Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, Can you please teach me how to solve these questions step by step with the finance formula? As understandable as possible. Thank you! I'm

Hi, Can you please teach me how to solve these questions step by step with the finance formula? As understandable as possible. Thank you!

I'm sharing the answer, because I want to understand how to solve it myself.

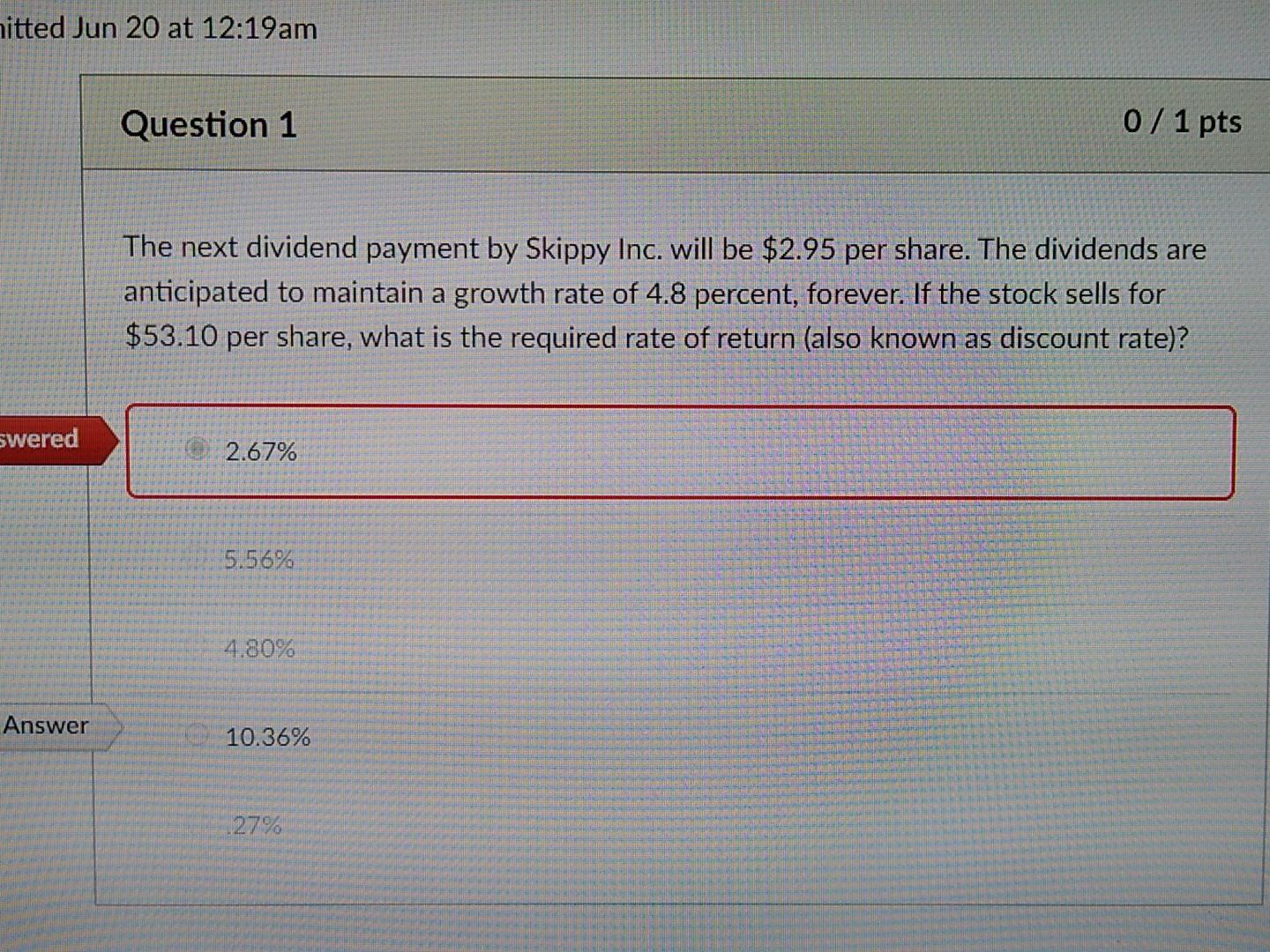

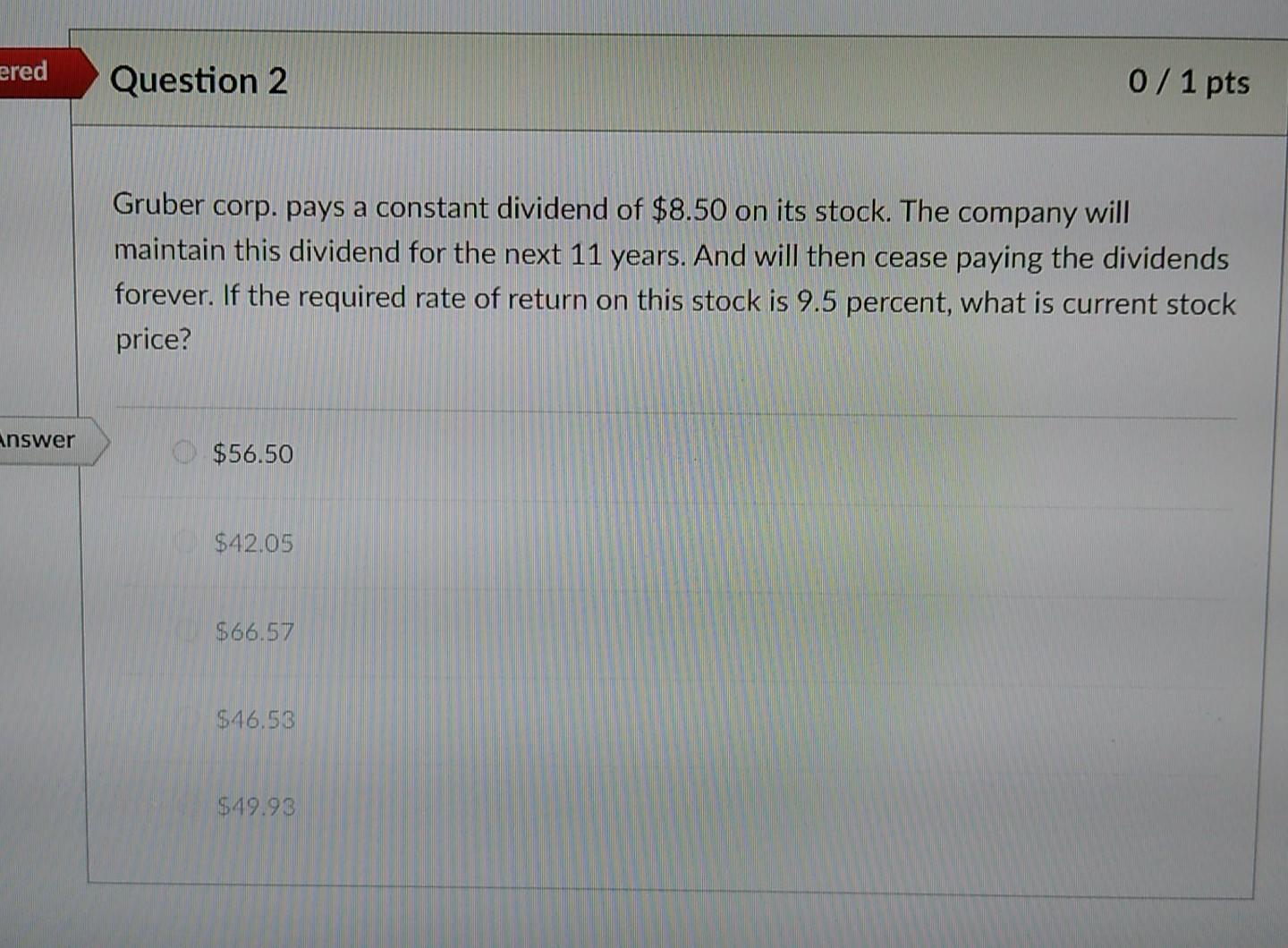

itted Jun 20 at 12:19 am Question 1 0/ 1 pts The next dividend payment by Skippy Inc. will be $2.95 per share. The dividends are anticipated to maintain a growth rate of 4.8 percent, forever. If the stock sells for $53.10 per share, what is the required rate of return (also known as discount rate)? swered 2.67% 5.56% 4.80% Answer 10.36% 27% ered Question 2 0/ 1 pts Gruber corp. pays a constant dividend of $8.50 on its stock. The company will maintain this dividend for the next 11 years. And will then cease paying the dividends forever. If the required rate of return on this stock is 9.5 percent, what is current stock price? Answer $56.50 $42.05 $66.57 $46.58 $49.93Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started