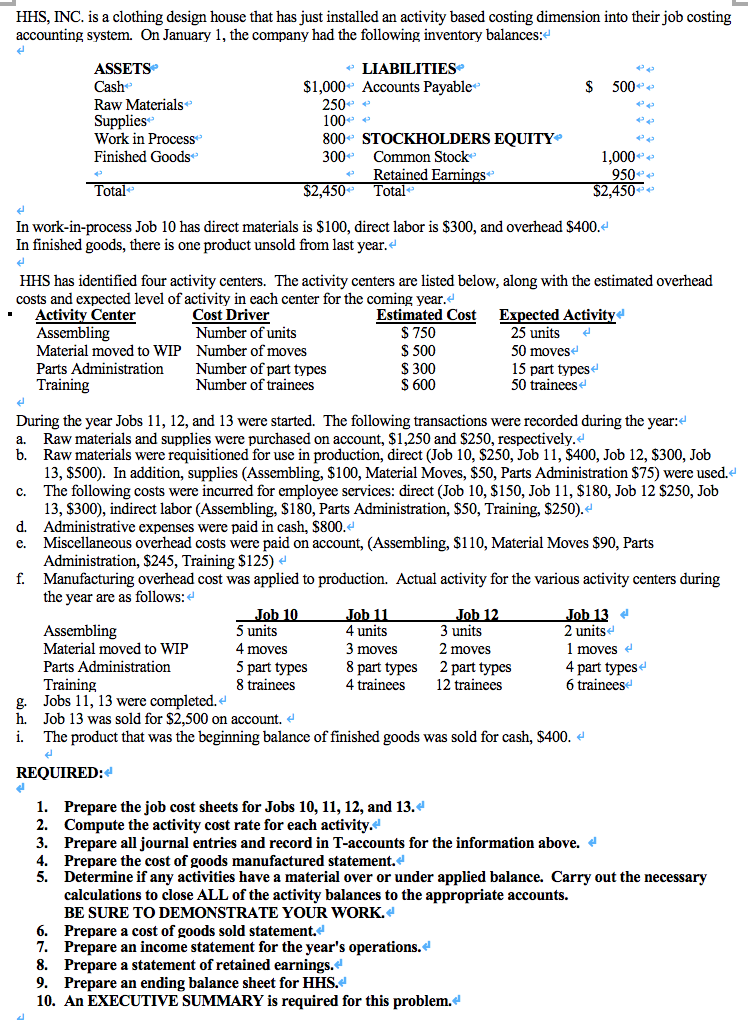

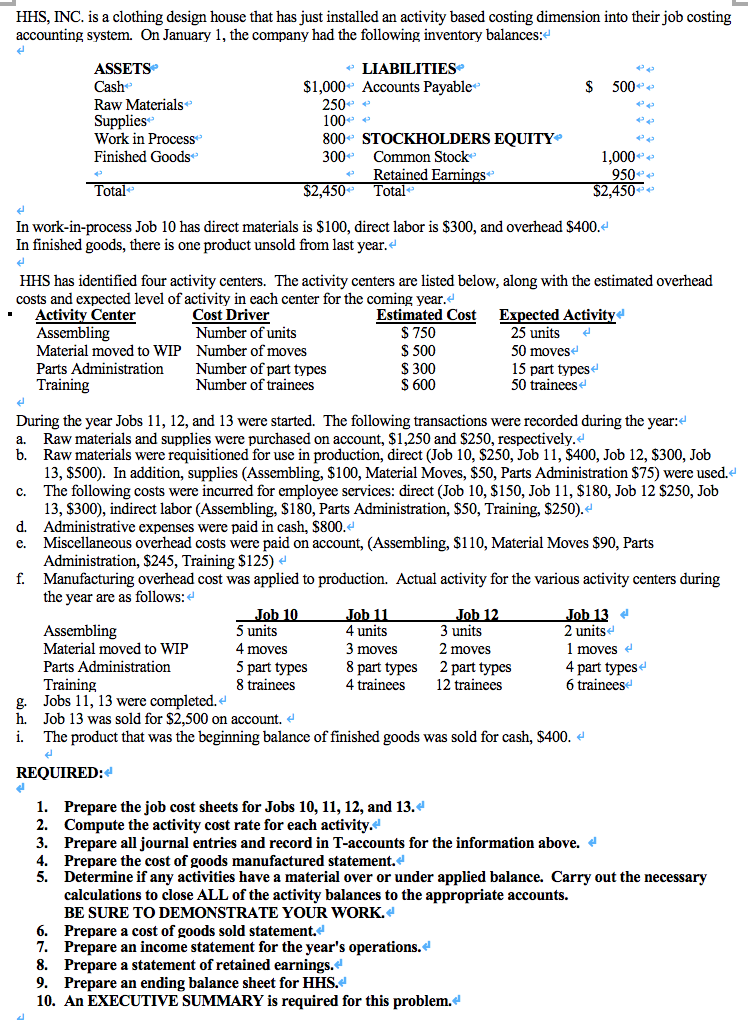

HHS, INC. is a clothing design house that has just installed an activity based costing dimension into their job costing accounting system. On January 1, the company had the following inventory balances: $ 500 + ASSETS Cash Raw Materials Supplies Work in Process Finished Goods + LIABILITIES $1,000+ Accounts Payable 250 100 800 STOCKHOLDERS EQUITY 300. Common Stock + Retained Earnings $2,450 Total 1,000 950 Total $2,450 In work-in-process Job 10 has direct materials is $100, direct labor is $300, and overhead $400.- In finished goods, there is one product unsold from last year. HHS has identified four activity centers. The activity centers are listed below, along with the estimated overhead costs and expected level of activity in each center for the coming year. Activity Center Cost Driver Estimated Cost Expected Activity Assembling Number of units $ 750 25 units Material moved to WIP Number of moves $ 500 50 moves Parts Administration Number of part types $ 300 15 part typese Training Number of trainees $ 600 50 trainees During the year Jobs 11, 12, and 13 were started. The following transactions were recorded during the year: a. Raw materials and supplies were purchased on account, $1,250 and $250, respectively. b. Raw materials were requisitioned for use in production, direct (Job 10, $250, Job 11, $400, Job 12, $300, Job 13, $500). In addition, supplies (Assembling, $100, Material Moves, $50, Parts Administration $75) were used. c. The following costs were incurred for employee services: direct (Job 10, $150, Job 11, $180, Job 12 $250, Job 13, $300), indirect labor (Assembling, $180, Parts Administration, $50, Training, $250). d. Administrative expenses were paid in cash, $800. e. Miscellaneous overhead costs were paid on account, (Assembling, $110, Material Moves $90, Parts Administration, $245, Training $125) f. Manufacturing overhead cost was applied to production. Actual activity for the various activity centers during the year are as follows: Job 10 Job 11 Job 12 Job 13 Assembling 5 units 4 units 3 units 2 units Material moved to WIP 4 moves 3 moves 2 moves 1 moves Parts Administration 5 part types 8 part types 2 part types 4 part types Training 8 trainees 4 trainees 12 trainees 6 trainees Jobs 11, 13 were completed. h. Job 13 was sold for $2,500 on account. i. The product that was the beginning balance of finished goods was sold for cash, $400. REQUIRED: 1. Prepare the job cost sheets for Jobs 10, 11, 12, and 13. 2. Compute the activity cost rate for each activity. 3. Prepare all journal entries and record in T-accounts for the information above. 4. Prepare the cost of goods manufactured statement. 5. Determine if any activities have a material over or under applied balance. Carry out the necessary calculations to close ALL of the activity balances to the appropriate accounts. BE SURE TO DEMONSTRATE YOUR WORK. 6. Prepare a cost of goods sold statement. 7. Prepare an income statement for the year's operations. 8. Prepare a statement of retained earnings. 9. Prepare an ending balance sheet for HHS. 10. An EXECUTIVE SUMMARY is required for this problem. HHS, INC. is a clothing design house that has just installed an activity based costing dimension into their job costing accounting system. On January 1, the company had the following inventory balances: $ 500 + ASSETS Cash Raw Materials Supplies Work in Process Finished Goods + LIABILITIES $1,000+ Accounts Payable 250 100 800 STOCKHOLDERS EQUITY 300. Common Stock + Retained Earnings $2,450 Total 1,000 950 Total $2,450 In work-in-process Job 10 has direct materials is $100, direct labor is $300, and overhead $400.- In finished goods, there is one product unsold from last year. HHS has identified four activity centers. The activity centers are listed below, along with the estimated overhead costs and expected level of activity in each center for the coming year. Activity Center Cost Driver Estimated Cost Expected Activity Assembling Number of units $ 750 25 units Material moved to WIP Number of moves $ 500 50 moves Parts Administration Number of part types $ 300 15 part typese Training Number of trainees $ 600 50 trainees During the year Jobs 11, 12, and 13 were started. The following transactions were recorded during the year: a. Raw materials and supplies were purchased on account, $1,250 and $250, respectively. b. Raw materials were requisitioned for use in production, direct (Job 10, $250, Job 11, $400, Job 12, $300, Job 13, $500). In addition, supplies (Assembling, $100, Material Moves, $50, Parts Administration $75) were used. c. The following costs were incurred for employee services: direct (Job 10, $150, Job 11, $180, Job 12 $250, Job 13, $300), indirect labor (Assembling, $180, Parts Administration, $50, Training, $250). d. Administrative expenses were paid in cash, $800. e. Miscellaneous overhead costs were paid on account, (Assembling, $110, Material Moves $90, Parts Administration, $245, Training $125) f. Manufacturing overhead cost was applied to production. Actual activity for the various activity centers during the year are as follows: Job 10 Job 11 Job 12 Job 13 Assembling 5 units 4 units 3 units 2 units Material moved to WIP 4 moves 3 moves 2 moves 1 moves Parts Administration 5 part types 8 part types 2 part types 4 part types Training 8 trainees 4 trainees 12 trainees 6 trainees Jobs 11, 13 were completed. h. Job 13 was sold for $2,500 on account. i. The product that was the beginning balance of finished goods was sold for cash, $400. REQUIRED: 1. Prepare the job cost sheets for Jobs 10, 11, 12, and 13. 2. Compute the activity cost rate for each activity. 3. Prepare all journal entries and record in T-accounts for the information above. 4. Prepare the cost of goods manufactured statement. 5. Determine if any activities have a material over or under applied balance. Carry out the necessary calculations to close ALL of the activity balances to the appropriate accounts. BE SURE TO DEMONSTRATE YOUR WORK. 6. Prepare a cost of goods sold statement. 7. Prepare an income statement for the year's operations. 8. Prepare a statement of retained earnings. 9. Prepare an ending balance sheet for HHS. 10. An EXECUTIVE SUMMARY is required for this