Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hfac232-1 please help Express Couriers (Pty) Ltd is a global leader in the logistics industry. The entity specialises in international shipping, courier services and transportation.

hfac232-1 please help

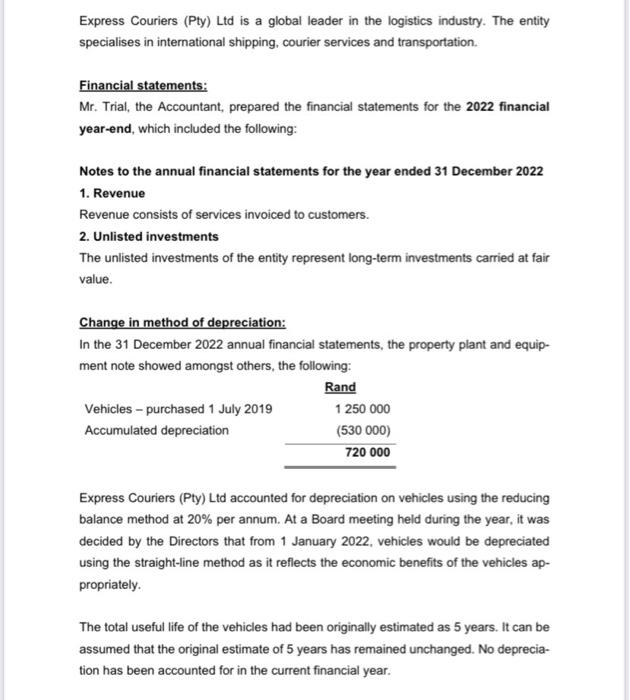

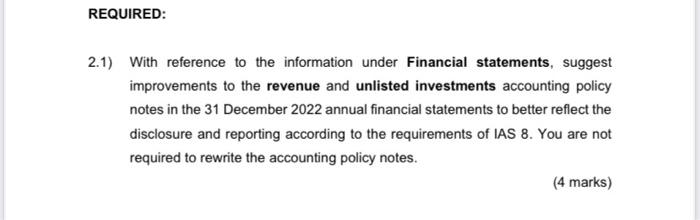

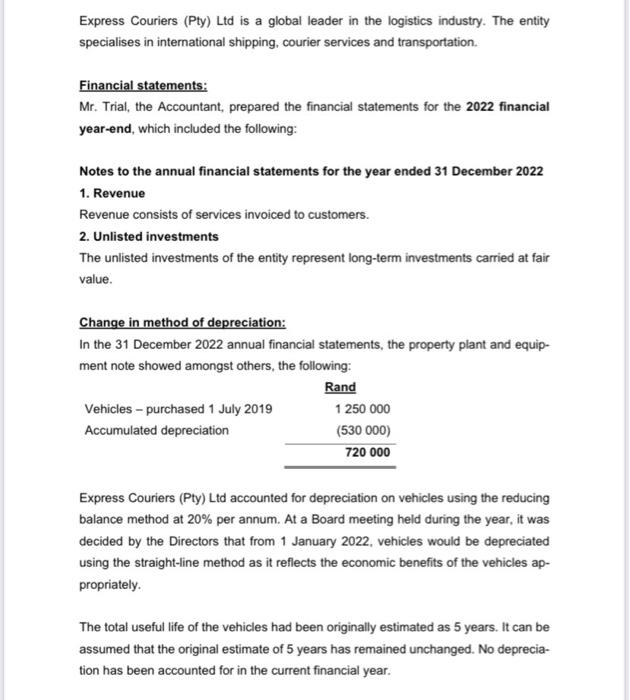

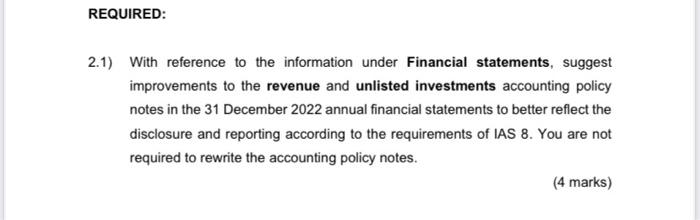

Express Couriers (Pty) Ltd is a global leader in the logistics industry. The entity specialises in international shipping, courier services and transportation. Financial statements: Mr. Trial, the Accountant, prepared the financial statements for the 2022 financial year-end, which included the following: Notes to the annual financial statements for the year ended 31 December 2022 1. Revenue Revenue consists of services invoiced to customers. 2. Unlisted investments The unlisted investments of the entity represent long-term investments carried at fair value. Change in method of depreciation: In the 31 December 2022 annual financial statements, the property plant and equipment note showed amongst others, the following: Express Couriers (Pty) Ltd accounted for depreciation on vehicles using the reducing balance method at 20% per annum. At a Board meeting held during the year, it was decided by the Directors that from 1 January 2022, vehicles would be depreciated using the straight-line method as it reflects the economic benefits of the vehicles appropriately. The total useful life of the vehicles had been originally estimated as 5 years. It can be assumed that the original estimate of 5 years has remained unchanged. No depreciation has been accounted for in the current financial year. 1) With reference to the information under Financial statements, suggest improvements to the revenue and unlisted investments accounting policy notes in the 31 December 2022 annual financial statements to better reflect the disclosure and reporting according to the requirements of IAS 8 . You are not required to rewrite the accounting policy notes. Express Couriers (Pty) Ltd is a global leader in the logistics industry. The entity specialises in international shipping, courier services and transportation. Financial statements: Mr. Trial, the Accountant, prepared the financial statements for the 2022 financial year-end, which included the following: Notes to the annual financial statements for the year ended 31 December 2022 1. Revenue Revenue consists of services invoiced to customers. 2. Unlisted investments The unlisted investments of the entity represent long-term investments carried at fair value. Change in method of depreciation: In the 31 December 2022 annual financial statements, the property plant and equipment note showed amongst others, the following: Express Couriers (Pty) Ltd accounted for depreciation on vehicles using the reducing balance method at 20% per annum. At a Board meeting held during the year, it was decided by the Directors that from 1 January 2022, vehicles would be depreciated using the straight-line method as it reflects the economic benefits of the vehicles appropriately. The total useful life of the vehicles had been originally estimated as 5 years. It can be assumed that the original estimate of 5 years has remained unchanged. No depreciation has been accounted for in the current financial year. 1) With reference to the information under Financial statements, suggest improvements to the revenue and unlisted investments accounting policy notes in the 31 December 2022 annual financial statements to better reflect the disclosure and reporting according to the requirements of IAS 8 . You are not required to rewrite the accounting policy notes

Express Couriers (Pty) Ltd is a global leader in the logistics industry. The entity specialises in international shipping, courier services and transportation. Financial statements: Mr. Trial, the Accountant, prepared the financial statements for the 2022 financial year-end, which included the following: Notes to the annual financial statements for the year ended 31 December 2022 1. Revenue Revenue consists of services invoiced to customers. 2. Unlisted investments The unlisted investments of the entity represent long-term investments carried at fair value. Change in method of depreciation: In the 31 December 2022 annual financial statements, the property plant and equipment note showed amongst others, the following: Express Couriers (Pty) Ltd accounted for depreciation on vehicles using the reducing balance method at 20% per annum. At a Board meeting held during the year, it was decided by the Directors that from 1 January 2022, vehicles would be depreciated using the straight-line method as it reflects the economic benefits of the vehicles appropriately. The total useful life of the vehicles had been originally estimated as 5 years. It can be assumed that the original estimate of 5 years has remained unchanged. No depreciation has been accounted for in the current financial year. 1) With reference to the information under Financial statements, suggest improvements to the revenue and unlisted investments accounting policy notes in the 31 December 2022 annual financial statements to better reflect the disclosure and reporting according to the requirements of IAS 8 . You are not required to rewrite the accounting policy notes. Express Couriers (Pty) Ltd is a global leader in the logistics industry. The entity specialises in international shipping, courier services and transportation. Financial statements: Mr. Trial, the Accountant, prepared the financial statements for the 2022 financial year-end, which included the following: Notes to the annual financial statements for the year ended 31 December 2022 1. Revenue Revenue consists of services invoiced to customers. 2. Unlisted investments The unlisted investments of the entity represent long-term investments carried at fair value. Change in method of depreciation: In the 31 December 2022 annual financial statements, the property plant and equipment note showed amongst others, the following: Express Couriers (Pty) Ltd accounted for depreciation on vehicles using the reducing balance method at 20% per annum. At a Board meeting held during the year, it was decided by the Directors that from 1 January 2022, vehicles would be depreciated using the straight-line method as it reflects the economic benefits of the vehicles appropriately. The total useful life of the vehicles had been originally estimated as 5 years. It can be assumed that the original estimate of 5 years has remained unchanged. No depreciation has been accounted for in the current financial year. 1) With reference to the information under Financial statements, suggest improvements to the revenue and unlisted investments accounting policy notes in the 31 December 2022 annual financial statements to better reflect the disclosure and reporting according to the requirements of IAS 8 . You are not required to rewrite the accounting policy notes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started