Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi can someone please help me answer the questions (a, b and c) in picture 3 of P10 - 2. The information needed to answer

Hi can someone please help me answer the questions (a, b and c) in picture 3 of P10 - 2. The information needed to answer the questions is provided in pictures 1, 2 and 3. Thank you.

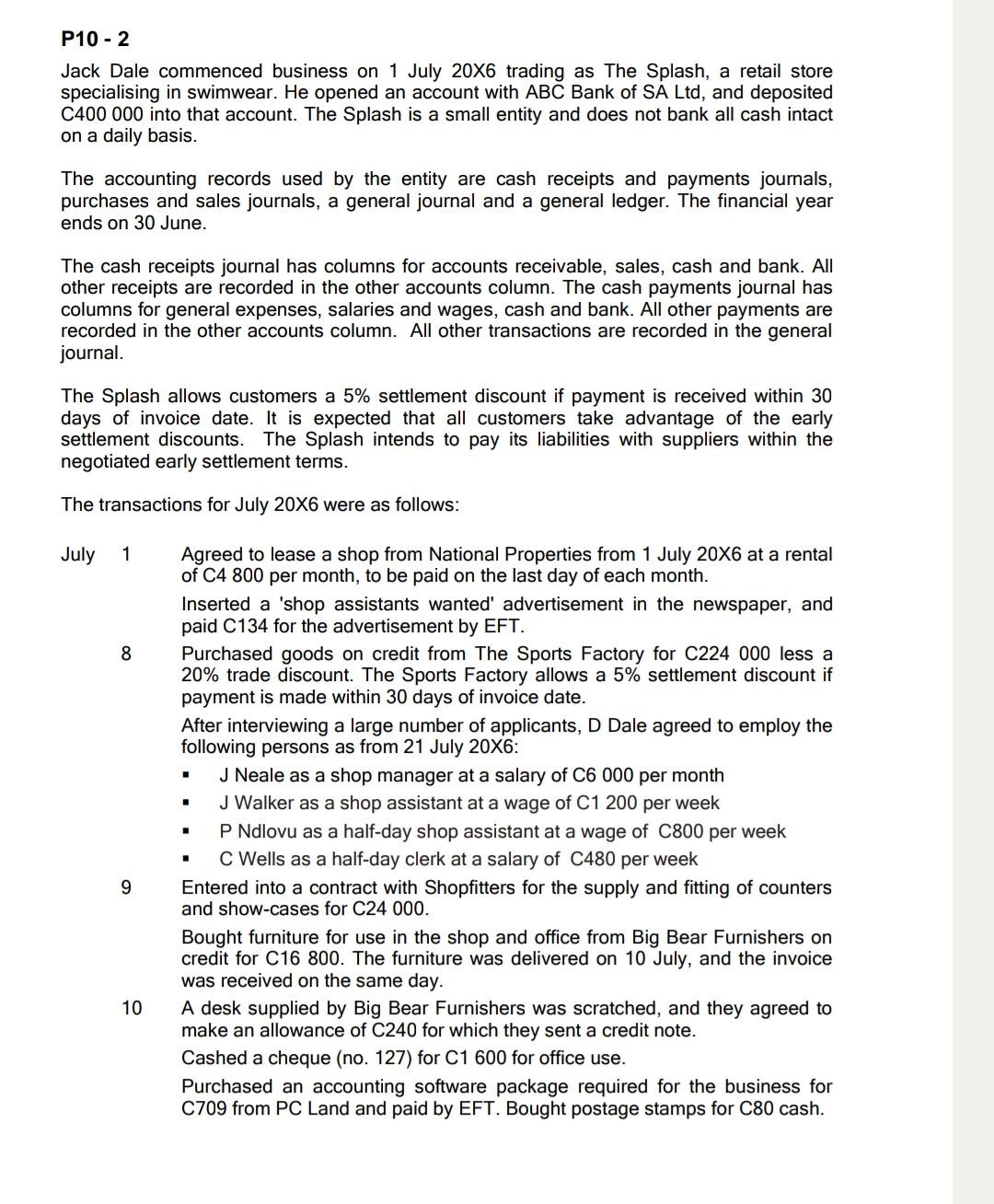

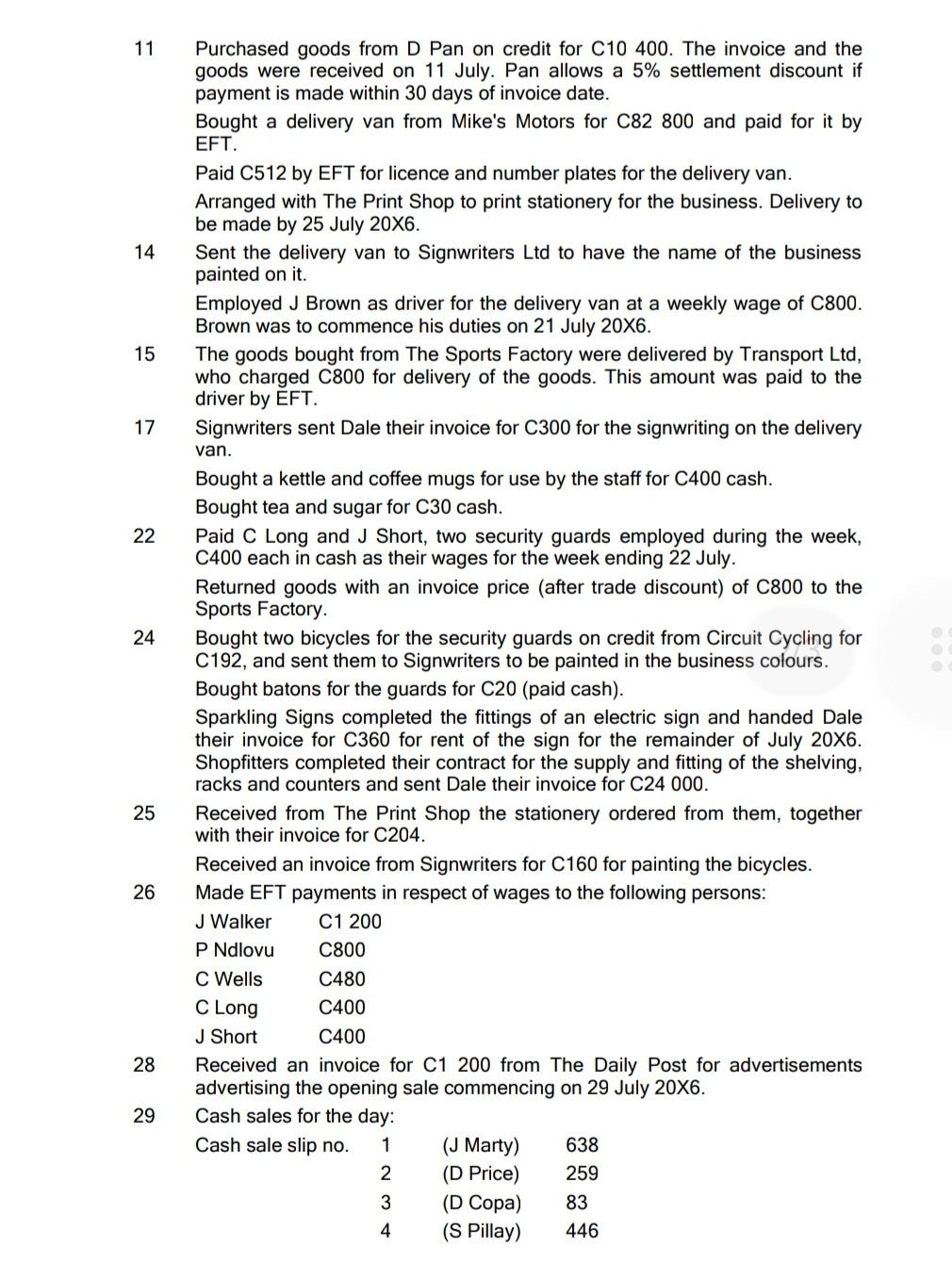

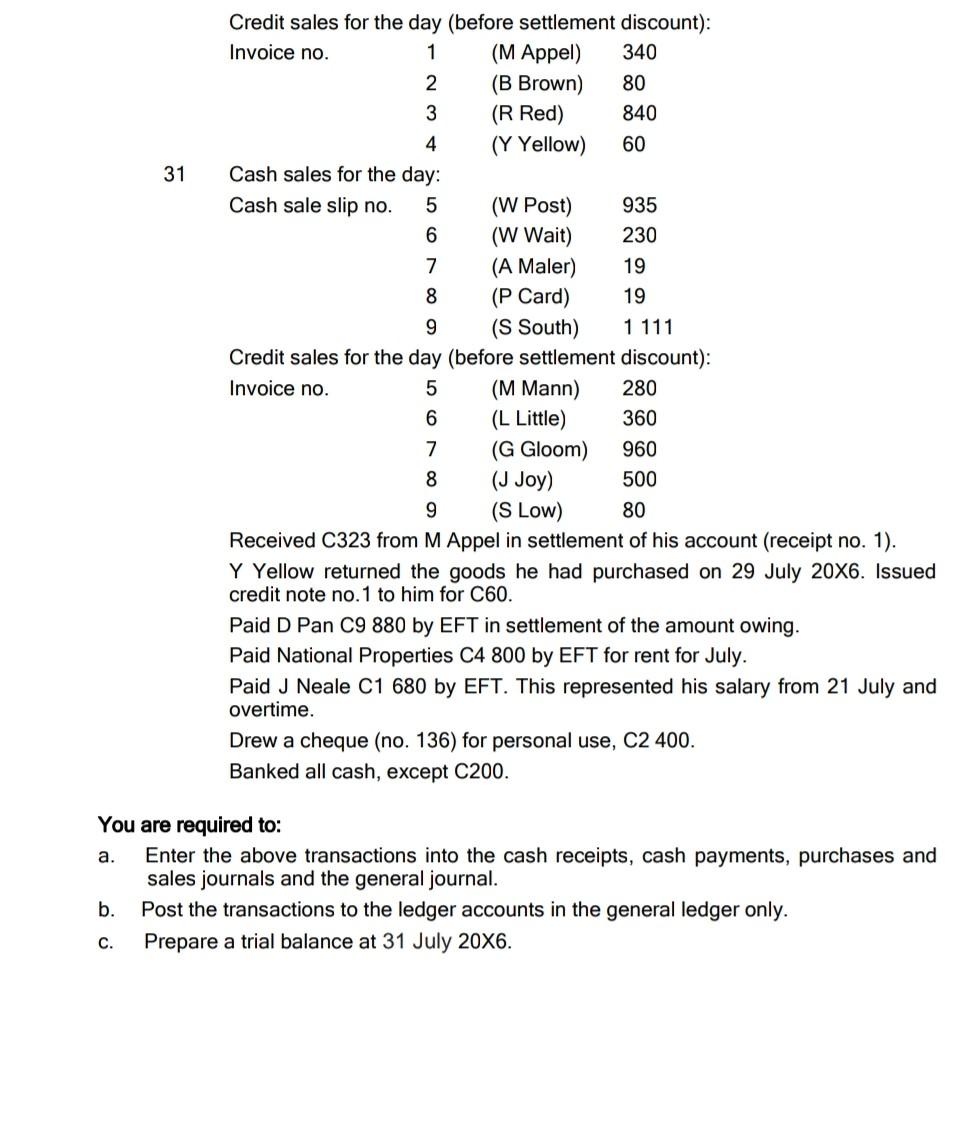

P10 - 2 Jack Dale commenced business on 1 July 206 trading as The Splash, a retail store specialising in swimwear. He opened an account with ABC Bank of SA Ltd, and deposited C400 000 into that account. The Splash is a small entity and does not bank all cash intact on a daily basis. The accounting records used by the entity are cash receipts and payments journals, purchases and sales journals, a general journal and a general ledger. The financial year ends on 30 June. The cash receipts journal has columns for accounts receivable, sales, cash and bank. All other receipts are recorded in the other accounts column. The cash payments journal has columns for general expenses, salaries and wages, cash and bank. All other payments are recorded in the other accounts column. All other transactions are recorded in the general journal. The Splash allows customers a 5% settlement discount if payment is received within 30 days of invoice date. It is expected that all customers take advantage of the early settlement discounts. The Splash intends to pay its liabilities with suppliers within the negotiated early settlement terms. The transactions for July 206 were as follows: July 1 Agreed to lease a shop from National Properties from 1 July 206 at a rental of C4 800 per month, to be paid on the last day of each month. Inserted a 'shop assistants wanted' advertisement in the newspaper, and paid C134 for the advertisement by EFT. 8 Purchased goods on credit from The Sports Factory for C224 000 less a 20% trade discount. The Sports Factory allows a 5% settlement discount if payment is made within 30 days of invoice date. After interviewing a large number of applicants, D Dale agreed to employ the following persons as from 21 July 20X6: - J Neale as a shop manager at a salary of C6 000 per month - J Walker as a shop assistant at a wage of C1 200 per week - P Ndlovu as a half-day shop assistant at a wage of C800 per week - C Wells as a half-day clerk at a salary of C480 per week 9 Entered into a contract with Shopfitters for the supply and fitting of counters and show-cases for C24 000. Bought furniture for use in the shop and office from Big Bear Furnishers on credit for C16800. The furniture was delivered on 10 July, and the invoice was received on the same day. 10 A desk supplied by Big Bear Furnishers was scratched, and they agreed to make an allowance of C240 for which they sent a credit note. Cashed a cheque (no. 127) for C1600 for office use. Purchased an accounting software package required for the business for C709 from PC Land and paid by EFT. Bought postage stamps for C80 cash. 11 Purchased goods from D Pan on credit for C10 400. The invoice and the goods were received on 11 July. Pan allows a 5% settlement discount if payment is made within 30 days of invoice date. Bought a delivery van from Mike's Motors for C82 800 and paid for it by EFT. Paid C512 by EFT for licence and number plates for the delivery van. Arranged with The Print Shop to print stationery for the business. Delivery to be made by 25 July 206. 14 Sent the delivery van to Signwriters Ltd to have the name of the business painted on it. Employed J Brown as driver for the delivery van at a weekly wage of C800. Brown was to commence his duties on 21 July 206. 15 The goods bought from The Sports Factory were delivered by Transport Ltd, who charged C800 for delivery of the goods. This amount was paid to the driver by EFT. 17 Signwriters sent Dale their invoice for C300 for the signwriting on the delivery van. Bought a kettle and coffee mugs for use by the staff for C400 cash. Bought tea and sugar for C30 cash. 22 Paid C Long and J Short, two security guards employed during the week, C400 each in cash as their wages for the week ending 22 July. Returned goods with an invoice price (after trade discount) of C800 to the Sports Factory. 24 Bought two bicycles for the security guards on credit from Circuit Cycling for C192, and sent them to Signwriters to be painted in the business colours. Bought batons for the guards for C20 (paid cash). Sparkling Signs completed the fittings of an electric sign and handed Dale their invoice for C360 for rent of the sign for the remainder of July 206. Shopfitters completed their contract for the supply and fitting of the shelving, racks and counters and sent Dale their invoice for C24 000 . 25 Received from The Print Shop the stationery ordered from them, together with their invoice for C204. Received an invoice from Signwriters for C160 for painting the bicycles. 26 Made EFT payments in respect of wages to the following persons: J Walker C1200 P Ndlovu C800 C Wells C480 C Long C400 J Short C400 28 Received an invoice for C1 200 from The Daily Post for advertisements advertising the opening sale commencing on 29 July 20 X6. 29 Cash sales for the day: Credit sales for the day (before settlement discount): 31 Cash sales for the day: Cashsaleslipno.7856(AMaler)(PCard)9(WPost)(WWait)1919(SSouth)9352301111 Credit sales for the dav (before settlement discount): Received C323 from M Appel in settlement of his account (receipt no. 1). Y Yellow returned the goods he had purchased on 29 July 20X6. Issued credit note no. 1 to him for C60. Paid D Pan C9 880 by EFT in settlement of the amount owing. Paid National Properties C4 800 by EFT for rent for July. Paid J Neale C1 680 by EFT. This represented his salary from 21 July and overtime. Drew a cheque (no. 136) for personal use, C2 400. Banked all cash, except C200. You are required to: a. Enter the above transactions into the cash receipts, cash payments, purchases and sales journals and the general journal. b. Post the transactions to the ledger accounts in the general ledger only. c. Prepare a trial balance at 31 July 206Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started