Hi dear helper,

Please letting me know how to calculate it(step by step) and give me an explanation about the steps, thanks, I'll give you the thumb!

(If you can't or do not want to, please let someone else do, thanks)

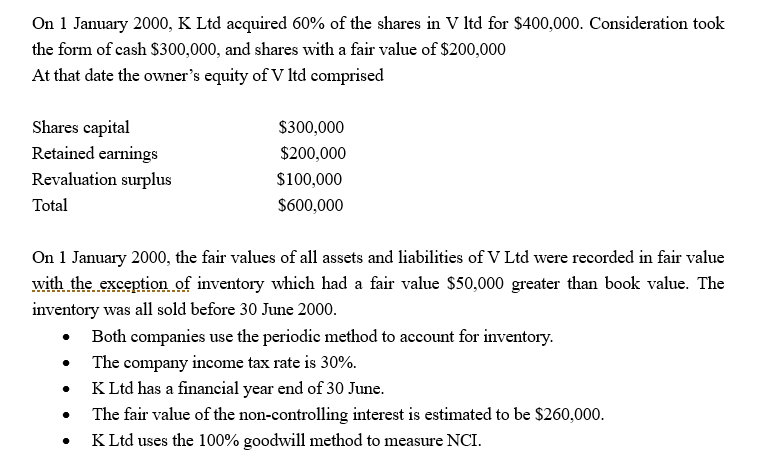

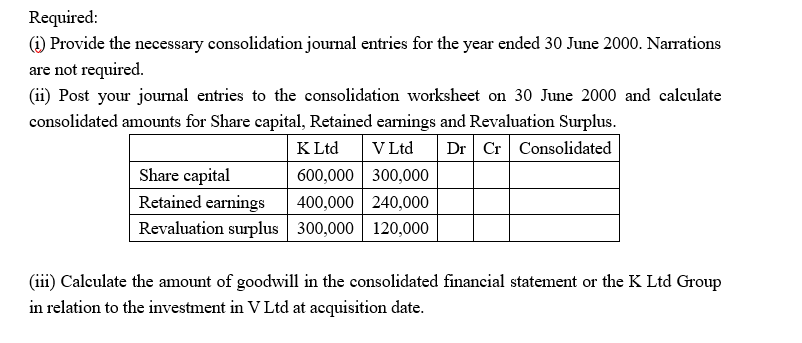

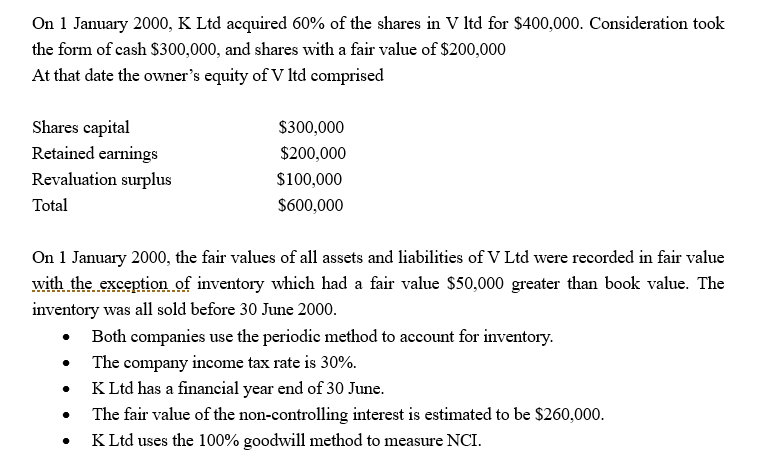

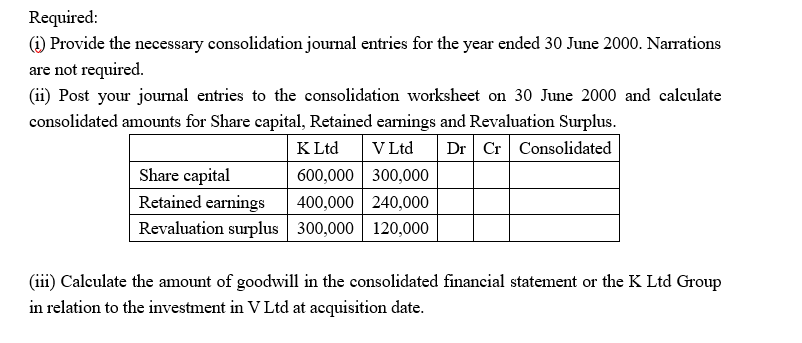

On 1 January 2000, K Ltd acquired 60% of the shares in V ltd for $400,000. Consideration took the form of cash $300,000, and shares with a fair value of $200,000 At that date the owner's equity of V ltd comprised Shares capital $300,000 Retained earnings $200,000 $100,000 Revaluation surplus Total $600,000 On 1 January 2000, the fair values of all assets and liabilities of V Ltd were recorded in fair value with the exception of inventory which had a fair value $50,000 greater than book value. The inventory was all sold before 30 June 2000. Both companies use the periodic method to account for inventory. The company income tax rate is 30%. K Ltd has a financial year end of 30 June. The fair value of the non-controlling interest is estimated to be $260,000. K Ltd uses the 100% goodwill method to measure NCI. Required: (1) Provide the necessary consolidation journal entries for the year ended 30 June 2000. Narrations are not required. (ii) Post your journal entries to the consolidation worksheet on 30 June 2000 and calculate consolidated amounts for Share capital, Retained earnings and Revaluation Surplus. K Ltd V Ltd Dr Cr Consolidated Share capital 600,000 300,000 Retained earnings 400,000 240,000 Revaluation surplus 300,000 120,000 (iii) Calculate the amount of goodwill in the consolidated financial statement or the K Ltd Group in relation to the investment in V Ltd at acquisition date. On 1 January 2000, K Ltd acquired 60% of the shares in V ltd for $400,000. Consideration took the form of cash $300,000, and shares with a fair value of $200,000 At that date the owner's equity of V ltd comprised Shares capital $300,000 Retained earnings $200,000 $100,000 Revaluation surplus Total $600,000 On 1 January 2000, the fair values of all assets and liabilities of V Ltd were recorded in fair value with the exception of inventory which had a fair value $50,000 greater than book value. The inventory was all sold before 30 June 2000. Both companies use the periodic method to account for inventory. The company income tax rate is 30%. K Ltd has a financial year end of 30 June. The fair value of the non-controlling interest is estimated to be $260,000. K Ltd uses the 100% goodwill method to measure NCI. Required: (1) Provide the necessary consolidation journal entries for the year ended 30 June 2000. Narrations are not required. (ii) Post your journal entries to the consolidation worksheet on 30 June 2000 and calculate consolidated amounts for Share capital, Retained earnings and Revaluation Surplus. K Ltd V Ltd Dr Cr Consolidated Share capital 600,000 300,000 Retained earnings 400,000 240,000 Revaluation surplus 300,000 120,000 (iii) Calculate the amount of goodwill in the consolidated financial statement or the K Ltd Group in relation to the investment in V Ltd at acquisition date