hi can u tell me how can i do this in financial calculator

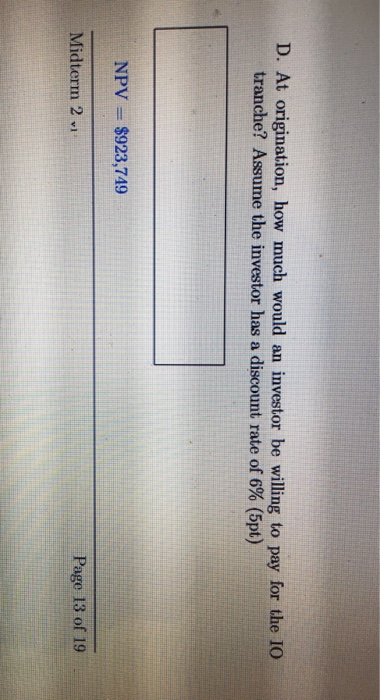

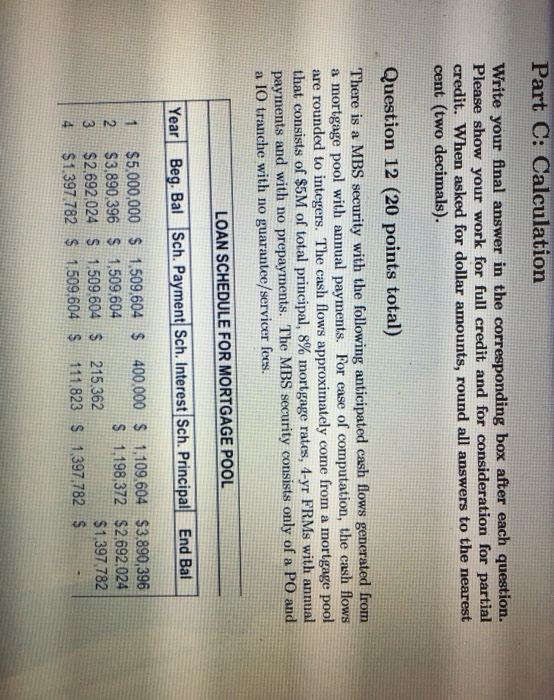

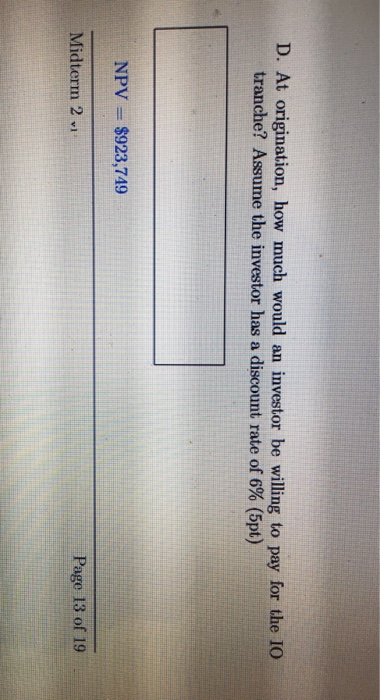

Part C: Calculation Write your final answer in the corresponding box after each question. Please show your work for full credit and for consideration for partial credit. When asked for dollar amounts, round all answers to the nearest cent (two decimals). Question 12 (20 points total) There is a MBS security with the following anticipated cash flows generated from a mortgage pool with annual payments. For ease of computation, the cash flows are rounded to integers. The cash flows approximately come from a mortgage pool that consists of $5M of total principal, 8% mortgage rates, 4-yr FRMs with annual payments and with no prepayments. The MBS security consists only of a PO and a 10 tranche with no guarantee/servicer focs. LOAN SCHEDULE FOR MORTGAGE POOL Year Beg. Bal Sch. Payment Sch. Interest Sch. Principal End Bal $5,000,000 $1.509,604 $ $3,890,396 $ 1,509,604 $2,692,024 $1.509.604 $ $1.397 782 $1,509,604 $ 400,000 $ 1.109.604 $3.890,396 $ 1,198,372 $2.692.024 215.362 $1,397 782 111,823 $ 1.397 782 $ D. At origination, how much would an investor be willing to pay for the 10 tranche? Assume the investor has a discount rate of 6% (5pt) NPV = $923,749 Midterm 2 1 Page 13 of 19 Part C: Calculation Write your final answer in the corresponding box after each question. Please show your work for full credit and for consideration for partial credit. When asked for dollar amounts, round all answers to the nearest cent (two decimals). Question 12 (20 points total) There is a MBS security with the following anticipated cash flows generated from a mortgage pool with annual payments. For ease of computation, the cash flows are rounded to integers. The cash flows approximately come from a mortgage pool that consists of $5M of total principal, 8% mortgage rates, 4-yr FRMs with annual payments and with no prepayments. The MBS security consists only of a PO and a 10 tranche with no guarantee/servicer focs. LOAN SCHEDULE FOR MORTGAGE POOL Year Beg. Bal Sch. Payment Sch. Interest Sch. Principal End Bal $5,000,000 $1.509,604 $ $3,890,396 $ 1,509,604 $2,692,024 $1.509.604 $ $1.397 782 $1,509,604 $ 400,000 $ 1.109.604 $3.890,396 $ 1,198,372 $2.692.024 215.362 $1,397 782 111,823 $ 1.397 782 $ D. At origination, how much would an investor be willing to pay for the 10 tranche? Assume the investor has a discount rate of 6% (5pt) NPV = $923,749 Midterm 2 1 Page 13 of 19

hi can u tell me how can i do this in financial calculator

hi can u tell me how can i do this in financial calculator