement and present to the shareholders for a vote. See Exhibit for Oracle's letter. BEA Systems board responded the same day (Exhibit 2) reiterating its Tejection of the offer and suggesting that Oracle could take the offer directly to the Nhurcholders. Such exchange of letters and public statements continued for the Icahn, who owned about 13% of its shares, to accept the Oracle offer or get a higher bid from others. Oracle on its part indicated that it would not engage in proxy war by taking the offer directly to the shareholders. It stated that if BEA board rejected the offer, Oracle would look for other suitable targets. In its October 23 letter, Oracle gave an ultimatum to BEA board to accept the offer for otherwise the offer would expire on October 28. In the letter Oracle urged BEA board to sign an acquisition agreement and present to the shareholders for a vote. Sve Exhibiti for Oracle's letter. BEA Systems board responded the same day (Exhibit 2) reiterating its rejection of the offer and suggesting that Oracle could take the offer directly to the shareholders. Such exchange of letters and public statements continued for the subsequent days, weeks and months. BEA's stock price declined as the deadline of October 28 came and passed. See Exhibit 3 for stock price reactions to the offer and subsequent communications, Larry Ellison, Oracle CEO, made a public statement in November in which he stated that if BEA wanted to stay independent, they did a good job. He further stated that should Oracle make another attempt to buy BEA, it would be at a lower offer price than the original $17 per share. He claimed the fact that no other company showed interest indicated the Oracle offer of $17 per shure was generous Carl learn also stepped up his pressure on BEA. He threatened to start a proxy warto replace the board of directors or even bring class action against the company. He demanded that BEA accept Orucle's offer or find a better offer from other suitors. BEA offered Icalin to examine its books under confidentiality agreement without offering the same to other shareholders. Icahn sobered up after secretly examining the books. This gave hope and credence to BEA's insistence on S21 per share. Many analysts also expected Oracle to come back with a higher offer, even if it might not be as high as $21. Compounding the problem for BEA was that it was not current in its reporting requirements. It was supposed to file all quarterly and annual reports with the Securities und Exchange Commission by the end of December 2007. BEA requested an extension to the first week of the New Year. The SEC threatened penalty and delisting from stock exchanges if the company would fail to be current by the end of January 2008. BEA filed its reports and became current in January. There was no surprise in the reports. BEA adjusted past reports as far back as 2005. With the new information and behind the curtains negotiations, Oracle made a new cash offer of $19.375 per share on January 16, 2008. BEA accepted the offer and its stock price jumped from $15.58 on 1/15/08 to close at S18.46 on 1/16/08. Shortly afterwards, the two companies entered into a mandatory definitive agreement to scal the deal. The party that might withdraw from the deal would pay a penalty of $250 million 1.21 BEA Systems Business Description! BEA Systems was incorporated in 1995. Its primary SIC code is 7372 (prepackaged software) and secondary SIC code is 7371 (computer programming services) BEA Systems engaged in enterprise application and service infrastructure software. Its BEA Tuxedos product family, which is an application infrastructure platform for large transactional processing systems for C.CH and COBOL systems, and BEA WebLogic product family, which consists of application infrastructure software for Java applications, perform functions such as transaction processing, clustering, caching. Ioad balancing, failover, security, integration and management features, all of which provide high levels of reliability, availability, scalability and performance for enterprise applications BEA's product focus has three main elements: (1) selling a broad application infrastructure platform, with the individual elements tightly integrated into a single product, but also available for purchase as individul units, (2) extending application infrastructure into emerging use cases, and selling a broad service infrastructure platform, with the individual elements tightly integrated into a single platform, but available for purchase as individual units. The company's modular but tightly integrated approach allows it to service the application and service infrastructure markets by enabling customers to buy just the modules needed for a specific project then to casily unify and extend those modules into a platform as they deploy subsequent projects, or to huy the entire platform at once. manufacturing, retail, airlines, pharmaceuticals, package delivery and insurance. Its products serve as a platform for systems such as billing, provisioning, customer service, electronic funds transfer, ATM networks, securities trading and settlement, online banking, Internet sales, inventory management, supply chain management, enterprise resource planning, scheduling, logistics and hotel, airline and car rental reservations. In addition, BEA offers associated customer support, training and consulting services, Financially, BEA Systems has been successful. I expanded globally through both internal growth and series of acquisitions. Its compound average annual revenue growth rate over the past five years is 9%. The services revenue grew faster than the license fees revenue and the trend seem to continue for the foreseeable future. BEA does not pay dividends See Exhibit 4 for BEA's financial statements. Exhibit presents BEA'S competitors and their revente market share. The dominant company in the sub-industry is EDS (Electronic Data Systems) with market share of 61% followed by Perot Systems Corp with 7% and Cognizant Technology Solutions Corp (CTS) with 69market share BEA holds fourth place with market share of 4% Oracle Corporation Oracle was founded in 1977 and has more than 30 years of operating history by 2007 Like BEA Systems it grew internally as well as externally through a series of acquisitions. Its more recent acquisitions included loopleSoft, Sichel, and SPL World Group. Larry Ellison, CEO, and his management team are reputed for successful acquisitions and integrations. Many consider the merger of BEA Systems with Oracle perfect match Oracle Corporation, an enterprise software company, engages in the development manufacture, distribution, servicing and marketing of database, middleware, and application software. The company operates in five moments New Software License Software license Updates and Products Support Consulting, On Demand, and Education. The New Software Licenses ciment provides licemes for database and middleware software, including database management software, application server software, analytics, development tools, and collaboration software and applications software, which provides enterprise information for the financials, human resources, maintenance management, manufacturing, marketing product lifecycle management, procurement, projects, and supply chain planning sectors. The Software License Updates and Products Support segment provides customers with rights to specified software product upgrades and maintenance releases and Internet access to technical content, as well as Internet and telephone access to technical support persoanel. The Consi sement design, implements, deploys, and upgrades database, middleware, and application software. The On Demand segment provides multifcatured software and hardware management, and maintenance services for clients deploying itsuse middleware, and application software. This segment also provides support assistance, technical account management, configuration and performance analyse personalired support, malon-site technical services, and other related series The Education scient offers online courses and sell puced media training on CD-ROM The company distributes its products and services to resellers, system integrators/implementers, consultants, education providers, Internet service providers, network integrators, and independent software vendors. Oracle's primary SIC code is 7372 (prepackaged software) and secondary SIC codes are 7373 (computer integrated systems design), 5045 (computers, peripherals & software) and 6719 (holding companies, nec). The major competitors and their revenue market share are presented in Exhibit 6. Oracle is second with 20% market share after the industry giant, Microsoft Corporation with 55% market share. CA, Inc. is a distant third with market share of 4%. Acquisition of BEA is expected to strengthen Oracle's position in the industry. Although Oracle and BEA Systems have some overlaps in products, there is significant difference in their markets. Still there was a concern that they may face tough antitrust case against their merger. Oracle has been in sound financial condition. Its annual revenue was around $20 billion It also had a load of cash in its balance sheet. In spite of the economic slowdown, Oracle beat Wall Street expectations in its fourth quarter report and lifted the tech sector. In spite of these, it would issue a $5 billion note to finance the acquisition of BEA Systems See Exhibit 7 for Oracle's financial highlights. Case Questions 1. Describe the main issues from the point of both Oracle and BEA Systems. Who is more correct in the negotiation over price? 2. On October 12 when Oracle's offer of $17 was made public, BEA's stock price increase to $18.82, more than the offer price. On January 16, 2008, when the new offer of $19.375 per share is made, BEA's stock price increased but didn'! surpass the offer price. Why? What kind of information set is af play in the market in each case? 3. On January 16, 2008, after the new offer is made and accepted, what is the market's estimated probability of the deal closing? What is the market's estimate for synergies? Assume premerger prices of $15.50 for BEA and $22.00 for Oracle. After announcement prices are $18.46 for BEA and $27.90 for Oracle Shares outstanding of Oracle were 5,107 million and BEA systems shares were 413.032 million. How is the synergy divided between the two groups of shareholders? 4. Assume market rate of return of 14%, risk-free rate of 4% and beta of 0.98 for BEA Systems. Assume also that BEA will continue to grow at its recent average annual growth rate of 9% for indefinite period. Prepare free cash flow projections for BEA and estimate its value. Does Oracle's initial offer of $17 per share undervalue BEA? What about the $19.3752 5. What average annual growth rate in sales justifies Oracle's original offer of $17 per share? New offer of $19.375? BEA's demanded price of $27 per share! 6. What is your assessment of anti-trust issues with respect to this merger