Hi can you please do it for me with excel and show me the formula please

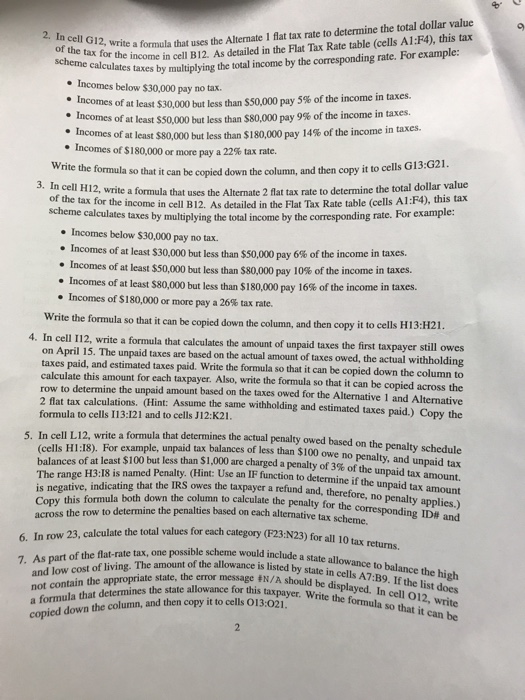

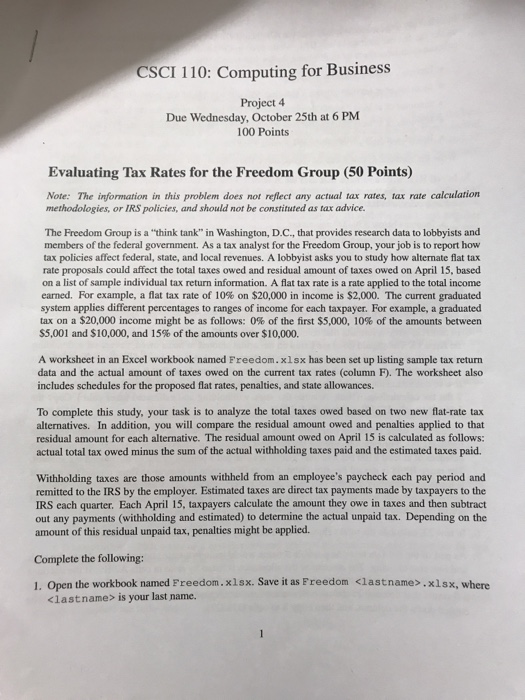

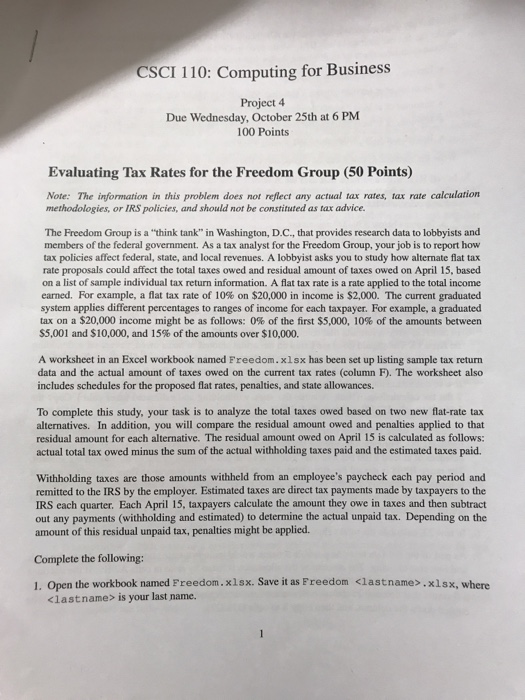

CSCI 110: Computing for Business Project 4 Due Wednesday, October 25th at 6 PM 100 Points Evaluating Tax Rates for the Freedom Group (50 Points) Note: The information in this problem does not reflect any actual tax rates, tax rate calculation methodologies, or IRS policies, and should not be constituted as tax advice. The Freedom Group is a "think tank" in Washington, D.C., that provides research data to lobbyists and members of the federal government. As a tax analyst for the Freedom Group, your job is to report how tax policies affect federal, state, and local revenues. A lobbyist asks you to study how alternate flat tax rate proposals could affect the total taxes owed and residual amount of taxes owed on April 15, based on a list of sample individual tax return information. A flat tax rate is a rate applied to the total income earned. For example, a flat tax rate of 10% on $20,000 in income is $2,000. The current graduated system applies different percentages to ranges of income for each taxpayer. For example, a graduated tax on a $20,000 income might be as follows: 0% of the first $5,000, 10% of the amounts between 5,001 and $10,000, and 15% of the amounts over $10,000. A worksheet in an Excel workbook named Freedom.xlsx has been set up listing sample tax return data and the actual amount of taxes owed on the current tax rates (column The worksheet also includes schedules for the proposed flat rates, penalties, and state allowances. To complete this study, your task is to analyze the total taxes owed based on two new flat-rate tax alternatives. In addition, you will compare the residual amount owed and penalties applied to that residual amount for each alternative. The residual amount owed on April 15 is calculated as follows: actual total tax owed minus the sum of the actual withholding taxes paid and the estimated taxes paid. Withholding taxes are those amounts withheld from an employee's paycheck each pay period and remitted to the IRS by the employer. Estimated taxes are direct tax payments made by taxpayers to the IRS each quarter. Each April 15, taxpayers calculate the amount they owe in taxes and then subtract out any payments (withholding and estimated) to determine the actual unpaid tax. Depending on the amount of this residual unpaid tax, penalties might be applied. Complete the following 1. Open the workbook named Freedom.xlsx. Save it as Freedom

.x1sx, where is your last name. CSCI 110: Computing for Business Project 4 Due Wednesday, October 25th at 6 PM 100 Points Evaluating Tax Rates for the Freedom Group (50 Points) Note: The information in this problem does not reflect any actual tax rates, tax rate calculation methodologies, or IRS policies, and should not be constituted as tax advice. The Freedom Group is a "think tank" in Washington, D.C., that provides research data to lobbyists and members of the federal government. As a tax analyst for the Freedom Group, your job is to report how tax policies affect federal, state, and local revenues. A lobbyist asks you to study how alternate flat tax rate proposals could affect the total taxes owed and residual amount of taxes owed on April 15, based on a list of sample individual tax return information. A flat tax rate is a rate applied to the total income earned. For example, a flat tax rate of 10% on $20,000 in income is $2,000. The current graduated system applies different percentages to ranges of income for each taxpayer. For example, a graduated tax on a $20,000 income might be as follows: 0% of the first $5,000, 10% of the amounts between 5,001 and $10,000, and 15% of the amounts over $10,000. A worksheet in an Excel workbook named Freedom.xlsx has been set up listing sample tax return data and the actual amount of taxes owed on the current tax rates (column The worksheet also includes schedules for the proposed flat rates, penalties, and state allowances. To complete this study, your task is to analyze the total taxes owed based on two new flat-rate tax alternatives. In addition, you will compare the residual amount owed and penalties applied to that residual amount for each alternative. The residual amount owed on April 15 is calculated as follows: actual total tax owed minus the sum of the actual withholding taxes paid and the estimated taxes paid. Withholding taxes are those amounts withheld from an employee's paycheck each pay period and remitted to the IRS by the employer. Estimated taxes are direct tax payments made by taxpayers to the IRS each quarter. Each April 15, taxpayers calculate the amount they owe in taxes and then subtract out any payments (withholding and estimated) to determine the actual unpaid tax. Depending on the amount of this residual unpaid tax, penalties might be applied. Complete the following 1. Open the workbook named Freedom.xlsx. Save it as Freedom .x1sx, where is your last name

Hi can you please do it for me with excel and show me the formula please

Hi can you please do it for me with excel and show me the formula please