Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi can you please explain the steps on how you find the answers for the NPV boxes clearly please in a) Calculate the NPV (Net

Hi can you please explain the steps on how you find the answers for the NPV boxes clearly please in

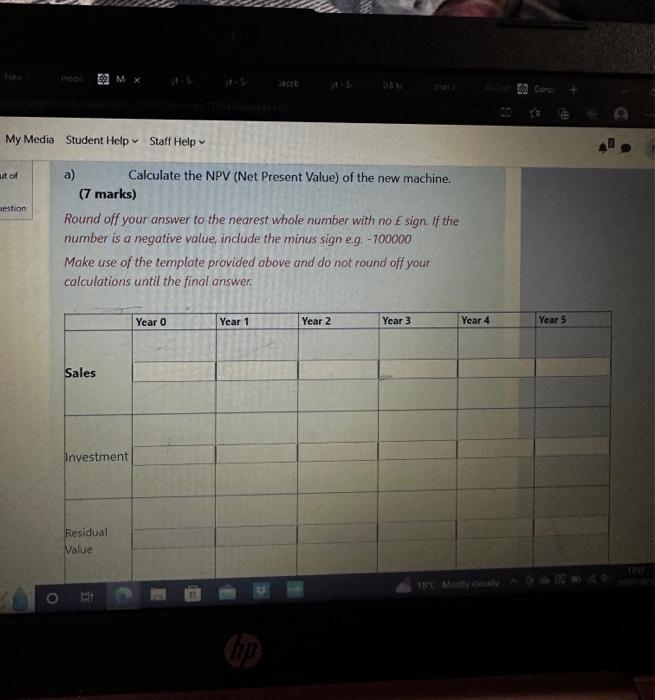

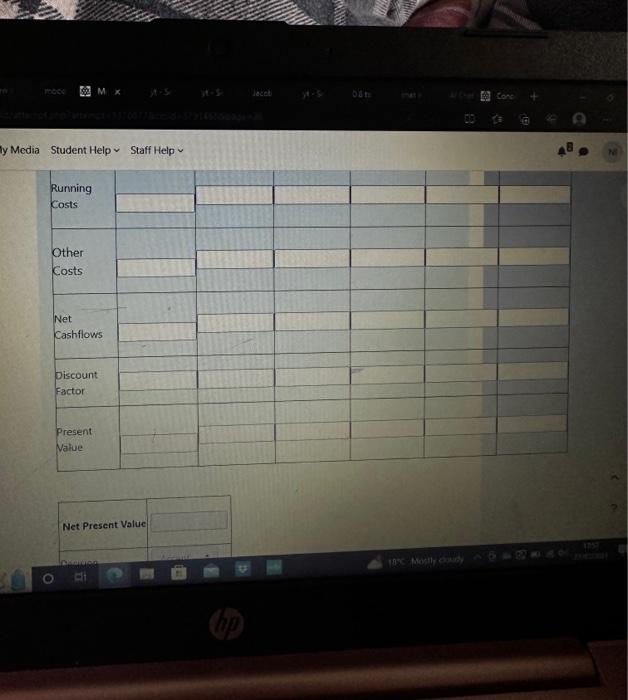

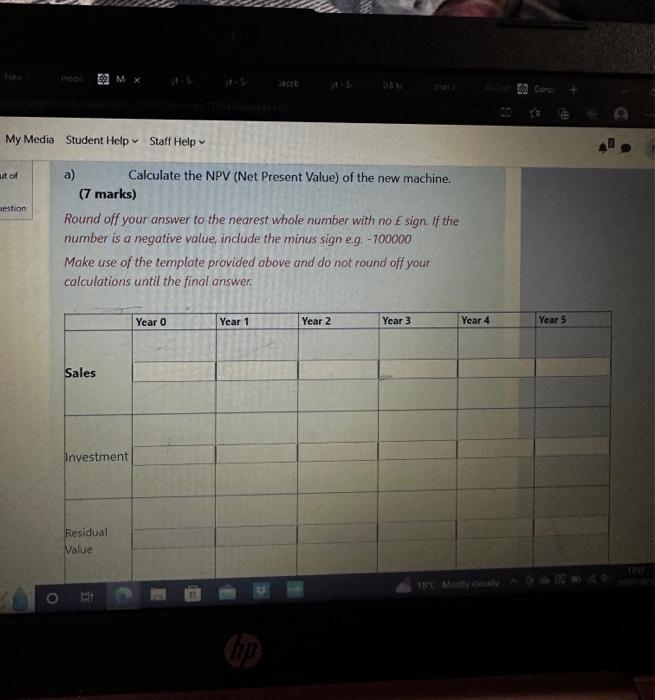

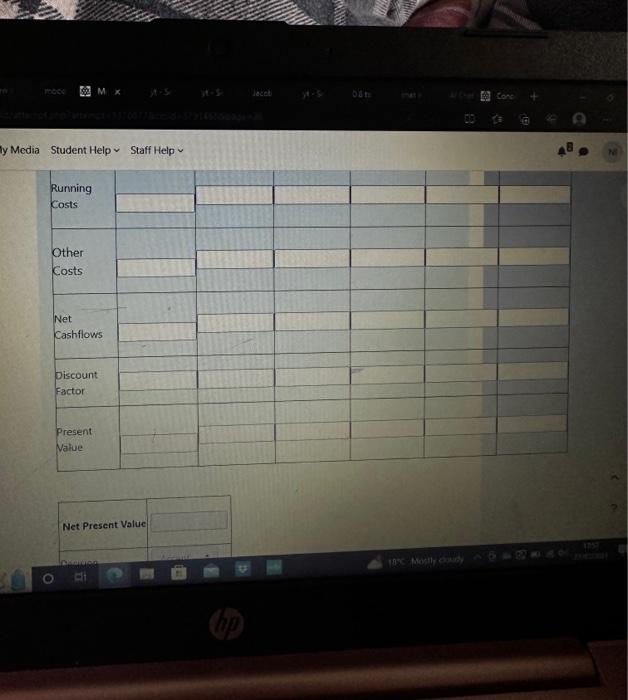

a) Calculate the NPV (Net Present Value) of the new machine. (7 marks) Round off your answer to the nearest whole number with no f sign. If the number is a negative value, include the minus sign e.g. -100000 Make use of the template provided above and do not round off your calculations until the final answer. ly Media Student Help Staff Help Stadler Ltd is setting up a business selling fast food in Manchester. They are need kitchen equipment to cook the food on the premises. Stadler L.td are considering three different types of projects and have been provided with the following data: Project A This will involve an initial outlay of 250,000. The estimated life of the equipment is 5 years and there is 15,000 scrap value at the end of its life. The annual running costs are estimated at 10,000 per annum and cash inflows are expected to be 90,000 per annum. Running costs are expected to increase by 5% per annum while cash inflows will increase by 2% per annum. It is company policy to use a cost of capital of 10% to evaluate capital investment projects. Stadler use a template for their calculations and this can be found on the link below: Capital Budgeting Template (click to download)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started