Answered step by step

Verified Expert Solution

Question

1 Approved Answer

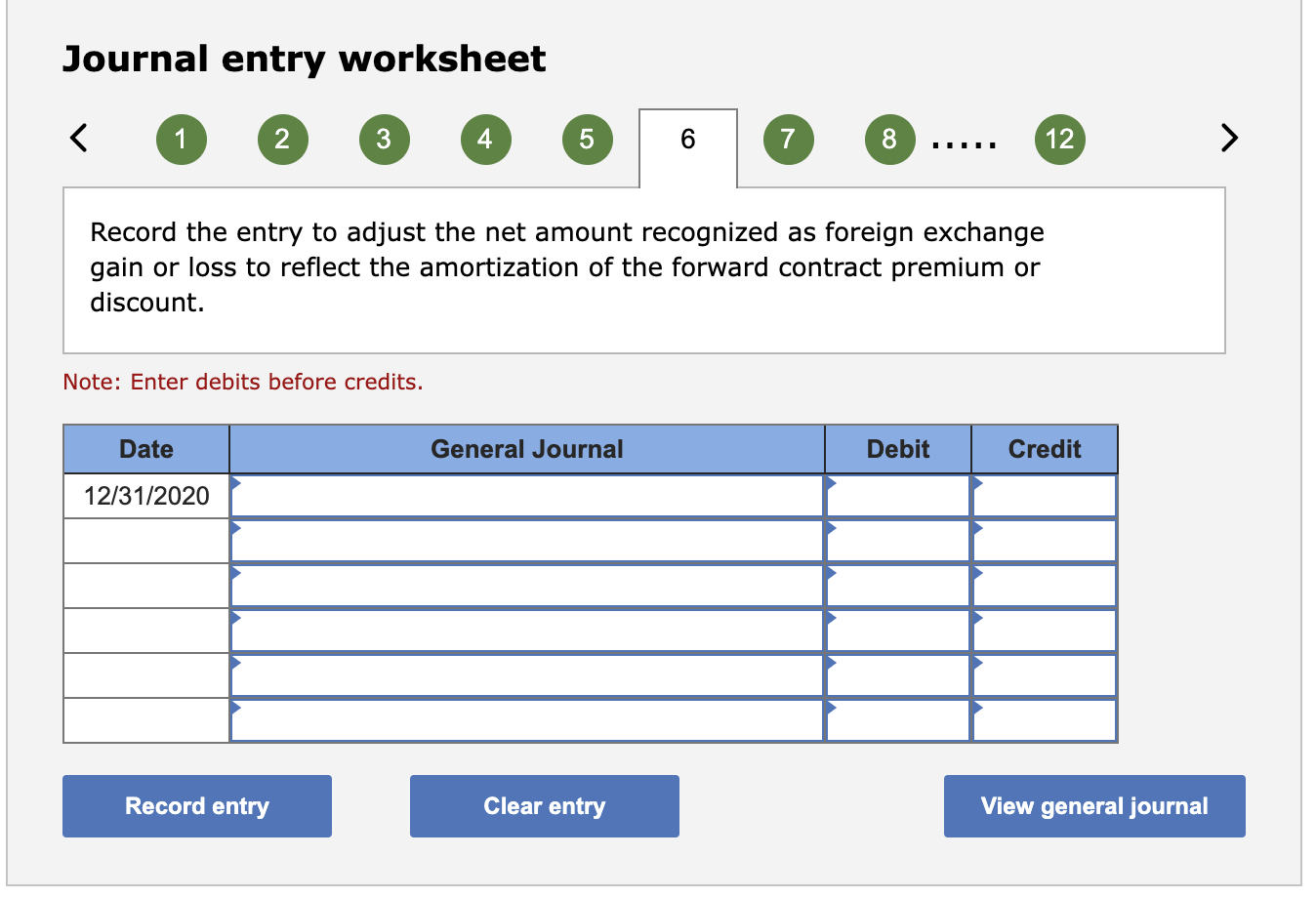

Hi can you please help me with this journal entry. I have this so far... Foreign Exchange Net loss (12/31) = 800 Amortization = 800

Hi can you please help me with this journal entry.

I have this so far...

Foreign Exchange Net loss (12/31) = 800

Amortization = 800

But I'm not sure how to calculate the amount for this journal entry. I know the accounts would be foreign exchange gain/loss and OCI, but I'm not sure which is a debit or credit and to what amount.

If you can please explain like I'm 5 years old that would be great!

Thank you

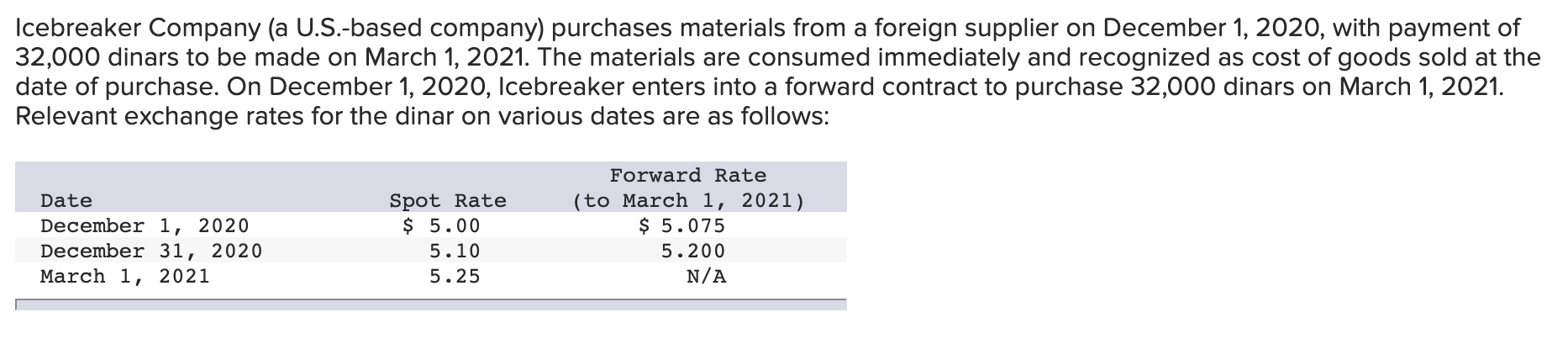

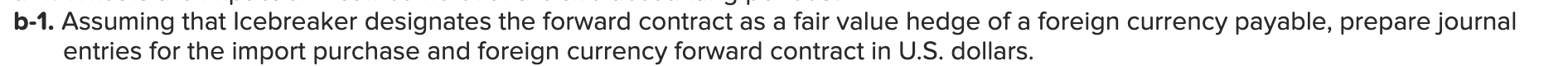

Icebreaker Company (a U.S.-based company) purchases materials from a foreign supplier on December 1,2020 , with payment of 32,000 dinars to be made on March 1,2021 . The materials are consumed immediately and recognized as cost of goods sold at the date of purchase. On December 1, 2020, Icebreaker enters into a forward contract to purchase 32,000 dinars on March 1, 2021. Relevant exchange rates for the dinar on various dates are as follows: b-1. Assuming that Icebreaker designates the forward contract as a fair value hedge of a foreign currency payable, prepare journal entries for the import purchase and foreign currency forward contract in U.S. dollars. Journal entry worksheet Record the entry to adjust the net amount recognized as foreign exchange gain or loss to reflect the amortization of the forward contract premium or discount. Note: Enter debits before credits. Icebreaker Company (a U.S.-based company) purchases materials from a foreign supplier on December 1,2020 , with payment of 32,000 dinars to be made on March 1,2021 . The materials are consumed immediately and recognized as cost of goods sold at the date of purchase. On December 1, 2020, Icebreaker enters into a forward contract to purchase 32,000 dinars on March 1, 2021. Relevant exchange rates for the dinar on various dates are as follows: b-1. Assuming that Icebreaker designates the forward contract as a fair value hedge of a foreign currency payable, prepare journal entries for the import purchase and foreign currency forward contract in U.S. dollars. Journal entry worksheet Record the entry to adjust the net amount recognized as foreign exchange gain or loss to reflect the amortization of the forward contract premium or discount. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started