Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi could you answer each question with steps showing how to solve please? 4. Caufield Inc. has never paid a dividend. However, they just announced

Hi could you answer each question with steps showing how to solve please?

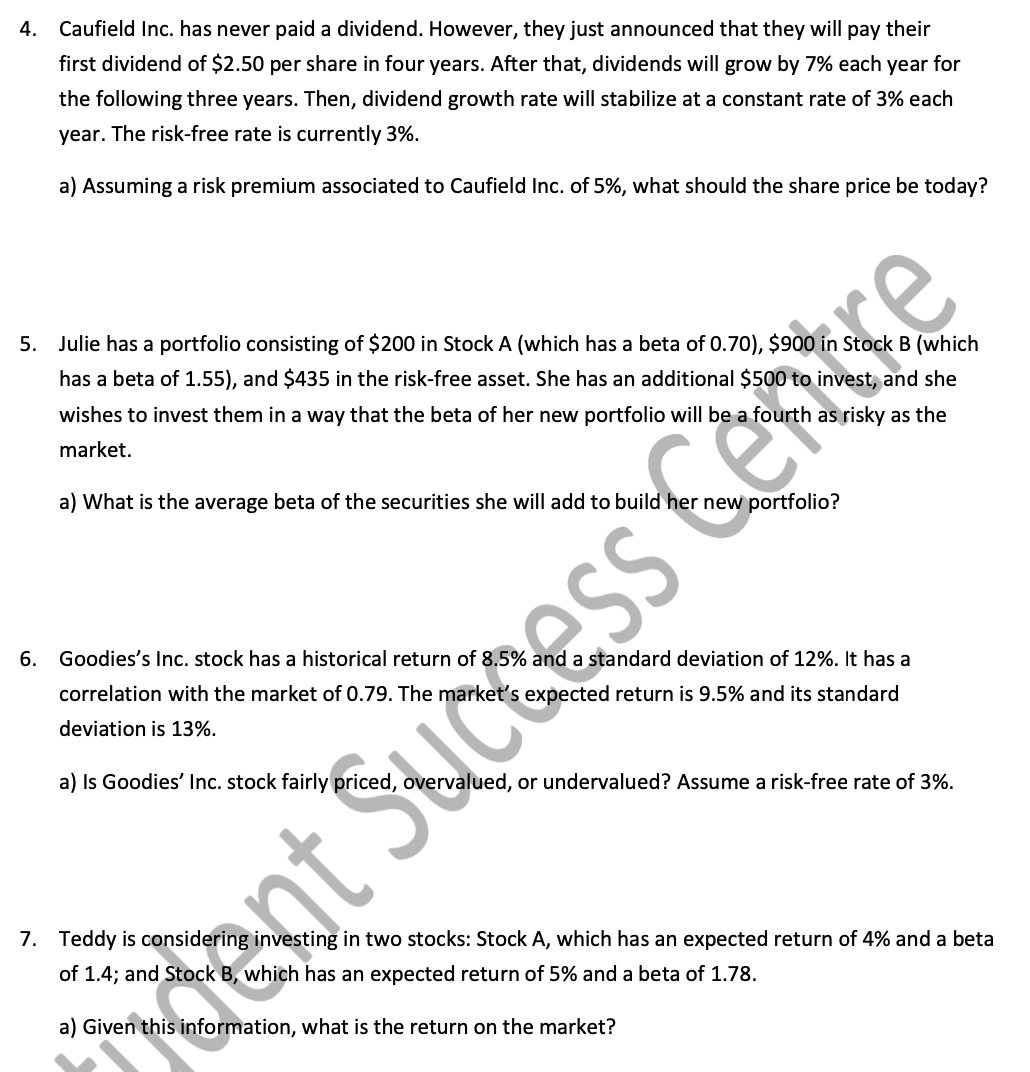

4. Caufield Inc. has never paid a dividend. However, they just announced that they will pay their first dividend of $2.50 per share in four years. After that, dividends will grow by 7% each year for the following three years. Then, dividend growth rate will stabilize at a constant rate of 3% each year. The risk-free rate is currently 3%. a) Assuming a risk premium associated to Caufield Inc. of 5%, what should the share price be today? 5. Julie has a portfolio consisting of $200 in Stock A (which has a beta of 0.70), $900 in Stock B (which has a beta of 1.55), and $435 in the risk-free asset. She has an additional $500 to invest, and she wishes to invest them in a way that the beta of her new portfolio will be a fourth as risky as the market. a) What is the average beta of the securities she will add to build her new portfolio? 6. Goodies's Inc. stock has a historical return of 8.5% and a standard deviation of 12%. It has a correlation with the market of 0.79 . The market's expected return is 9.5% and its standard deviation is 13%. a) Is Goodies' Inc. stock fairly priced, overvalued, or undervalued? Assume a risk-free rate of 3%. 7. Teddy is considering investing in two stocks: Stock A, which has an expected return of 4% and a beta of 1.4; and Stock B, which has an expected return of 5% and a beta of 1.78 . a) Given this information, what is the return on the market? 4. Caufield Inc. has never paid a dividend. However, they just announced that they will pay their first dividend of $2.50 per share in four years. After that, dividends will grow by 7% each year for the following three years. Then, dividend growth rate will stabilize at a constant rate of 3% each year. The risk-free rate is currently 3%. a) Assuming a risk premium associated to Caufield Inc. of 5%, what should the share price be today? 5. Julie has a portfolio consisting of $200 in Stock A (which has a beta of 0.70), $900 in Stock B (which has a beta of 1.55), and $435 in the risk-free asset. She has an additional $500 to invest, and she wishes to invest them in a way that the beta of her new portfolio will be a fourth as risky as the market. a) What is the average beta of the securities she will add to build her new portfolio? 6. Goodies's Inc. stock has a historical return of 8.5% and a standard deviation of 12%. It has a correlation with the market of 0.79 . The market's expected return is 9.5% and its standard deviation is 13%. a) Is Goodies' Inc. stock fairly priced, overvalued, or undervalued? Assume a risk-free rate of 3%. 7. Teddy is considering investing in two stocks: Stock A, which has an expected return of 4% and a beta of 1.4; and Stock B, which has an expected return of 5% and a beta of 1.78 . a) Given this information, what is the return on the market

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started