Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi, can u help me answer this question. I'll like your post you dont have to ask. You-Go-Go (YGG) is a business that officially commenced

hi, can u help me answer this question. I'll like your post you dont have to ask.

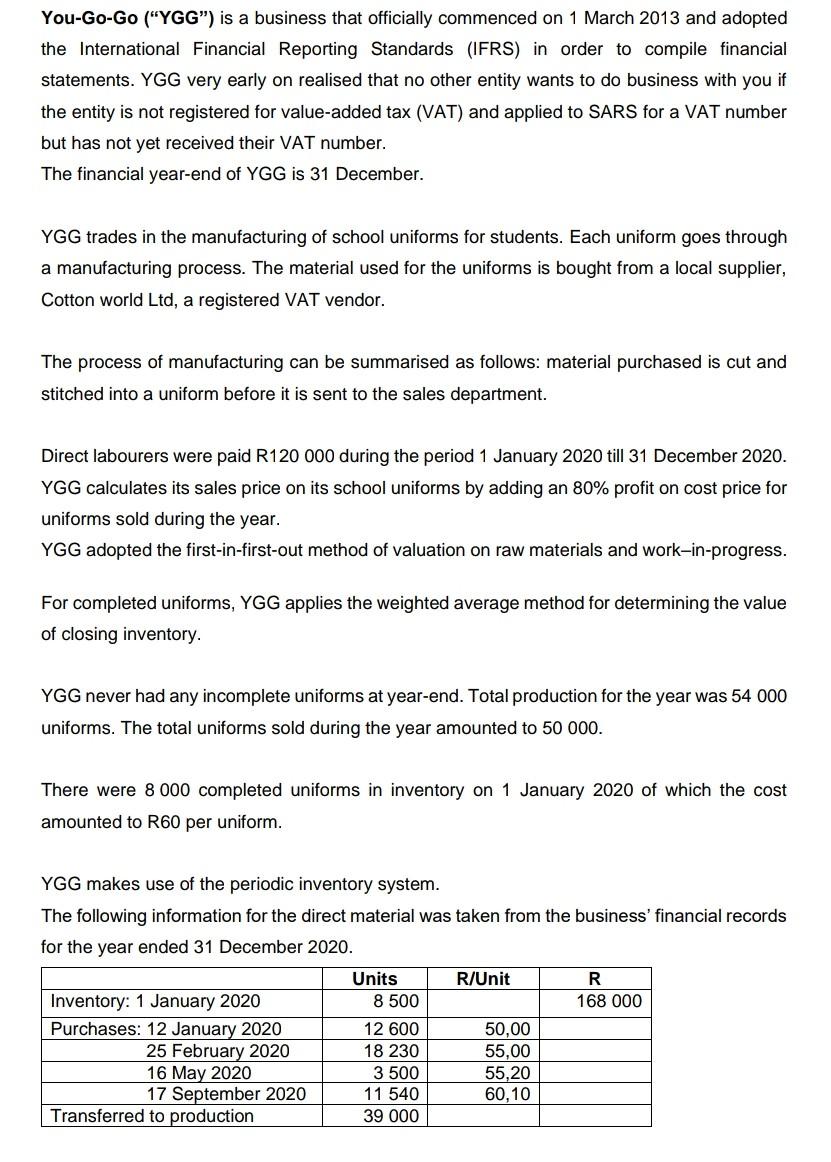

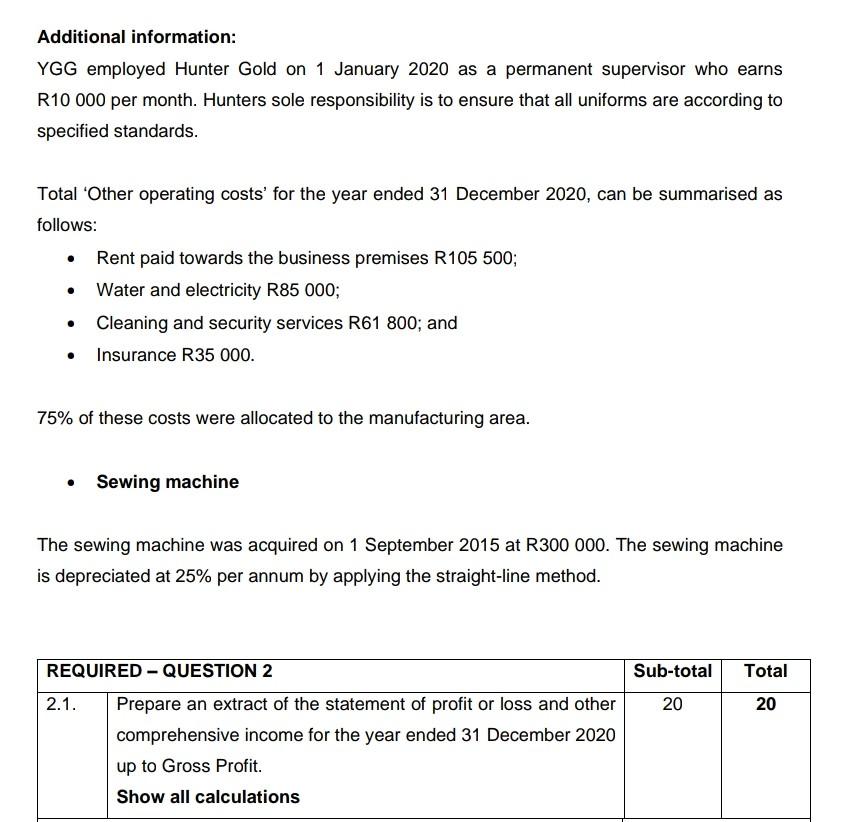

You-Go-Go ("YGG") is a business that officially commenced on 1 March 2013 and adopted the International Financial Reporting Standards (IFRS) in order to compile financial statements. YGG very early on realised that no other entity wants to do business with you if the entity is not registered for value-added tax (VAT) and applied to SARS for a VAT number but has not yet received their VAT number. The financial year-end of YGG is 31 December. YGG trades in the manufacturing of school uniforms for students. Each uniform goes through a manufacturing process. The material used for the uniforms is bought from a local supplier, Cotton world Ltd, a registered VAT vendor. The process of manufacturing can be summarised as follows: material purchased is cut and stitched into a uniform before it is sent to the sales department. Direct labourers were paid R120 000 during the period 1 January 2020 till 31 December 2020. YGG calculates its sales price on its school uniforms by adding an 80% profit on cost price for uniforms sold during the year. YGG adopted the first-in-first-out method of valuation on raw materials and work-in-progress. For completed uniforms, YGG applies the weighted average method for determining the value of closing inventory. YGG never had any incomplete uniforms at year-end. Total production for the year was 54 000 uniforms. The total uniforms sold during the year amounted to 50 000. There were 8 000 completed uniforms in inventory on 1 January 2020 of which the cost amounted to R60 per uniform. YGG makes use of the periodic inventory system. The following information for the direct material was taken from the business' financial records for the year ended 31 December 2020. Units R/Unit R Inventory: 1 January 2020 8 500 168 000 Purchases: 12 January 2020 12 600 50,00 25 February 2020 18 230 55,00 16 May 2020 3 500 55,20 17 September 2020 11 540 60,10 Transferred to production 39 000 Additional information: YGG employed Hunter Gold on 1 January 2020 as a permanent supervisor who earns R10 000 per month. Hunters sole responsibility is to ensure that all uniforms are according to specified standards. Total Other operating costs' for the year ended 31 December 2020, can be summarised as follows: Rent paid towards the business premises R105 500; Water and electricity R85 000; Cleaning and security services R61 800; and Insurance R35 000. 75% of these costs were allocated to the manufacturing area. Sewing machine The sewing machine was acquired on 1 September 2015 at R300 000. The sewing machine is depreciated at 25% per annum by applying the straight-line method. Sub-total Total 20 20 REQUIRED - QUESTION 2 2.1. Prepare an extract of the statement of profit or loss and other comprehensive income for the year ended 31 December 2020 up to Gross Profit. Show all calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started