Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi can you please help me solve this step by step Pepperdine, Inc. considers obtaining 40 percent of its one-year financing in Canadian dollars and

hi can you please help me solve this step by step

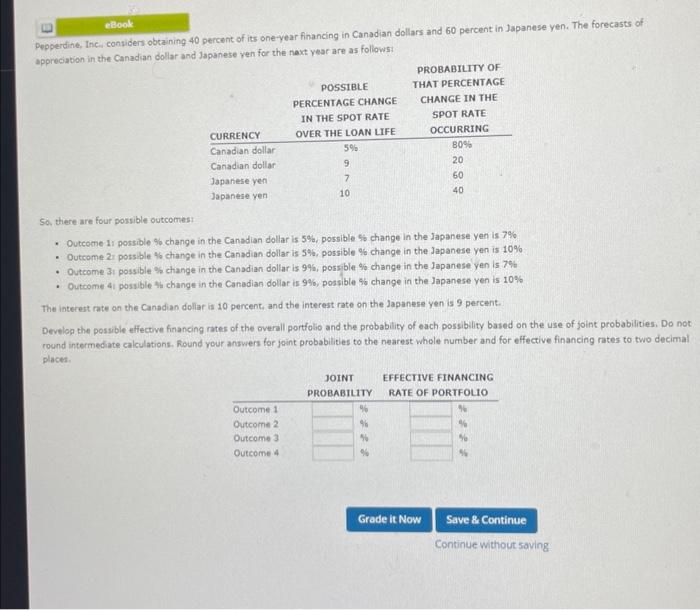

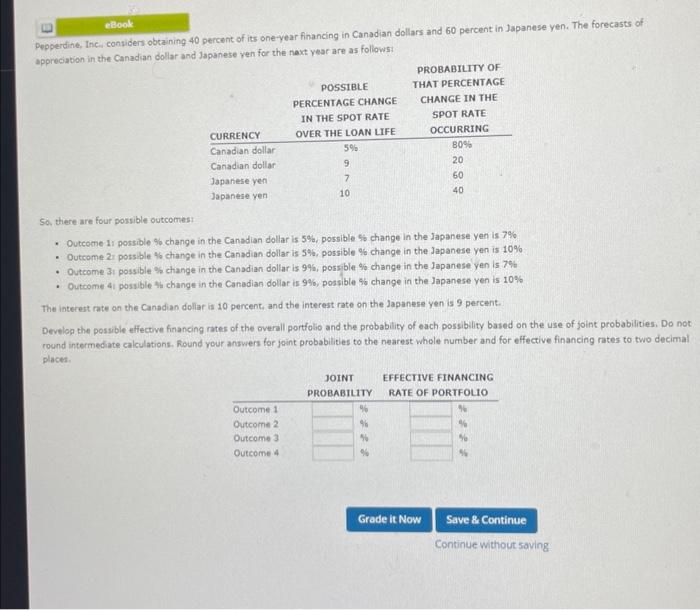

Pepperdine, Inc. considers obtaining 40 percent of its one-year financing in Canadian dollars and 60 percent in Japanese yen. The forecasts of eBook appreciation in the Canadian dollar and Japanese ven for the next year are as follows: So, there are four porsible outcomes: - Outcome 1 possible \% change in the Canadian dollar is 5%, possible % change in the Japanese yen is 7% - Outcome 21 possible 46 change in the Canadian dollar is 5% possible \% change in the Japanese ven is 10% - Outcome 31 possible % change in the Canadian dollar is 9%6, possible % change in the lapanese yen is 7% - Outcome 41 possible 4 change in the Canadian dollar is 9%, possible % change in the lapanese yen is 10% The interest rate on the Canadian dollar is 10 percent, and the interest rate on the Japanere yen is 9 percent: Develog the possible effective financing rates of the overall portfolio and the probability of each possiblity based on the use of joint probabilities. Do not round intermediate calculations. Found your answers for jaint probabilities to the nearest whole number and for effective financing rates to two decimal places. Pepperdine, Inc. considers obtaining 40 percent of its one-year financing in Canadian dollars and 60 percent in Japanese yen. The forecasts of eBook appreciation in the Canadian dollar and Japanese ven for the next year are as follows: So, there are four porsible outcomes: - Outcome 1 possible \% change in the Canadian dollar is 5%, possible % change in the Japanese yen is 7% - Outcome 21 possible 46 change in the Canadian dollar is 5% possible \% change in the Japanese ven is 10% - Outcome 31 possible % change in the Canadian dollar is 9%6, possible % change in the lapanese yen is 7% - Outcome 41 possible 4 change in the Canadian dollar is 9%, possible % change in the lapanese yen is 10% The interest rate on the Canadian dollar is 10 percent, and the interest rate on the Japanere yen is 9 percent: Develog the possible effective financing rates of the overall portfolio and the probability of each possiblity based on the use of joint probabilities. Do not round intermediate calculations. Found your answers for jaint probabilities to the nearest whole number and for effective financing rates to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started