Question

Hi can someone please help me? I need to 1, calculate the conversion cost per unit using activity drivers 2, calculate the unit manufacturing cost

Hi can someone please help me? I need to 1, calculate the conversion cost per unit using activity drivers 2, calculate the unit manufacturing cost using DL for OH and then do the same thing (unit mfg cost) using activity drivers. I only have 5 hours left PLEASE HELP!!

Here's the text:

CableTech Bell Corporation (CTB) operates in the telecommunications industry. CTB has two divisions: the Phone Division and the Cable Service Division. The Phone Division manufactures telephones in several plants located in the Midwest. The product lines run from relatively inexpensive touch-tone wall and desk phones to expensive, high-quality cellular phones. CTB also operates a cable TV service in Ohio. The Cable Service Division offers three products: a basic package with 25 channels; an enhanced package, which is the basic package plus 15 additional channels and two movie channels; and a pre- mium package, which is the basic package plus 25 additional channels and three movie channels.

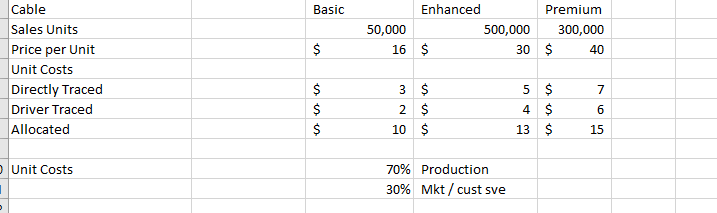

The Cable Service Division reported the following activity for the month of March:

The unit costs are divided as follows: 70 percent production and 30 percent marketing and customer service. Direct labor cost is the only driver used for tracing. Typically, the division uses only production costs to dene unit costs. The preceding unit product cost information was provided at the request of the marketing manager and was the result of a special study.

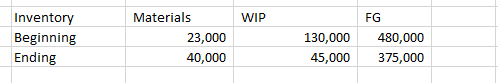

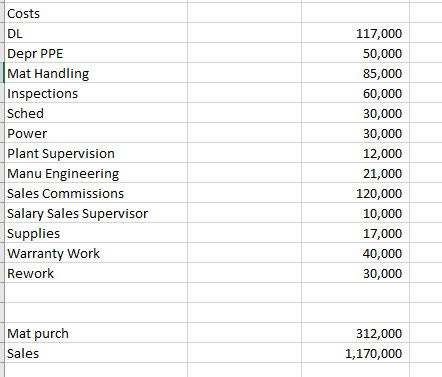

Bryce Youngers, the president of CTB, is reasonably satised with the performance of the Cable Service Division. Marchs performance is fairly typical of what has been happening over the past two years. The Phone Division, however, is another matter. Its overall prot performance has been declin- ing. Two years ago, income before income taxes had been about 25 percent of sales. Marchs dismal performance was also typical for what has been happening this year and is expected to continue unless some action by management is taken to reverse the trend. During March, the Phone Division reported the following results:

Inventories:

Costs:

After receiving the memo, Kim was intrigued. She then asked Jacob to use the same phone plant as a pilot for a preliminary ABC analysis. She instructed him to assign all overhead costs to the plants two products (Regular and Deluxe models), using only four activities. The four activities were rework, moving materials, inspecting products, and a general catch-all activity labeled other manufacturing activities. From the special study already performed, she knew that materials handling and inspecting involved signicant cost; from production reports, she also knew that the rework activity involved signif- icant cost. If the ABC and unit-based cost assignments did not differ by breaking out these three major activities, then ABC may not matter.

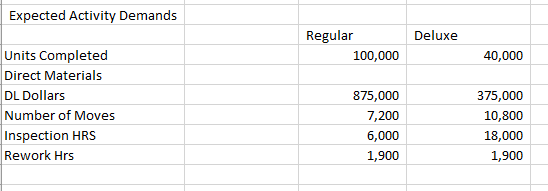

Pursuant to the request, Jacob produced the following cost and driver information:

| Activity | Expected Cost | Driver | Activity Capacity |

| Other Activities | 2,000,000 | DL $ | $1,250,000 |

| Moving Materials | 900,000 | # moves | 18,000 |

| Inspecting | 720,000 | Inspc Hrs | 24,000 |

| Reworking | 380,000 | Rework Hrs | 3,800 |

| Total OH Cost | $4,000,000 |

1.Calculate the conversion Cost Per Unit using ABC

2. Calculate the unit manufacturing cost using DL Dollars to assign overhead

3. Calculate the unit manufacturing cost using ABC

Basic 50,000 16 Enhanced 500,000 $ 30 Premium 300,000 $ 40 Cable Sales Units Price per Unit Unit Costs Directly Traced Driver Traced Allocated 3 2 10 $ $ $ 5 4 13 $ $ $ 7 6 15 Unit Costs 70% Production 30% Mkt /cust sve Costs DL Depr PPE Mat Handling Inspections Sched Power Plant Supervision Manu Engineering Sales Commissions Salary Sales Supervisor Supplies Warranty Work Rework 117,000 50,000 85,000 60,000 30,000 30,000 12,000 21,000 120,000 10,000 17,000 40,000 30,000 Mat purch Sales 312,000 1,170,000 Expected Activity Demands Deluxe Regular 100,000 40,000 Units Completed Direct Materials DL Dollars Number of Moves Inspection HRS Rework Hrs 875,000 7,200 6,000 1,900 375,000 10,800 18,000 1,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started