Hi, can you answer this question in more detail?

Subject: Taxation and Estate Planning

Q4. B

Mr. A owned a flat and let it to Mr. B for a three year lease from 1 June 2011 at a monthly rent of $30,000. Mr. B occupied the flat up to 30 June 2012, and disappeared. He did not pay the rent for the six months of December 2011 to May 2012. Mr. A took back the flat on 1 August 2012 and let it to Mr. C on 1 October 2012 at a monthly rent of $10,000. Mr. A paid rates of $2000 per quarter. Given 15% property tax rate, compute the property tax payable for the year of assessment 2011/12 and 2012/13. Show all the steps of your solutions and round up to the nearest dollar.

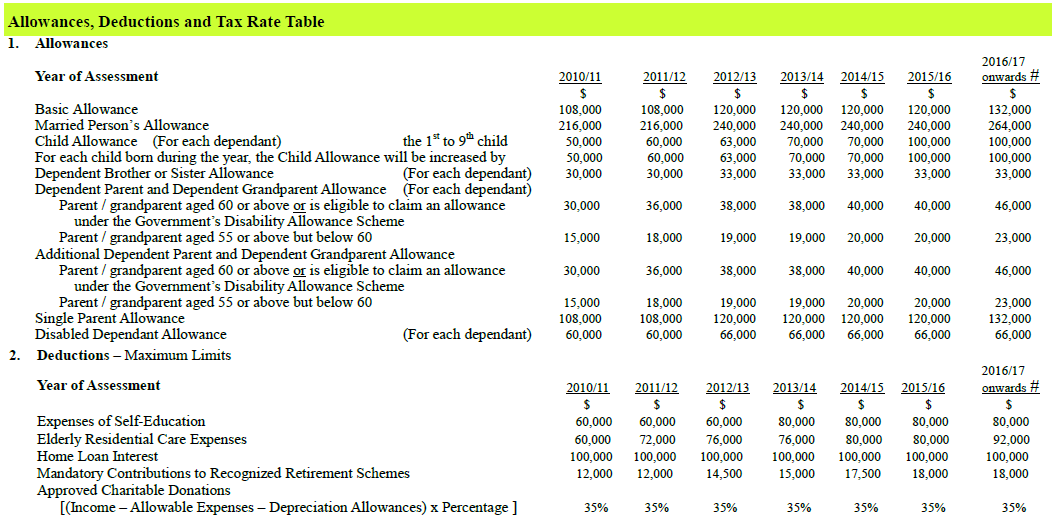

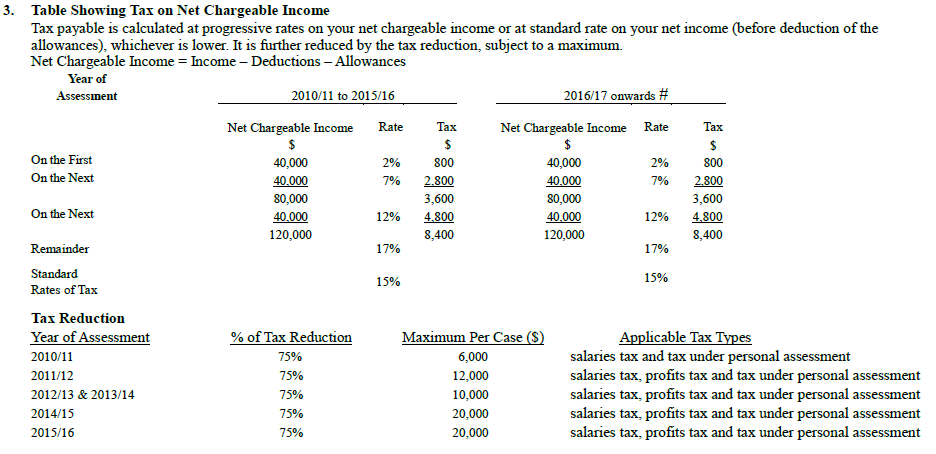

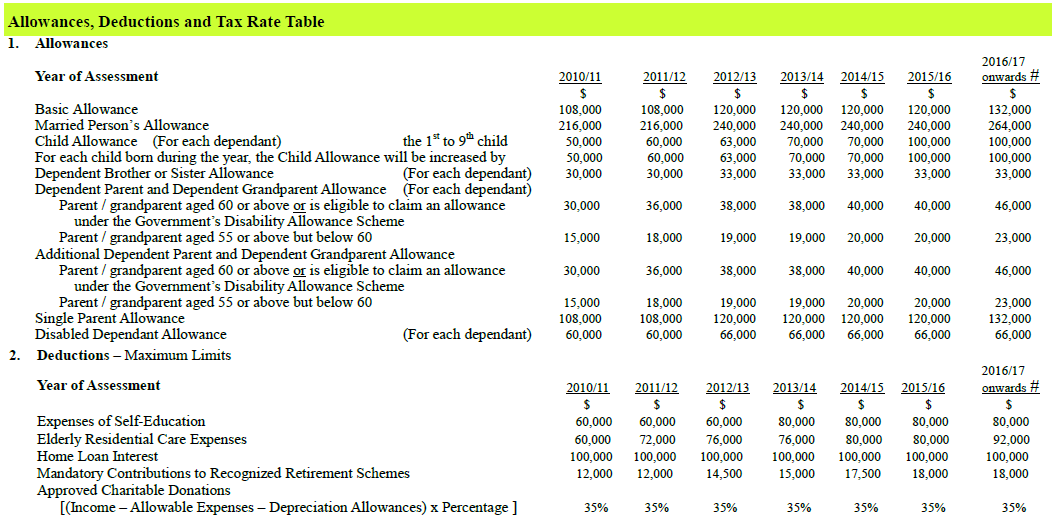

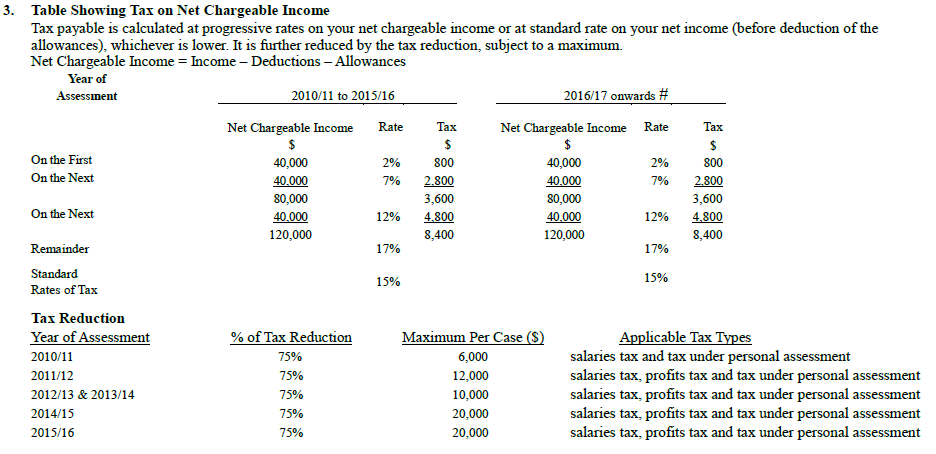

Allowances, Deductions and Tax Rate Table 1. Allowances 2016/17 Year of Assessment 2010/11 2011/12 2015/16 Onwards # $ 108.000 216,000 50,000 50.000 30,000 108,000 216.000 60,000 60.000 30,000 2012/13 $ 120.000 240.000 63.000 63.000 33.000 2013/14 $ 120,000 240,000 70,000 70,000 33,000 2014/15 $ 120,000 240,000 70,000 70,000 33,000 120,000 240,000 100,000 100.000 33.000 132,000 264,000 100,000 100.000 33,000 30,000 36,000 38,000 38,000 40.000 40,000 46,000 Basic Allowance Married Person's Allowance Child Allowance (For each dependant) the 1st to the child For each child born during the year, the Child Allowance will be increased by Dependent Brother or Sister Allowance (For each dependant) Dependent Parent and Dependent Grandparent Allowance (For each dependant) nt/grandparent aged 60 or above or is eligible to claim an allowance under the Government's Disability Allowance Scheme Parent grandparent aged 55 or above but below 60 Additional Dependent Parent and Dependent Grandparent Allowance Parent / grandparent aged 60 or above or is eligible to claim an allowance under the Government's Disability Allowance Scheme Parent / grandparent aged 55 or above but below 60 Single Parent Allowance Disabled Dependant Allowance (For each dependant) Deductions - Maximum Limits 15,000 18,000 19,000 19,000 20.000 20,000 23,000 30,000 36,000 38,000 38,000 40,000 40,000 46,000 15,000 108.000 60,000 18,000 108,000 60,000 19,000 120,000 66,000 19,000 120,000 66,000 20,000 120,000 66,000 20,000 120,000 66,000 23,000 132,000 66,000 2. Year of Assessment 2011/12 $ Expenses of Self-Education Elderly Residential Care Expenses Home Loan Interest Mandatory Contributions to Recognized Retirement Schemes Approved Charitable Donations [(Income - Allowable Expenses - Depreciation Allowances) x Percentage ] 2010/11 $ 60,000 60,000 100,000 12,000 60,000 72,000 100,000 12,000 2012/13 $ 60,000 76,000 100,000 14,500 2013/14 $ 80,000 76,000 100,000 15,000 2014/15 $ 80,000 80,000 100,000 17,500 2015/16 $ 80,000 80,000 100,000 18,000 2016/17 onwards # $ 80,000 92,000 100,000 18.000 35% 35% 35% 35% 35% 35% 35% Rate Tax $ 2% 2% 3. Table Showing Tax on Net Chargeable Income Tax payable is calculated at progressive rates on your net chargeable income or at standard rate on your net income (before deduction of the allowances), whichever is lower. It is further reduced by the tax reduction, subject to a maximum. Net Chargeable Income = Income - Deductions - Allowances Year of Assessinent 2010/11 to 2015/16 2016/17 onwards # Net Chargeable Income Tax Net Chargeable Income Rate $ $ $ On the First 40,000 800 40,000 800 On the Next 40,000 7% 2.800 40.000 7% 2.800 80,000 3,600 80,000 3,600 On the Next 40.000 12% 4.800 40.000 12% 4.800 120,000 8,400 120,000 8,400 Remainder 17% 17% Standard Rates of Tax Tax Reduction Year of Assessment % of Tax Reduction Maximum Per Case (S) Applicable Tax Types 2010/11 75% 6,000 salaries tax and tax under personal assessment 2011/12 75% 12,000 salaries tax, profits tax and tax under personal assessment 2012/13 & 2013/14 10,000 salaries tax, profits tax and tax under personal assessment 2014/15 75% 20,000 salaries tax, profits tax and tax under personal assessment 2015/16 salaries tax, profits tax and tax under personal assessment 15% 15% 75% 75% 20,000 Allowances, Deductions and Tax Rate Table 1. Allowances 2016/17 Year of Assessment 2010/11 2011/12 2015/16 Onwards # $ 108.000 216,000 50,000 50.000 30,000 108,000 216.000 60,000 60.000 30,000 2012/13 $ 120.000 240.000 63.000 63.000 33.000 2013/14 $ 120,000 240,000 70,000 70,000 33,000 2014/15 $ 120,000 240,000 70,000 70,000 33,000 120,000 240,000 100,000 100.000 33.000 132,000 264,000 100,000 100.000 33,000 30,000 36,000 38,000 38,000 40.000 40,000 46,000 Basic Allowance Married Person's Allowance Child Allowance (For each dependant) the 1st to the child For each child born during the year, the Child Allowance will be increased by Dependent Brother or Sister Allowance (For each dependant) Dependent Parent and Dependent Grandparent Allowance (For each dependant) nt/grandparent aged 60 or above or is eligible to claim an allowance under the Government's Disability Allowance Scheme Parent grandparent aged 55 or above but below 60 Additional Dependent Parent and Dependent Grandparent Allowance Parent / grandparent aged 60 or above or is eligible to claim an allowance under the Government's Disability Allowance Scheme Parent / grandparent aged 55 or above but below 60 Single Parent Allowance Disabled Dependant Allowance (For each dependant) Deductions - Maximum Limits 15,000 18,000 19,000 19,000 20.000 20,000 23,000 30,000 36,000 38,000 38,000 40,000 40,000 46,000 15,000 108.000 60,000 18,000 108,000 60,000 19,000 120,000 66,000 19,000 120,000 66,000 20,000 120,000 66,000 20,000 120,000 66,000 23,000 132,000 66,000 2. Year of Assessment 2011/12 $ Expenses of Self-Education Elderly Residential Care Expenses Home Loan Interest Mandatory Contributions to Recognized Retirement Schemes Approved Charitable Donations [(Income - Allowable Expenses - Depreciation Allowances) x Percentage ] 2010/11 $ 60,000 60,000 100,000 12,000 60,000 72,000 100,000 12,000 2012/13 $ 60,000 76,000 100,000 14,500 2013/14 $ 80,000 76,000 100,000 15,000 2014/15 $ 80,000 80,000 100,000 17,500 2015/16 $ 80,000 80,000 100,000 18,000 2016/17 onwards # $ 80,000 92,000 100,000 18.000 35% 35% 35% 35% 35% 35% 35% Rate Tax $ 2% 2% 3. Table Showing Tax on Net Chargeable Income Tax payable is calculated at progressive rates on your net chargeable income or at standard rate on your net income (before deduction of the allowances), whichever is lower. It is further reduced by the tax reduction, subject to a maximum. Net Chargeable Income = Income - Deductions - Allowances Year of Assessinent 2010/11 to 2015/16 2016/17 onwards # Net Chargeable Income Tax Net Chargeable Income Rate $ $ $ On the First 40,000 800 40,000 800 On the Next 40,000 7% 2.800 40.000 7% 2.800 80,000 3,600 80,000 3,600 On the Next 40.000 12% 4.800 40.000 12% 4.800 120,000 8,400 120,000 8,400 Remainder 17% 17% Standard Rates of Tax Tax Reduction Year of Assessment % of Tax Reduction Maximum Per Case (S) Applicable Tax Types 2010/11 75% 6,000 salaries tax and tax under personal assessment 2011/12 75% 12,000 salaries tax, profits tax and tax under personal assessment 2012/13 & 2013/14 10,000 salaries tax, profits tax and tax under personal assessment 2014/15 75% 20,000 salaries tax, profits tax and tax under personal assessment 2015/16 salaries tax, profits tax and tax under personal assessment 15% 15% 75% 75% 20,000