Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HHH Company was unable to pay its current obligations as they become due. SM Company was appointed as trustee on January 2, 2020. Creditors

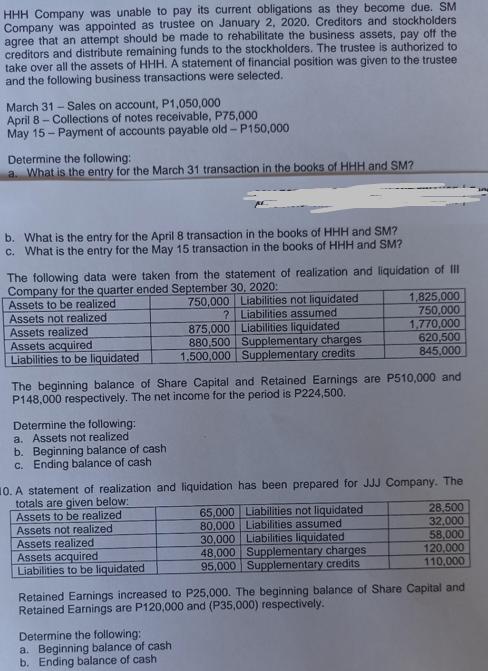

HHH Company was unable to pay its current obligations as they become due. SM Company was appointed as trustee on January 2, 2020. Creditors and stockholders agree that an attempt should be made to rehabilitate the business assets, pay off the creditors and distribute remaining funds to the stockholders. The trustee is authorized to take over all the assets of HHH. A statement of financial position was given to the trustee and the following business transactions were selected. March 31-Sales on account, P1,050,000 April 8- Collections of notes receivable, P75,000 May 15- Payment of accounts payable old-P150,000 Determine the following: a. What is the entry for the March 31 transaction in the books of HHH and SM? b. What is the entry for the April 8 transaction in the books of HHH and SM? c. What is the entry for the May 15 transaction in the books of HHH and SM? The following data were taken from the statement of realization and liquidation of III Company for the quarter ended September 30, 2020: 750,000 Assets to be realized Assets not realized Liabilities not liquidated Liabilities assumed ? Liabilities liquidated Assets realized Assets acquired Liabilities to be liquidated Determine the following: a. Assets not realized b. Beginning balance of cash c. Ending balance of cash The beginning balance of Share Capital and Retained Earnings are P510,000 and P148,000 respectively. The net income for the period is P224,500. Assets to be realized Assets not realized 875,000 880,500 Supplementary charges 1,500,000 Supplementary credits Assets realized Assets acquired Liabilities to be liquidated 0. A statement of realization and liquidation has been prepared for JJJ Company. The totals are given below: 1,825,000 750,000 Determine the following: a. Beginning balance of cash b. Ending balance of cash. 1,770,000 620,500 845,000 65,000 Liabilities not liquidated 80,000 Liabilities assumed 30,000 Liabilities liquidated 48,000 Supplementary charges 95,000 Supplementary credits 28,500 32,000 58,000 120,000 110,000 Retained Earnings increased to P25,000. The beginning balance of Share Capital and Retained Earnings are P120,000 and (P35,000) respectively.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

For Question 1 HHH Company a March 31 Transaction In the books of HHH Debit Accounts Receivable P105...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started