Answered step by step

Verified Expert Solution

Question

1 Approved Answer

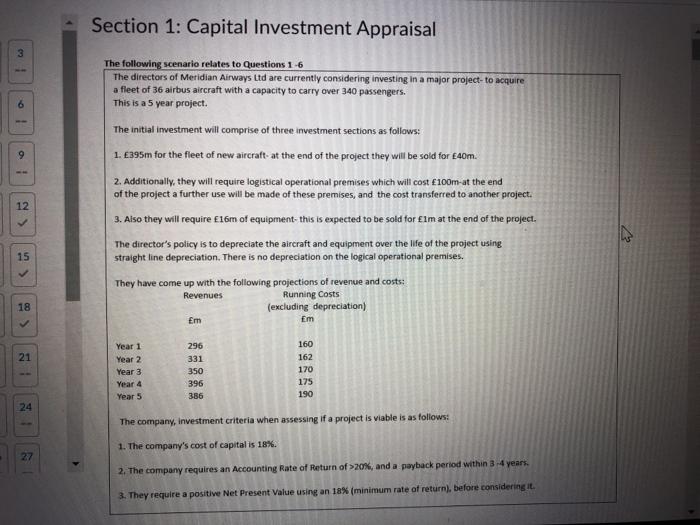

Hey the first picture the section is basically the scenario and the question is based of that. Section 1: Capital Investment Appraisal 3 9 The

Hey the first picture the section is basically the scenario and the question is based of that.

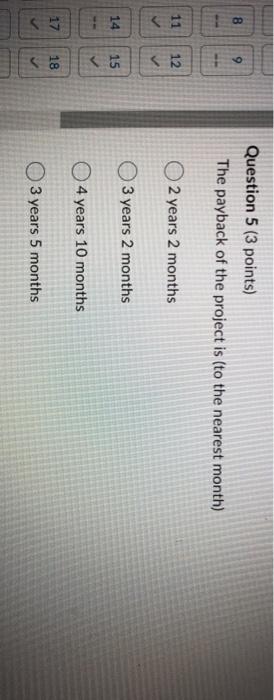

Section 1: Capital Investment Appraisal 3 9 The following scenario relates to Questions 1-6 The directors of Meridian Airways Ltd are currently considering investing in a major project to acquire a fleet of 36 airbus aircraft with a capacity to carry over 340 passengers. This is a 5 year project The initial investment will comprise of three investment sections as follows: 1. 395m for the fleet of new aircraft at the end of the project they will be sold for 40m. 2. Additionally, they will require logistical operational premises which will cost 100m-at the end of the project a further use will be made of these premises, and the cost transferred to another project: 3. Also they will require 16m of equipment- this is expected to be sold for Elm at the end of the project. The director's policy is to depreciate the aircraft and equipment over the life of the project using straight line depreciation. There is no depreciation on the logical operational premises. They have come up with the following projections of revenue and costs: Revenues Running Costs (excluding depreciation) Em Em 12 15 18 21 Year 1 Year 2 Year 3 Year 4 Year 5 296 331 350 396 386 160 162 170 175 190 24 The company, investment criteria when assessing if a project is viable is as follows: 1. The company's cost of capital is 18%. 27 2. The company requires an Accounting Rate of Return of >20%, and a payback period within 3-4 years. 3. They require a positive Net Present Value using an 18% (minimum rate of return), before considering it. Question 5 (3 points) The payback of the project is (to the nearest month) 11 12 2 years 2 months 3 years 2 months 14 15 4 years 10 months 17 18 3 years 5 months ) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started