hey there please make sure your table is exactly the same so i won't get confused placing the numbers in the right place.

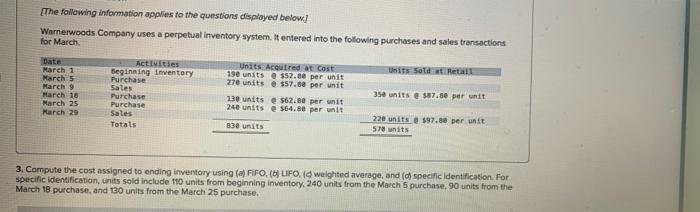

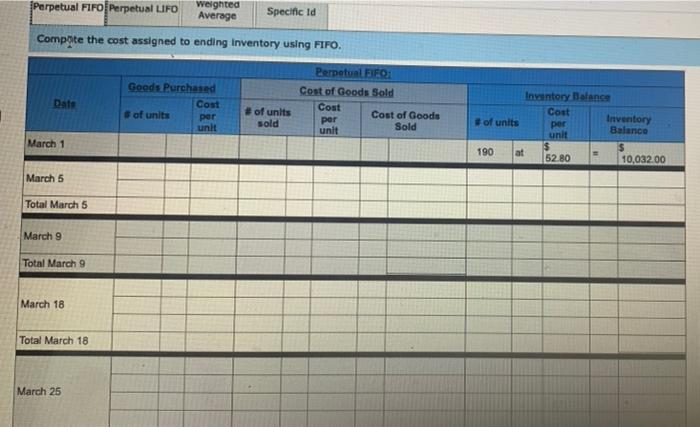

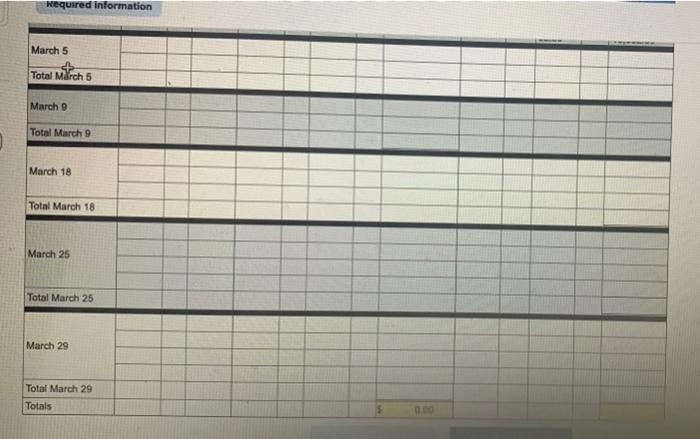

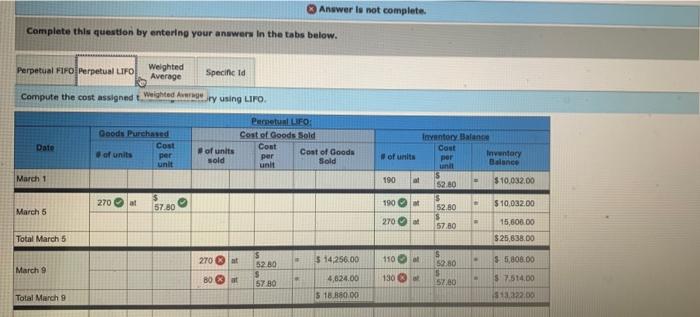

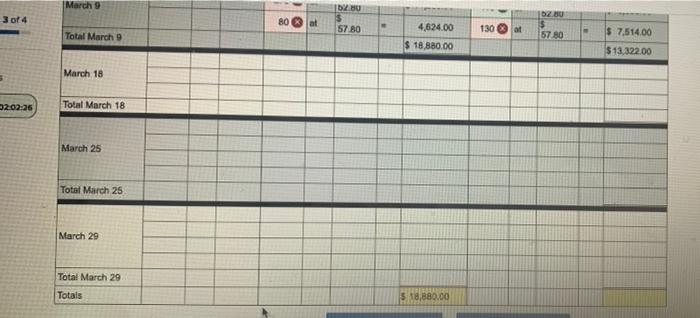

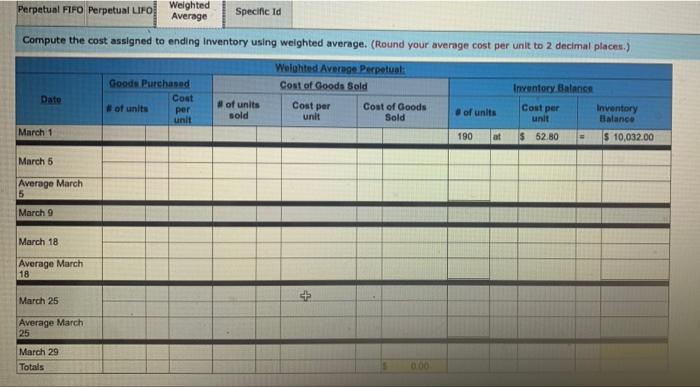

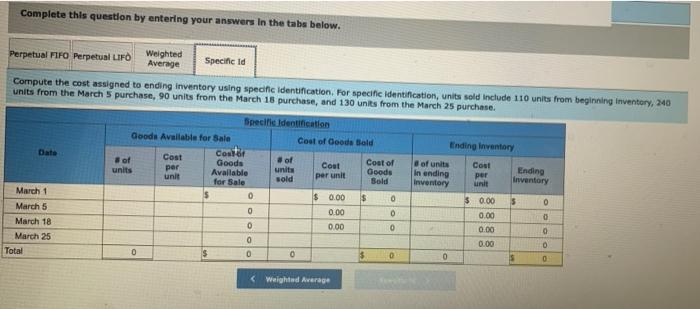

[The following information applies to the questions displayed below] Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March Uits Sold Date March 1 March 5 March 9 March 18 March 25 March 29 Activities Beginning inventory Purchase Sales Purchase Purchase Sales Totals Units Acquired at Cost 190 units 552.00 per unit 270 units $57.00 per unit 130 units 562.00 per unit e 240 units @ $64.80 per unit 350 unitse 87.00 per unit 838 units 220 units @ $97.88 per unit 578 units 3. Compute the cost assigned to ending inventory using (FIFO, (LIFO. I weighted average, and specific identification For specific identification units sold include 110 units from beginning inventory 240 units from the March 5 purchase. 90 units from the March 18 purchase, and 130 units from the March 25 purchase. Perpetual FIFO Perpetual LIFO weighted Average Specific id Compote the cost assigned to ending Inventory using FIFO. Date Goods Purchased Cost of units per unit Perpetual FIFO: Cost of Goods Sold Cost Cost of Goods per unit Sold # of units sold Inventory Balance Cost of units Inventory per unit Balance $ 190 $ 52.80 10,032.00 March 1 March 5 Total March 5 March 9 Total March 9 March 18 Total March 18 March 25 Required information March 5 Total Mrch 5 March 9 Total March 9 March 18 Total March 18 March 25 Total March 25 March 29 Total March 29 Totals Answer is not complete Complete this question by entering your answers in the tabs below. Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned Wighted for ry using Liro Date Goods Purchased Cost of units unit Perpetual LIFO: Cost of Goods Sold Cost per Cost of Goods Sold unit per of units sold of units Inventory Balance Cout per Inventory unit Balance $ 52.60 $10.032.00 March 1 190 270 > 190 57.80 March 5 $10.032.00 270 52.80 $ 57.80 15,608.00 $25,638,00 Total March 5 270 $ 14,256.00 110 5280 $5,808.00 52.80 March 9 80 at 57.80 130 5720 4,824.00 5 18.380.00 $ 7.514.00 13.222.00 Total March 9 March 9 . Z BU 3 of 4 80 at 57.80 4,624.00 130 Total March 9 57 80 $ 18,880.00 $ 7,514.00 $ 13,322.00 March 18 5 0202:26 Total March 18 March 25 Total March 25 March 29 Total March 29 Totals $ 18,880.00 Perpetual FIFO Perpetual LIFO Weighted Average Specific id Compute the cost assigned to ending inventory using weighted average. (Round your average cost per unit to 2 decimal places.) Welahted Average Perpetual Goods Purchased Cost of Goods Sold Inventory Balanse Cost # of units of units Cost per per Cost of Goods Cost per Inventory sold unit of units unit Sold unit Balance March 1 190 at $ 52.00 $ 10,032.00 Date March 5 Average March 5 March 9 March 18 Average March 18 + March 25 Average March 25 March 29 Totals 0.00 Complete this question by entering your answers in the tabs below. Perpetual Piro Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to ending inventory using specific identification. For specific identification, units sold include 110 units from beginning inventory, 240 units from the March 5 purchase, 90 units from the March 18 purchase, and 130 units from the March 25 purchase. Beece Identification Goods Available for Sale Coat of Goods Bald Ending Inventory Date Cositor of Cost #of Goods Cost of per Cost of units units Cout unit Available Goods unit In ending Ending per unit per sold for Sale Bold Inventory Inventory unit March 1 0 $ 0.00 $ $ 0.00 5 0 March 5 0 0.00 0.00 March 18 0 0.00 0.00 0 March 25 0 0.00 Total 0 $ 0 0 $ 0 0 0 0 OOO Ooo