Hi, can someone help with this exercise? I cannot get it right.

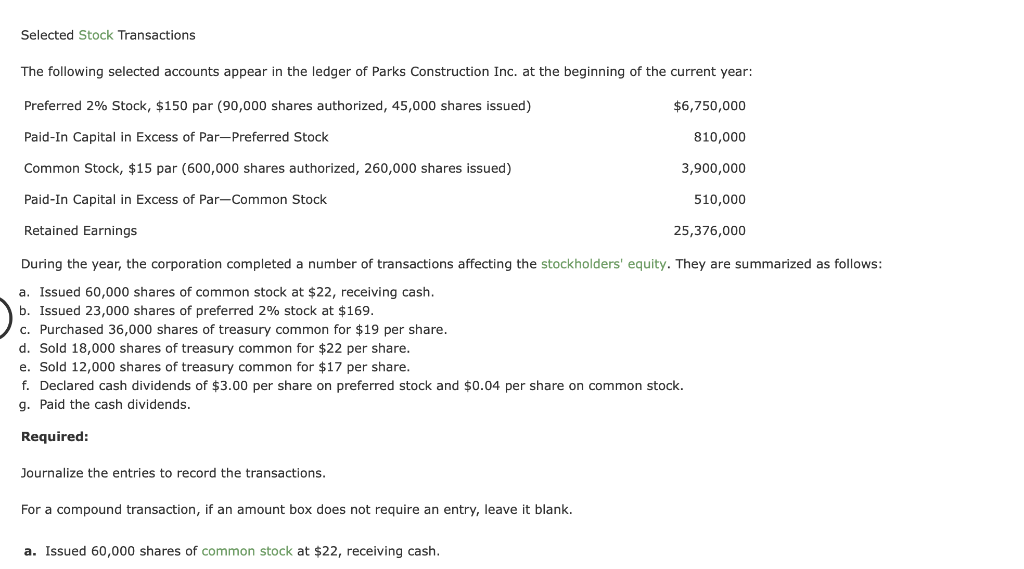

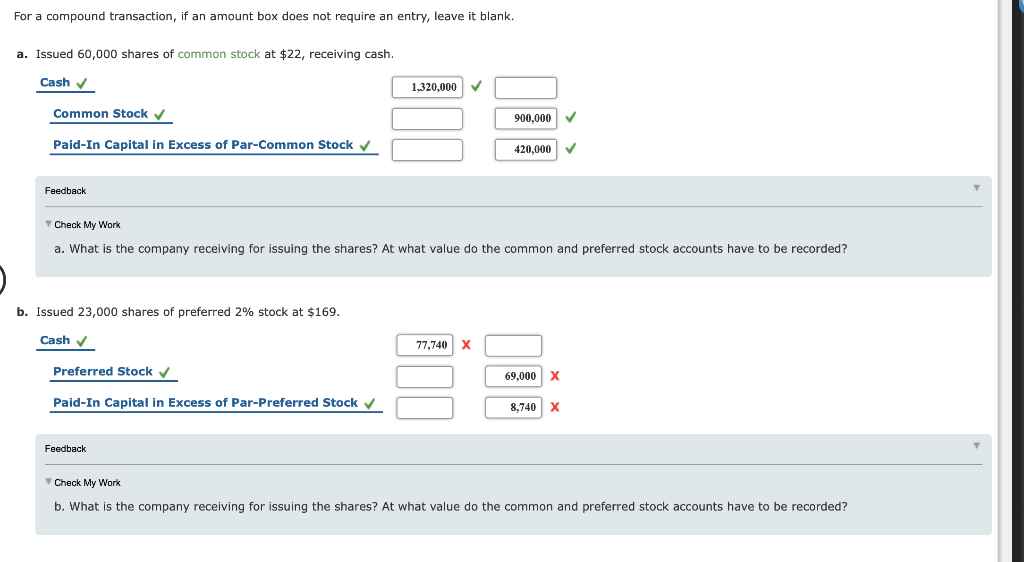

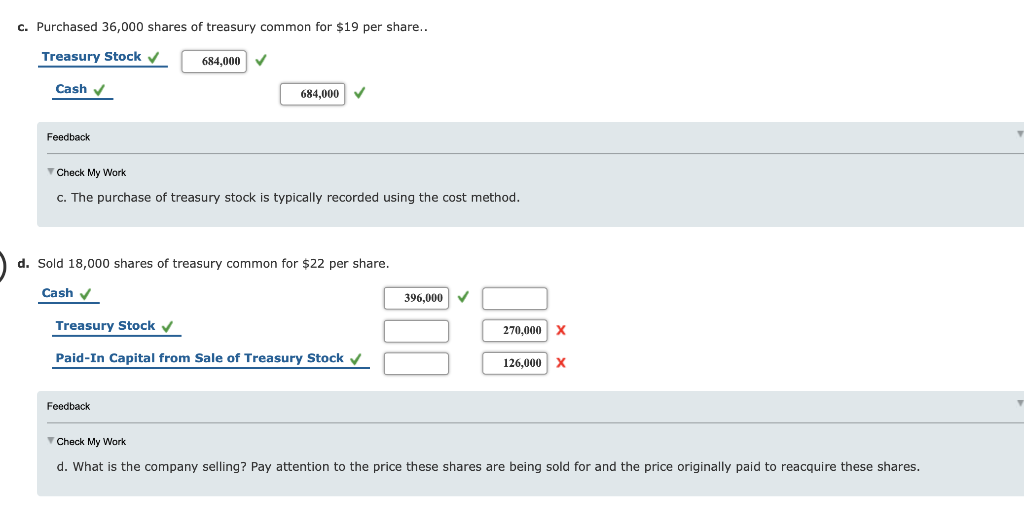

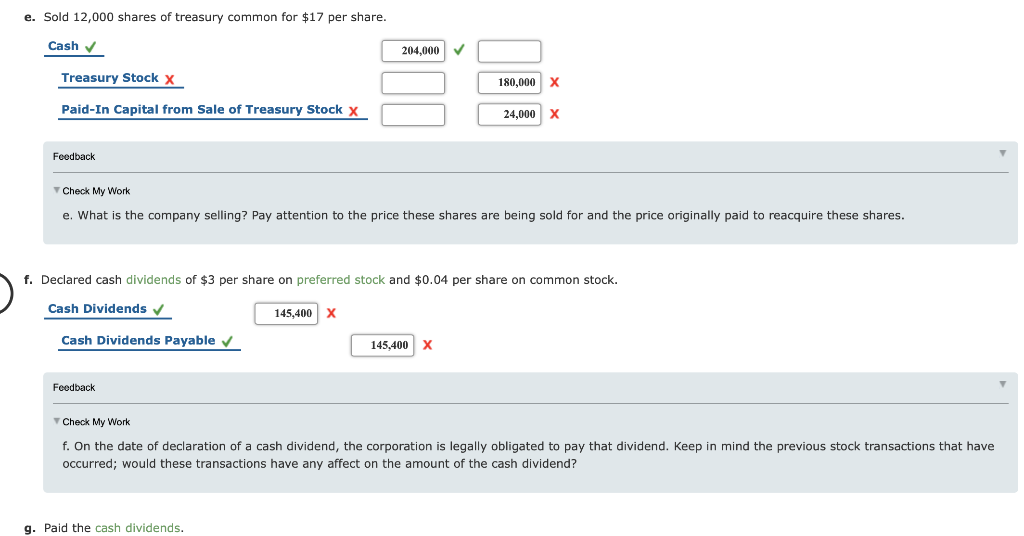

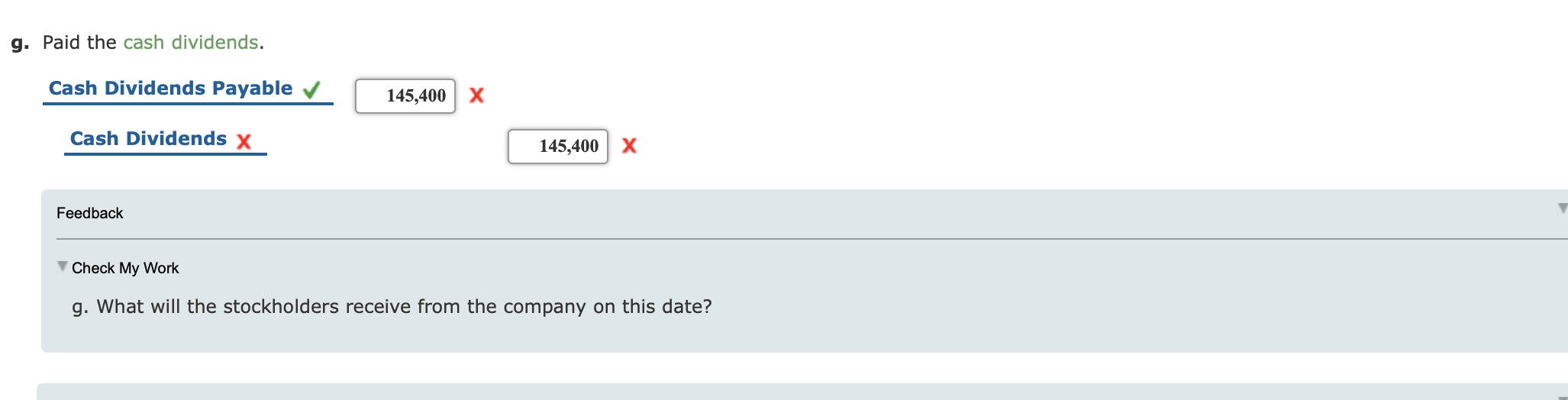

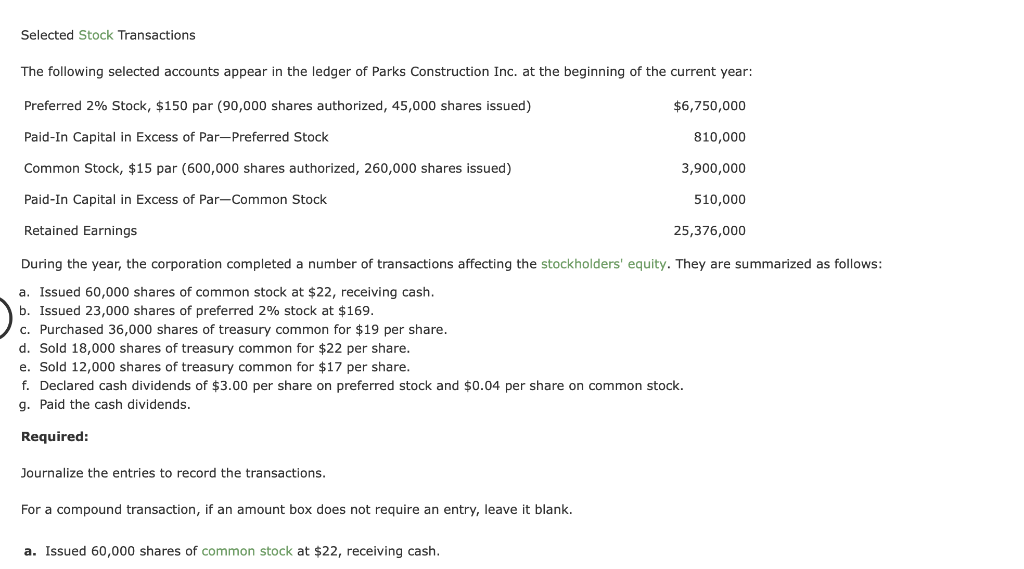

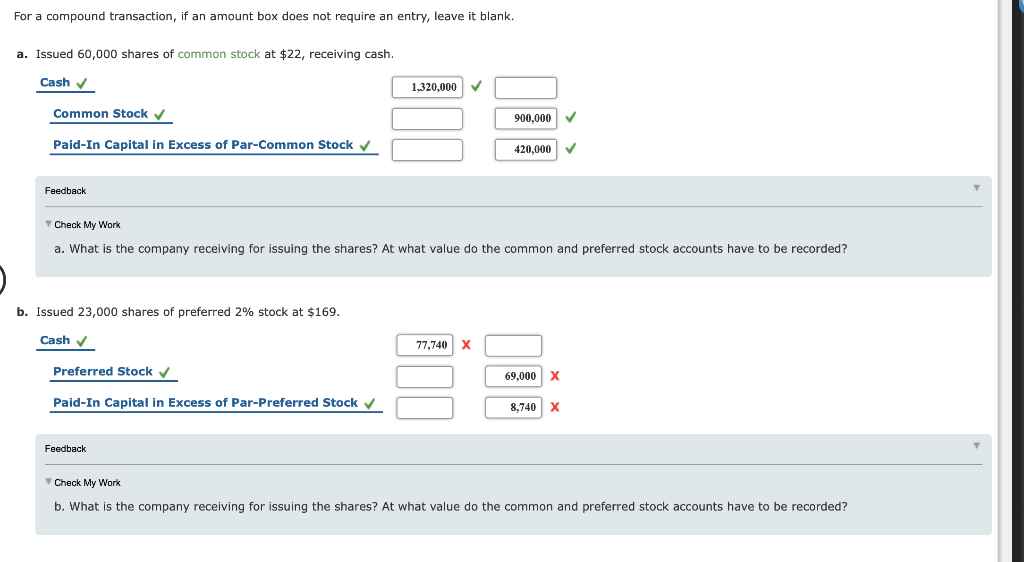

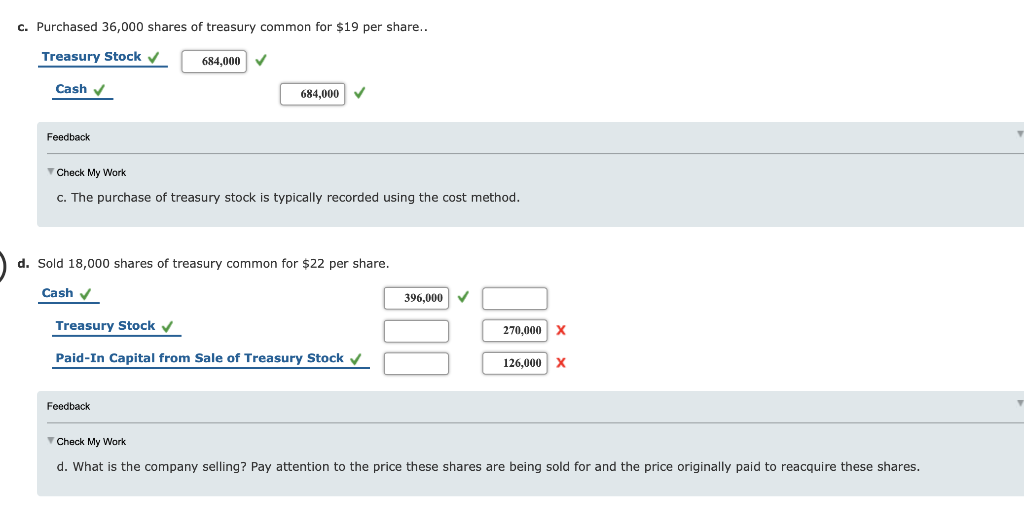

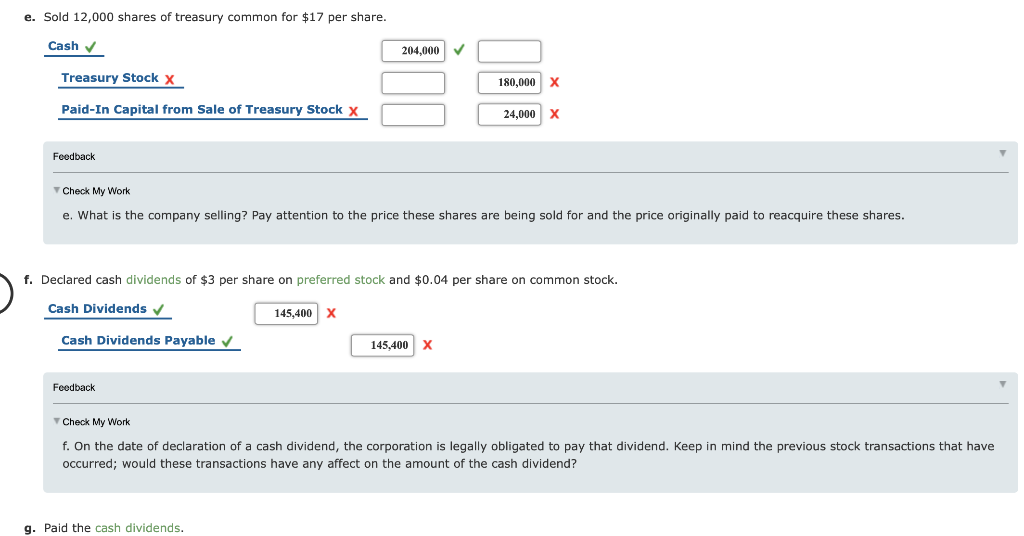

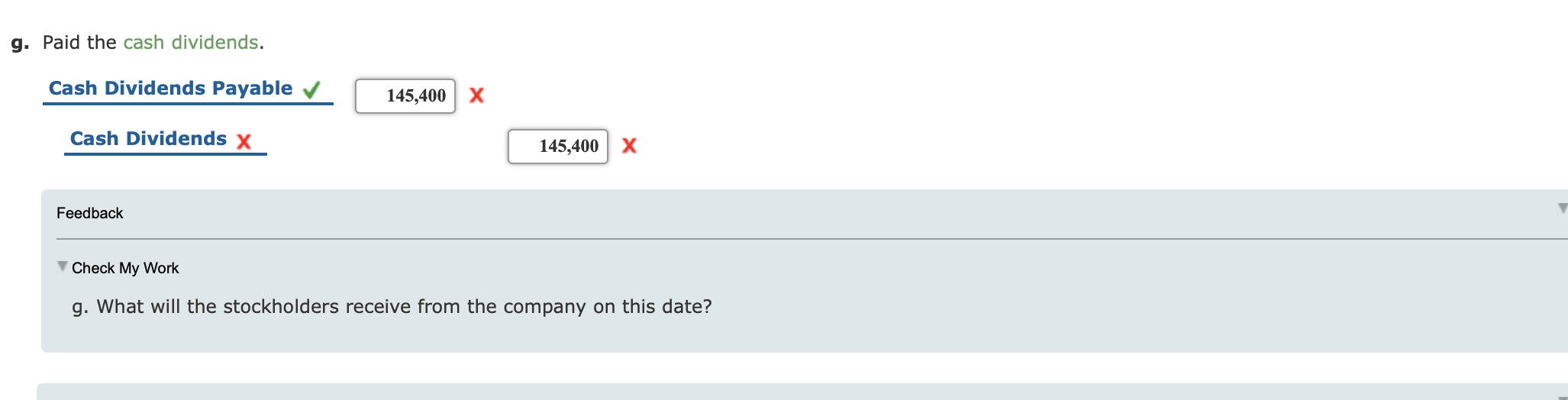

Selected Stock Transactions The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year: Preferred 2% Stock, $150 par (90,000 shares authorized, 45,000 shares issued) $6,750,000 Paid-In Capital in Excess of Par-Preferred Stock 810,000 Common Stock, $15 par (600,000 shares authorized, 260,000 shares issued) 3,900,000 Paid-In Capital in Excess of Par-Common Stock 510,000 Retained Earnings 25,376,000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: a. Issued 60,000 shares of common stock at $22, receiving cash. b. Issued 23,000 shares of preferred 2% stock at $169. C. Purchased 36,000 shares of treasury common for $19 per share. d. Sold 18,000 shares of treasury common for $22 per share. e. Sold 12,000 shares of treasury common for $17 per share. f. Declared cash dividends of $3.00 per share on preferred stock and $0.04 per share on common stock. g. Paid the cash dividends. Required: Journalize the entries to record the transactions. For a compound transaction, if an amount box does not require an entry, leave it blank. a. Issued 60,000 shares of common stock at $22, receiving cash. For a compound transaction, if an amount box does not require an entry, leave it blank. a. Issued 60,000 shares of common stock at $22, receiving cash. Cash 1,320,000 Common Stock 900,000 Paid-In Capital in Excess of Par-Common Stock 420,000 Feedback Check My Work a. What is the company receiving for issuing the shares? At what value do the common and preferred stock accounts have to be recorded? b. Issued 23,000 shares of preferred 2% stock at $169. Cash 77,740 Preferred Stock 69,000 Paid-In Capital in Excess of Par-Preferred Stock 8,740 Feedback Check My Work b. What is the company receiving for issuing the shares? At what value do the common and preferred stock accounts have to be recorded? c. Purchased 36,000 shares of treasury common for $19 per share.. Treasury Stock 684,000 Cash 684,000 Feedback Check My Work c. The purchase of treasury stock is typically recorded using the cost method. d. Sold 18,000 shares of treasury common for $22 per share. Cash 396,000 Treasury Stock 270,000 X Paid-In Capital from Sale of Treasury Stock 126,000 X Feedback Check My Work d. What is the company selling? Pay attention to the price these shares are being sold for and the price originally paid to reacquire these shares. e. Sold 12,000 shares of treasury common for $17 per share. Cash 204,000 Treasury Stock X 180,000 Paid-In Capital from Sale of Treasury Stock X 24,000 Feedback Check My Work e. What is the company selling? Pay attention to the price these shares are being sold for and the price originally paid to reacquire these shares. f. Declared cash dividends of $3 per share on preferred stock and $0.04 per share on common stock. Cash Dividends 145,400 Cash Dividends Payable 145,400 Feedback Check My Work f. On the date of declaration of a cash dividend, the corporation is legally obligated to pay that dividend. Keep in mind the previous stock transactions that have occurred; would these transactions have any affect on the amount of the cash dividend? g. Paid the cash dividends. g. Paid the cash dividends. Cash Dividends Payable 145,400 x Cash Dividends X 145,400 x Feedback Check My Work g. What will the stockholders receive from the company on this date