Hi, can you answer this question in more detail?

Subject: Hong Kong Taxation and Estate Planning

Q1. G

Mr. A is a branch manager of a bank in Hong Kong; his monthly salary is $100,000. His employer provided him with a rent-free flat for residence; the rateable value of the flat under the Rating Ordinance for the year was $130,000.

During the year, Mr. A paid an annual membership fee of $3,500 to the Hong Kong Bankers Association and spent $9,500 on entertainment with his staff and friends. He donated $450,000 to various charitable organizations in Hong Kong. He contributed 8% of his total salary to a MPF scheme during the year ended 31 March.

Mrs. A is an account manager of an advertising firm. Her monthly salary is $78,000. She made mandatory contributions to a mandatory provident fund amounting to 10% of her total income. She is studying a master degree in advertising; the annual tuition fee is $76,000. And she took one professional examination in advertising; the examination fee is $8,000.

The couple lives with Mr. As parents who are 58 and 69, respectively. Mrs. A does not live with her mother, but she gives $96,000 per year to support her mother. Mrs. As mother mainly lives in Taiwan and stays in Hong Kong for 80 days per year, and she is 66 years old. Mrs. As father is disabled and lives in nursing home; the basic annual cost is $70,000 plus doctors fees $8,600 is paid by Mrs. A. Mrs. As father was declared disabled by the Western Hospital during the year.

The couple decides to claim the related allowances respectively; therefore, Mr. A claims for his parents and Mrs. A claims for her parents.

The couple has two sons who are 4 and 10 years old. In January 2016, Mrs. A gave birth to a new born baby girl. So they have three children in total. The couple decided to nominate Mrs. A to claim the child allowance.

For the year of assessment 2015/16, 75% of the tax payable under salaries tax and personal assessment will be waived, subject to a ceiling of $20,000. Show all the steps of your solutions and round up to the nearest dollar.

(a) Based on the Tax Rate Tables; Compute the amounts of salaries tax payable by Mr. A and Mrs. A for the year of assessment 2015/16, if any.

(Answer: Individual assessment is 71,386+ 4,735 = 76,121 and Joint assessment is 102,326)

(b) Assume Mr. A pays rent of $16,000 and building management fee of $1,100 monthly. Also, he pays rates of $400 quarterly. Mr. A receives a refund of rent of $8,000 monthly from his employer.

Compute Mr. As assessable income before concessionary deductions for the year.

(Answer: 1,205,350)

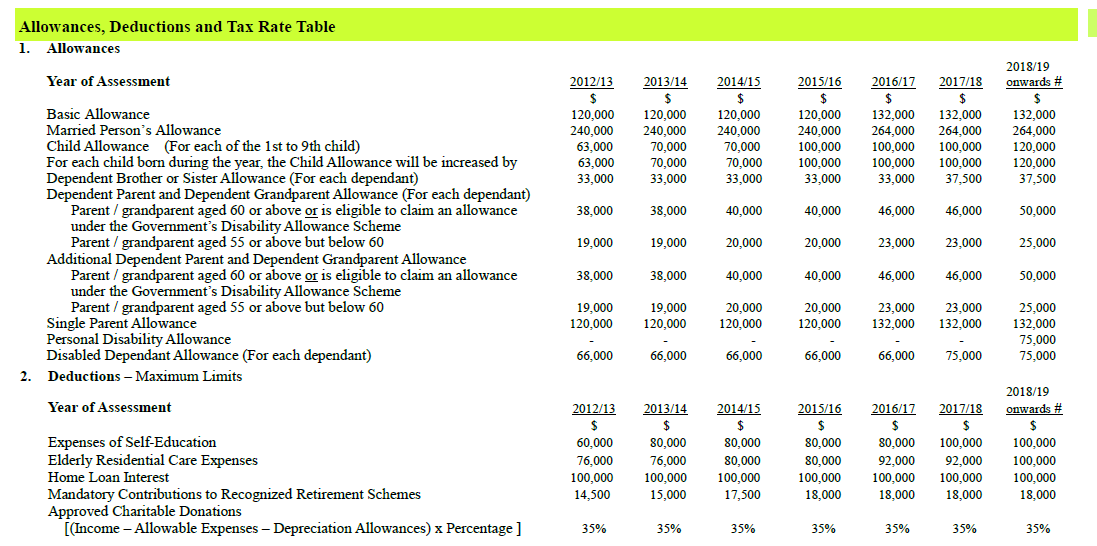

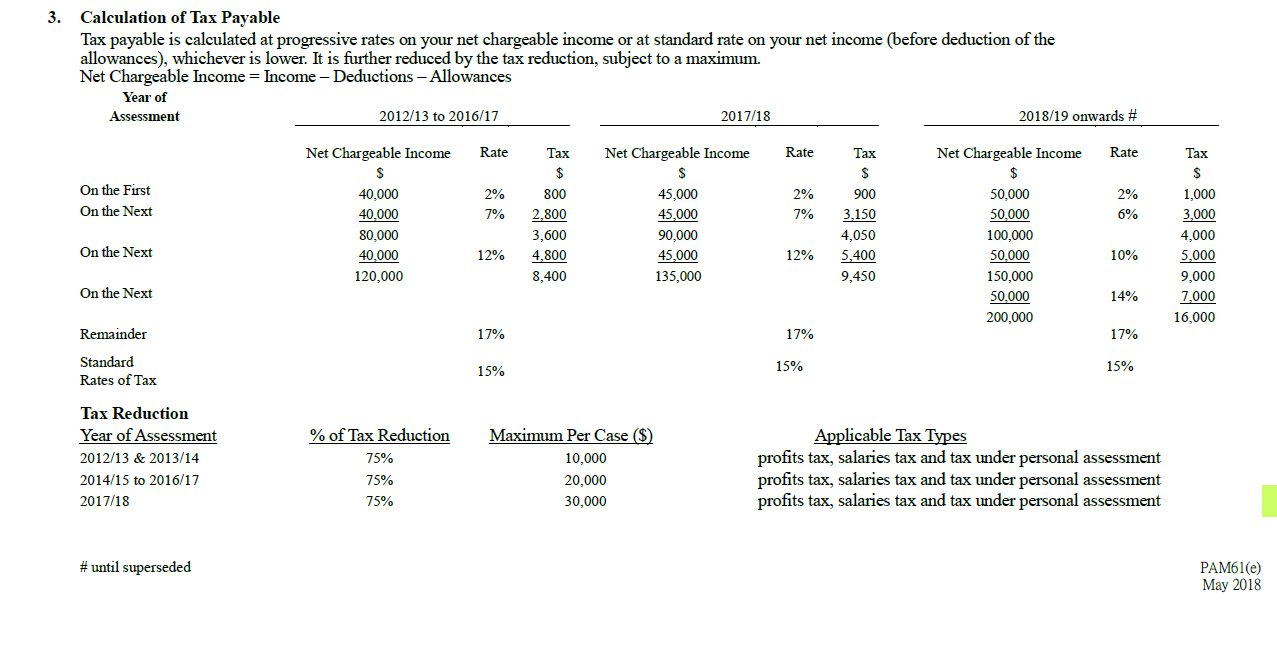

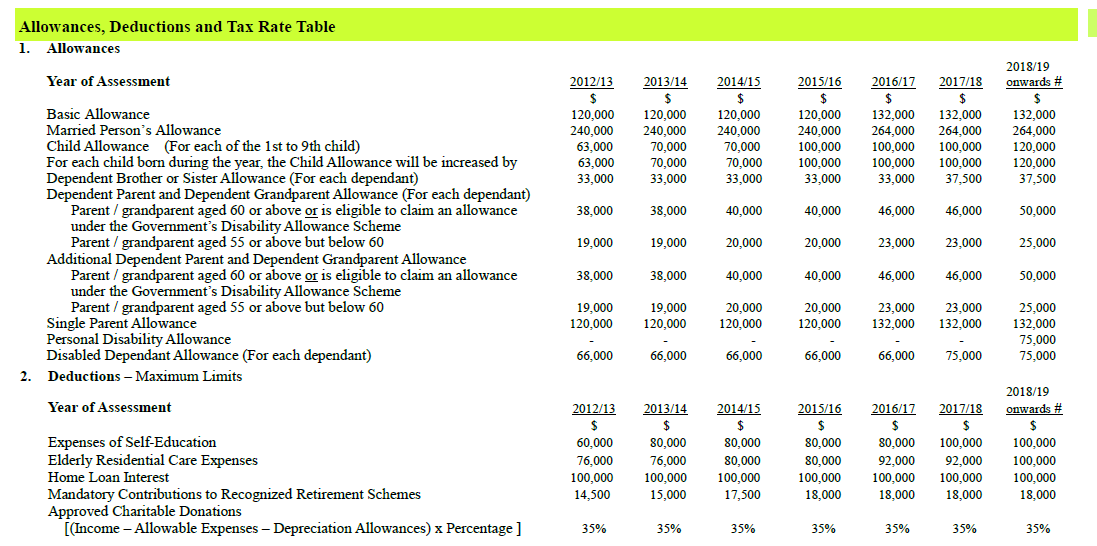

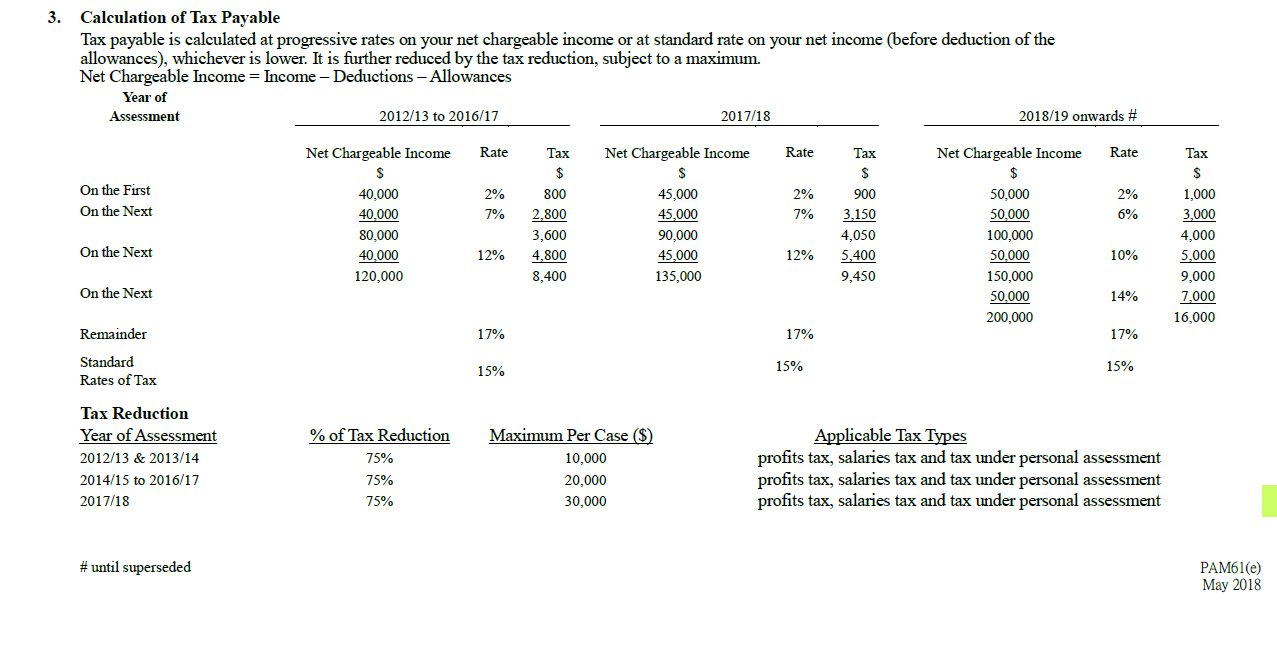

Allowances, Deductions and Tax Rate Table 1. Allowances Year of Assessment 2013/14 2014/15 2016/17 2017/18 $ 2012/13 $ 120.000 240,000 63.000 63,000 33,000 120,000 240,000 70,000 70.000 33,000 120,000 240,000 70,000 70,000 33,000 2015/16 $ 120,000 240,000 100,000 100.000 33.000 132,000 264.000 100,000 100,000 33,000 132.000 264.000 100.000 100.000 37,500 2018/19 onwards # $ 132.000 264.000 120,000 120.000 37,500 Dependent 38,000 38,000 40,000 40,000 46,000 46.000 50,000 Basic Allowance Married Person 's Allowance Child Allowance (For each of the 1st to 9th child) For each child born during the year, the Child Allowance will be increased by Dependent Brother or Sister Allowance (For each dependant) Parent t and Dependent Grandparent Allowance (For each dependant) Parent/grandparent aged 60 or above or is eligible to claim an allowance the Government's Disability Allowance Scheme Parent / grandparent aged 55 or above but below 60 Parent and Dependent Grandparent Allowance Parent/grandparent aged 60 or above or is eligible to claim an allowance under the Government's Disability Allowance Scheme Parent / grandparent aged 55 or above but below 60 Single Parent Allowance Personal Disability Allowance Disabled Dependant Allowance (For each dependant) 2. Deductions - Maximum Limits 19,000 19,000 20,000 20,000 23,000 23,000 25,000 Additional Dependent Pa 38,000 38,000 40,000 40,000 46,000 46,000 50,000 19,000 120,000 19,000 120,000 20,000 120,000 20,000 120,000 23,000 132,000 23,000 132,000 25,000 132,000 75,000 75,000 66,000 66,000 66,000 66,000 66,000 75,000 Year of Assessment 2013/14 2015/16 2017/18 $ $ Expenses of Self-Education Elderly Residential Care Expenses Home Loan Interest Mandatory Contributions to Recognized Retirement Schemes Approved Charitable Donations [(Income - Allowable Expenses Depreciation Allowances) x Percentage ] 2012/13 $ 60,000 76,000 100,000 14,500 80,000 76,000 100,000 15,000 2014/15 $ 80,000 80,000 100,000 17,500 80,000 80,000 100,000 18,000 2016/17 $ 80,000 92,000 100,000 18,000 100,000 92.000 100,000 18,000 2018/19 onwards # $ 100,000 100,000 100.000 18,000 35% 35% 35% 35% 35% 35% 35% 3. Calculation of Tax Payable Tax payable is calculated at progressive rates on your net chargeable income or at standard rate on your net income (before deduction of the allowances), whichever is lower. It is further reduced by the tax reduction, subject to a maximum. Net Chargeable Income = Income - Deductions - Allowances Year of Assessment 2012/13 to 2016/17 2017/18 2018/19 onwards # Rate Net Chargeable Income Rate Rate Tax $ On the First On the Next Net Chargeable Income S 40,000 40,000 80,000 40.000 120,000 2% 7% Tax $ 800 2,800 3,600 4,800 8,400 2% 7% 2% 6% 45,000 45,000 90.000 45,000 135,000 900 3,150 4,050 5,400 9,450 Net Chargeable Income $ 50,000 50,000 100,000 50,000 150.000 50,000 200,000 Tax $ 1,000 3,000 4,000 5,000 9,000 7,000 16,000 On the Next 12% 12% 10% On the Next 14% Remainder 17% 17% 17% Standard Rates of Tax 15% 15% 15% 15% Tax Reduction Year of Assessment 2012/13 & 2013/14 2014/15 to 2016/17 2017/18 % of Tax Reduction 75% 75% 75% Maximum Per Case ($) 10,000 20,000 30,000 Applicable Tax Types profits tax, salaries tax and tax under personal assessment profits tax, salaries tax and tax under personal assessment profits tax, salaries tax and tax under personal assessment # until superseded PAM61(e) May 2018 Allowances, Deductions and Tax Rate Table 1. Allowances Year of Assessment 2013/14 2014/15 2016/17 2017/18 $ 2012/13 $ 120.000 240,000 63.000 63,000 33,000 120,000 240,000 70,000 70.000 33,000 120,000 240,000 70,000 70,000 33,000 2015/16 $ 120,000 240,000 100,000 100.000 33.000 132,000 264.000 100,000 100,000 33,000 132.000 264.000 100.000 100.000 37,500 2018/19 onwards # $ 132.000 264.000 120,000 120.000 37,500 Dependent 38,000 38,000 40,000 40,000 46,000 46.000 50,000 Basic Allowance Married Person 's Allowance Child Allowance (For each of the 1st to 9th child) For each child born during the year, the Child Allowance will be increased by Dependent Brother or Sister Allowance (For each dependant) Parent t and Dependent Grandparent Allowance (For each dependant) Parent/grandparent aged 60 or above or is eligible to claim an allowance the Government's Disability Allowance Scheme Parent / grandparent aged 55 or above but below 60 Parent and Dependent Grandparent Allowance Parent/grandparent aged 60 or above or is eligible to claim an allowance under the Government's Disability Allowance Scheme Parent / grandparent aged 55 or above but below 60 Single Parent Allowance Personal Disability Allowance Disabled Dependant Allowance (For each dependant) 2. Deductions - Maximum Limits 19,000 19,000 20,000 20,000 23,000 23,000 25,000 Additional Dependent Pa 38,000 38,000 40,000 40,000 46,000 46,000 50,000 19,000 120,000 19,000 120,000 20,000 120,000 20,000 120,000 23,000 132,000 23,000 132,000 25,000 132,000 75,000 75,000 66,000 66,000 66,000 66,000 66,000 75,000 Year of Assessment 2013/14 2015/16 2017/18 $ $ Expenses of Self-Education Elderly Residential Care Expenses Home Loan Interest Mandatory Contributions to Recognized Retirement Schemes Approved Charitable Donations [(Income - Allowable Expenses Depreciation Allowances) x Percentage ] 2012/13 $ 60,000 76,000 100,000 14,500 80,000 76,000 100,000 15,000 2014/15 $ 80,000 80,000 100,000 17,500 80,000 80,000 100,000 18,000 2016/17 $ 80,000 92,000 100,000 18,000 100,000 92.000 100,000 18,000 2018/19 onwards # $ 100,000 100,000 100.000 18,000 35% 35% 35% 35% 35% 35% 35% 3. Calculation of Tax Payable Tax payable is calculated at progressive rates on your net chargeable income or at standard rate on your net income (before deduction of the allowances), whichever is lower. It is further reduced by the tax reduction, subject to a maximum. Net Chargeable Income = Income - Deductions - Allowances Year of Assessment 2012/13 to 2016/17 2017/18 2018/19 onwards # Rate Net Chargeable Income Rate Rate Tax $ On the First On the Next Net Chargeable Income S 40,000 40,000 80,000 40.000 120,000 2% 7% Tax $ 800 2,800 3,600 4,800 8,400 2% 7% 2% 6% 45,000 45,000 90.000 45,000 135,000 900 3,150 4,050 5,400 9,450 Net Chargeable Income $ 50,000 50,000 100,000 50,000 150.000 50,000 200,000 Tax $ 1,000 3,000 4,000 5,000 9,000 7,000 16,000 On the Next 12% 12% 10% On the Next 14% Remainder 17% 17% 17% Standard Rates of Tax 15% 15% 15% 15% Tax Reduction Year of Assessment 2012/13 & 2013/14 2014/15 to 2016/17 2017/18 % of Tax Reduction 75% 75% 75% Maximum Per Case ($) 10,000 20,000 30,000 Applicable Tax Types profits tax, salaries tax and tax under personal assessment profits tax, salaries tax and tax under personal assessment profits tax, salaries tax and tax under personal assessment # until superseded PAM61(e) May 2018