Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi can you please solve A only ? Thank you P7-4A The bank portion of the bank reconciliation for Horsman Company at October Prepare a

Hi can you please solve A only ? Thank you

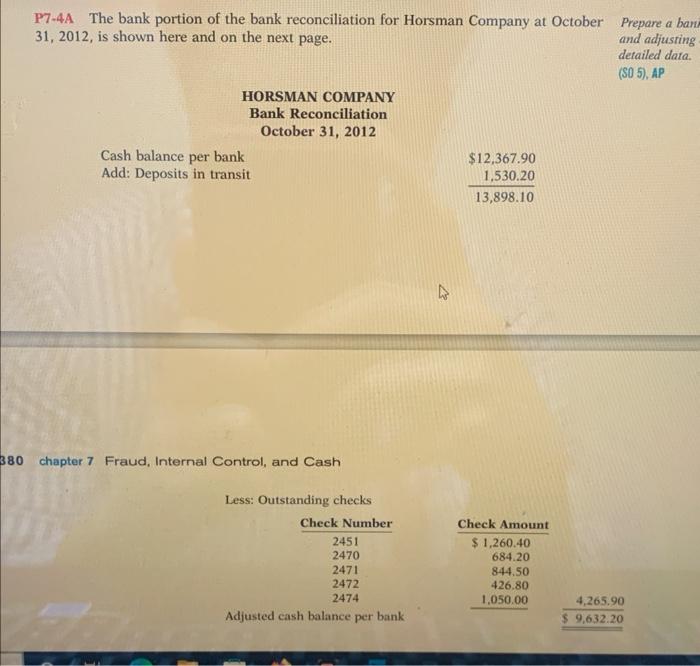

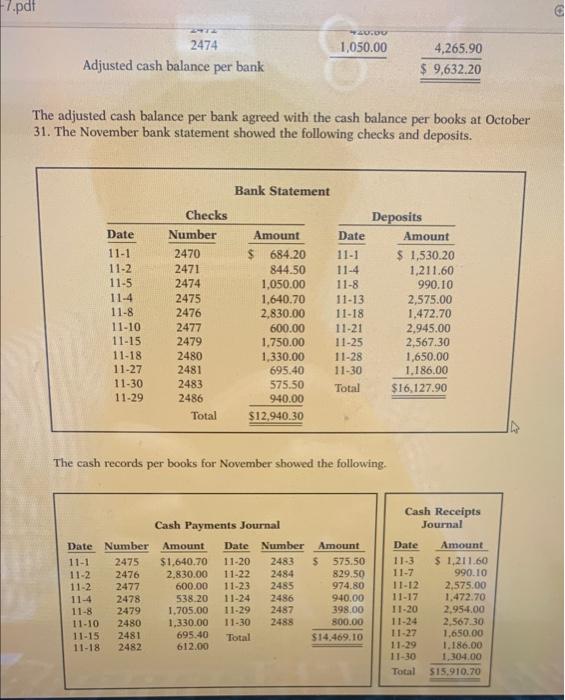

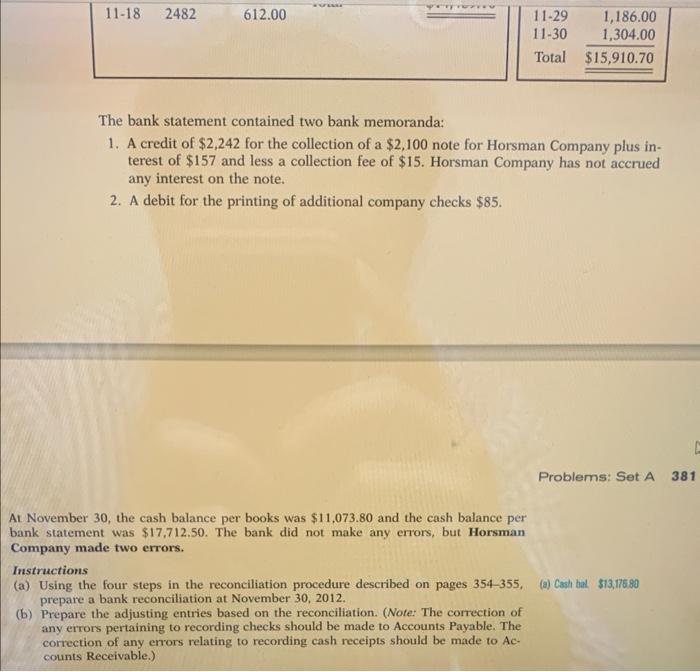

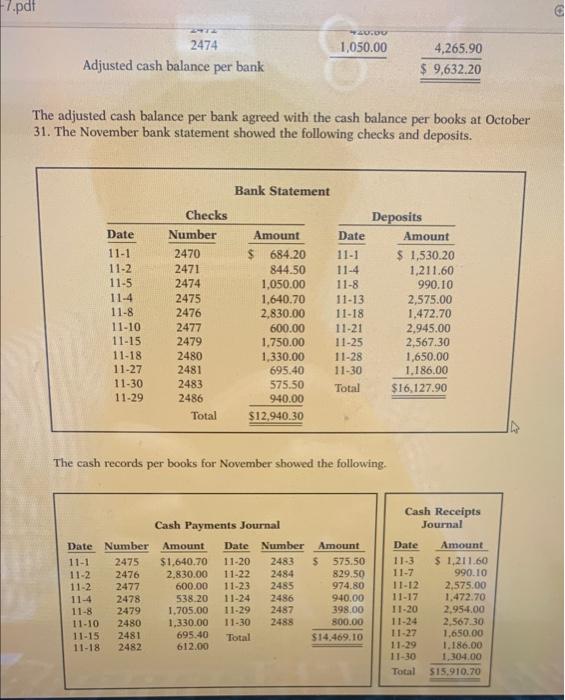

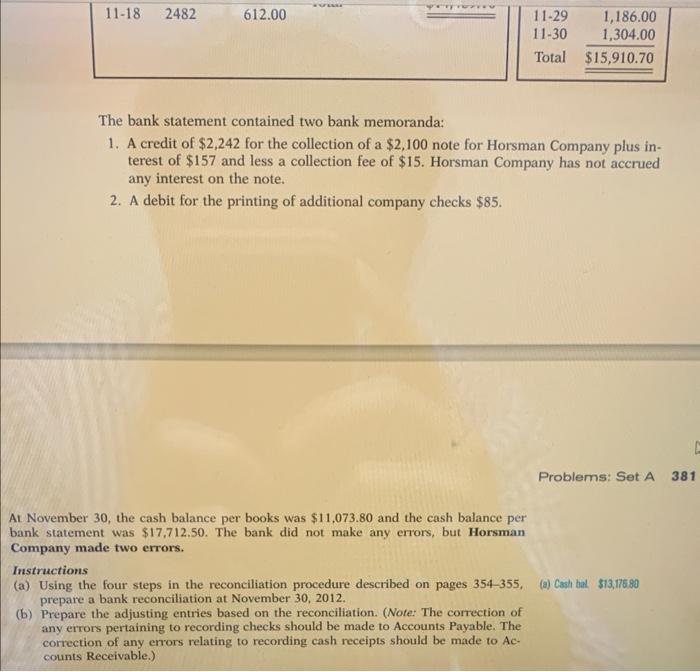

P7-4A The bank portion of the bank reconciliation for Horsman Company at October Prepare a ban 31,2012 , is shown here and on the next page. and adjusting detailed data. (S0 5), AP 380 chapter 7 Fraud, Internal Control, and Cash Less: Outstanding checks Ac The adjusted cash balance per bank agreed with the cash balance per books at October 31. The November bank statement showed the following checks and deposits. The cash records per books for November showed the following. The bank statement contained two bank memoranda: 1. A credit of $2,242 for the collection of a $2,100 note for Horsman Company plus interest of $157 and less a collection fee of $15. Horsman Company has not accrued any interest on the note. 2. A debit for the printing of additional company checks $85. At November 30 , the cash balance per books was $11,073.80 and the cash balance per bank statement was $17,712.50. The bank did not make any errors, but Horsman Company made two errors. Instructions (a) Using the four steps in the reconciliation procedure described on pages 354-355, (a) Casih ball $13,17580 prepare a bank reconciliation at November 30, 2012. (b) Prepare the adjusting entries based on the reconciliation. (Note: The correction of any errors pertaining to recording checks should be made to Accounts Payable. The correction of any errors relating to recording cash receipts should be made to Accounts Receivable.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started