Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi guys if i could get a solution with the relevant formula would be really appreciated An investor observes the current market prices of three

hi guys if i could get a solution with the relevant formula would be really appreciated

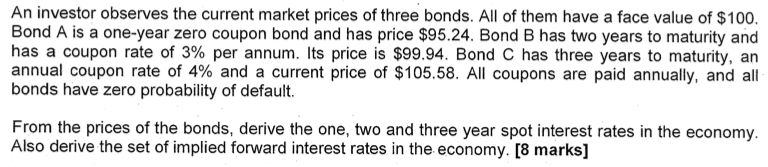

An investor observes the current market prices of three bonds. All of them have a face value of $100. Bond A is a one-year zero coupon bond and has price $95.24. Bond B has two years to maturity and has a coupon rate of 3% per annum. Its price is $99.94. Bond C has three years to maturity, an annual coupon rate of 4% and a current price of $105.58. All coupons are paid annually, and all bonds have zero probability of default. From the prices of the bonds, derive the one, two and three year spot interest rates in the economy. Also derive the set of implied forward interest rates in the economy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started