Question

Hi, could you please provide me with a step-by-step solution to the 2 part questions? I have an idea of how to solve the first

Hi, could you please provide me with a step-by-step solution to the 2 part questions? I have an idea of how to solve the first part, but struggling to understand Part II.

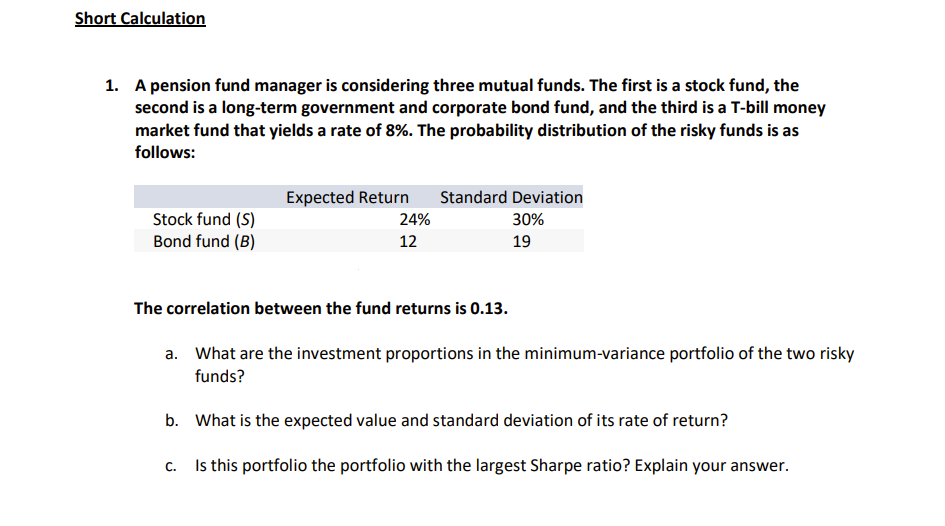

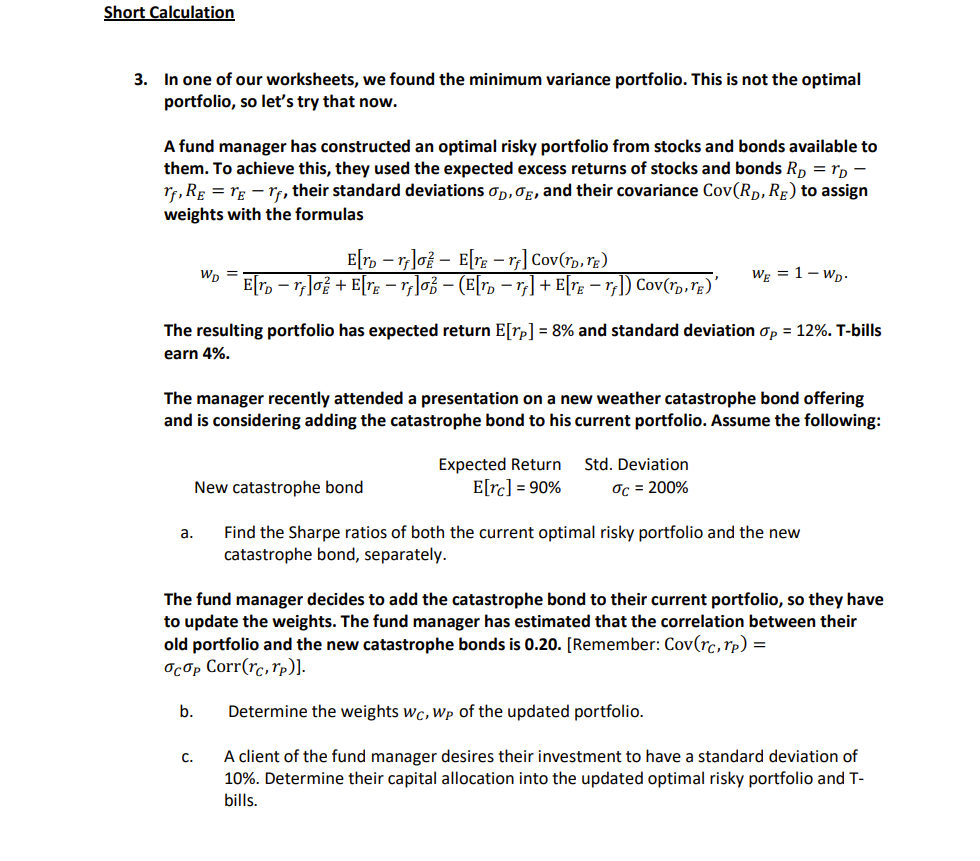

Short Calculation 1. A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 8%. The probability distribution of the risky funds is as follows: Expected Return Standard Deviation Stock fund (S) 24% 30% Bond fund (B) 12 19 The correlation between the fund returns is 0.13. a. What are the investment proportions in the minimum-variance portfolio of the two risky funds? b. What is the expected value and standard deviation of its rate of return? C. Is this portfolio the portfolio with the largest Sharpe ratio? Explain your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Cross Cultural Management

Authors: Marie Joelle Browaeys, Roger Price

3rd Edition

1292015896, 978-1292015897

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App