Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi, help me complete this question. QUESTION 4 (15 Marks; 27 Minutes) Assume a value-added tax (VAT) rate of 15%. Cinema Equipment (Pty) Ltd ('Cin

hi, help me complete this question.

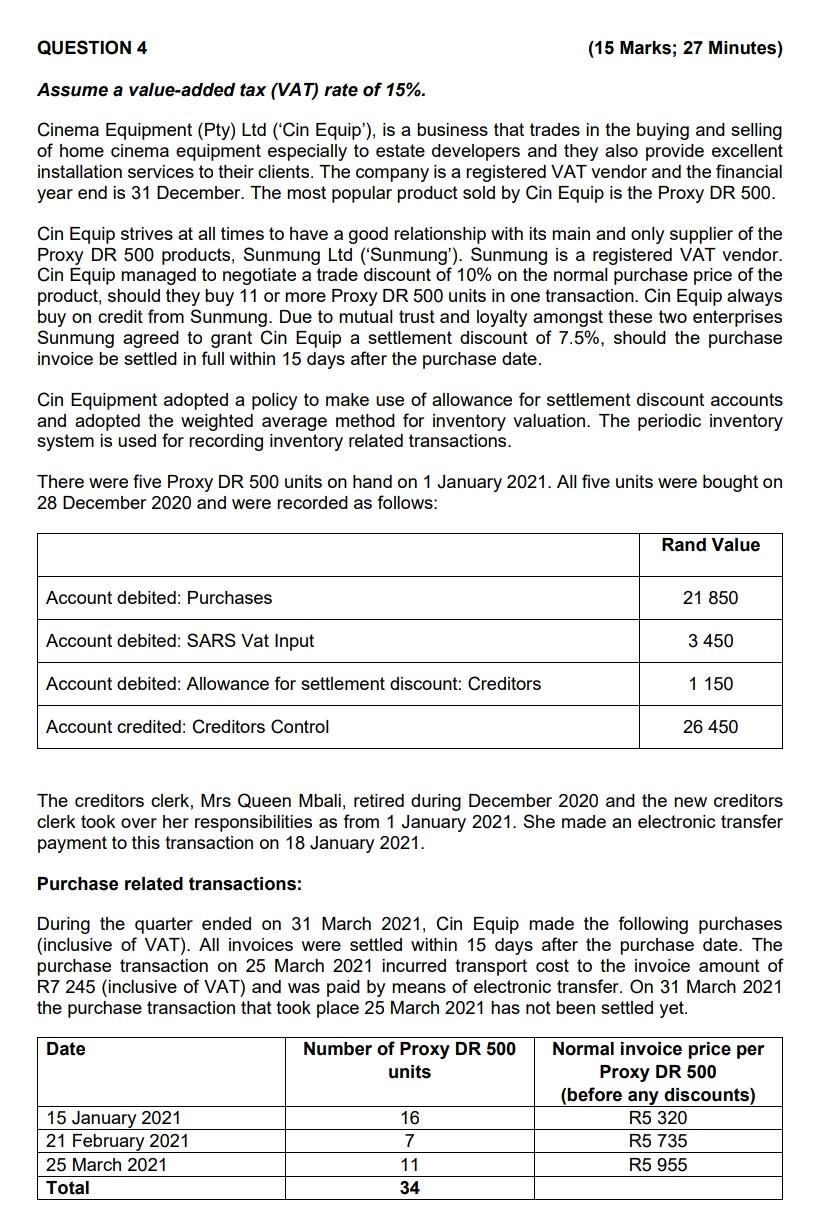

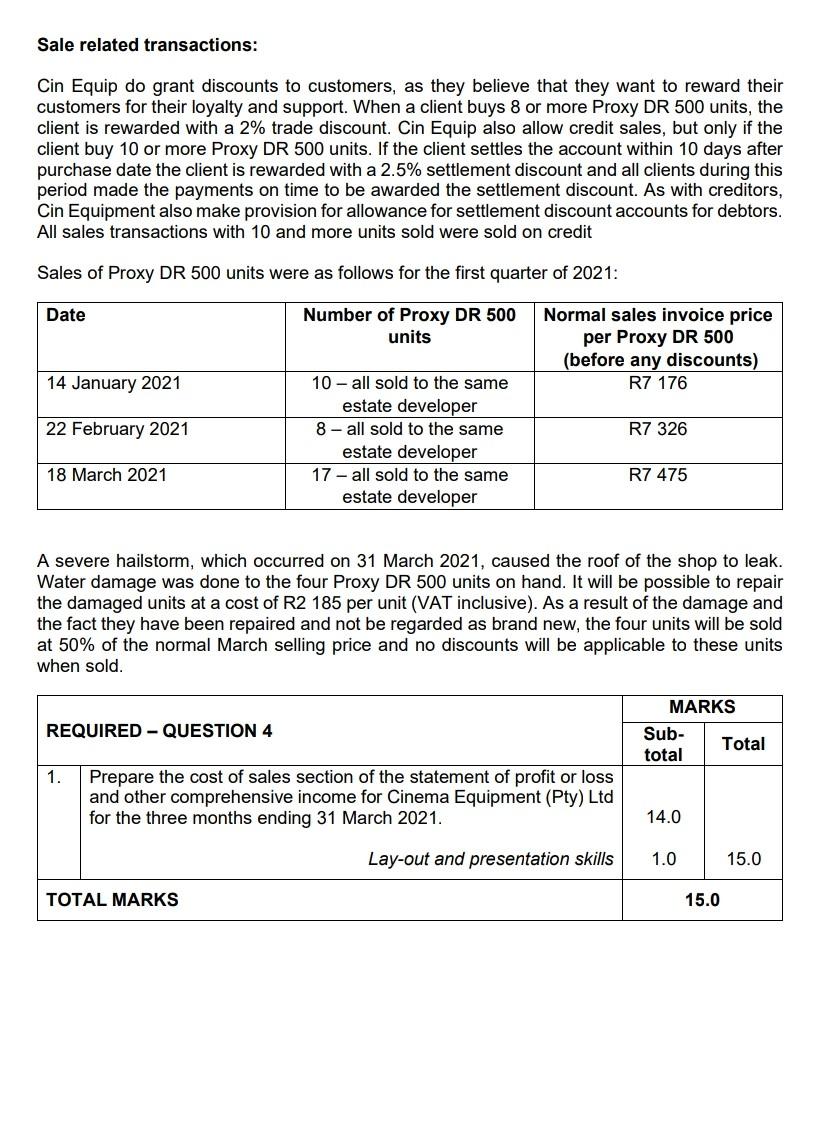

QUESTION 4 (15 Marks; 27 Minutes) Assume a value-added tax (VAT) rate of 15%. Cinema Equipment (Pty) Ltd ('Cin Equip'), is a business that trades in the buying and selling of home cinema equipment especially to estate developers and they also provide excellent installation services to their clients. The company is a registered VAT vendor and the financial year end is 31 December. The most popular product sold by Cin Equip is the Proxy DR 500. Cin Equip strives at all times to have a good relationship with its main and only supplier of the Proxy DR 500 products, Sunmung Ltd ("Sunmung'). Sunmung is a registered VAT vendor. Cin Equip managed to negotiate a trade discount of 10% on the normal purchase price of the product, should they buy 11 or more Proxy DR 500 units in one transaction. Cin Equip always buy on credit from Sunmung. Due to mutual trust and loyalty amongst these two enterprises Sunmung agreed to grant Cin Equip a settlement discount of 7.5%, should the purchase invoice be settled in full within 15 days after the purchase date. Cin Equipment adopted a policy to make use of allowance for settlement discount accounts and adopted the weighted average method for inventory valuation. The periodic inventory system is used for recording inventory related transactions. There were five Proxy DR 500 units on hand on 1 January 2021. All five units were bought on 28 December 2020 and were recorded as follows: Rand Value Account debited: Purchases 21 850 Account debited: SARS Vat Input 3 450 Account debited: Allowance for settlement discount: Creditors 1 150 Account credited: Creditors Control 26 450 The creditors clerk, Mrs Queen Mbali, retired during December 2020 and the new creditors clerk took over her responsibilities as from 1 January 2021. She made an electronic transfer payment to this transaction on 18 January 2021. Purchase related transactions: During the quarter ended on 31 March 2021, Cin Equip made the following purchases (inclusive of VAT). All invoices were settled within 15 days after the purchase date. The purchase transaction on 25 March 2021 incurred transport cost to the invoice amount of R7 245 (inclusive of VAT) and was paid by means of electronic transfer. On 31 March 2021 the purchase transaction that took place 25 March 2021 has not been settled yet. Date Number of Proxy DR 500 units Normal invoice price per Proxy DR 500 (before any discounts) R5 320 R5 735 R5 955 15 January 2021 21 February 2021 25 March 2021 Total 16 7 11 34 Sale related transactions: Cin Equip do grant discounts to customers, as they believe that they want to reward their customers for their loyalty and support. When a client buys 8 or more Proxy DR 500 units, the client is rewarded with a 2% trade discount. Cin Equip also allow credit sales, but only if the client buy 10 or more Proxy DR 500 units. If the client settles the account within 10 days after purchase date the client is rewarded with a 2.5% settlement discount and all clients during this period made the payments on time to be awarded the settlement discount. As with creditors, Cin Equipment also make provision for allowance for settlement discount accounts for debtors. All sales transactions with 10 and more units sold were sold on credit Sales of Proxy DR 500 units were as follows for the first quarter of 2021: Date Number of Proxy DR 500 units Normal sales invoice price per Proxy DR 500 (before any discounts) R7 176 14 January 2021 22 February 2021 R7 326 10 - all sold to the same estate developer 8- all sold to the same estate developer 17 - all sold to the same estate developer 18 March 2021 R7 475 A severe hailstorm, which occurred on 31 March 2021, caused the roof of the shop to leak. Water damage was done to the four Proxy DR 500 units on hand. It will be possible to repair the damaged units at a cost of R2 185 per unit (VAT inclusive). As a result of the damage and the fact they have been repaired and not be regarded as brand new, the four units will be sold at 50% of the normal March selling price and no discounts will be applicable to these units when sold. REQUIRED - QUESTION 4 MARKS Sub- total Total 1. Prepare the cost of sales section of the statement of profit or loss and other comprehensive income for Cinema Equipment (Pty) Ltd for the three months ending 31 March 2021. 14.0 Lay-out and presentation skills 1.0 15.0 TOTAL MARKS 15.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started