Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi can you answer this and also provide the solution? thanks Masters of Business Administration Cost Concept 1. The Variable Cost of Goods Sold in

hi can you answer this and also provide the solution? thanks

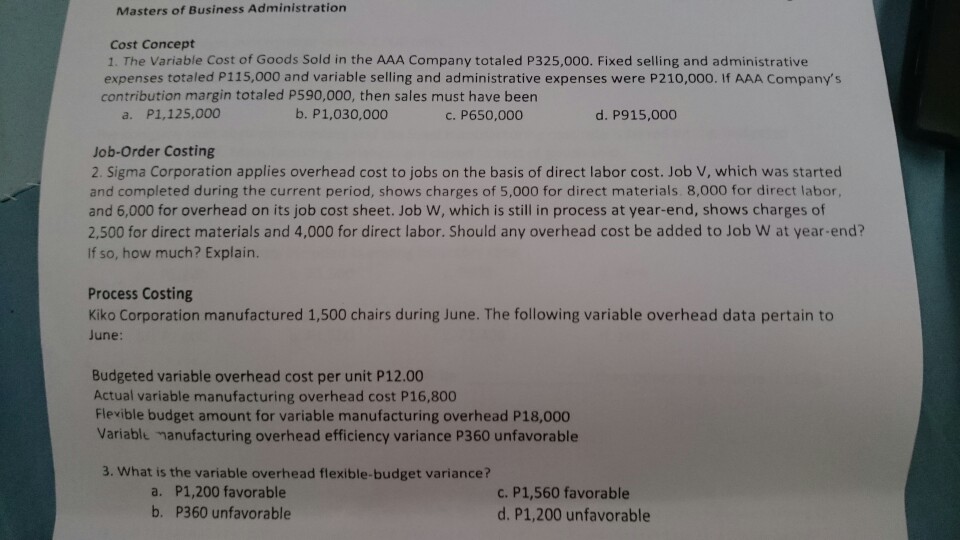

Masters of Business Administration Cost Concept 1. The Variable Cost of Goods Sold in the AAA Company totaled P325,000. Fixed selling and administrative expenses totaled P115,000 and variable selling and administrative expenses were P210,000. If AAA Company's contribution margin totaled P590,000, then sales must have been a. P1,125,000 b. P1,030,000 c. P650,000 d. P915,000 Job-Order Costing 2. Sigma Corporation applies overhead cost to jobs on the basis of direct labor cost. Job V, which was started and completed during the current period, shows charges of 5,000 for direct materials 8,000 for direct labor, and 6,000 for overhead on its job cost sheet. Job W, which is still in process at year-end, shows charges of 2.500 for direct materials and 4,000 for direct labor. Should any overhead cost be added to Job W at year end? If so, how much? Explain Process Costing Kiko Corporation manufactured 1,500 chairs during June. The following variable overhead data pertain to June Budgeted variable overhead cost per unit P12.00 Actual variable manufacturing overhead cost P16,800 Flevible budget amount for variable manufacturing overhead P18,000 Variable manufacturing overhead efficiency variance P360 unfavorable 3. What is the variable overhead flexible-budget variance? a. P1,200 favorable b. P360 unfavorable c. P1,560 favorable d. P1,200 unfavorableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started