Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi can someone help me answer the questions (a, b, c, d, e, f and g) in the pictures attached. The information to answer the

Hi can someone help me answer the questions (a, b, c, d, e, f and g) in the pictures attached. The information to answer the questions are in the second picture under question g. Thank you

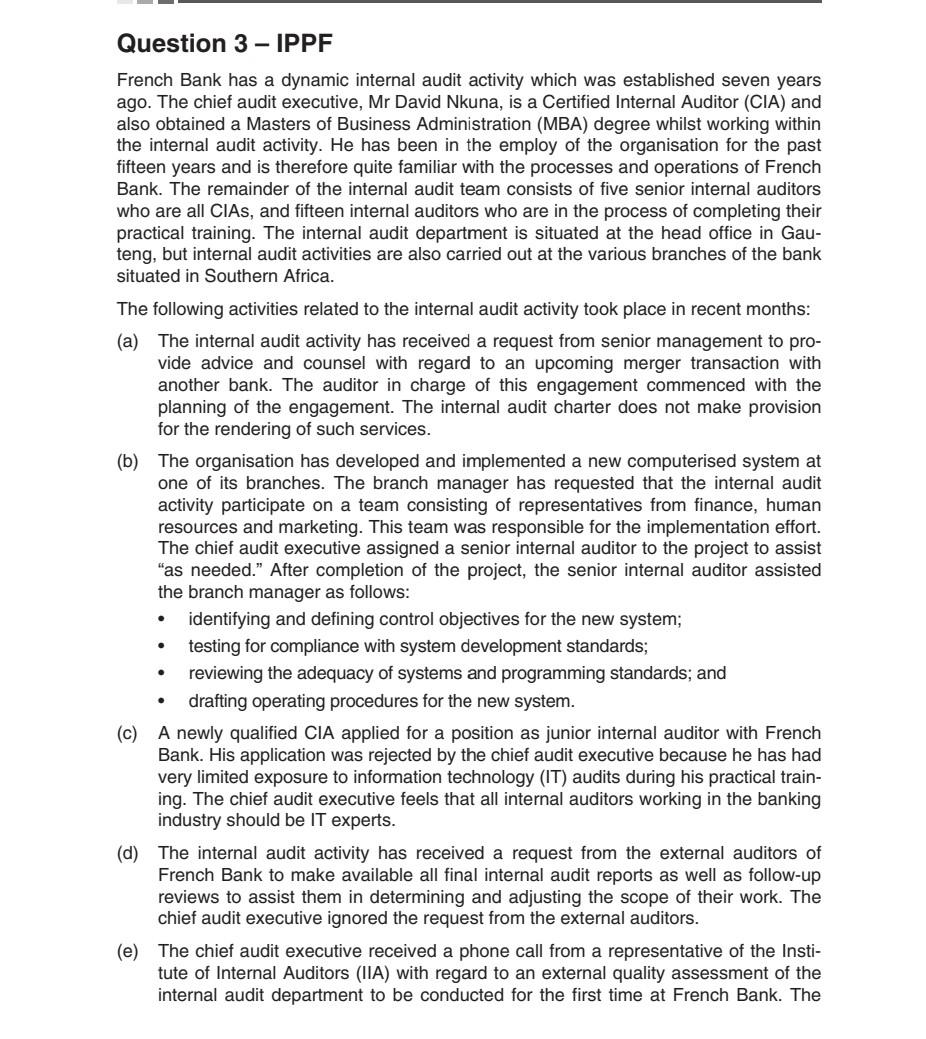

Question 3 - IPPF French Bank has a dynamic internal audit activity which was established seven years ago. The chief audit executive, Mr David Nkuna, is a Certified Internal Auditor (CIA) and also obtained a Masters of Business Administration (MBA) degree whilst working within the internal audit activity. He has been in the employ of the organisation for the past fifteen years and is therefore quite familiar with the processes and operations of French Bank. The remainder of the internal audit team consists of five senior internal auditors who are all CIAs, and fifteen internal auditors who are in the process of completing their practical training. The internal audit department is situated at the head office in Gauteng, but internal audit activities are also carried out at the various branches of the bank situated in Southern Africa. The following activities related to the internal audit activity took place in recent months: (a) The internal audit activity has received a request from senior management to provide advice and counsel with regard to an upcoming merger transaction with another bank. The auditor in charge of this engagement commenced with the planning of the engagement. The internal audit charter does not make provision for the rendering of such services. (b) The organisation has developed and implemented a new computerised system at one of its branches. The branch manager has requested that the internal audit activity participate on a team consisting of representatives from finance, human resources and marketing. This team was responsible for the implementation effort. The chief audit executive assigned a senior internal auditor to the project to assist "as needed." After completion of the project, the senior internal auditor assisted the branch manager as follows: - identifying and defining control objectives for the new system; - testing for compliance with system development standards; - reviewing the adequacy of systems and programming standards; and - drafting operating procedures for the new system. (c) A newly qualified CIA applied for a position as junior internal auditor with French Bank. His application was rejected by the chief audit executive because he has had very limited exposure to information technology (IT) audits during his practical training. The chief audit executive feels that all internal auditors working in the banking industry should be IT experts. (d) The internal audit activity has received a request from the external auditors of French Bank to make available all final internal audit reports as well as follow-up reviews to assist them in determining and adjusting the scope of their work. The chief audit executive ignored the request from the external auditors. (e) The chief audit executive received a phone call from a representative of the Institute of Internal Auditors (IIA) with regard to an external quality assessment of the internal audit department to be conducted for the first time at French Bank. The chief audit executive suggested to the IIA representative that she phones the chief financial officer, because it is his responsibility to maintain the quality assurance and improvement programme. The chief audit executive also commented that an external quality assessment will not be necessary, because everything in the internal audit department is under control. (f) A senior internal auditor conducted an audit engagement in the human resources department. The internal auditor has been conducting this engagement for the past six years and has since become very friendly with one of the managers in human resources, Mr Nice. During the current audit, the auditor discovered that former employees, who have been retrenched, are still on the employee list and are being paid. The auditor decided not to take this matter further, because Mr Nice, his friend, is responsible for removing retrenched or retired employees from the employee list and he trusts that his friend will remove these individuals from the list in the near future. (g) A junior internal auditor has been assigned to conduct an audit engagement for a division where fraudulent activities have been identified in the past. The inexperienced internal auditor decided not to take any responsibility for the prevention or detection of fraud within this division. You are required to: Comment, with reference to the International Professional Practices Framework, on whether the internal auditor's actions are in line with the IIA's Code of Ethics and Standards (especially the Attribute Standards). Your comment should include recommendations for the appropriate action to be followedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started