Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, can someone help me with this question especially part b. The blue is the answer Much appreciated for your help Question B1 The table

Hi, can someone help me with this question especially part b. The blue is the answer

Much appreciated for your help

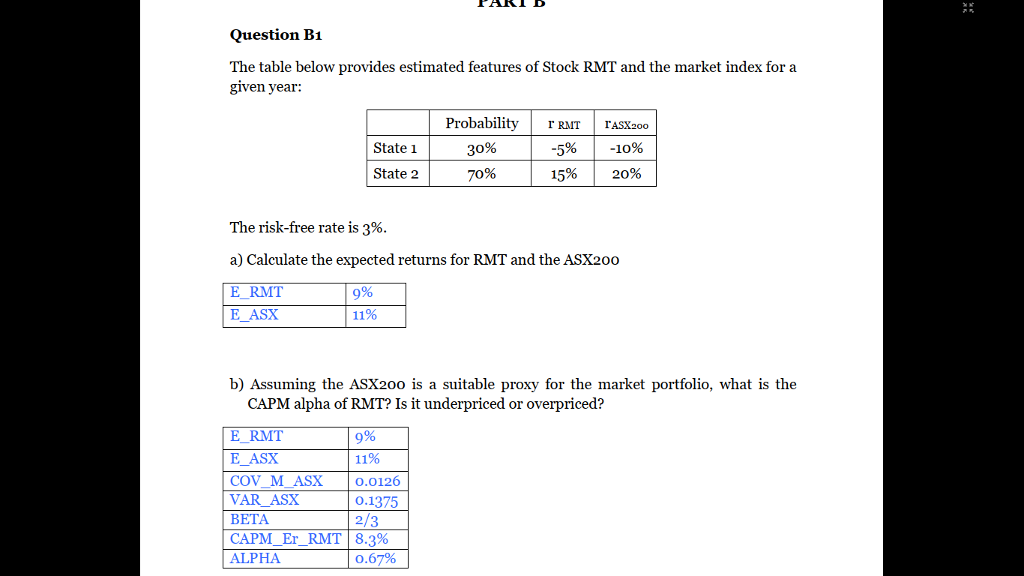

Question B1 The table below provides estimated features of Stock RMT and the market index for a given year: ProbabilityRTIASX200 -5% | -10% 15% | 20% State 1 30% State 2 70% The risk-free rate is 3% a) Calculate the expected returns for RMT and the ASX200 E RMT E ASX 9% 11% b) Assuming the ASX2o0 is a suitable proxy for the market portfolio, what is the CAPM alpha of RMT? Is it underpriced or overpriced? 9% 11% E RMT E ASX COV M ASX 10.0126 VAR ASX ? ??? CAPM-Er RMT | 8.3% ALPHA 0.1375 2 0.67%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started