Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi can you please help me Assignment #2 - The Accounting Model - Prepare Basic Financial Statements (2%) This assignment relates to the following Course

hi can you please help me

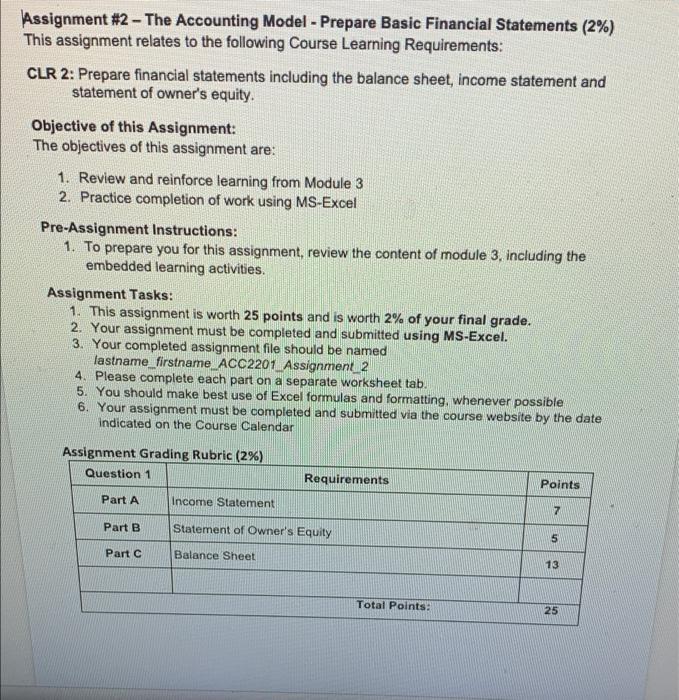

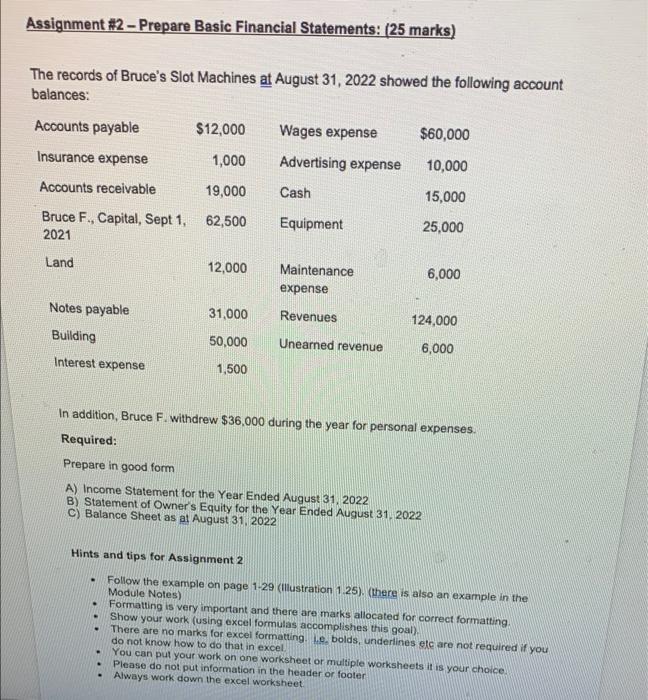

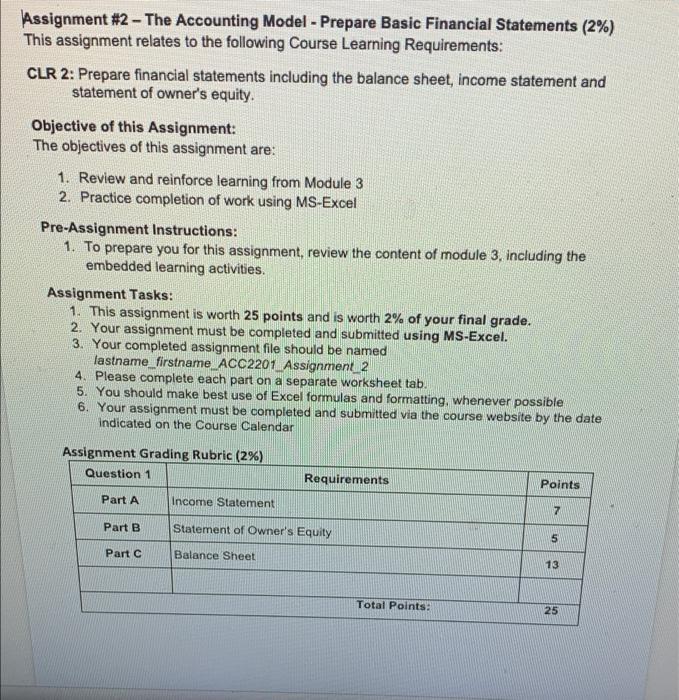

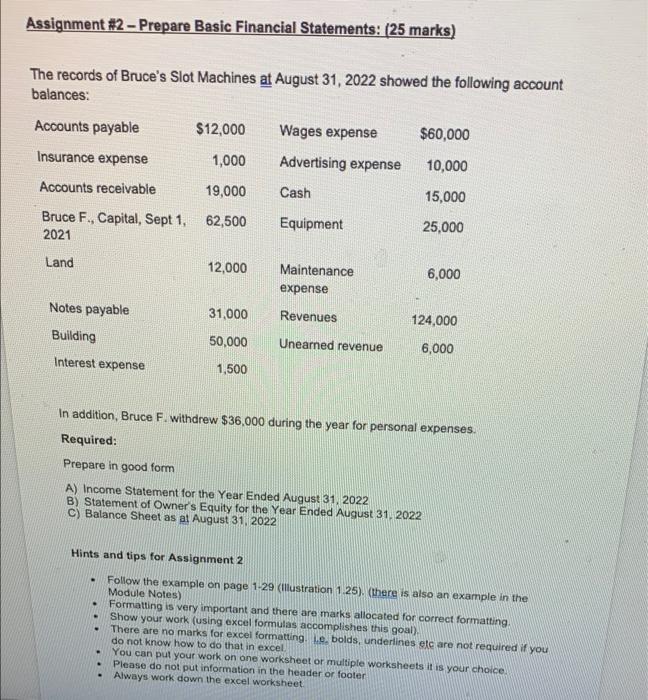

Assignment #2 - The Accounting Model - Prepare Basic Financial Statements (2%) This assignment relates to the following Course Learning Requirements: CLR 2: Prepare financial statements including the balance sheet, income statement and statement of owner's equity. Objective of this Assignment: The objectives of this assignment are: 1. Review and reinforce learning from Module 3 2. Practice completion of work using MS-Excel Pre-Assignment Instructions: 1. To prepare you for this assignment, review the content of module 3, including the embedded learning activities. Assignment Tasks: 1. This assignment is worth 25 points and is worth 2% of your final grade. 2. Your assignment must be completed and submitted using MS-Excel. 3. Your completed assignment file should be named lastname_firstname_ACC2201 Assignment_2 4. Please complete each part on a separate worksheet tab. 5. You should make best use of Excel formulas and formatting, whenever possible 6. Your assignment must be completed and submitted via the course website by the date indicated on the Course Calendar Assignment Grading Rubric (2%) Question 1 Requirements Points Part A Income Statement 7 Part B Statement of Owner's Equity 5 Part C Balance Sheet 13 Total Points: 25 Assignment #2 - Prepare Basic Financial Statements: (25 marks) The records of Bruce's Slot Machines at August 31, 2022 showed the following account balances: Accounts payable $12,000 Wages expense $60,000 Insurance expense 1,000 Advertising expense 10,000 Accounts receivable 19,000 Cash 15,000 Bruce F., Capital, Sept 1, 62,500 Equipment 25,000 2021 Land 12,000 Maintenance expense 6,000 Notes payable 31,000 Revenues 124,000 Building 50,000 Unearned revenue 6,000 Interest expense 1,500 In addition, Bruce F. withdrew $36,000 during the year for personal expenses. Required: Prepare in good form A) Income Statement for the Year Ended August 31, 2022 B) Statement of Owner's Equity for the Year Ended August 31, 2022 C) Balance Sheet as at August 31, 2022 Hints and tips for Assignment 2 . Follow the example on page 1-29 (Illustration 1 25), (there is also an example in the Module Notes) Formatting is very important and there are marks allocated for correct formatting Show your work (using excel formulas accomplishes this goal), There are no marks for excel formatting. Le bolds, underlines etc are not required if you do not know how to do that in excel You can put your work on one worksheet or multiple worksheets it is your choice Please do not put information in the header or footer Always work down the excel worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started