Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hh Wright is a builder. His business will have spare capacity over the coming six months and he has been investigating two projects. Project A

hh

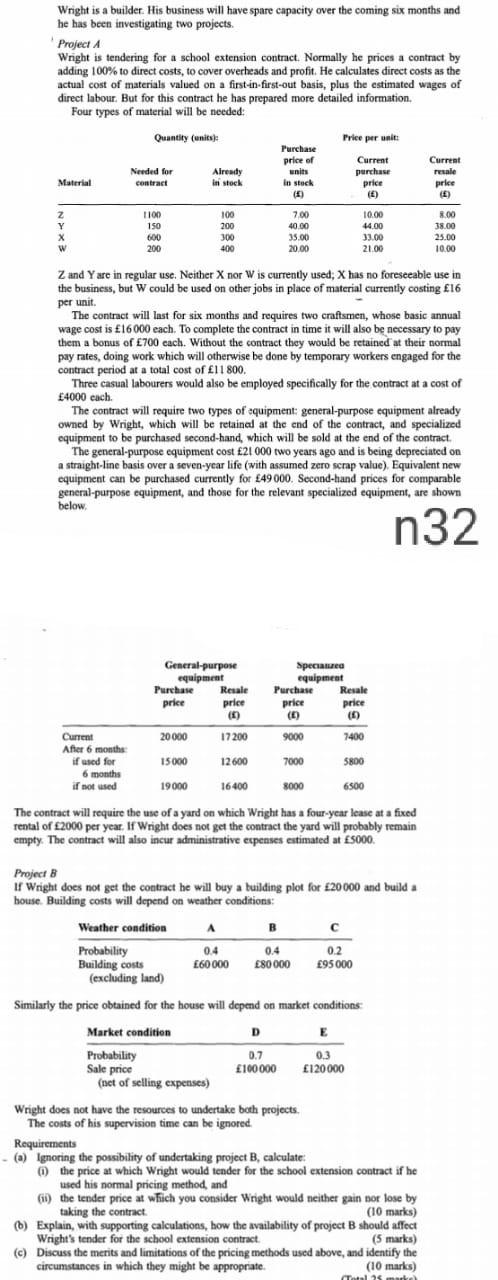

Wright is a builder. His business will have spare capacity over the coming six months and he has been investigating two projects. Project A Wright is tendering for a school extension contract. Normally he prices a contract by adding 100% to direct costs, to cover overheads and profit. He calculates direct costs as the actual cost of materials valued on a first-in-first-out basis, plus the estimated wages of direct labour. But for this contract he has prepared more detailed information Four types of material will be needed: Quantity (units Price per unit: Needed for contract Material Purchase price of units In stock (5) Already In stock Current purchase price () Current reale price () Z Y X w 1100 150 600 200 100 200 100 400 700 40.00 35.00 20.00 10.00 44.00 33.00 21.00 8.00 38.00 25.00 10.00 Z and Yare in regular use. Neither X nor Wis currently used: X has no foreseeable use in the business, but W could be used on other jobs in place of material currently costing 16 per unit. The contract will last for six months and requires two craftsmen, whose basic annual wage cost is 16000 each. To complete the contract in time it will also be necessary to pay them a bonus of 700 cach. Without the contract they would be retained at their normal pay rates, doing work which will otherwise be done by temporary workers engaged for the contract period at a total cost of 11800. Three casual labourers would also be employed specifically for the contract at a cost of 4000 each The contract will require two types of equipment: general-purpose equipment already owned by Wright, which will be retained at the end of the contract, and specialized equipment to be purchased second-hand, which will be sold at the end of the contract. The general-purpose equipment cost 21 000 two years ago and is being depreciated on a straight-line basis over a seven-year life (with assumed zero scrap value) Equivalent new equipment can be purchased currently for 49000. Second-hand prices for comparable general-purpose equipment, and those for the relevant specialized equipment, are shown below n32 General-purpose Speciale equipment equipment Purchase Resale Purchase Resale price price price price (1) () (1) Current 20000 17200 9000 7400 After 6 months if used for 15000 12 600 7000 5800 6 months if not used 19000 16400 8000 6500 The contract will require the use of a yard on which Wright has a four-year lease at a fixed rental of 2000 per year. If Wright does not get the contract the yard will probably remain empty. The contract will also incur administrative expenses estimated at 8000 Project B If Wright does not get the contract he will buy a building plot for 20000 and build a house. Building costs will depend on weather conditions: Weather condition A B Probability 04 0.4 0.2 Building costs 60 000 80000 95 000 (excluding land) Similarly the price obtained for the house will depend on market conditions D E Market condition Probability Sale price (act of selling expenses) 0.7 100000 0.3 120000 Wright does not have the resources to undertake both projects The costs of his supervision time can be ignored. Requirements () Ignoring the possibility of undertaking project B, calculate the price at which Wright would tender for the school extension contract if he used his normal pricing method, and (ii) the tender price at which you consider Wright would neither gain or lose by taking the contract (10 marks) (6) Explain, with supporting calculations, how the availability of project B should affect Wright's tender for the school extension contract (5 marks) (c) Discuss the merits and limitations of the pricing methods used above, and identify the circumstances in which they might be appropriate (10 marks) Total 25.markStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started