Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi, help me identify which are correct. 1. Which of the following definitions is applicable to Accrued expenses: (1) a) It is a present economic

hi, help me identify which are correct.

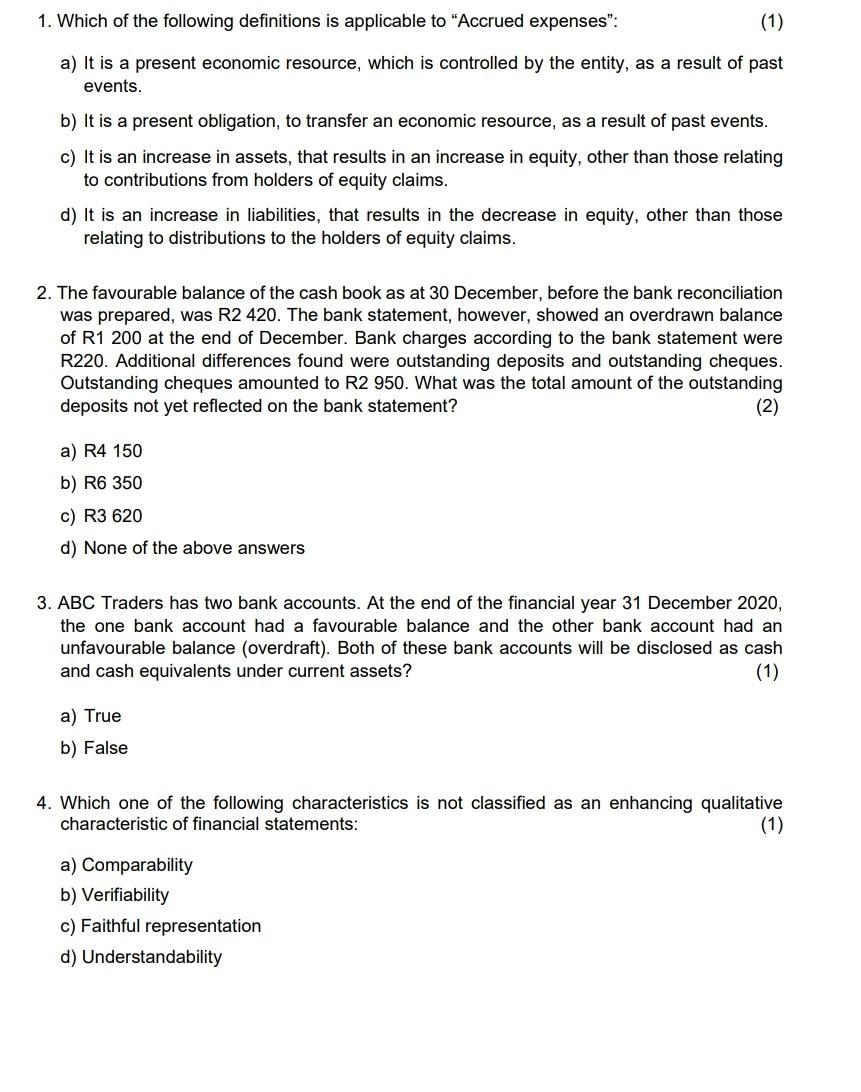

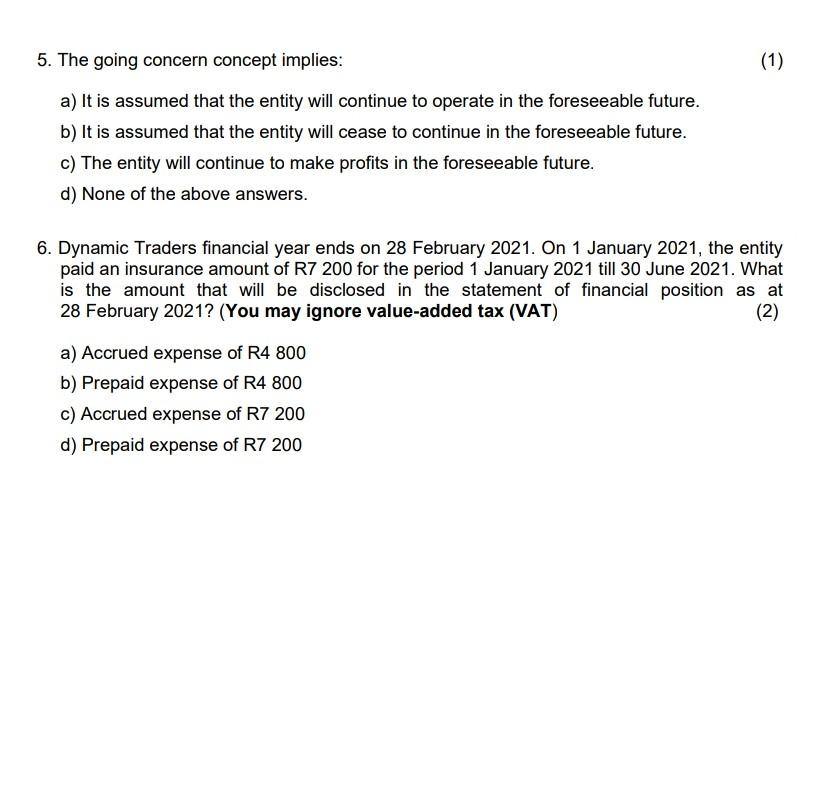

1. Which of the following definitions is applicable to "Accrued expenses": (1) a) It is a present economic resource, which is controlled by the entity, as a result of past events. b) It is a present obligation, to transfer an economic resource, as a result of past events. c) It is an increase in assets, that results in an increase in equity, other than those relating to contributions from holders of equity claims. d) It is an increase in liabilities, that results in the decrease in equity, other than those relating to distributions to the holders of equity claims. 2. The favourable balance of the cash book as at 30 December, before the bank reconciliation was prepared, was R2 420. The bank statement, however, showed an overdrawn balance of R1 200 at the end of December. Bank charges according to the bank statement were R220. Additional differences found were outstanding deposits and outstanding cheques. Outstanding cheques amounted to R2 950. What was the total amount of the outstanding deposits not yet reflected on the bank statement? (2) a) R4 150 b) R6 350 c) R3 620 d) None of the above answers 3. ABC Traders has two bank accounts. At the end of the financial year 31 December 2020, the one bank account had a favourable balance and the other bank account had an unfavourable balance (overdraft). Both of these bank accounts will be disclosed as cash and cash equivalents under current assets? (1) a) True b) False 4. Which one of the following characteristics is not classified as an enhancing qualitative characteristic of financial statements: (1) a) Comparability b) Verifiability c) Faithful representation d) Understandability (1) 5. The going concern concept implies: a) It is assumed that the entity will continue to operate in the foreseeable future. b) It is assumed that the entity will cease to continue in the foreseeable future. c) The entity will continue to make profits in the foreseeable future. d) None of the above answers. 6. Dynamic Traders financial year ends on 28 February 2021. On 1 January 2021, the entity paid an insurance amount of R7 200 for the period 1 January 2021 till 30 June 2021. What is the amount that will be disclosed in the statement of financial position as at 28 February 2021? (You may ignore value-added tax (VAT) (2) a) Accrued expense of R4 800 b) Prepaid expense of R4 800 c) Accrued expense of R7 200 d) Prepaid expense of R7 200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started