Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi can you re-present it under Cost/ Benefit analysis please Today, the vast majority of large companies use computers to initiate money transfers and to

Hi can you re-present it under Cost/ Benefit analysis please

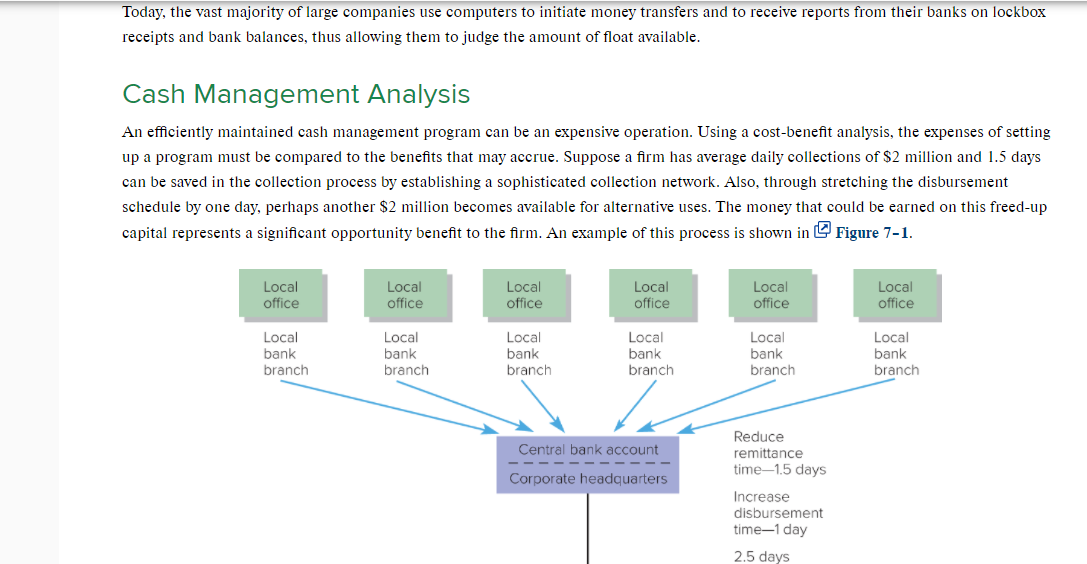

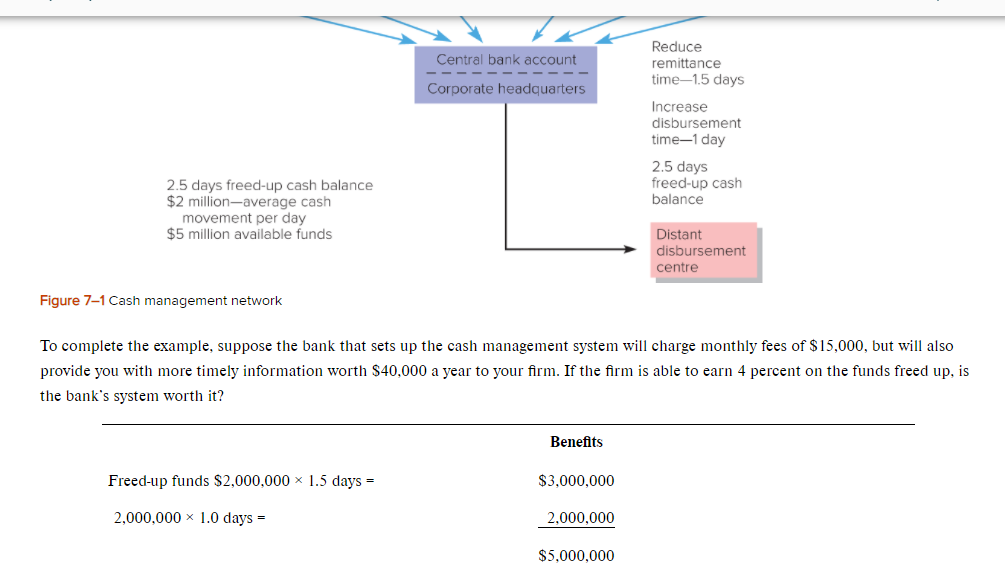

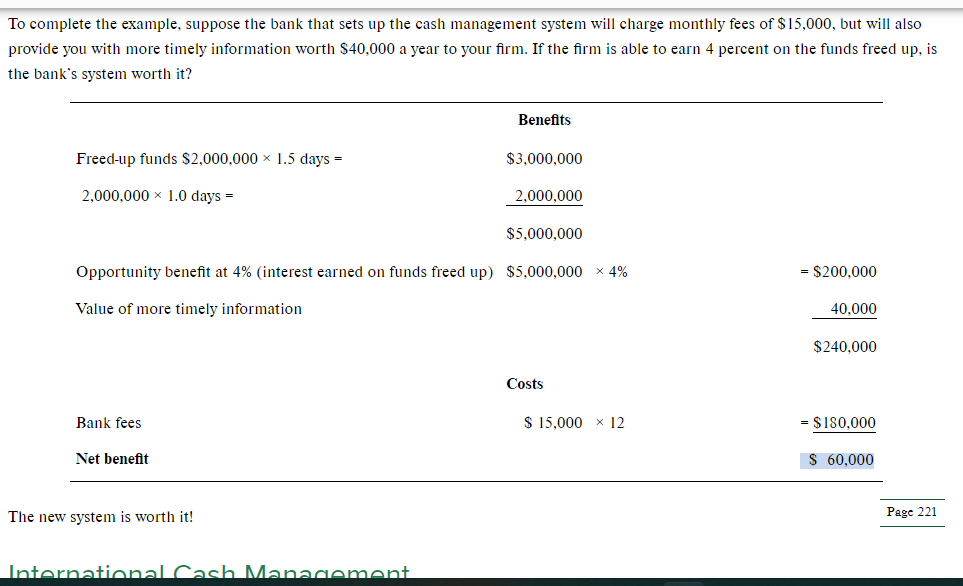

Today, the vast majority of large companies use computers to initiate money transfers and to receive reports from their banks on lockbox receipts and bank balances, thus allowing them to judge the amount of float available. Cash Management Analysis An efficiently maintained cash management program can be an expensive operation. Using a cost-benefit analysis, the expenses of setting up a program must be compared to the benefits that may accrue. Suppose a firm has average daily collections of $2 million and 1.5 days can be saved in the collection process by establishing a sophisticated collection network. Also, through stretching the disbursement schedule by one day, perhaps another $2 million becomes available for alternative uses. The money that could be earned on this freed-up capital represents a significant opportunity benefit to the firm. An example of this process is shown in Figure 7-1. Local office Local office Local office Local office Local office Local office Local bank branch Local bank branch Local bank branch Local bank branch Local bank branch Local bank branch Central bank account Reduce remittance time-15 days Corporate headquarters Increase disbursement time-1 day 2.5 days Central bank account Reduce remittance time-1.5 days Corporate headquarters Increase disbursement time-1 day 2.5 days freed-up cash balance 2.5 days freed-up cash balance $2 million-average cash movement per day $5 million available funds Distant disbursement centre Figure 7-1 Cash management network To complete the example, suppose the bank that sets up the cash management system will charge monthly fees of $15,000, but will also provide you with more timely information worth $40,000 a year to your firm. If the firm is able to earn 4 percent on the funds freed up, is the bank's system worth it? Benefits Freed-up funds $2,000,000 * 1.5 days = $3,000,000 2,000,000 1.0 days = 2,000,000 $5,000,000 To complete the example, suppose the bank that sets up the cash management system will charge monthly fees of $15,000, but will also provide you with more timely information worth $40,000 a year to your firm. If the firm is able to earn 4 percent on the funds freed up, is the bank's system worth it? Benefits Freed-up funds $2,000,000 * 1.5 days = $3,000,000 2,000,000 1.0 days = 2,000,000 $5,000,000 Opportunity benefit at 4% (interest earned on funds freed up) $5,000,000 * 4% = $200,000 Value of more timely information 40,000 $240,000 Costs Bank fees $ 15,000 x 12 = $180,000 Net benefit $ 60,000 The new system is worth it! Page 221 International Cash Management Today, the vast majority of large companies use computers to initiate money transfers and to receive reports from their banks on lockbox receipts and bank balances, thus allowing them to judge the amount of float available. Cash Management Analysis An efficiently maintained cash management program can be an expensive operation. Using a cost-benefit analysis, the expenses of setting up a program must be compared to the benefits that may accrue. Suppose a firm has average daily collections of $2 million and 1.5 days can be saved in the collection process by establishing a sophisticated collection network. Also, through stretching the disbursement schedule by one day, perhaps another $2 million becomes available for alternative uses. The money that could be earned on this freed-up capital represents a significant opportunity benefit to the firm. An example of this process is shown in Figure 7-1. Local office Local office Local office Local office Local office Local office Local bank branch Local bank branch Local bank branch Local bank branch Local bank branch Local bank branch Central bank account Reduce remittance time-15 days Corporate headquarters Increase disbursement time-1 day 2.5 days Central bank account Reduce remittance time-1.5 days Corporate headquarters Increase disbursement time-1 day 2.5 days freed-up cash balance 2.5 days freed-up cash balance $2 million-average cash movement per day $5 million available funds Distant disbursement centre Figure 7-1 Cash management network To complete the example, suppose the bank that sets up the cash management system will charge monthly fees of $15,000, but will also provide you with more timely information worth $40,000 a year to your firm. If the firm is able to earn 4 percent on the funds freed up, is the bank's system worth it? Benefits Freed-up funds $2,000,000 * 1.5 days = $3,000,000 2,000,000 1.0 days = 2,000,000 $5,000,000 To complete the example, suppose the bank that sets up the cash management system will charge monthly fees of $15,000, but will also provide you with more timely information worth $40,000 a year to your firm. If the firm is able to earn 4 percent on the funds freed up, is the bank's system worth it? Benefits Freed-up funds $2,000,000 * 1.5 days = $3,000,000 2,000,000 1.0 days = 2,000,000 $5,000,000 Opportunity benefit at 4% (interest earned on funds freed up) $5,000,000 * 4% = $200,000 Value of more timely information 40,000 $240,000 Costs Bank fees $ 15,000 x 12 = $180,000 Net benefit $ 60,000 The new system is worth it! Page 221 International Cash ManagementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started