Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, Any help is VERY VERY much appreciated. Bayshore Inc. uses the perpetual inventory system. Bayshore Inc. is owned by Tina Smith. The company had

Hi, Any help is VERY VERY much appreciated.

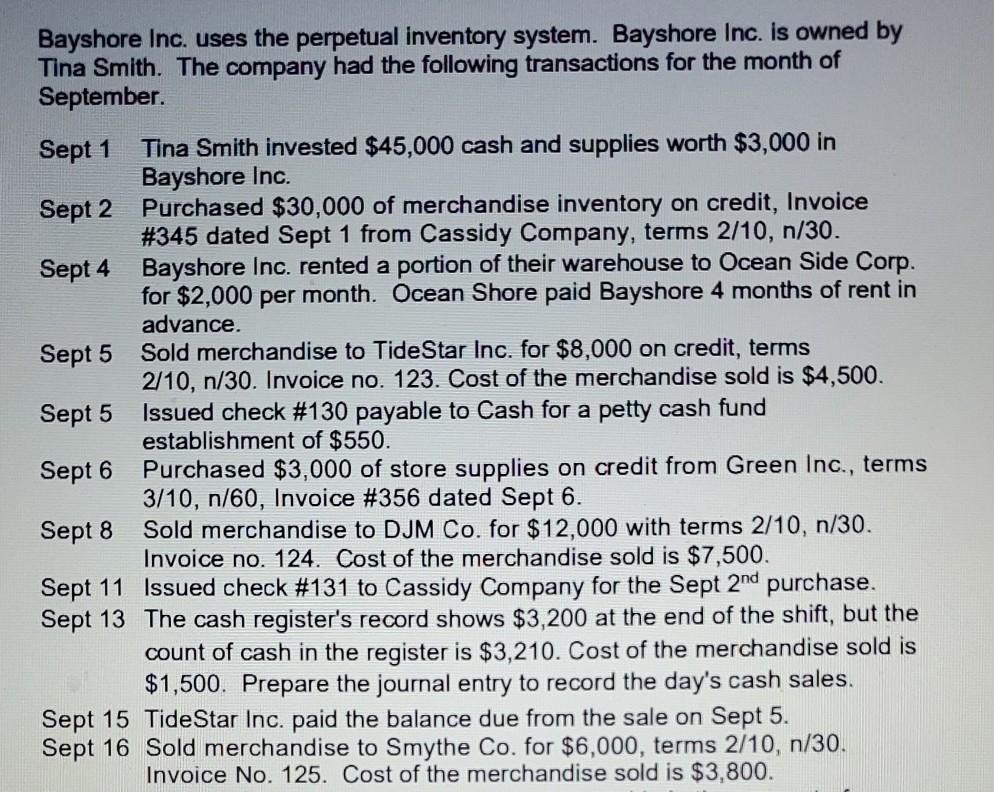

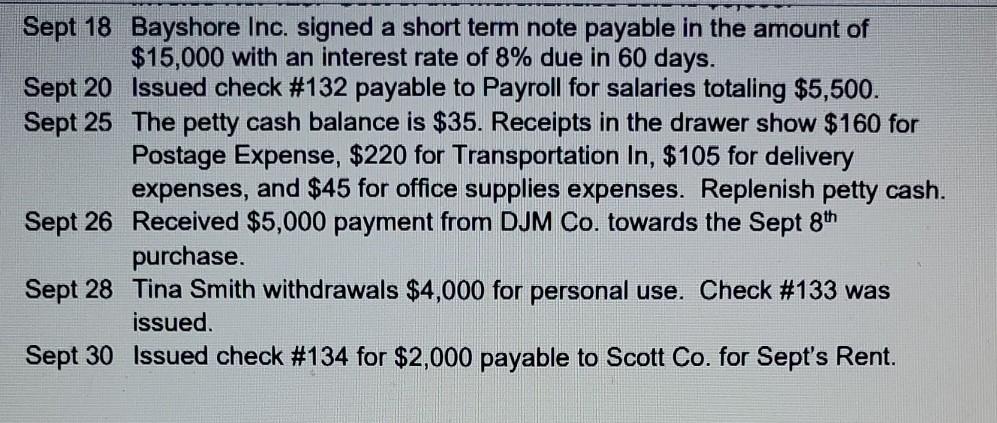

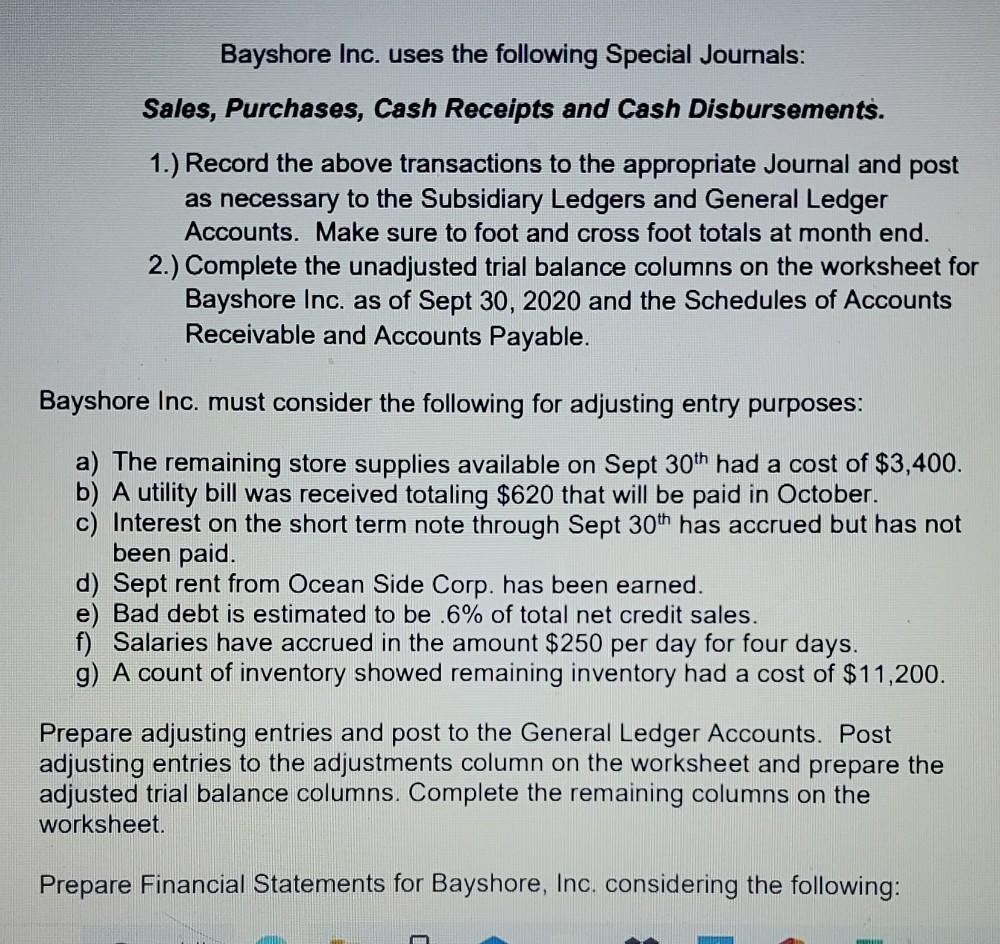

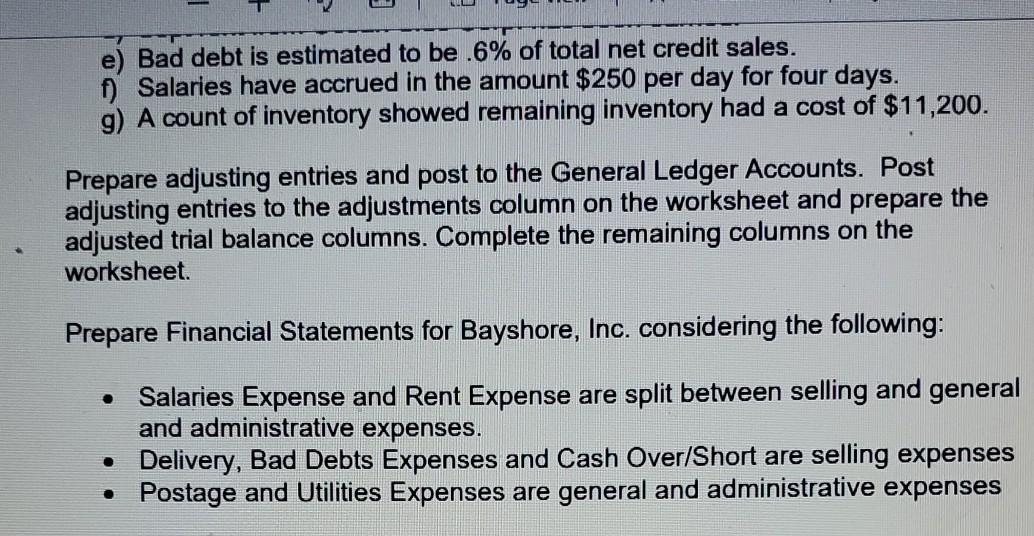

Bayshore Inc. uses the perpetual inventory system. Bayshore Inc. is owned by Tina Smith. The company had the following transactions for the month of September Sept 1 Tina Smith invested $45,000 cash and supplies worth $3,000 in Bayshore Inc. Sept 2 Purchased $30,000 of merchandise inventory on credit, Invoice #345 dated Sept 1 from Cassidy Company, terms 2/10, n/30. Sept 4 Bayshore Inc. rented a portion of their warehouse to Ocean Side Corp. for $2,000 per month. Ocean Shore paid Bayshore 4 months of rent in advance. Sept 5 Sold merchandise to Tide Star Inc. for $8,000 on credit, terms 2/10, n/30. Invoice no. 123. Cost of the merchandise sold is $4,500. Sept 5 Issued check #130 payable to Cash for a petty cash fund establishment of $550. Sept 6 Purchased $3,000 of store supplies on credit from Green Inc., terms 3/10, n/60, Invoice #356 dated Sept 6. Sept 8 Sold merchandise to DJM Co. for $12,000 with terms 2/10, n/30. Invoice no. 124. Cost of the merchandise sold is $7,500. Sept 11 Issued check #131 to Cassidy Company for the Sept 2nd purchase. Sept 13 The cash register's record shows $3,200 at the end of the shift, but the count of cash in the register is $3,210. Cost of the merchandise sold is $1,500. Prepare the journal entry to record the day's cash sales. Sept 15 Tide Star Inc. paid the balance due from the sale on Sept 5. Sept 16 Sold merchandise to Smythe Co. for $6,000, terms 2/10, n/30. Invoice No. 125. Cost of the merchandise sold is $3,800. Sept 18 Bayshore Inc. signed a short term note payable in the amount of $15,000 with an interest rate of 8% due in 60 days. Sept 20 Issued check #132 payable to Payroll for salaries totaling $5,500. Sept 25 The petty cash balance is $35. Receipts in the drawer show $ 160 for Postage Expense, $220 for Transportation In, $105 for delivery expenses, and $45 for office supplies expenses. Replenish petty cash. Sept 26 Received $5,000 payment from DJM Co. towards the Sept 8th purchase. Sept 28 Tina Smith withdrawals $4,000 for personal use. Check #133 was issued. Sept 30 Issued check #134 for $2,000 payable to Scott Co. for Sept's Rent. Bayshore Inc. uses the following Special Journals: Sales, Purchases, Cash Receipts and Cash Disbursements. 1.) Record the above transactions to the appropriate Journal and post as necessary to the Subsidiary Ledgers and General Ledger Accounts. Make sure to foot and cross foot totals at month end. 2.) Complete the unadjusted trial balance columns on the worksheet for Bayshore Inc. as of Sept 30, 2020 and the Schedules of Accounts Receivable and Accounts Payable. Bayshore Inc. must consider the following for adjusting entry purposes: a) The remaining store supplies available on Sept 30th had a cost $3,400. b) A utility bill was received totaling $620 that will be paid in October. c) Interest on the short term note through Sept 30th has accrued but has not been paid. d) Sept rent from Ocean Side Corp. has been earned. e) Bad debt is estimated to be .6% of total net credit sales. Salaries have accrued in the amount $250 per day for four days. g) A count of inventory showed remaining inventory had a cost of $11,200. Prepare adjusting entries and post to the General Ledger Accounts. Post adjusting entries to the adjustments column on the worksheet and prepare the adjusted trial balance columns. Complete the remaining columns on the worksheet. Prepare Financial Statements for Bayshore, Inc. considering the following: LLL e) Bad debt is estimated to be .6% of total net credit sales. f) Salaries have accrued in the amount $250 per day for four days. g) A count of inventory showed remaining inventory had a cost of $11,200. Prepare adjusting entries and post to the General Ledger Accounts. Post adjusting entries to the adjustments column on the worksheet and prepare the adjusted trial balance columns. Complete the remaining columns on the worksheet. Prepare Financial Statements for Bayshore, Inc. considering the following: . Salaries Expense and Rent Expense are split between selling and general and administrative expenses. Delivery, Bad Debts Expenses and Cash Over/Short are selling expenses Postage and Utilities Expenses are general and administrative expenses Bayshore Inc. uses the perpetual inventory system. Bayshore Inc. is owned by Tina Smith. The company had the following transactions for the month of September Sept 1 Tina Smith invested $45,000 cash and supplies worth $3,000 in Bayshore Inc. Sept 2 Purchased $30,000 of merchandise inventory on credit, Invoice #345 dated Sept 1 from Cassidy Company, terms 2/10, n/30. Sept 4 Bayshore Inc. rented a portion of their warehouse to Ocean Side Corp. for $2,000 per month. Ocean Shore paid Bayshore 4 months of rent in advance. Sept 5 Sold merchandise to Tide Star Inc. for $8,000 on credit, terms 2/10, n/30. Invoice no. 123. Cost of the merchandise sold is $4,500. Sept 5 Issued check #130 payable to Cash for a petty cash fund establishment of $550. Sept 6 Purchased $3,000 of store supplies on credit from Green Inc., terms 3/10, n/60, Invoice #356 dated Sept 6. Sept 8 Sold merchandise to DJM Co. for $12,000 with terms 2/10, n/30. Invoice no. 124. Cost of the merchandise sold is $7,500. Sept 11 Issued check #131 to Cassidy Company for the Sept 2nd purchase. Sept 13 The cash register's record shows $3,200 at the end of the shift, but the count of cash in the register is $3,210. Cost of the merchandise sold is $1,500. Prepare the journal entry to record the day's cash sales. Sept 15 Tide Star Inc. paid the balance due from the sale on Sept 5. Sept 16 Sold merchandise to Smythe Co. for $6,000, terms 2/10, n/30. Invoice No. 125. Cost of the merchandise sold is $3,800. Sept 18 Bayshore Inc. signed a short term note payable in the amount of $15,000 with an interest rate of 8% due in 60 days. Sept 20 Issued check #132 payable to Payroll for salaries totaling $5,500. Sept 25 The petty cash balance is $35. Receipts in the drawer show $ 160 for Postage Expense, $220 for Transportation In, $105 for delivery expenses, and $45 for office supplies expenses. Replenish petty cash. Sept 26 Received $5,000 payment from DJM Co. towards the Sept 8th purchase. Sept 28 Tina Smith withdrawals $4,000 for personal use. Check #133 was issued. Sept 30 Issued check #134 for $2,000 payable to Scott Co. for Sept's Rent. Bayshore Inc. uses the following Special Journals: Sales, Purchases, Cash Receipts and Cash Disbursements. 1.) Record the above transactions to the appropriate Journal and post as necessary to the Subsidiary Ledgers and General Ledger Accounts. Make sure to foot and cross foot totals at month end. 2.) Complete the unadjusted trial balance columns on the worksheet for Bayshore Inc. as of Sept 30, 2020 and the Schedules of Accounts Receivable and Accounts Payable. Bayshore Inc. must consider the following for adjusting entry purposes: a) The remaining store supplies available on Sept 30th had a cost $3,400. b) A utility bill was received totaling $620 that will be paid in October. c) Interest on the short term note through Sept 30th has accrued but has not been paid. d) Sept rent from Ocean Side Corp. has been earned. e) Bad debt is estimated to be .6% of total net credit sales. Salaries have accrued in the amount $250 per day for four days. g) A count of inventory showed remaining inventory had a cost of $11,200. Prepare adjusting entries and post to the General Ledger Accounts. Post adjusting entries to the adjustments column on the worksheet and prepare the adjusted trial balance columns. Complete the remaining columns on the worksheet. Prepare Financial Statements for Bayshore, Inc. considering the following: LLL e) Bad debt is estimated to be .6% of total net credit sales. f) Salaries have accrued in the amount $250 per day for four days. g) A count of inventory showed remaining inventory had a cost of $11,200. Prepare adjusting entries and post to the General Ledger Accounts. Post adjusting entries to the adjustments column on the worksheet and prepare the adjusted trial balance columns. Complete the remaining columns on the worksheet. Prepare Financial Statements for Bayshore, Inc. considering the following: . Salaries Expense and Rent Expense are split between selling and general and administrative expenses. Delivery, Bad Debts Expenses and Cash Over/Short are selling expenses Postage and Utilities Expenses are general and administrative expensesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started