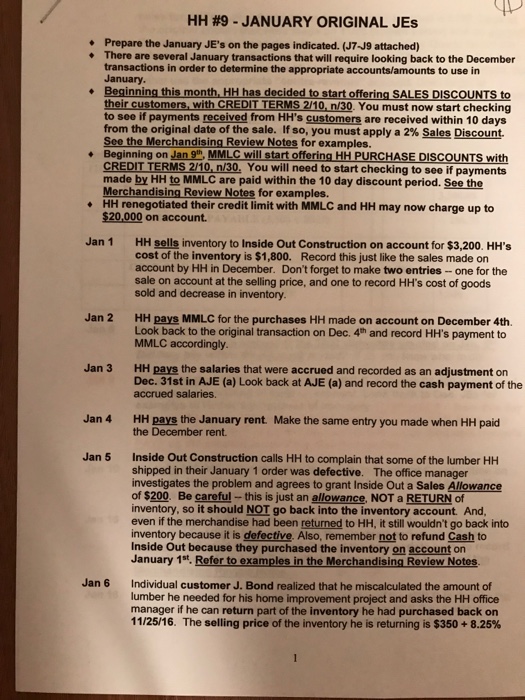

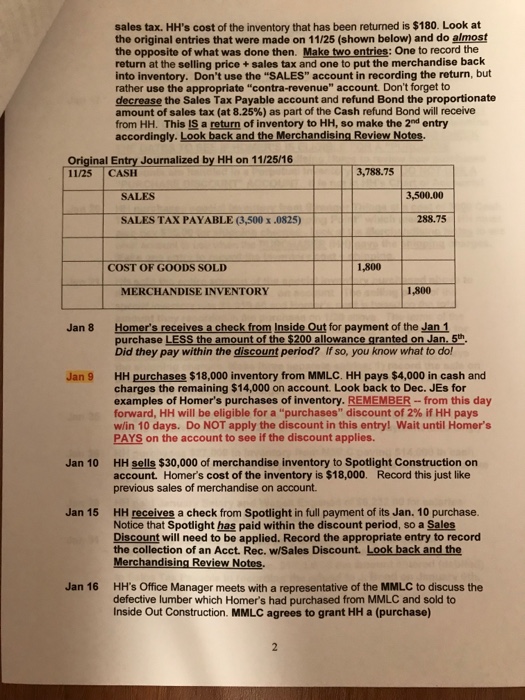

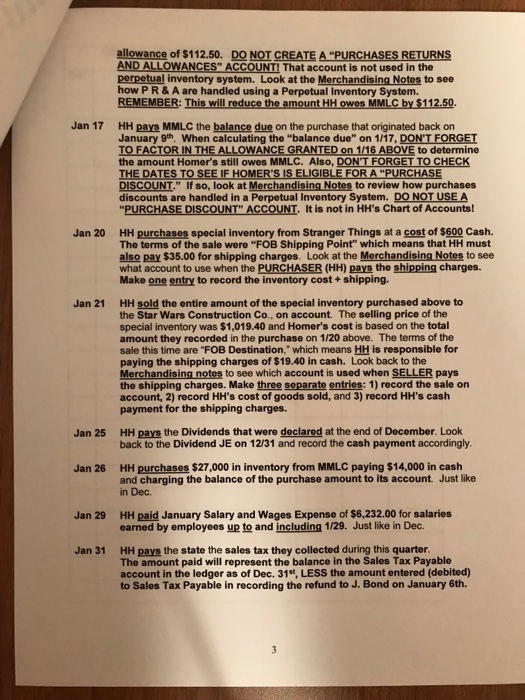

HH #9-JANUARY ORIGINAL JES Prepare the January JE's on the pages indicated. (J7-J9 attached) There are several January transactions that will require looking back to the December transactions in order to determine the appropriate accounts/amounts to use in January. Beginning this month, HH has decided to start offering SALES DISCOUNTS to their customers, with CREDIT TERMS 2/10,n/30. You must now start checking to see if payments received from HH's customers are received within 10 days from the original date of the sale. If so, you must apply a 2% Sales Discount. See the Merchandising Review Notes for examples. Beginning on Jan 9th, MMLC will start offering HH PURCHASE DISCOUNTS with CREDIT TERMS 2/10, n/30, You will need to start checking to see if payments made by HH to MMLC are paid within the 10 day discount period. See the Merchandising Review Notes for examples HH renegotiated their credit limit with MMLC and HH may now charge up to $20.000 on account. * Jan 1 HH sells inventory to Inside Out Construction on account for $3,200. HH's cost of the inventory is $1,800. Record this just like the sales made on account by HH in December. Don't forget to make two entries-one for the sale on account at the selling price, and one to record HH's cost of goods sold and decrease in inventory. Jan 2 HH pays MMLC for the purchases HH made on account on December 4th Look back to the original transaction on Dec. 4th and record HH's payment to MMLC accordingly Jan 3 HH pays the salaries that were accrued and recorded as an adjustment on Dec. 31st in AJE (a) Look back at AJE (a) and record the cash payment of the accrued salaries. Jan 4 HH pays the January rent Make the same entry you made when HH paid the December rent. Inside Out Construction calls HH to complain that some of the lumber HH shipped in their January 1 order was defective. The office manager investigates the problem and agrees to grant Inside Out a Sales Allowance of $200. Be careful-this is just an allowance,NOT a RETURN of inventory, so it should NOT go back into the inventory account. And even if the merchandise had been returned to HH, it still wouldn't go back into inventory because it is defective. Also, remember not to refund Cash to Inside Out because they purchased the inventory on account on January 1st. Refer to examples in the Merchandising Review Notes Jan 5 Jan 6 Individual customer J. Bond realized that he miscalculated the amount of lumber he needed for his home improvement project and asks the HH office manager if he can return part of the inventory he had purchased back on 11/25/16. The selling price of the inventory he is returning is $350 + 8.25%