Hi, can you please calculate the ROE from these two photos, and can you explain how you got the net income and shareholders equity for 2015

Please show working

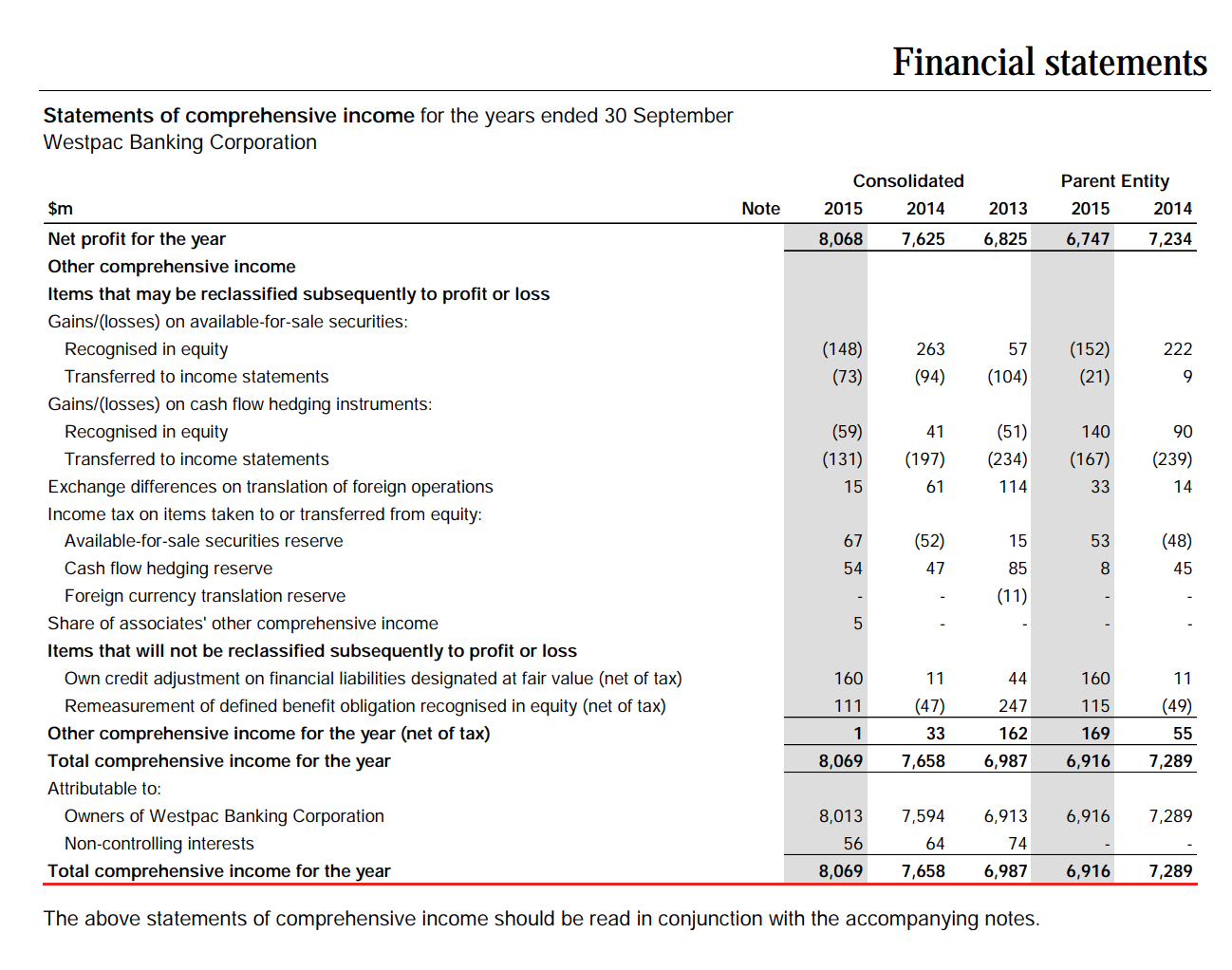

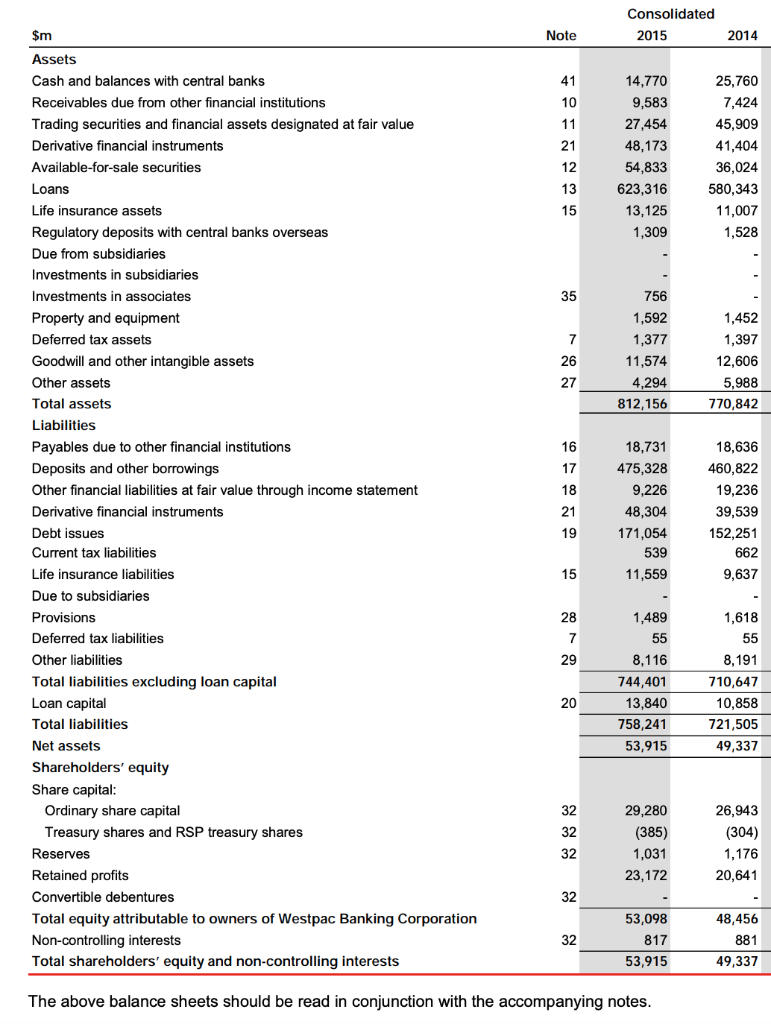

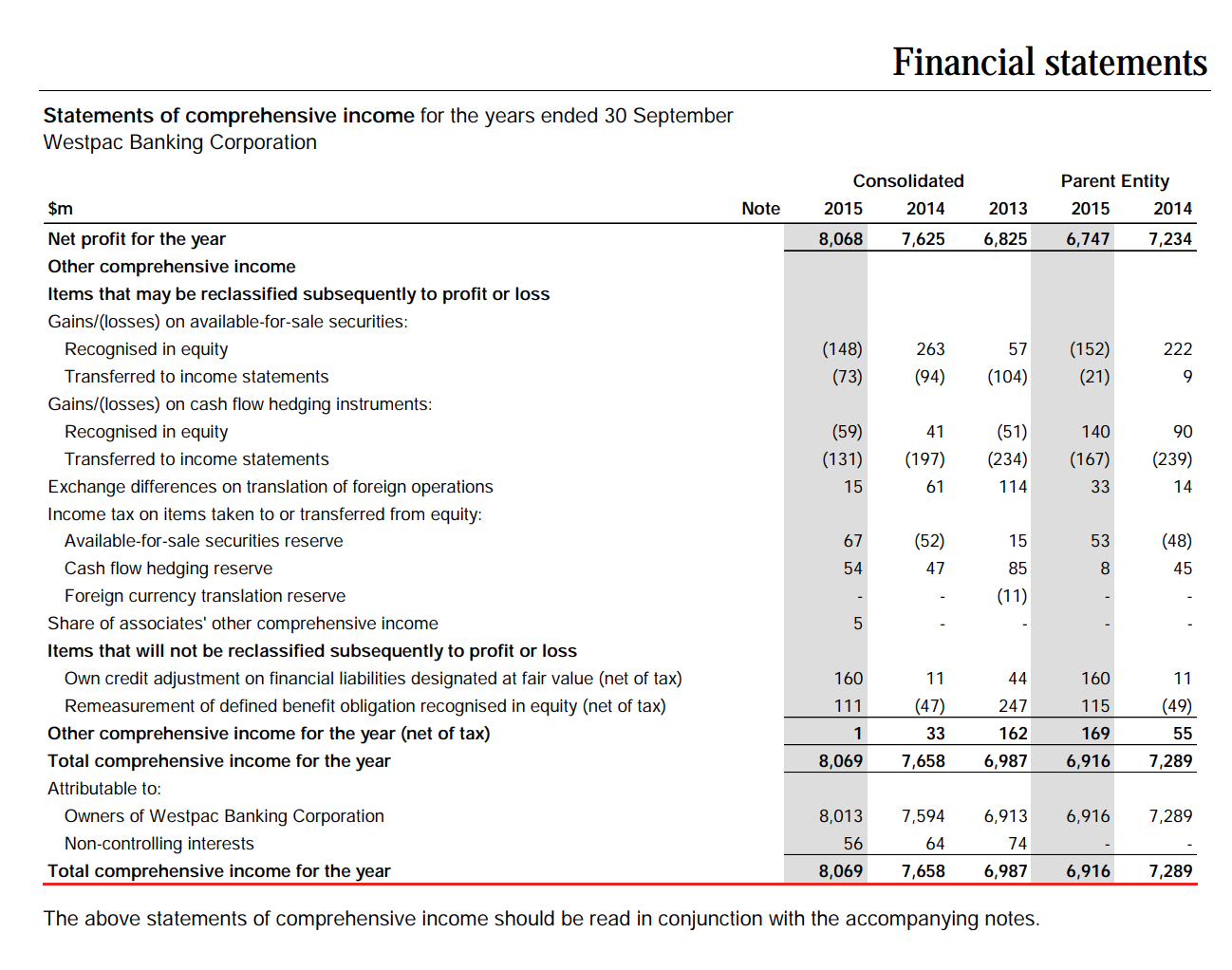

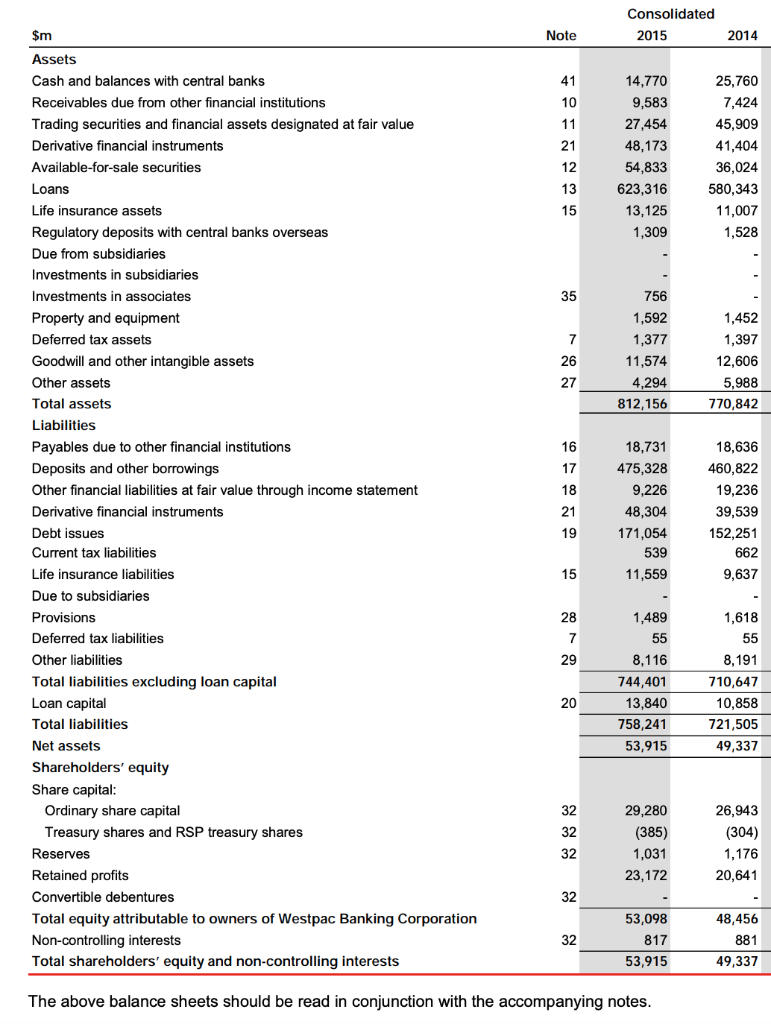

Financial statements Statements of comprehensive income for the years ended 30 September Westpac Banking Corporation Note Consolidated 2015 2014 8,068 7,625 2013 6,825 Parent Entity 2015 2014 6,747 7,234 222 (148) (73) 263 (94) 57 (104) (152) (21) 41 140 (59) (131) (51) (234) 114 (167) $m Net profit for the year Other comprehensive income Items that may be reclassified subsequently to profit or loss Gains/(losses) on available-for-sale securities: Recognised in equity Transferred to income statements Gains/losses) on cash flow hedging instruments: Recognised in equity Transferred to income statements Exchange differences on translation of foreign operations Income tax on items taken to or transferred from equity: Available-for-sale securities reserve Cash flow hedging reserve Foreign currency translation reserve Share of associates' other comprehensive income Items that will not be reclassified subsequently to profit or loss Own credit adjustment on financial liabilities designated at fair value (net of tax) Remeasurement of defined benefit obligation recognised in equity (net of tax) Other comprehensive income for the year (net of tax) Total comprehensive income for the year Attributable to: Owners of Westpac Banking Corporation Non-controlling interests Total comprehensive income for the year - 53 160 111 1 8,069 11 (47) 33 7,658 44 247 162 6,987 160 115 169 6,916 (49) 7,289 6,916 7,289 8,013 - 56 8,069 7,594 64 7,658 6,913 74 6,987 6,916 7,289 The above statements of comprehensive income should be read in conjunction with the accompanying notes. Consolidated 2015 Note 2014 14,770 9,583 27,454 48,173 54,833 623,316 13,125 1,309 25,760 7,424 45,909 41,404 36,024 580,343 11,007 1,528 756 1,592 1,377 11,574 4,294 812,156 1,452 1,397 12,606 5,988 770,842 $m Assets Cash and balances with central banks Receivables due from other financial institutions Trading securities and financial assets designated at fair value Derivative financial instruments Available-for-sale securities Loans Life insurance assets Regulatory deposits with central banks overseas Due from subsidiaries Investments in subsidiaries Investments in associates Property and equipment Deferred tax assets Goodwill and other intangible assets Other assets Total assets Liabilities Payables due to other financial institutions Deposits and other borrowings Other financial liabilities at fair value through income statement Derivative financial instruments Debt issues Current tax liabilities Life insurance liabilities Due to subsidiaries Provisions Deferred tax liabilities Other liabilities Total liabilities excluding loan capital Loan capital Total liabilities Net assets Shareholders' equity Share capital: Ordinary share capital Treasury shares and RSP treasury shares Reserves Retained profits Convertible debentures Total equity attributable to owners of Westpac Banking Corporation Non-controlling interests Total shareholders' equity and non-controlling interests 18,731 475,328 9,226 48,304 171,054 18,636 460,822 19,236 39,539 152,251 662 9,637 539 11,559 1,489 1,618 55 55 8,116 744,401 13,840 758,241 53,915 8,191 710,647 10,858 721,505 49,337 29,280 (385) 1,031 23,172 26,943 (304) 1,176 20,641 53,098 817 53,915 48,456 881 49,337 The above balance sheets should be read in conjunction with the accompanying notes