Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi Answer for the given project question in detail avoiding plagiarism or give correct reference. Take your time but answer properly please Please study case

Hi Answer for the given project question in detail avoiding plagiarism or give correct reference.

Take your time but answer properly please

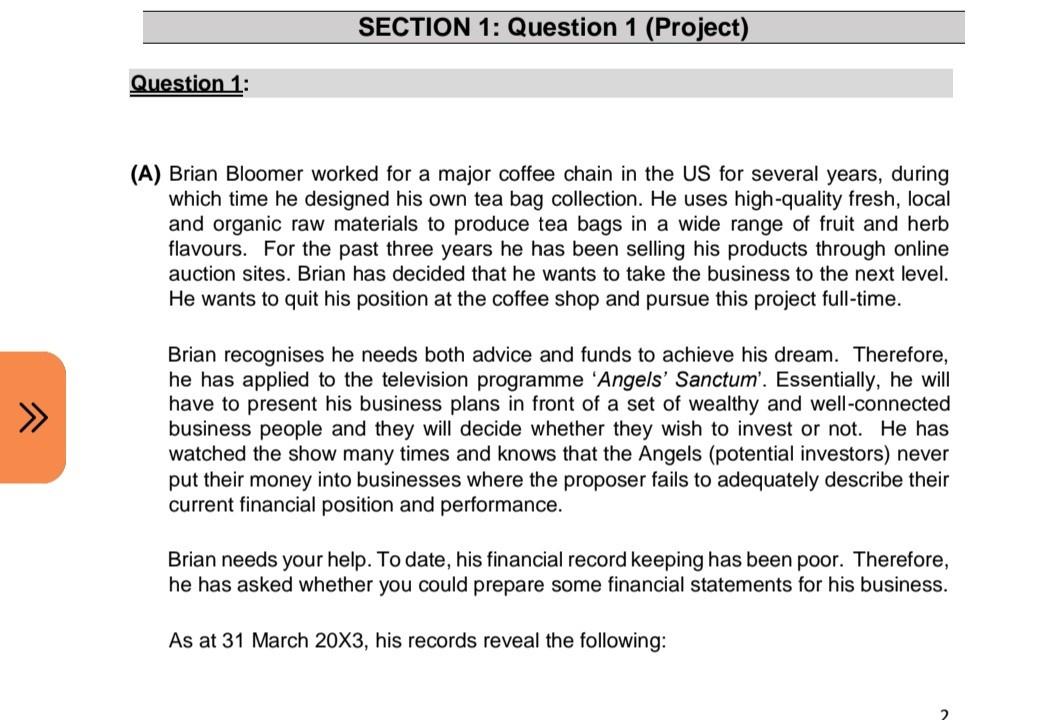

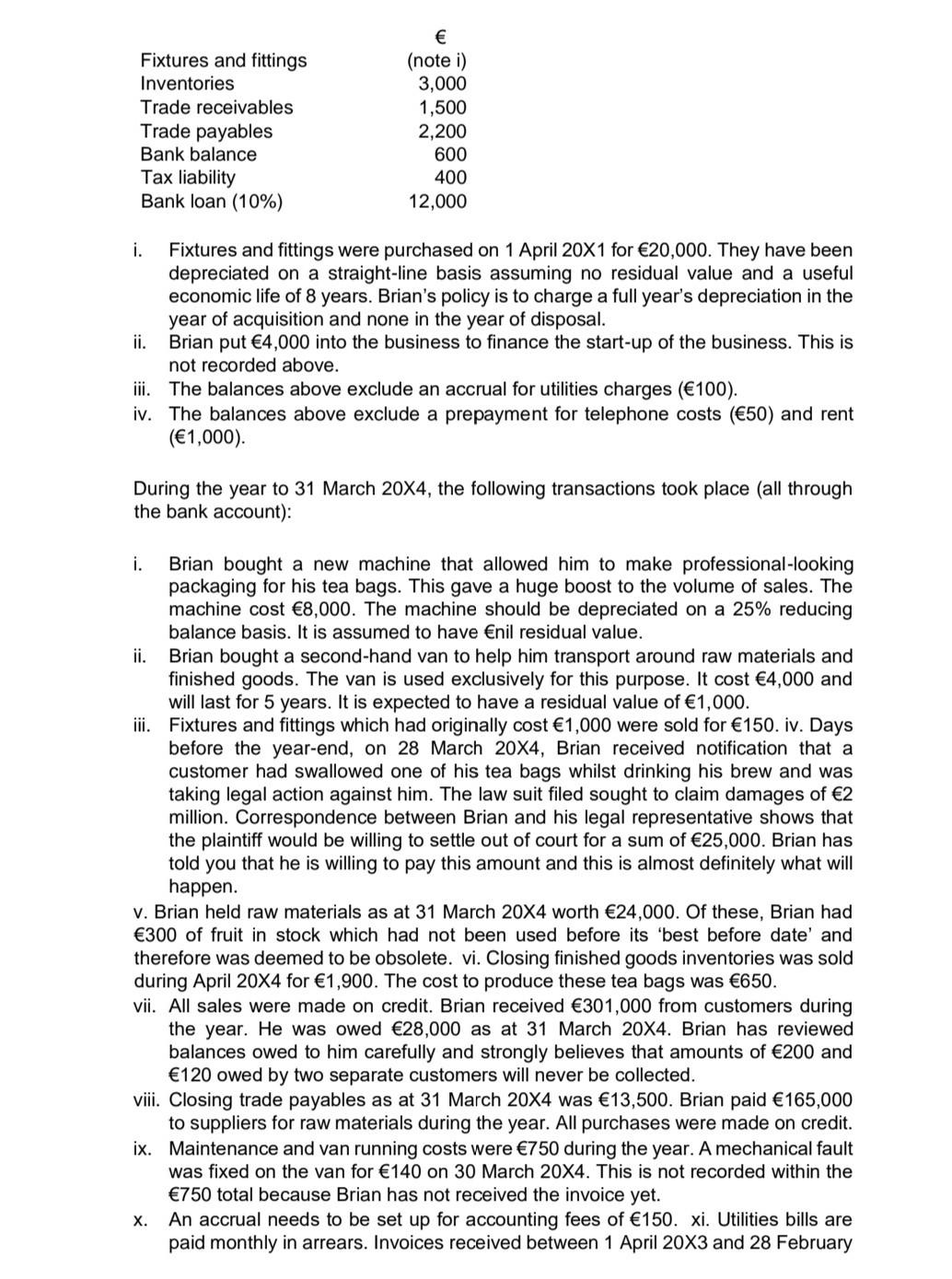

Please study case and answer the required questions properly.

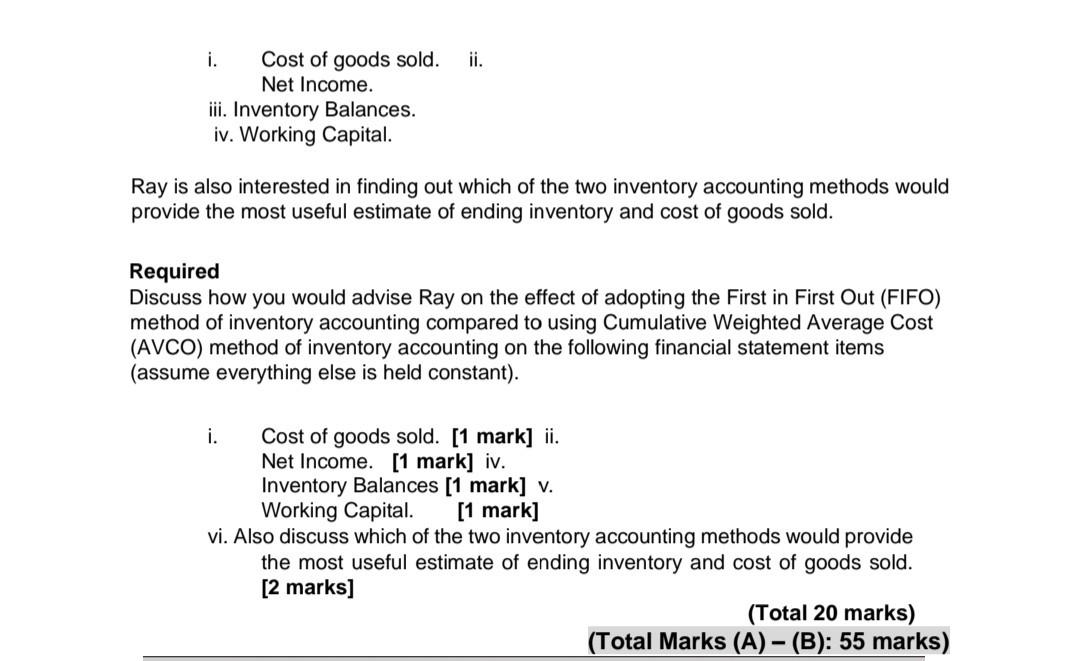

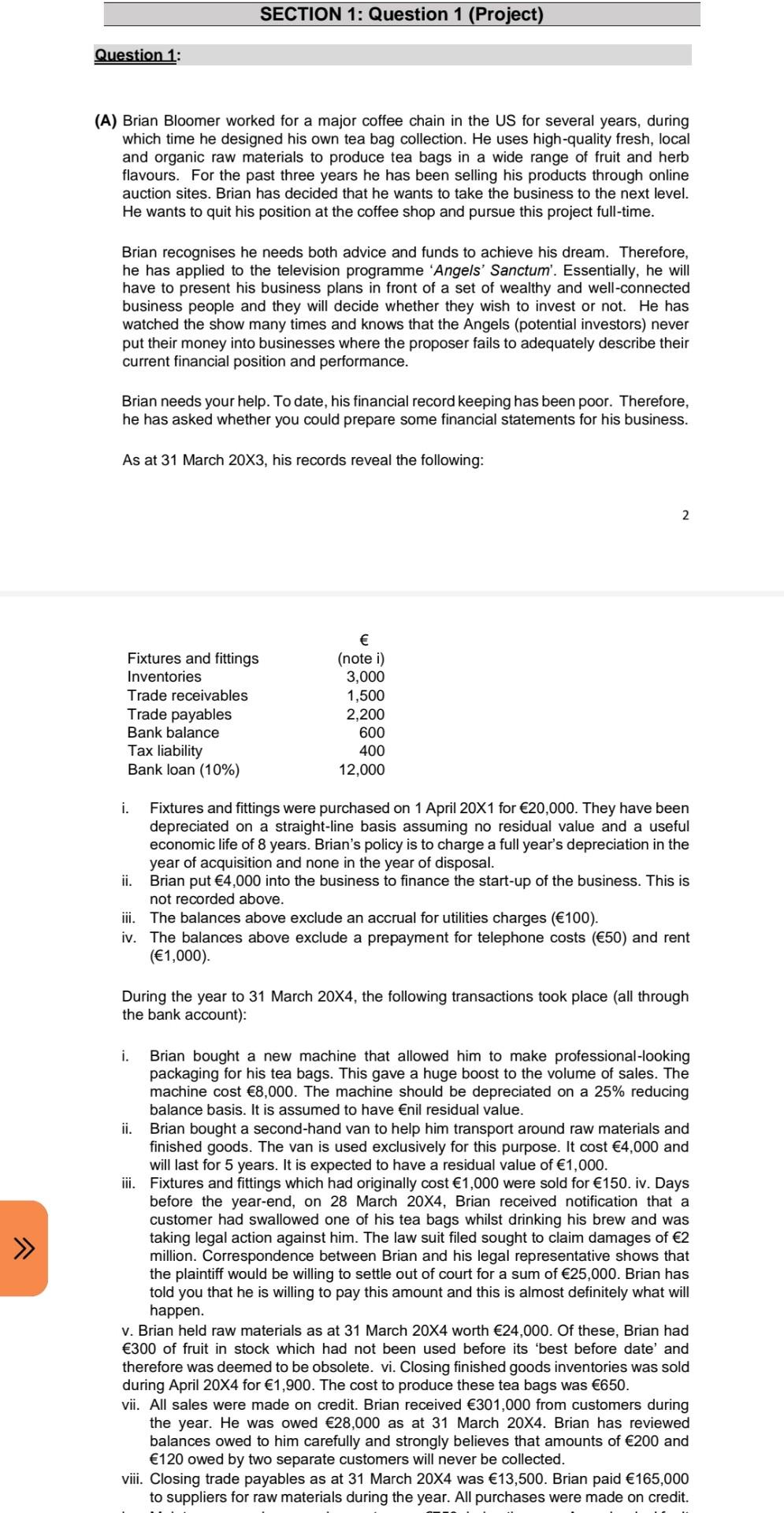

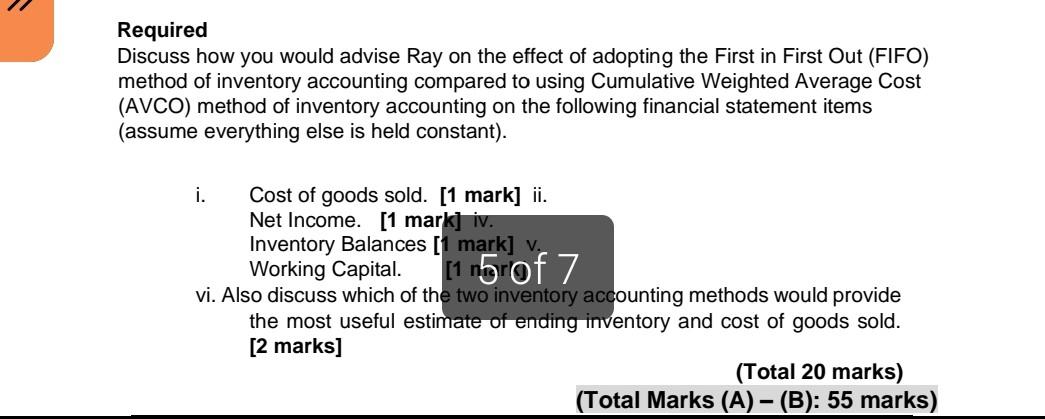

he has applied to the television programme Angels Sanctum. Essentially, he will have to present his business plans in front of a set of wealthy and well-connected business people and they will decide whether they wish to invest or not. He has watched the show many times and knows that the Angels (potential investors) never put their money into businesses where the proposer fails to adequately describe their current financial position and performance. Brian needs your help. To date, his financial record keeping has been poor. Therefore, he has asked whether you could prepare some financial statements for his business, As at 31 March 20X3, his records reveal the following: 2 Fixtures and fittings Inventories Trade receivables Trade payables Bank balance Tax liability Bank loan (10%) (notei) 3,000 1,500 2,200 600 400 12,000 Fixtures and fittings were purchased on 1 April 20x1 for 20,000. They have been depreciated on a straight-line basis assuming no residual value and a useful economic life of 8 years, Brian's policy is to charge a full year's depreciation in the year of acquisition and none in the year of disposal. ii. Brian put 4,000 into the business to finance the start-up of the business. This is not recorded above. ii. The balances above exclude an accrual for utilities charges (100). iv. The balances above exclude a prepayment for telephone costs (50) and rent ( ) (1,000). During the year to 31 March 20X4, the following transactions took place (all through the bank account): i. Brian bought a new machine that allowed him to make professional-looking packaging for his tea bags. This gave a huge boost to the volume of sales. The machine cost 8,000. The machine should be depreciated on a 25% reducing balance basis. It is assumed to have Enil residual value. ii. Brian bought a second-hand van to help him transport around raw materials and finished goods. The van is used exclusively for this purpose. It cost 4,000 and will last for 5 years. It is expected to have a residual value of 1,000. . Fixtures and fittings which had originally cost 1,000 were sold for 150. iv. Days before the year-end, on 28 March 20X4, Brian received notification that a customer had swallowed one of his tea bags whilst drinking his brew and was taking legal action against him. The law suit filed sought to claim damages of 2 million. Correspondence between Brian and his legal representative shows that the plaintiff would be willing to settle out of court for a sum of 25,000. Brian has told you that he is willing to pay this amount and this is almost definitely what will happen. v. Brian held raw materials as at 31 March 20X4 worth 24.000. Of these, Brian had 300 of fruit in stock which had not been used before its 'best before date and therefore was deemed to be obsolete. vi. Closing finished goods inventories was sold during April 20X4 for 1,900. The cost to produce these tea bags was 650. Vi. All sales were made on credit. Brian received 301,000 from customers during the year. He was owed 28,000 as at 31 March 20x4. Brian has reviewed balances owed to him carefully and strongly believes that amounts of 200 and 120 owed by two separate customers will never be collected. vii. Closing trade payables as at 31 March 20x4 was 13,500. Brian paid 165,000 to suppliers for raw materials during the year. All purchases were made on credit. ix. Maintenance and van running costs were 750 during the year. A mechanical fault was fixed on the van for 140 on 30 March 20X4. This is not recorded within the 750 total because Brian has not received the invoice yet. X. An accrual needs to be set up for accounting fees of 150. xi. Utilities bills are paid monthly in arrears, Invoices received between 1 April 20x3 and 28 February 3 20x4 amounted to 2,000. The March 20X4 invoice has not been received yet but is expected to be 200. xi: Telephone charges are paid in advance and as at 31 March 20X4 Brian had paid 1,200 of which 100 relates to the year ended 31 March 20X5. Rent is paid monthly in advance. The annual rent was increased on 1 October 20x3 to 15.000 xi. The remaining administrative expenses paid amounted to 40,500. Xiv. Brian paid tax during the year of 400 and has estimated this year's tax charge will be in the region of 1,200. This will need to be paid in June 20X4. xv. The loan interest had not been paid for the year to 31 March 20x4 as at the year end. Required a) Prepare a statement of financial position as at 31 March 20X4 and a statement of comprehensive income for the year ended 31 March 20X4 for Brian's tea bag business. (20 marks) b) He has been advised to incorporate his business but does not know whether this will make it easier for the Angels, or any other future investors, to invest. Discuss this proposal. (200-300 words) (10 marks) (Total: 30 marks) : (B) The following table provides inventory data for Enriques Ltd, a manufacturer of specialist engineering equipment for the financial year 20X4 January 1 (beginning inventory) 5.000 units @ 12,000 per unit March Purchase 3,000 units @ 13,000 per unit November Purchase 4.000 units @ 13,500 per unit April sales 3,000 units @ 14,000 per unit December sales 4,000 units @ 14,000 per unit Required Calculate the cost of goods sold and the ending inventory for Enriques Lid for 20x4 using the following inventory accounting methods. First in First Out (FIFO). [5 marks] Cumulative Weighted Average Cost (AVCO). [8 marks b) Ray Batcher, the finance director of Evelyn Flowers is considering adopting an inventory accounting policy and is not sure whether to adopt the First in First Out (FIFO) or the Cumulative Weighted Average Cost (AVCO) method of inventory accounting, Ray forecasts a period of rising prices and increasing inventory quantities, Ray wants your advice on the effect of adopting the First in First Out (FIFO) method of inventory accounting compared to using the Cumulative Weighted Average Cost (AVCO) method of inventory accounting on the following financial statement items (assume everything else is held constant). II. i Cost of goods sold. Net Income. ili. Inventory Balances iv. Working Capital Ray is also interested in finding out which of the two inventory accounting methods would provide the most useful estimate of ending inventory and cost of goods sold. Required Discuss how you would advise Ray on the effect of adopting the First in First Out (FIFO) method of inventory accounting compared to using Cumulative Weighted Average Cost (AVCO) method of inventory accounting on the following financial statement items (assume everything else is held constant). Cost of goods sold. [1 mark] il Net Income. (1 mark] iv. Inventory Balances [1 mark] v. Working Capital. [1 mark] vi. Also discuss which of the two inventory accounting methods would provide the most useful estimate of ending inventory and cost of goods sold. [2 marks) (Total 20 marks) ) (Total Marks (A)-(B): 55 marks) = SECTION 1: Question 1 (Project) Question 1: (A) Brian Bloomer worked for a major coffee chain in the US for several years, during which time he designed his own tea bag collection. He uses high-quality fresh, local and organic raw materials to produce tea bags in a wide range of fruit and herb flavours. For the past three years he has been selling his products through online auction sites. Brian has decided that he wants to take the business to the next level. He wants to quit his position at the coffee shop and pursue this project full-time. >> Brian recognises he needs both advice and funds to achieve his dream. Therefore, he has applied to the television programme 'Angels' Sanctum'. Essentially, he will have to present his business plans in front of a set of wealthy and well-connected business people and they will decide whether they wish to invest or not. He has watched the show many times and knows that the Angels (potential investors) never put their money into businesses where the proposer fails to adequately describe their current financial position and performance. Brian needs your help. To date, his financial record keeping has been poor. Therefore, he has asked whether you could prepare some financial statements for his business. As at 31 March 20X3, his records reveal the following: Fixtures and fittings Inventories Trade receivables Trade payables Bank balance Tax liability Bank loan (10%) (notei) 3,000 1,500 2,200 600 400 12,000 i. Fixtures and fittings were purchased on 1 April 20X1 for 20,000. They have been depreciated on a straight-line basis assuming no residual value and a useful economic life of 8 years. Brian's policy is to charge a full year's depreciation in the year of acquisition and none in the year of disposal. ii. Brian put 4,000 into the business to finance the start-up of the business. This is not recorded above. ii. The balances above exclude an accrual for utilities charges (100). iv. The balances above exclude a prepayment for telephone costs (50) and rent (1,000). During the year to 31 March 20X4, the following transactions took place (all through the bank account): i. Brian bought a new machine that allowed him to make professional-looking packaging for his tea bags. This gave a huge boost to the volume of sales. The machine cost 8,000. The machine should be depreciated on a 25% reducing balance basis. It is assumed to have nil residual value. ii. Brian bought a second-hand van to help him transport around raw materials and finished goods. The van is used exclusively for this purpose. It cost 4,000 and will last for 5 years. It is expected to have a residual value of 1,000. iii. Fixtures and fittings which had originally cost 1,000 were sold for 150. iv. Days before the year-end, on 28 March 20X4, Brian received notification that a customer had swallowed one of his tea bags whilst drinking his brew and was taking legal action against him. The law suit filed sought to claim damages of 2 million. Correspondence between Brian and his legal representative shows that the plaintiff would be willing to settle out of court for a sum of 25,000. Brian has told you that he is willing to pay this amount and this is almost definitely what will happen. V. Brian held raw materials as at 31 March 20X4 worth 24,000. Of these, Brian had 300 of fruit in stock which had not been used before its best before date' and therefore was deemed to be obsolete. vi. Closing finished goods inventories was sold during April 20X4 for 1,900. The cost to produce these tea bags was 650. vii. All sales were made on credit. Brian received 301,000 from customers during the year. He was owed 28,000 as at 31 March 20X4. Brian has reviewed balances owed to him carefully and strongly believes that amounts of 200 and 120 owed by two separate customers will never be collected. viii. Closing trade payables as at 31 March 20X4 was 13,500. Brian paid 165,000 to suppliers for raw materials during the year. All purchases were made on credit. ix. Maintenance and van running costs were 750 during the year. A mechanical fault was fixed on the van for 140 on 30 March 20X4. This is not recorded within the 750 total because Brian has not received the invoice yet. X. An accrual needs to be set up for accounting fees of 150. xi. Utilities bills are paid monthly in arrears. Invoices received between 1 April 20X3 and 28 February 20X4 amounted to 2,000. The March 20X4 invoice has not been received yet but is expected to be 200. xii. Telephone charges are paid in advance and as at 31 March 20X4 Brian had paid 1,200 of which 100 relates to the year ended 31 March 20X5. Rent is paid monthly in advance. The annual rent was increased on 1 October 20X3 to 15,000. xiii. The remaining administrative expenses paid amounted to 40,500. xiv. Brian paid tax during the year of 400 and has estimated this year's tax charge will be in the region of 1,200. This will need to be paid in June 20X4. xv. The loan interest had not been paid for the year to 31 March 20X4 as at the year end. Required a) Prepare a statement of financial position as at 31 March 20X4 and a statement of comprehensive income for the year ended 31 March 20X4 for Brian's tea bag business. (20 marks) b) He has been advised to incorporate his business but does not know whether this will make it easier for the Angels, or any other future investors, to invest. Discuss this proposal. (200-300 words) (10 marks) (Total: 30 marks) (B) The following table provides inventory data for Enriques Ltd, a manufacturer of specialist engineering equipment for the financial year 20X4. January 1 (beginning inventory) 5,000 units @ 12,000 per unit March Purchase 3,000 units @ 13,000 per unit November Purchase 4.000 units @ 13,500 per unit April sales 3,000 units @ 14,000 per unit December sales 4,000 units @ 14,000 per unit Required Calculate the cost of goods sold and the ending inventory for Enriques Ltd for 20X4 using the following inventory accounting methods. i. ii. First in First Out (FIFO). Cumulative Weighted Average Cost (AVCO). [5 marks] [8 marks] b) Ray Batcher, the finance director of Evelyn Flowers is considering adopting an inventory accounting policy and is not sure whether to adopt the First in First Out (FIFO) or the Cumulative Weighted Average Cost (AVCO) method of inventory accounting. Ray forecasts a period of rising prices and increasing inventory quantities. Ray wants your advice on the effect of adopting the First in First Out (FIFO) method of inventory accounting compared to using the Cumulative Weighted Average Cost (AVCO) method of inventory accounting on the following financial statement items (assume everything else is held constant). ii. i. Cost of goods sold. Net Income. iii. Inventory Balances. iv. Working Capital. Ray is also interested in finding out which of the two inventory accounting methods would provide the most useful estimate of ending inventory and cost of goods sold. Required Discuss how you would advise Ray on the effect of adopting the First in First Out (FIFO) method of inventory accounting compared to using Cumulative Weighted Average Cost (AVCO) method of inventory accounting on the following financial statement items (assume everything else is held constant). i. Cost of goods sold. [1 mark] ii. Net Income. [1 iv. Inventory Balances [1 mark] v. Working Capital. [1 mark] vi. Also discuss which of the two inventory accounting methods would provide the most useful estimate of ending inventory and cost of goods sold. [2 marks] (Total 20 marks) (Total Marks (A) - (B): 55 marks) SECTION 1: Question 1 (Project) Question 1: (A) Brian Bloomer worked for a major coffee chain in the US for several years, during which time he designed his own tea bag collection. He uses high-quality fresh, local and organic raw materials to produce tea bags in a wide range of fruit and herb flavours. For the past three years he has been selling his products through online auction sites. Brian has decided that he wants to take the business to the next level. He wants to quit his position at the coffee shop and pursue this project full-time. Brian recognises he needs both advice and funds to achieve his dream. Therefore, he has applied to the television programme 'Angels' Sanctum'. Essentially, he will have to present his business plans in front of a set of wealthy and well-connected business people and they will decide whether they wish to invest or not. He has watched the show many times and knows that the Angels (potential investors) never put their money into businesses where the proposer fails to adequately describe their current financial position and performance. Brian needs your help. To date, his financial record keeping has been poor. Therefore, he has asked whether you could prepare some financial statements for his business. As at 31 March 20X3, his records reveal the following: 2 Fixtures and fittings Inventories Trade receivables Trade payables Bank balance Tax liability Bank loan (10%) (notei) 3,000 1,500 2,200 600 400 12,000 i. Fixtures and fittings were purchased on 1 April 20X1 for 20,000. They have been depreciated on a straight-line basis assuming no residual value and a useful economic life of 8 years. Brian's policy is to charge a full year's depreciation in the year of acquisition and none in the year of disposal. ii. Brian put 4,000 into the business to finance the start-up of the business. This is not recorded above. iii. The balances above exclude an accrual for utilities charges (100). iv. The balances above exclude a prepayment for telephone costs (50) and rent (1,000). During the year to 31 March 20X4, the following transactions took place (all through the bank account): i. Brian bought a new machine that allowed him to make professional-looking packaging for his tea bags. This gave a huge boost to the volume of sales. The machine cost 8,000. The machine should be depreciated on a 25% reducing balance basis. It is assumed to have nil residual value. ii. Brian bought a second-hand van to help him transport around raw materials and finished goods. The van is used exclusively for this purpose. It cost 4,000 and will last for 5 years. It is expected to have a residual value of 1,000. iii. Fixtures and fittings which had originally cost 1,000 were sold for 150. iv. Days before the year-end, on 28 March 20X4, Brian received notification that a customer had swallowed one of his tea bags whilst drinking his brew and was taking legal action against him. The law suit filed sought to claim damages of 2 million. Correspondence between Brian and his legal representative shows that the plaintiff would be willing to settle out of court for a sum of 25,000. Brian has told you that he is willing to pay this amount and this is almost definitely what will happen. v. Brian held raw materials as at 31 March 20X4 worth 24,000. Of these, Brian had 300 of fruit in stock which had not been used before its 'best before date and therefore was deemed to be obsolete. vi. Closing finished goods inventories was sold during April 20X4 for 1,900. The cost to produce these tea bags was 650. vii. All sales were made on credit. Brian received 301,000 from customers during the year. He was owed 28,000 as at 31 March 20X4. Brian has reviewed balances owed to him carefully and strongly believes that amounts of 200 and 120 owed by two separate customers will never be collected. viii. Closing trade payables as at 31 March 20X4 was 13,500. Brian paid 165,000 to suppliers for raw materials during the year. All purchases were made on credit. ix. Maintenance and van running costs were 750 during the year. A mechanical fault was fixed on the van for 140 on 30 March 20X4. This is not recorded within the 750 total because Brian has not received the invoice yet. X. An accrual needs to be set up for accounting fees of 150. xi. Utilities bills are paid monthly in arrears. Invoices received between 1 April 20X3 and 28 February 3 20X4 amounted to 2,000. The March 20X4 invoice has not been received yet but is expected to be 200. xii. Telephone charges are paid in advance and as at 31 March 20X4 Brian had paid 1,200 of which 100 relates to the year ended 31 March 20X5. Rent is paid monthly in advance. The annual rent was increased on 1 October 20X3 to 15,000. xiii. The remaining administrative expenses paid amounted to 40,500. xiv. Brian paid tax during the year of 400 and has estimated this year's tax charge will be in the region of 1,200. This will need to be paid in June 20X4. xv. The loan interest had not been paid for the year to 31 March 20X4 as at the year end. Required a) Prepare a statement of financial position as at 31 March 20X4 and a statement of comprehensive income for the year ended 31 March 20X4 for Brian's tea bag business. (20 marks) b) He has been advised to incorporate his business but does not know whether this will make it easier for the Angels, or any other future investors, to invest. Discuss this proposal. (200-300 words) (10 marks) (Total: 30 marks) (B) The following table provides inventory data for Enriques Ltd, a manufacturer of specialist eering equipment for the financial year 20X4. January 1 (beginning inventory) 5,000 units @ 12,000 per unit March Purchase 3,000 units @ 13,000 per unit November Purchase 4.000 units @ 13,500 per unit April sales 3,000 units @ 14,000 per unit December sales 4,000 units @ 14,000 per unit Required Calculate the cost of goods sold and the ending inventory for Enriques Ltd for 20X4 using the following inventory accounting methods. i. ii. First in First Out (FIFO). Cumulative Weighted Average Cost (AVCO). [5 marks] [8 marks] b) Ray Batcher, the finance director of Evelyn Flowers is considering adopting an inventory accounting policy and is not sure whether to adopt the First in First Out (FIFO) or the Cumulative Weighted Average Cost (AVCO) method of inventory accounting. Ray forecasts a period of rising prices and increasing inventory quantities. Ray wants your advice on the effect of adopting the First in First Out (FIFO) method of inventory accounting compared to using the Cumulative Weighted Average Cost (AVCO) method of inventory accounting on the following financial statement items (assume everything else is held constant). 4 >> ii. i. Cost of goods sold. Net Income. iii. Inventory Balances. iv. Working Capital. Ray is also interested in finding out which of the two inventory accounting methods would provide the most useful estimate of ending inventory and cost of goods sold. Required Discuss how you would advise Ray on the effect of adopting the First in First Out (FIFO) method of inventory accounting compared to using Cumulative Weighted Average Cost (AVCO) method of inventory accounting on the following financial statement items (assume everything else is held constant). i. Cost of goods sold. [1 mark] ii. Net Income. [1 mark] iv. Inventory Balances [1 mark] v. Working Capital. [1 n5 of 7 vi. Also discuss which of the two inventory accounting methods would provide the most useful estimate of ending inventory and cost of goods sold. [2 marks] (Total 20 marks) (Total Marks (A) - (B): 55 marks) - he has applied to the television programme Angels Sanctum. Essentially, he will have to present his business plans in front of a set of wealthy and well-connected business people and they will decide whether they wish to invest or not. He has watched the show many times and knows that the Angels (potential investors) never put their money into businesses where the proposer fails to adequately describe their current financial position and performance. Brian needs your help. To date, his financial record keeping has been poor. Therefore, he has asked whether you could prepare some financial statements for his business, As at 31 March 20X3, his records reveal the following: 2 Fixtures and fittings Inventories Trade receivables Trade payables Bank balance Tax liability Bank loan (10%) (notei) 3,000 1,500 2,200 600 400 12,000 Fixtures and fittings were purchased on 1 April 20x1 for 20,000. They have been depreciated on a straight-line basis assuming no residual value and a useful economic life of 8 years, Brian's policy is to charge a full year's depreciation in the year of acquisition and none in the year of disposal. ii. Brian put 4,000 into the business to finance the start-up of the business. This is not recorded above. ii. The balances above exclude an accrual for utilities charges (100). iv. The balances above exclude a prepayment for telephone costs (50) and rent ( ) (1,000). During the year to 31 March 20X4, the following transactions took place (all through the bank account): i. Brian bought a new machine that allowed him to make professional-looking packaging for his tea bags. This gave a huge boost to the volume of sales. The machine cost 8,000. The machine should be depreciated on a 25% reducing balance basis. It is assumed to have Enil residual value. ii. Brian bought a second-hand van to help him transport around raw materials and finished goods. The van is used exclusively for this purpose. It cost 4,000 and will last for 5 years. It is expected to have a residual value of 1,000. . Fixtures and fittings which had originally cost 1,000 were sold for 150. iv. Days before the year-end, on 28 March 20X4, Brian received notification that a customer had swallowed one of his tea bags whilst drinking his brew and was taking legal action against him. The law suit filed sought to claim damages of 2 million. Correspondence between Brian and his legal representative shows that the plaintiff would be willing to settle out of court for a sum of 25,000. Brian has told you that he is willing to pay this amount and this is almost definitely what will happen. v. Brian held raw materials as at 31 March 20X4 worth 24.000. Of these, Brian had 300 of fruit in stock which had not been used before its 'best before date and therefore was deemed to be obsolete. vi. Closing finished goods inventories was sold during April 20X4 for 1,900. The cost to produce these tea bags was 650. Vi. All sales were made on credit. Brian received 301,000 from customers during the year. He was owed 28,000 as at 31 March 20x4. Brian has reviewed balances owed to him carefully and strongly believes that amounts of 200 and 120 owed by two separate customers will never be collected. vii. Closing trade payables as at 31 March 20x4 was 13,500. Brian paid 165,000 to suppliers for raw materials during the year. All purchases were made on credit. ix. Maintenance and van running costs were 750 during the year. A mechanical fault was fixed on the van for 140 on 30 March 20X4. This is not recorded within the 750 total because Brian has not received the invoice yet. X. An accrual needs to be set up for accounting fees of 150. xi. Utilities bills are paid monthly in arrears, Invoices received between 1 April 20x3 and 28 February 3 20x4 amounted to 2,000. The March 20X4 invoice has not been received yet but is expected to be 200. xi: Telephone charges are paid in advance and as at 31 March 20X4 Brian had paid 1,200 of which 100 relates to the year ended 31 March 20X5. Rent is paid monthly in advance. The annual rent was increased on 1 October 20x3 to 15.000 xi. The remaining administrative expenses paid amounted to 40,500. Xiv. Brian paid tax during the year of 400 and has estimated this year's tax charge will be in the region of 1,200. This will need to be paid in June 20X4. xv. The loan interest had not been paid for the year to 31 March 20x4 as at the year end. Required a) Prepare a statement of financial position as at 31 March 20X4 and a statement of comprehensive income for the year ended 31 March 20X4 for Brian's tea bag business. (20 marks) b) He has been advised to incorporate his business but does not know whether this will make it easier for the Angels, or any other future investors, to invest. Discuss this proposal. (200-300 words) (10 marks) (Total: 30 marks) : (B) The following table provides inventory data for Enriques Ltd, a manufacturer of specialist engineering equipment for the financial year 20X4 January 1 (beginning inventory) 5.000 units @ 12,000 per unit March Purchase 3,000 units @ 13,000 per unit November Purchase 4.000 units @ 13,500 per unit April sales 3,000 units @ 14,000 per unit December sales 4,000 units @ 14,000 per unit Required Calculate the cost of goods sold and the ending inventory for Enriques Lid for 20x4 using the following inventory accounting methods. First in First Out (FIFO). [5 marks] Cumulative Weighted Average Cost (AVCO). [8 marks b) Ray Batcher, the finance director of Evelyn Flowers is considering adopting an inventory accounting policy and is not sure whether to adopt the First in First Out (FIFO) or the Cumulative Weighted Average Cost (AVCO) method of inventory accounting, Ray forecasts a period of rising prices and increasing inventory quantities, Ray wants your advice on the effect of adopting the First in First Out (FIFO) method of inventory accounting compared to using the Cumulative Weighted Average Cost (AVCO) method of inventory accounting on the following financial statement items (assume everything else is held constant). II. i Cost of goods sold. Net Income. ili. Inventory Balances iv. Working Capital Ray is also interested in finding out which of the two inventory accounting methods would provide the most useful estimate of ending inventory and cost of goods sold. Required Discuss how you would advise Ray on the effect of adopting the First in First Out (FIFO) method of inventory accounting compared to using Cumulative Weighted Average Cost (AVCO) method of inventory accounting on the following financial statement items (assume everything else is held constant). Cost of goods sold. [1 mark] il Net Income. (1 mark] iv. Inventory Balances [1 mark] v. Working Capital. [1 mark] vi. Also discuss which of the two inventory accounting methods would provide the most useful estimate of ending inventory and cost of goods sold. [2 marks) (Total 20 marks) ) (Total Marks (A)-(B): 55 marks) = SECTION 1: Question 1 (Project) Question 1: (A) Brian Bloomer worked for a major coffee chain in the US for several years, during which time he designed his own tea bag collection. He uses high-quality fresh, local and organic raw materials to produce tea bags in a wide range of fruit and herb flavours. For the past three years he has been selling his products through online auction sites. Brian has decided that he wants to take the business to the next level. He wants to quit his position at the coffee shop and pursue this project full-time. >> Brian recognises he needs both advice and funds to achieve his dream. Therefore, he has applied to the television programme 'Angels' Sanctum'. Essentially, he will have to present his business plans in front of a set of wealthy and well-connected business people and they will decide whether they wish to invest or not. He has watched the show many times and knows that the Angels (potential investors) never put their money into businesses where the proposer fails to adequately describe their current financial position and performance. Brian needs your help. To date, his financial record keeping has been poor. Therefore, he has asked whether you could prepare some financial statements for his business. As at 31 March 20X3, his records reveal the following: Fixtures and fittings Inventories Trade receivables Trade payables Bank balance Tax liability Bank loan (10%) (notei) 3,000 1,500 2,200 600 400 12,000 i. Fixtures and fittings were purchased on 1 April 20X1 for 20,000. They have been depreciated on a straight-line basis assuming no residual value and a useful economic life of 8 years. Brian's policy is to charge a full year's depreciation in the year of acquisition and none in the year of disposal. ii. Brian put 4,000 into the business to finance the start-up of the business. This is not recorded above. ii. The balances above exclude an accrual for utilities charges (100). iv. The balances above exclude a prepayment for telephone costs (50) and rent (1,000). During the year to 31 March 20X4, the following transactions took place (all through the bank account): i. Brian bought a new machine that allowed him to make professional-looking packaging for his tea bags. This gave a huge boost to the volume of sales. The machine cost 8,000. The machine should be depreciated on a 25% reducing balance basis. It is assumed to have nil residual value. ii. Brian bought a second-hand van to help him transport around raw materials and finished goods. The van is used exclusively for this purpose. It cost 4,000 and will last for 5 years. It is expected to have a residual value of 1,000. iii. Fixtures and fittings which had originally cost 1,000 were sold for 150. iv. Days before the year-end, on 28 March 20X4, Brian received notification that a customer had swallowed one of his tea bags whilst drinking his brew and was taking legal action against him. The law suit filed sought to claim damages of 2 million. Correspondence between Brian and his legal representative shows that the plaintiff would be willing to settle out of court for a sum of 25,000. Brian has told you that he is willing to pay this amount and this is almost definitely what will happen. V. Brian held raw materials as at 31 March 20X4 worth 24,000. Of these, Brian had 300 of fruit in stock which had not been used before its best before date' and therefore was deemed to be obsolete. vi. Closing finished goods inventories was sold during April 20X4 for 1,900. The cost to produce these tea bags was 650. vii. All sales were made on credit. Brian received 301,000 from customers during the year. He was owed 28,000 as at 31 March 20X4. Brian has reviewed balances owed to him carefully and strongly believes that amounts of 200 and 120 owed by two separate customers will never be collected. viii. Closing trade payables as at 31 March 20X4 was 13,500. Brian paid 165,000 to suppliers for raw materials during the year. All purchases were made on credit. ix. Maintenance and van running costs were 750 during the year. A mechanical fault was fixed on the van for 140 on 30 March 20X4. This is not recorded within the 750 total because Brian has not received the invoice yet. X. An accrual needs to be set up for accounting fees of 150. xi. Utilities bills are paid monthly in arrears. Invoices received between 1 April 20X3 and 28 February 20X4 amounted to 2,000. The March 20X4 invoice has not been received yet but is expected to be 200. xii. Telephone charges are paid in advance and as at 31 March 20X4 Brian had paid 1,200 of which 100 relates to the year ended 31 March 20X5. Rent is paid monthly in advance. The annual rent was increased on 1 October 20X3 to 15,000. xiii. The remaining administrative expenses paid amounted to 40,500. xiv. Brian paid tax during the year of 400 and has estimated this year's tax charge will be in the region of 1,200. This will need to be paid in June 20X4. xv. The loan interest had not been paid for the year to 31 March 20X4 as at the year end. Required a) Prepare a statement of financial position as at 31 March 20X4 and a statement of comprehensive income for the year ended 31 March 20X4 for Brian's tea bag business. (20 marks) b) He has been advised to incorporate his business but does not know whether this will make it easier for the Angels, or any other future investors, to invest. Discuss this proposal. (200-300 words) (10 marks) (Total: 30 marks) (B) The following table provides inventory data for Enriques Ltd, a manufacturer of specialist engineering equipment for the financial year 20X4. January 1 (beginning inventory) 5,000 units @ 12,000 per unit March Purchase 3,000 units @ 13,000 per unit November Purchase 4.000 units @ 13,500 per unit April sales 3,000 units @ 14,000 per unit December sales 4,000 units @ 14,000 per unit Required Calculate the cost of goods sold and the ending inventory for Enriques Ltd for 20X4 using the following inventory accounting methods. i. ii. First in First Out (FIFO). Cumulative Weighted Average Cost (AVCO). [5 marks] [8 marks] b) Ray Batcher, the finance director of Evelyn Flowers is considering adopting an inventory accounting policy and is not sure whether to adopt the First in First Out (FIFO) or the Cumulative Weighted Average Cost (AVCO) method of inventory accounting. Ray forecasts a period of rising prices and increasing inventory quantities. Ray wants your advice on the effect of adopting the First in First Out (FIFO) method of inventory accounting compared to using the Cumulative Weighted Average Cost (AVCO) method of inventory accounting on the following financial statement items (assume everything else is held constant). ii. i. Cost of goods sold. Net Income. iii. Inventory Balances. iv. Working Capital. Ray is also interested in finding out which of the two inventory accounting methods would provide the most useful estimate of ending inventory and cost of goods sold. Required Discuss how you would advise Ray on the effect of adopting the First in First Out (FIFO) method of inventory accounting compared to using Cumulative Weighted Average Cost (AVCO) method of inventory accounting on the following financial statement items (assume everything else is held constant). i. Cost of goods sold. [1 mark] ii. Net Income. [1 iv. Inventory Balances [1 mark] v. Working Capital. [1 mark] vi. Also discuss which of the two inventory accounting methods would provide the most useful estimate of ending inventory and cost of goods sold. [2 marks] (Total 20 marks) (Total Marks (A) - (B): 55 marks) SECTION 1: Question 1 (Project) Question 1: (A) Brian Bloomer worked for a major coffee chain in the US for several years, during which time he designed his own tea bag collection. He uses high-quality fresh, local and organic raw materials to produce tea bags in a wide range of fruit and herb flavours. For the past three years he has been selling his products through online auction sites. Brian has decided that he wants to take the business to the next level. He wants to quit his position at the coffee shop and pursue this project full-time. Brian recognises he needs both advice and funds to achieve his dream. Therefore, he has applied to the television programme 'Angels' Sanctum'. Essentially, he will have to present his business plans in front of a set of wealthy and well-connected business people and they will decide whether they wish to invest or not. He has watched the show many times and knows that the Angels (potential investors) never put their money into businesses where the proposer fails to adequately describe their current financial position and performance. Brian needs your help. To date, his financial record keeping has been poor. Therefore, he has asked whether you could prepare some financial statements for his business. As at 31 March 20X3, his records reveal the following: 2 Fixtures and fittings Inventories Trade receivables Trade payables Bank balance Tax liability Bank loan (10%) (notei) 3,000 1,500 2,200 600 400 12,000 i. Fixtures and fittings were purchased on 1 April 20X1 for 20,000. They have been depreciated on a straight-line basis assuming no residual value and a useful economic life of 8 years. Brian's policy is to charge a full year's depreciation in the year of acquisition and none in the year of disposal. ii. Brian put 4,000 into the business to finance the start-up of the business. This is not recorded above. iii. The balances above exclude an accrual for utilities charges (100). iv. The balances above exclude a prepayment for telephone costs (50) and rent (1,000). During the year to 31 March 20X4, the following transactions took place (all through the bank account): i. Brian bought a new machine that allowed him to make professional-looking packaging for his tea bags. This gave a huge boost to the volume of sales. The machine cost 8,000. The machine should be depreciated on a 25% reducing balance basis. It is assumed to have nil residual value. ii. Brian bought a second-hand van to help him transport around raw materials and finished goods. The van is used exclusively for this purpose. It cost 4,000 and will last for 5 years. It is expected to have a residual value of 1,000. iii. Fixtures and fittings which had originally cost 1,000 were sold for 150. iv. Days before the year-end, on 28 March 20X4, Brian received notification that a customer had swallowed one of his tea bags whilst drinking his brew and was taking legal action against him. The law suit filed sought to claim damages of 2 million. Correspondence between Brian and his legal representative shows that the plaintiff would be willing to settle out of court for a sum of 25,000. Brian has told you that he is willing to pay this amount and this is almost definitely what will happen. v. Brian held raw materials as at 31 March 20X4 worth 24,000. Of these, Brian had 300 of fruit in stock which had not been used before its 'best before date and therefore was deemed to be obsolete. vi. Closing finished goods inventories was sold during April 20X4 for 1,900. The cost to produce these tea bags was 650. vii. All sales were made on credit. Brian received 301,000 from customers during the year. He was owed 28,000 as at 31 March 20X4. Brian has reviewed balances owed to him carefully and strongly believes that amounts of 200 and 120 owed by two separate customers will never be collected. viii. Closing trade payables as at 31 March 20X4 was 13,500. Brian paid 165,000 to suppliers for raw materials during the year. All purchases were made on credit. ix. Maintenance and van running costs were 750 during the year. A mechanical fault was fixed on the van for 140 on 30 March 20X4. This is not recorded within the 750 total because Brian has not received the invoice yet. X. An accrual needs to be set up for accounting fees of 150. xi. Utilities bills are paid monthly in arrears. Invoices received between 1 April 20X3 and 28 February 3 20X4 amounted to 2,000. The March 20X4 invoice has not been received yet but is expected to be 200. xii. Telephone charges are paid in advance and as at 31 March 20X4 Brian had paid 1,200 of which 100 relates to the year ended 31 March 20X5. Rent is paid monthly in advance. The annual rent was increased on 1 October 20X3 to 15,000. xiii. The remaining administrative expenses paid amounted to 40,500. xiv. Brian paid tax during the year of 400 and has estimated this year's tax charge will be in the region of 1,200. This will need to be paid in June 20X4. xv. The loan interest had not been paid for the year to 31 March 20X4 as at the year end. Required a) Prepare a statement of financial position as at 31 March 20X4 and a statement of comprehensive income for the year ended 31 March 20X4 for Brian's tea bag business. (20 marks) b) He has been advised to incorporate his business but does not know whether this will make it easier for the Angels, or any other future investors, to invest. Discuss this proposal. (200-300 words) (10 marks) (Total: 30 marks) (B) The following table provides inventory data for Enriques Ltd, a manufacturer of specialist eering equipment for the financial year 20X4. January 1 (beginning inventory) 5,000 units @ 12,000 per unit March Purchase 3,000 units @ 13,000 per unit November Purchase 4.000 units @ 13,500 per unit April sales 3,000 units @ 14,000 per unit December sales 4,000 units @ 14,000 per unit Required Calculate the cost of goods sold and the ending inventory for Enriques Ltd for 20X4 using the following inventory accounting methods. i. ii. First in First Out (FIFO). Cumulative Weighted Average Cost (AVCO). [5 marks] [8 marks] b) Ray Batcher, the finance director of Evelyn Flowers is considering adopting an inventory accounting policy and is not sure whether to adopt the First in First Out (FIFO) or the Cumulative Weighted Average Cost (AVCO) method of inventory accounting. Ray forecasts a period of rising prices and increasing inventory quantities. Ray wants your advice on the effect of adopting the First in First Out (FIFO) method of inventory accounting compared to using the Cumulative Weighted Average Cost (AVCO) method of inventory accounting on the following financial statement items (assume everything else is held constant). 4 >> ii. i. Cost of goods sold. Net Income. iii. Inventory Balances. iv. Working Capital. Ray is also interested in finding out which of the two inventory accounting methods would provide the most useful estimate of ending inventory and cost of goods sold. Required Discuss how you would advise Ray on the effect of adopting the First in First Out (FIFO) method of inventory accounting compared to using Cumulative Weighted Average Cost (AVCO) method of inventory accounting on the following financial statement items (assume everything else is held constant). i. Cost of goods sold. [1 mark] ii. Net Income. [1 mark] iv. Inventory Balances [1 mark] v. Working Capital. [1 n5 of 7 vi. Also discuss which of the two inventory accounting methods would provide the most useful estimate of ending inventory and cost of goods sold. [2 marks] (Total 20 marks) (Total Marks (A) - (B): 55 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started