Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi can you help me with question c) and d) please You are a financial advisor and your manager asked you to evaluate the following

hi can you help me with question c) and d) please

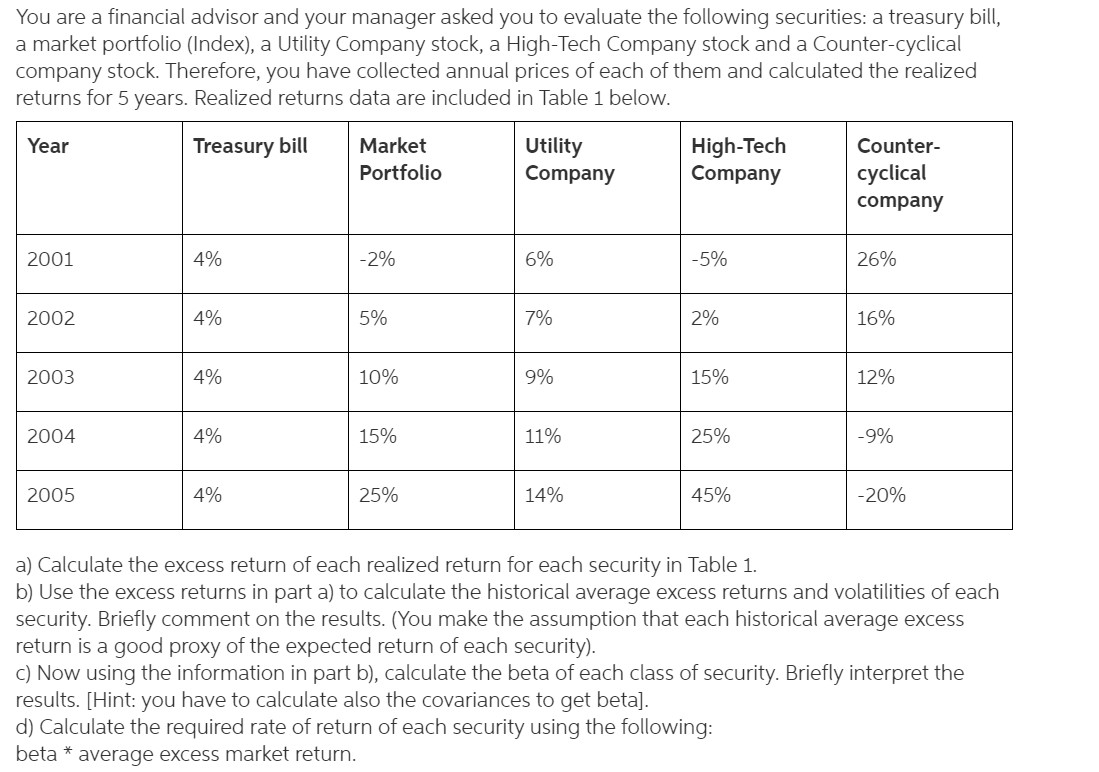

You are a financial advisor and your manager asked you to evaluate the following securities: a treasury bill, a market portfolio (Index), a Utility Company stock, a High-Tech Company stock and a Counter-cyclical company stock. Therefore, you have collected annual prices of each of them and calculated the realized returns for 5 years. Realized returns data are included in Table 1 below. Year Treasury bill Market Portfolio Utility Company High-Tech Company Counter- cyclical company 2001 4% -2% 6% -5% 26% 2002 4% 5% 2% 16% 2003 4% 10% 15% 12% 2004 4% 15% 11% 25% -9% 2005 4% 25% 14% 45% -20% a) Calculate the excess return of each realized return for each security in Table 1. b) Use the excess returns in part a) to calculate the historical average excess returns and volatilities of each security. Briefly comment on the results. (You make the assumption that each historical average excess return is a good proxy of the expected return of each security). c) Now using the information in part b), calculate the beta of each class of security. Briefly interpret the results. (Hint: you have to calculate also the covariances to get beta). d) Calculate the required rate of return of each security using the following: beta * average excess market return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started