Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HI guys I was wondering if I could have help with this question? it needs to be done in excel and I have no idea

HI guys

I was wondering if I could have help with this question? it needs to be done in excel and I have no idea

I have also attached the template down the bottom and the GST is 10%

thank you

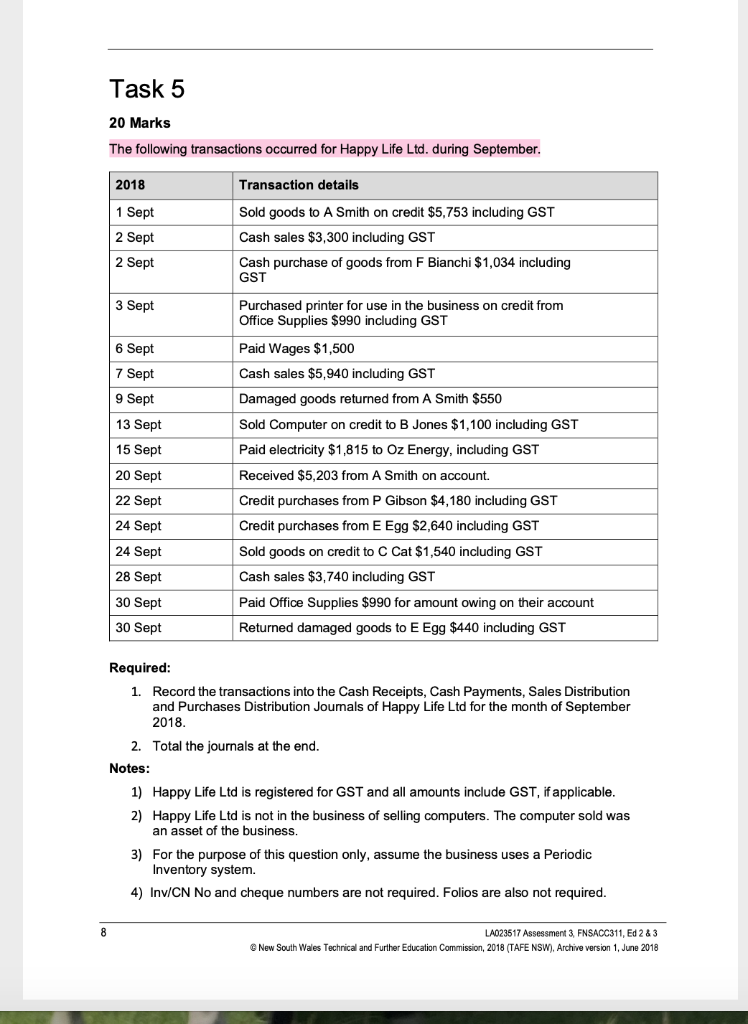

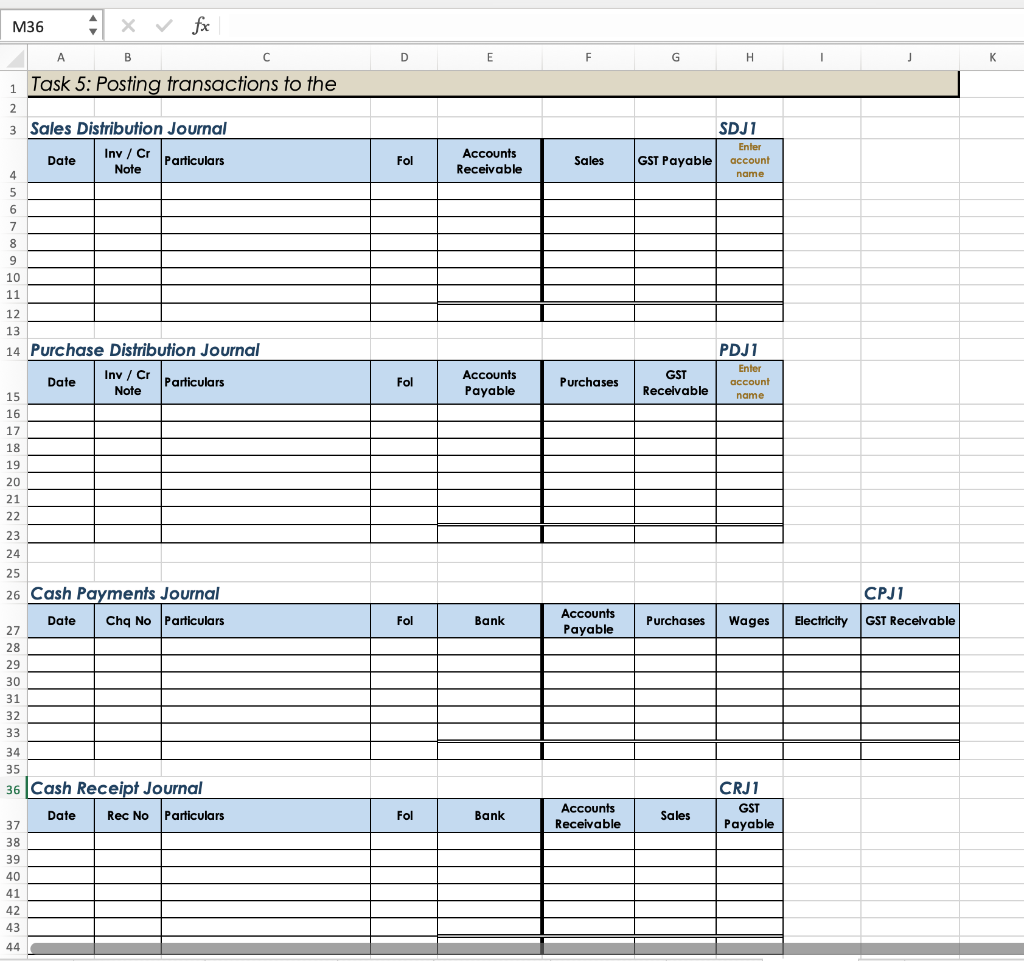

Task 5 20 Marks The following transactions occurred for Happy Life Ltd. during September. 2018 Transaction details 1 Sept 2 Sept Sold goods to A Smith on credit $5,753 including GST Cash sales $3,300 including GST Cash purchase of goods from F Bianchi $1,034 including GST 2 Sept 3 Sept 6 Sept 7 Sept Purchased printer for use in the business on credit from Office Supplies $990 including GST Paid Wages $1,500 Cash sales $5,940 including GST Damaged goods returned from A Smith $550 Sold Computer on credit to B Jones $1,100 including GST Paid electricity $1,815 to Oz Energy, including GST 9 Sept 13 Sept 15 Sept Received $5,203 from A Smith on account. 20 Sept 22 Sept 24 Sept 24 Sept 28 Sept Credit purchases from P Gibson $4,180 including GST Credit purchases from E Egg $2,640 including GST Sold goods on credit to C Cat $1,540 including GST Cash sales $3,740 including GST Paid Office Supplies $990 for amount owing on their account Returned damaged goods to E Egg $440 including GST 30 Sept 30 Sept Required: 1. Record the transactions into the Cash Receipts, Cash Payments, Sales Distribution and Purchases Distribution Journals of Happy Life Ltd for the month of September 2018. 2. Total the journals at the end. Notes: 1) Happy Life Ltd is registered for GST and all amounts include GST, if applicable. 2) Happy Life Ltd is not in the business of selling computers. The computer sold was an asset of the business. 3) For the purpose of this question only, assume the business uses a Periodic Inventory system. 4) Inv/CN No and cheque numbers are not required. Folios are also not required. 8 LA023517 Assessment 3 FNSACC311, Ed 2 & 3 @ New South Wales Technical and Further Education Commission, 2018 (TAFE NSW), Archive version 1, June 2018 M36 X fx A B D E F G J K 1 SDJ1 Enter account name Accounts Receivable Fol Sales GST Payable Task 5: Posting transactions to the 2 3 Sales Distribution Journal Date Inv / Cr Particulars 4 Note 5 6 7 8 9 10 11 12 13 14 Purchase Distribution Journal Inv / Cr Date Particulars 15 Note 16 17 18 Accounts Payable Fol PDJ1 Enter account name GST Receivable Purchases 19 20 21 22 23 24 25 26 Cash Payments Journal CPJ1 Date Chq No Particulars Fol Bank Accounts Payable Purchases Wages Electricity GST Receivable 27 28 29 30 31 32 33 34 35 36 Cash Receipt Journal CRJ1 GST Payable Date Rec No Particulars Fol Accounts Receivable Bank Sales 37 38 39 40 41 42 43 44

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started