Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi all. please assist with the question below. Also, please provide with the principals of dealing with mutually exclusive assets with unequal lives. thanking you

Hi all. please assist with the question below. Also, please provide with the principals of dealing with mutually exclusive assets with unequal lives. thanking you in advance.

kindly assist with example 3 only please . thank you

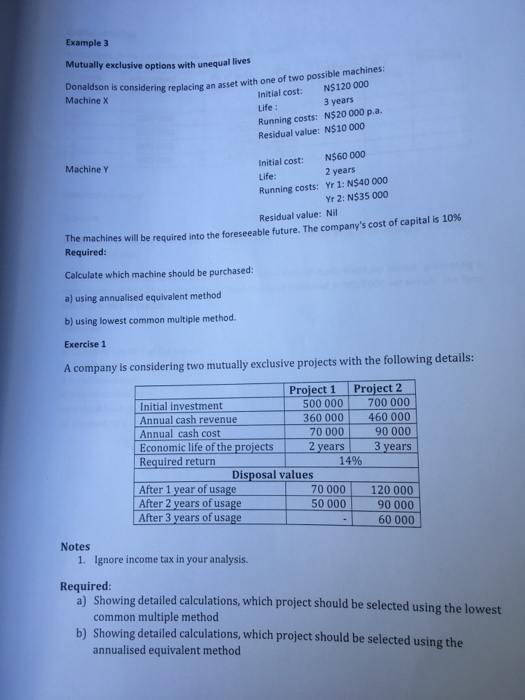

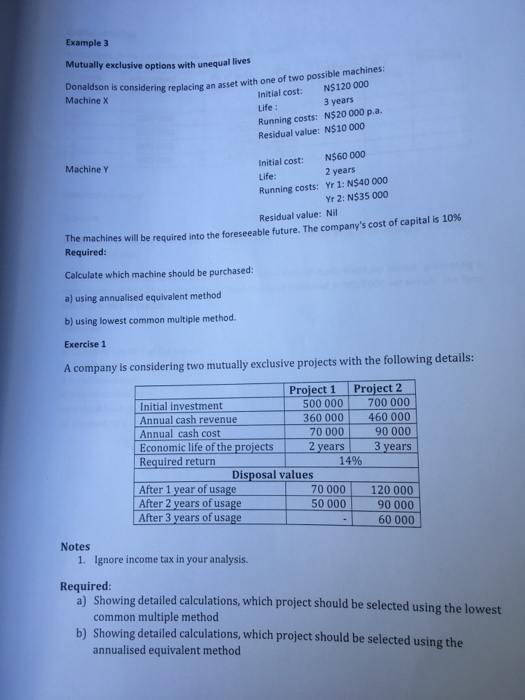

Example 3 Mutually exclusive options with unequal lives Donaldson is Initial cost: N$120 000 Life Running costs: N$20 000 pa. Residual value: N$10 000 considering replacing an asset with one of two possible machines Machine X 3 years Initial cost: N$60 000 Life: Running costs: Yr 1: N$40 000 Machine Y 2 years Yr 2: N$35 000 Residual value: Nil 10% The machines will be required into the foreseeable future. The company's cost of capital is Required: Calculate which machine should be purchased a) using annualised equivalent method b) using lowest common multiple method Exercise 1 A company is considering two mutually exclusive projects with the following details: Project 1 Project 2 Initial investment Annual cash revenue Annual cash cost Economic life of the projects Required return 500 000700 000 360 000 460 000 90000 3 years 70 000 2 years 14% Disposal values After 1 year of usage After 2 years of usage After 3 years of usage 70000 120 000 90 000 60000 50 000 Notes 1. Ignore income tax in your analysis. Required Showing detailed calculations, which project should be selected using the lowest common multiple method a) b) Showing detailed calculations, which project should be selected using the annualised equivalent method Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started