Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi can both be answered please. Cullman Transport Company is considering investing in a truck that is expected to generate cash inflows of $43,000 per

Hi can both be answered please.

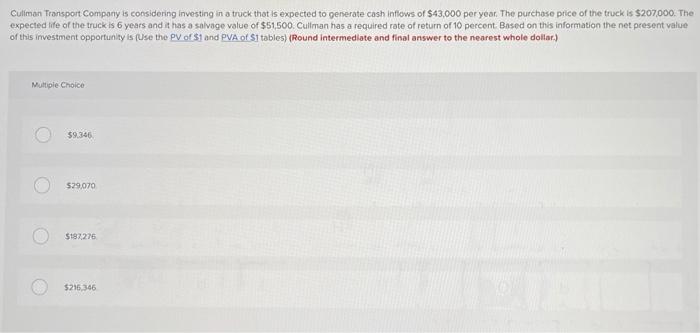

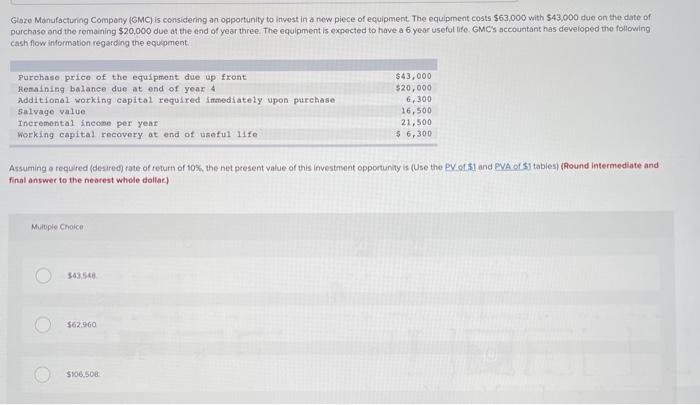

Cullman Transport Company is considering investing in a truck that is expected to generate cash inflows of $43,000 per year. The purchase price of the truck is $207,000. The expected life of the truck is 6 years and it has a salvage value of $51,500. Cullman has a required rate of return of 10 percent. Based on this information the net present value of this investment opportunity is (Use the PV of S1 and PVA of S1 tables) (Round intermediate and final answer to the nearest whole dollar) Multiple Choice $9.346 $29,070 $187.276 $216,346 Glaze Manufacturing Company (GMC) is considering an opportunity to invest in a new piece of equipment. The equipment costs $63,000 with $43.000 due on the date of purchase and the remaining $20,000 due at the end of year three. The equipment is expected to have a 6 year useful life GMC's accountant has developed the following cash flow information regarding the equipment Purchase price of the equipment due up front Remaining balance due at end of year 4 Additional working capital required immediately upon purchase Salvage value Incremental income per yene Working capital recovery at end of useful life $43,000 $20,000 6,300 16,500 21,500 $ 6,300 Assuming a required (desired) rate of return of 10%, the net present value of this investment opportunity is (Use the PV 0151 and PVA 1 tables (Round Intermediate and final answer to the nearest whole dollar) Multiple Choice 343540 $62.960 $106.508

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started