Answered step by step

Verified Expert Solution

Question

1 Approved Answer

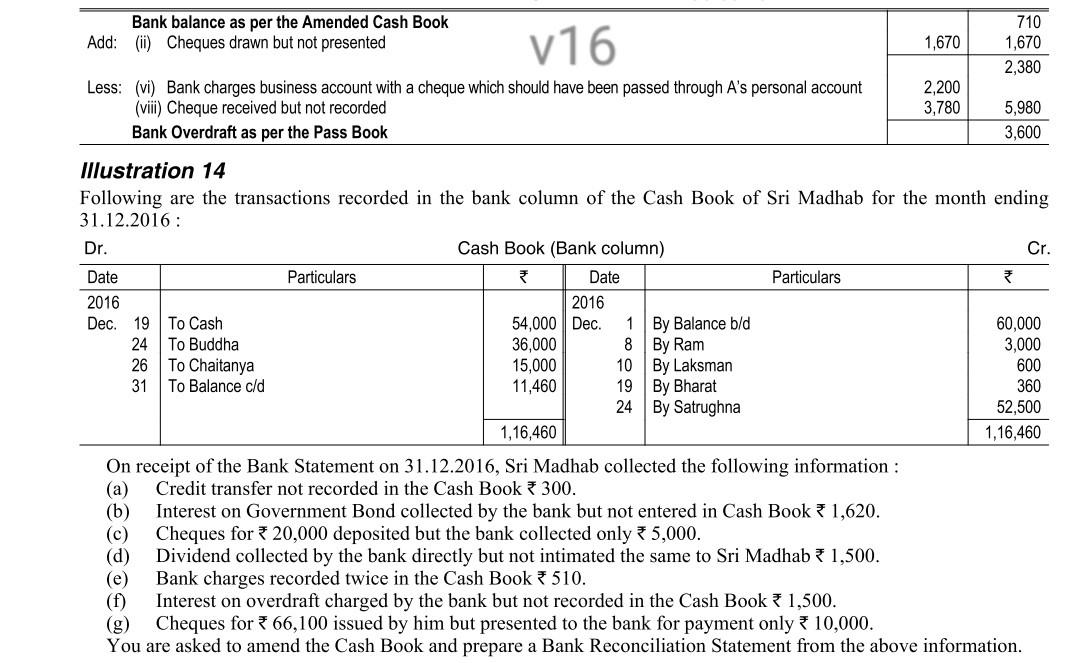

hh Bank balance as per the Amended Cash Book Add: (i) Cheques drawn but not presented V16 1,670 710 1,670 2,380 Less: (vi) Bank charges

hh

Bank balance as per the Amended Cash Book Add: (i) Cheques drawn but not presented V16 1,670 710 1,670 2,380 Less: (vi) Bank charges business account with a cheque which should have been passed through A's personal account (viii) Cheque received but not recorded Bank Overdraft as per the Pass Book 2,200 3,780 5,980 3,600 Illustration 14 Following are the transactions recorded in the bank column of the Cash Book of Sri Madhab for the month ending 31.12.2016: Dr. Cash Book (Bank column) Cr. Date Particulars Date Particulars 2016 2016 Dec. 19 To Cash 54,000 Dec. 1 By Balance b/d 60,000 24 To Buddha 36,000 8 By Ram 3,000 26 To Chaitanya 15,000 10 By Laksman 600 31 To Balance c/d 11,460 19 | By Bharat 360 24 By Satrughna 52.500 1,16,460 1,16,460 On receipt of the Bank Statement on 31.12.2016, Sri Madhab collected the following information : (a) Credit transfer not recorded in the Cash Book 300. (b) Interest on Government Bond collected by the bank but not entered in Cash Book * 1,620. (C) Cheques for 20,000 deposited but the bank collected only 5,000. (d) Dividend collected by the bank directly but not intimated the same to Sri Madhab * 1,500. (e) Bank charges recorded twice in the Cash Book 510. (f) Interest on overdraft charged by the bank but not recorded in the Cash Book * 1,500. (g) Cheques for 66,100 issued by him but presented to the bank for payment only * 10,000. You are asked to amend the Cash Book and prepare a Bank Reconciliation Statement from the above informationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started