Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi! each question below has an answer (Bold). Could you please explain to me why those are the answers and why the others (each) are

Hi! each question below has an answer (Bold). Could you please explain to me why those are the answers and why the others (each) are wrong? I am preparing for my final and just want to make sure I really understand why and why not of each of them. Thanks.

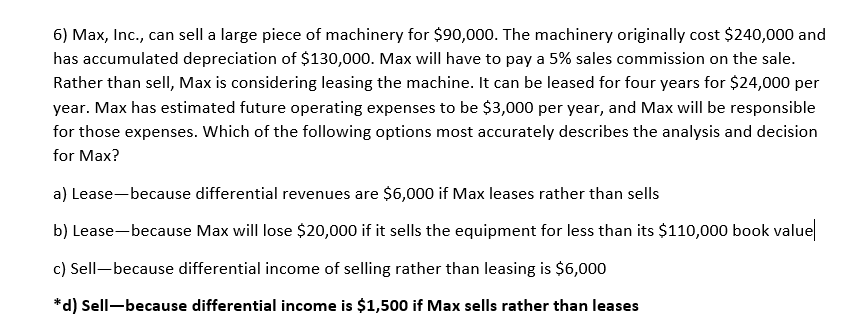

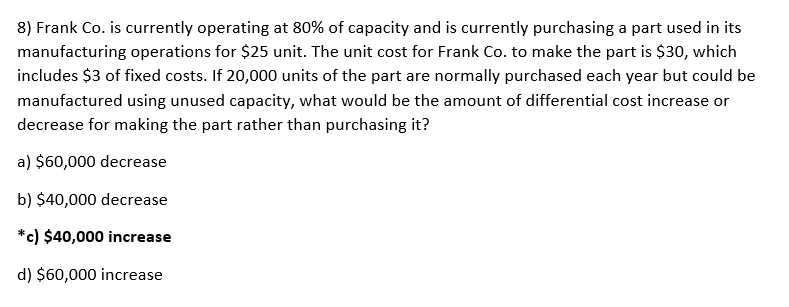

6) Max, Inc., can sell a large piece of machinery for $90,000. The machinery originally cost $240,000 and has accumulated depreciation of $130,000. Max will have to pay a 5% sales commission on the sale. Rather than sell, Max is considering leasing the machine. It can be leased for four years for $24,000 per year. Max has estimated future operating expenses to be $3,000 per year, and Max will be responsible for those expenses. Which of the following options most accurately describes the analysis and decision for Max? a) Lease-because differential revenues are $6,000 if Max leases rather than sells b) Lease-because Max will lose $20,000 if it sells the equipment for less than its $110,000 book value c) Sell-because differential income of selling rather than leasing is $6,000 *d) Sell-because differential income is $1,500 if Max sells rather than leases 8) Frank Co. is currently operating at 80% of capacity and is currently purchasing a part used in its manufacturing operations for $25 unit. The unit cost for Frank Co. to make the part is $30, which includes $3 of fixed costs. If 20,000 units of the part are normally purchased each year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease for making the part rather than purchasing it? a) $60,000 decrease b) $40,000 decrease *c) $40,000 increase d) $60,000 increaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started