Hi can you please help me solve this step by step I am confused thank you. EXCEL IS ALLOWED

Hi can you please help me solve this step by step I am confused thank you. EXCEL IS ALLOWED

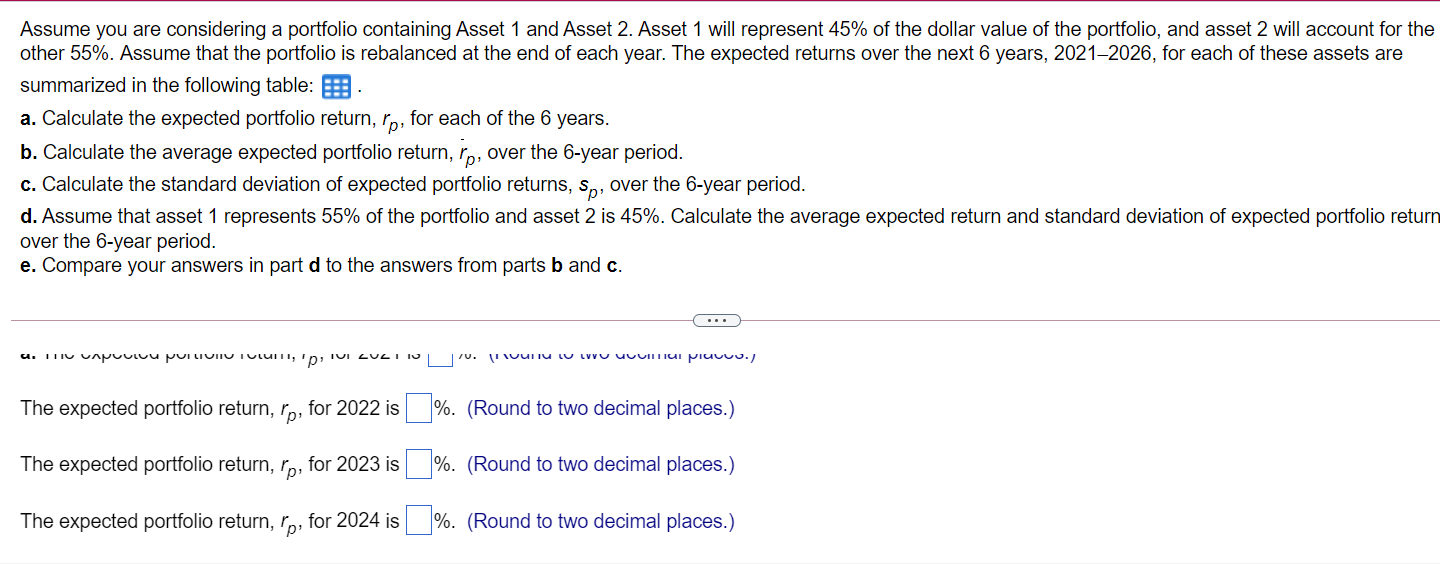

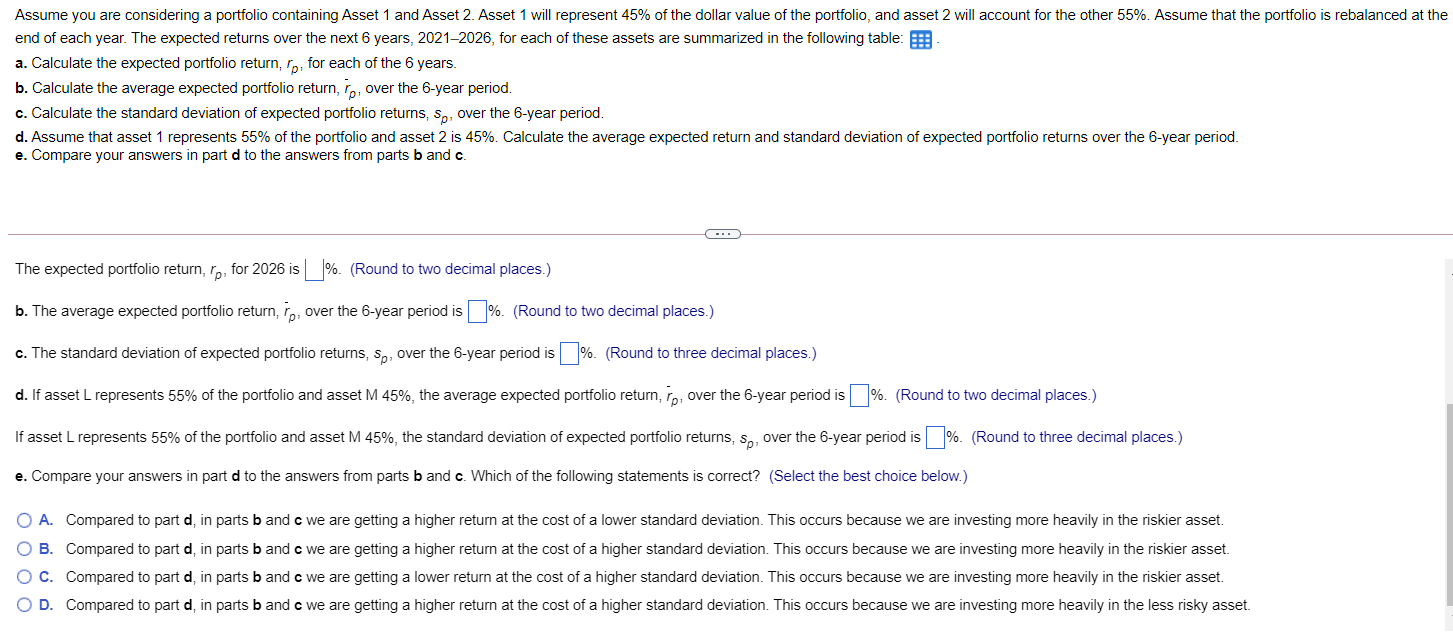

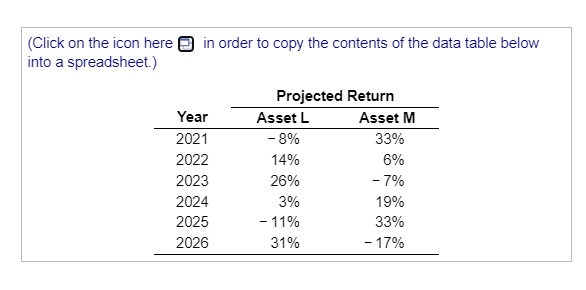

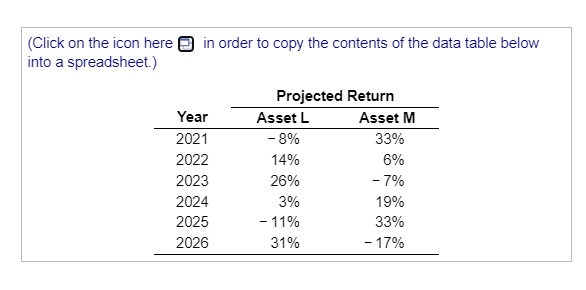

Assume you are considering a portfolio containing Asset 1 and Asset 2. Asset 1 will represent 45% of the dollar value of the portfolio, and asset 2 will account for the other 55%. Assume that the portfolio is rebalanced at the end of each year. The expected returns over the next 6 years, 2021-2026, for each of these assets are summarized in the following table: B. a. Calculate the expected portfolio return, rp, for each of the 6 years. b. Calculate the average expected portfolio return, rp, over the 6-year period. c. Calculate the standard deviation of expected portfolio returns, Sp, over the 6-year period. d. Assume that asset 1 represents 55% of the portfolio and asset 2 is 45%. Calculate the average expected return and standard deviation of expected portfolio return over the 6-year period. e. Compare your answers in part d to the answers from parts b and c. u. "Tu vapuuluu pui LIVIU IULUITT, 'p, IVI LUCI 10 10. vuru LU Luv U LIGI piuuuu.) The expected portfolio return, lp, for 2022 is | %. (Round to two decimal places.) The expected portfolio return, 'p: for 2023 is %. (Round to two decimal places.) The expected portfolio return, lp, for 2024 is %. (Round to two decimal places.) Assume you are considering a portfolio containing Asset 1 and Asset 2. Asset 1 will represent 45% of the dollar value of the portfolio, and asset 2 will account for the other 55%. Assume that the portfolio is rebalanced at the end of each year. The expected returns over the next 6 years, 2021-2026, for each of these assets are summarized in the following table: a. Calculate the expected portfolio return, lp, for each of the 6 years. b. Calculate the average expected portfolio return, 1o, over the 6-year period. c. Calculate the standard deviation of expected portfolio returns, Sp, over the 6-year period. d. Assume that asset 1 represents 55% of the portfolio and asset 2 is 45%. Calculate the average expected return and standard deviation of expected portfolio returns over the 6-year period. e. Compare your answers in part d to the answers from parts b and c. .. The expected portfolio return, rn, for 2026 is l_l%. (Round to two decimal places.) b. The average expected portfolio return, 1o, over the 6-year period is 1%. (Round to two decimal places.) c. The standard deviation of expected portfolio returns, Sp, over the 6-year period is %. (Round to three decimal places.) d. If asset L represents 55% of the portfolio and asset M 45%, the average expected portfolio return, rei over the 6-year period is \%. (Round to two decimal places.) If asset L represents 55% of the portfolio and asset M 45%, the standard deviation of expected portfolio returns, Sp, over the 6-year period is 1%. (Round to three decimal places.) e. Compare your answers in part d to the answers from parts b and c. Which of the following statements is correct? (Select the best choice below.) O A. Compared to part d, in parts b and c we are getting a higher return at the cost of a lower standard deviation. This occurs because we are investing more heavily in the riskier asset. B. Compared to part d, in parts b and c we are getting a higher return at the cost of a higher standard deviation. This occurs because we are investing more heavily in the riskier asset. O c. Compared to part d, in parts b and c we are getting a lower return at the cost of a higher standard deviation. This occurs because we are investing more heavily in the riskier asset. OD. Compared to part d, in parts b and c we are getting a higher return at the cost of a higher standard deviation. This occurs because we are investing more heavily in the less risky asset. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Projected Return Year Asset L Asset M 2021 -8% 33% 2022 14% 6% 2023 26% -7% 2024 3% 19% 2025 - 11% 33% 2026 31% - 17%

Hi can you please help me solve this step by step I am confused thank you. EXCEL IS ALLOWED

Hi can you please help me solve this step by step I am confused thank you. EXCEL IS ALLOWED