Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER FOR THIS QUESTION (SHORT ANSWER PLEASE) ASAP! Taxation Law- Australia R ead carefully the question please , ALL THE BEST PS: I will give

ANSWER FOR THIS QUESTION (SHORT ANSWER PLEASE) ASAP!

Taxation Law- Australia

Read carefully the question please,

ALL THE BEST

PS: I will give you very good review and recommendation.

THANKS SO MUCH IN ADVANCE!

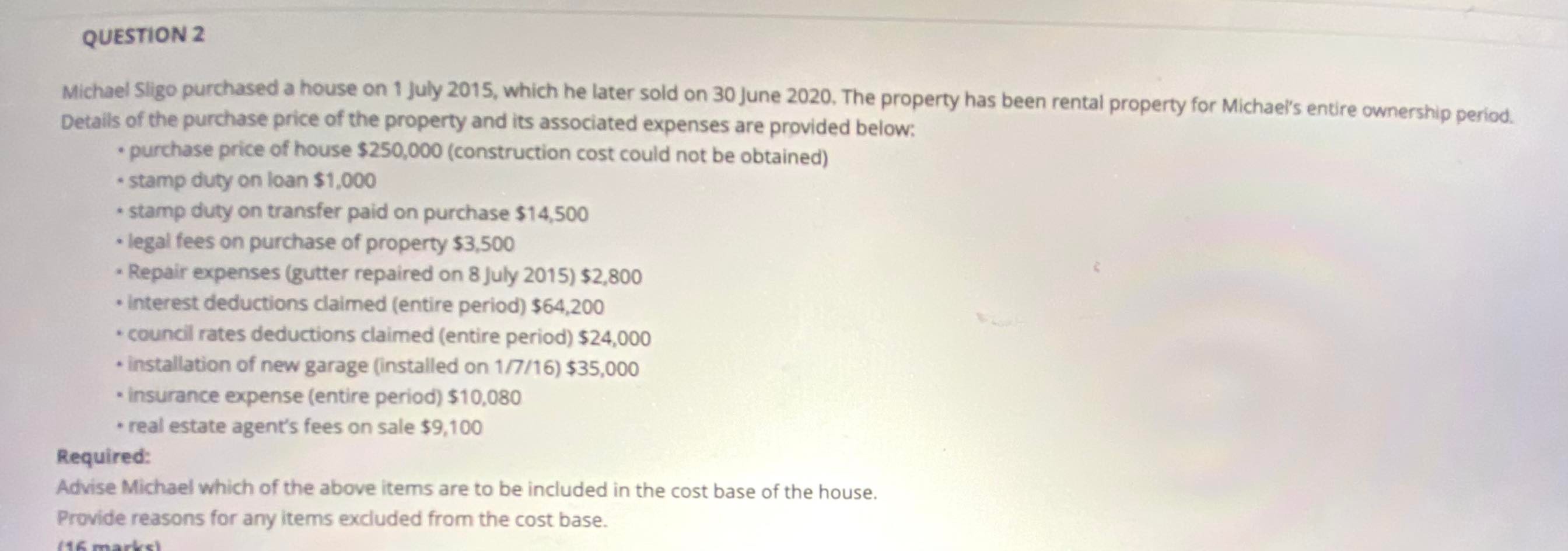

QUESTION 2 Michael Sligo purchased a house on 1 July 2015, which he later sold on 30 June 2020. The property has been rental property for Michael's entire ownership period. Details of the purchase price of the property and its associated expenses are provided below: purchase price of house $250,000 (construction cost could not be obtained) stamp duty on loan $1,000 stamp duty on transfer paid on purchase $14,500 legal fees on purchase of property $3,500 - Repair expenses (gutter repaired on 8 July 2015) $2,800 interest deductions claimed (entire period) $64,200 -council rates deductions claimed (entire period) $24,000 installation of new garage (installed on 1/7/16) $35,000 insurance expense (entire period) $10,080 real estate agent's fees on sale $9,100 . Required: Advise Michael which of the above items are to be included in the cost base of the house. Provide reasons for any items excluded from the cost base. (16 marks

Step by Step Solution

★★★★★

3.36 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

Items included in Michaels cost base Purchase price of house 250000 Stamp duty on transfer paid on p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started