Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi guys, I'm getting stuck on this question for cost accounting. any help would be greatly appreciated!! CHAPTER 2 HOMEWORK ASSIGNMENT Williams Instruments manufactures specialized

Hi guys, I'm getting stuck on this question for cost accounting. any help would be greatly appreciated!!

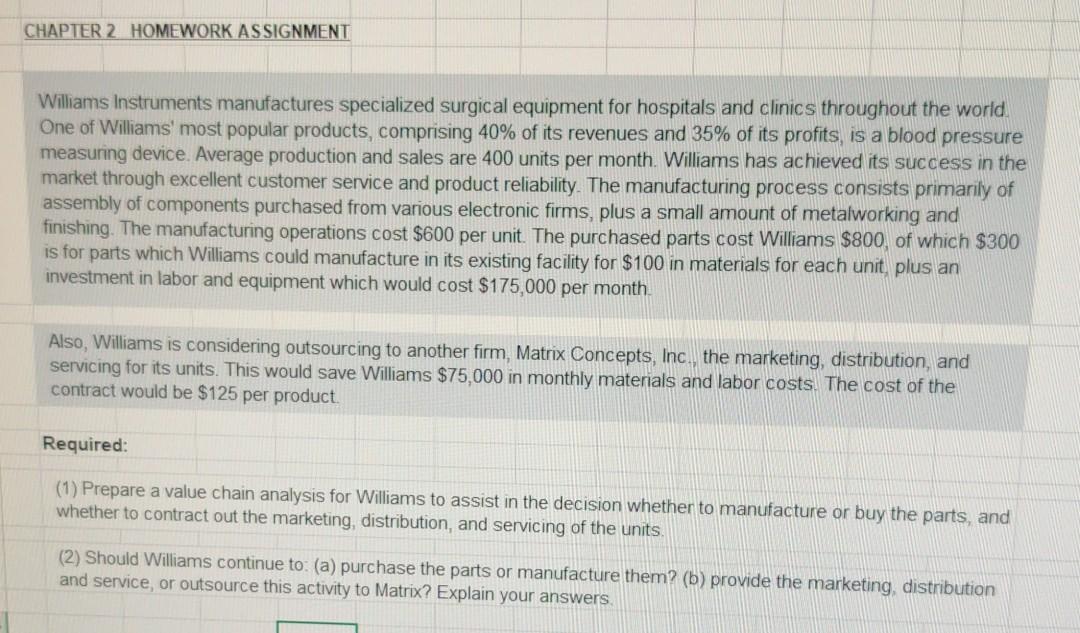

CHAPTER 2 HOMEWORK ASSIGNMENT Williams Instruments manufactures specialized surgical equipment for hospitals and clinics throughout the world. One of Williams' most popular products, comprising 40% of its revenues and 35% of its profits, is a blood pressure measuring device. Average production and sales are 400 units per month. Williams has achieved its success in the market through excellent customer service and product reliability. The manufacturing process consists primarily of assembly of components purchased from various electronic firms, plus a small amount of metalworking and finishing. The manufacturing operations cost $600 per unit. The purchased parts cost Williams $800, of which $300 is for parts which Williams could manufacture in its existing facility for $100 in materials for each unit, plus an investment in labor and equipment which would cost $175,000 per month Also, Williams is considering outsourcing to another firm, Matrix Concepts, Inc., the marketing, distribution, and servicing for its units. This would save Williams $75,000 in monthly materials and labor costs. The cost of the contract would be $125 per product Required: (1) Prepare a value chain analysis for Williams to assist in the decision whether to manufacture or buy the parts, and whether to contract out the marketing, distribution, and servicing of the units. (2) Should Williams continue to: (a) purchase the parts or manufacture them? (b) provide the marketing, distribution and service, or outsource this activity to Matrix? Explain your answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started