Question

Hi, can you help with a detailed solution and screenshots in excel? Thanks part a) For the application described above, develop a complete LP model

Hi, can you help with a detailed solution and screenshots in excel? Thanks

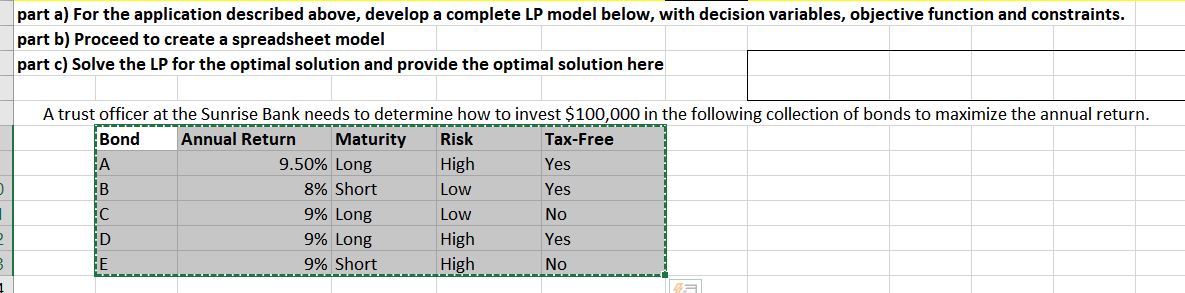

part a) For the application described above, develop a complete LP model below, with decision variables, objective function and constraints.

part b) Proceed to create a spreadsheet model

part c) Solve the LP for the optimal solution and provide the optimal solution here

A trust officer at the Sunrise Bank needs to determine how to invest $100,000 in the following collection of bonds to maximize the annual return.

Bond Annual Return Maturity Risk Tax-Free

A 9.50% Long High Yes

B 8% Short Low Yes

C 9% Long Low No

D 9% Long High Yes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started