Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi help plz Assignment Brief and Guidance: The Scenario Accounting plays a vital role in running a business because it helps you to track income

Hi help plz

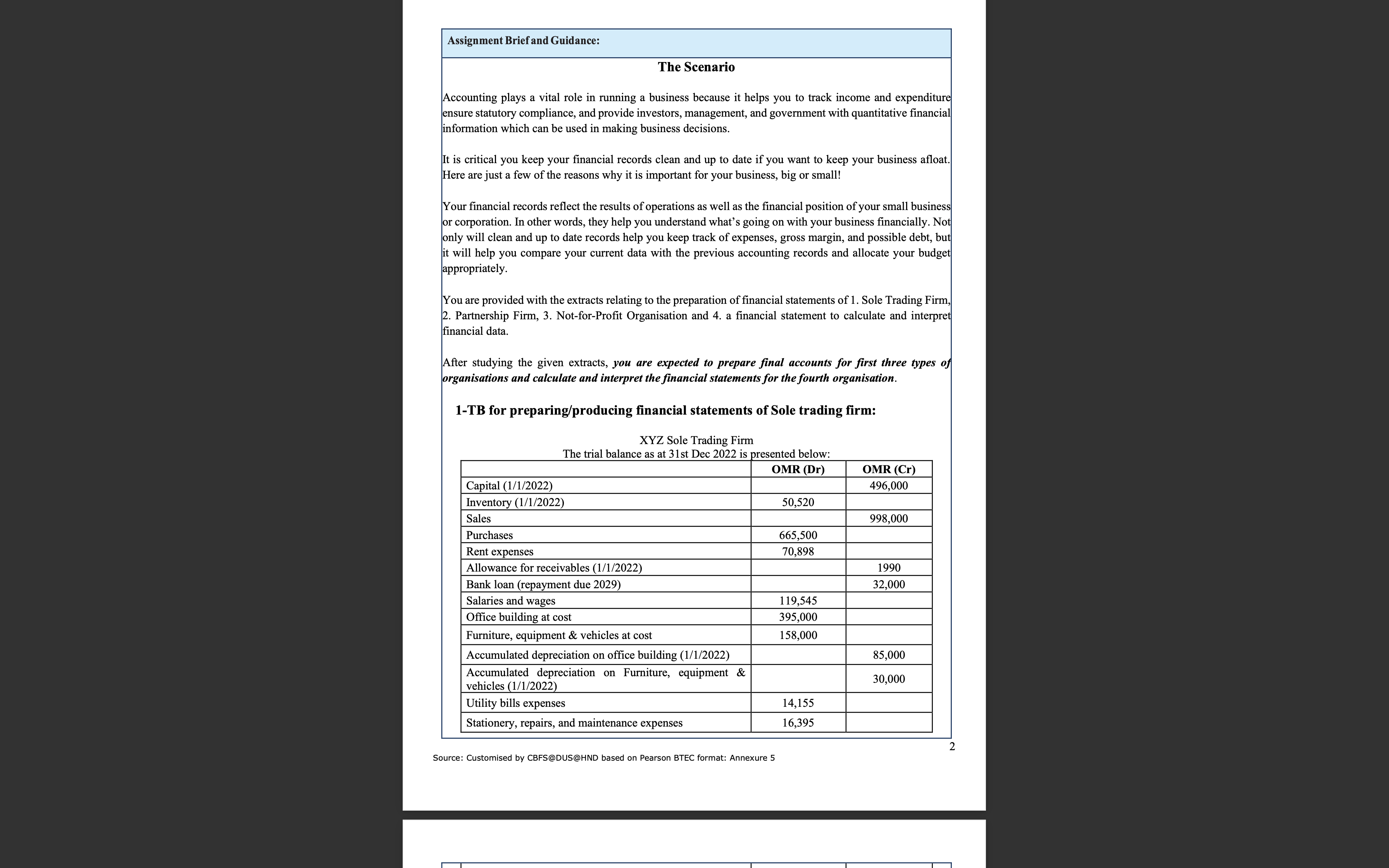

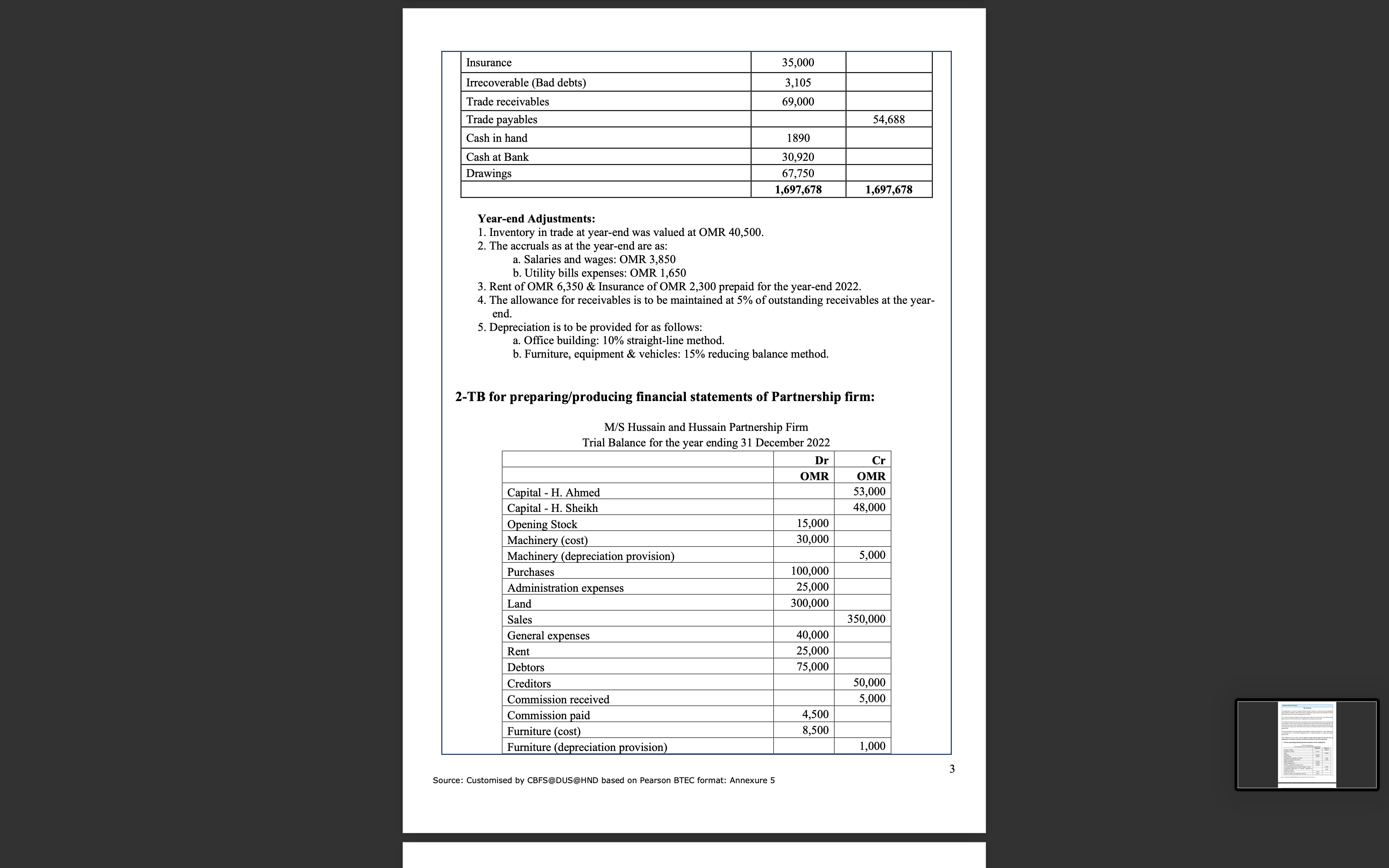

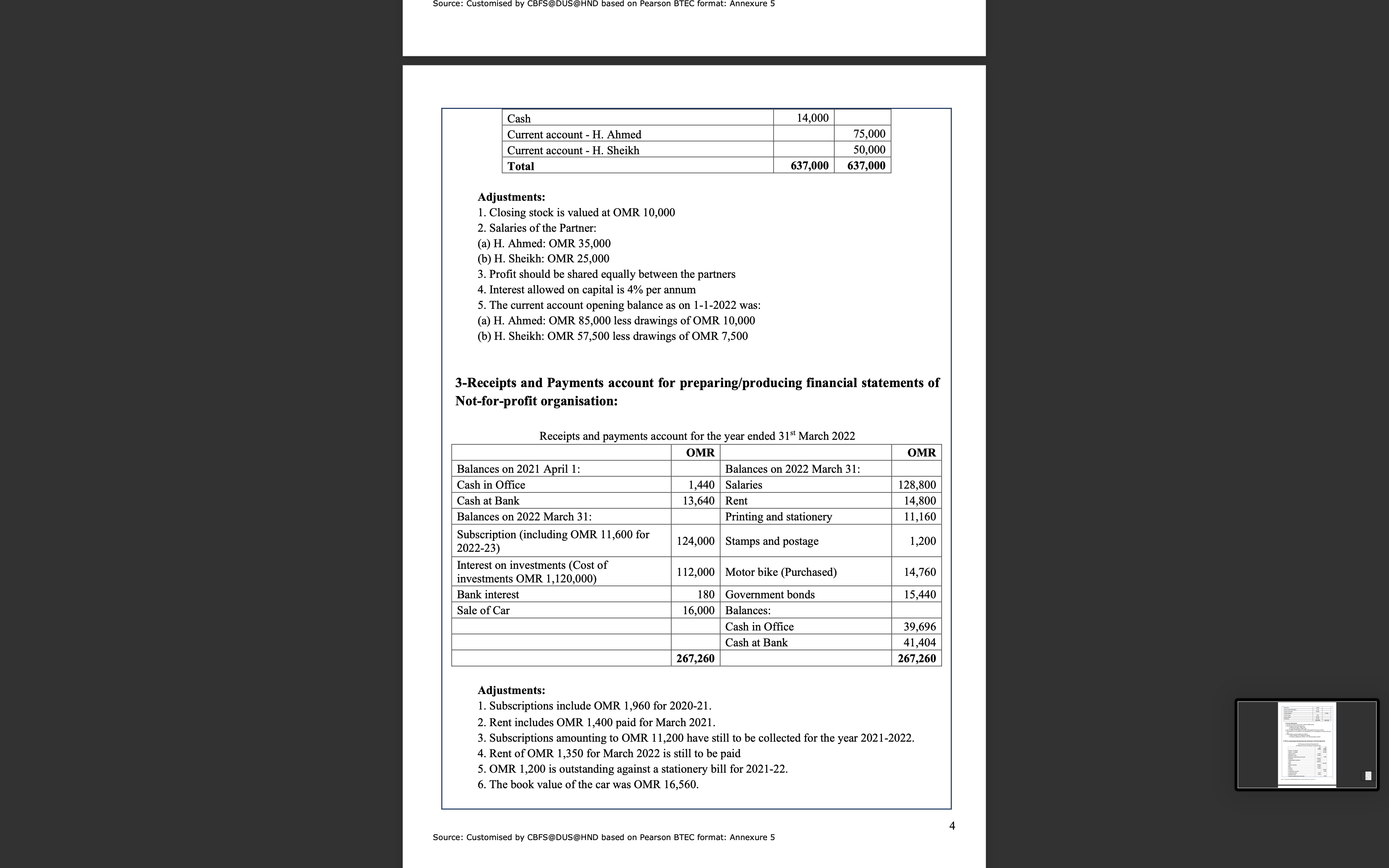

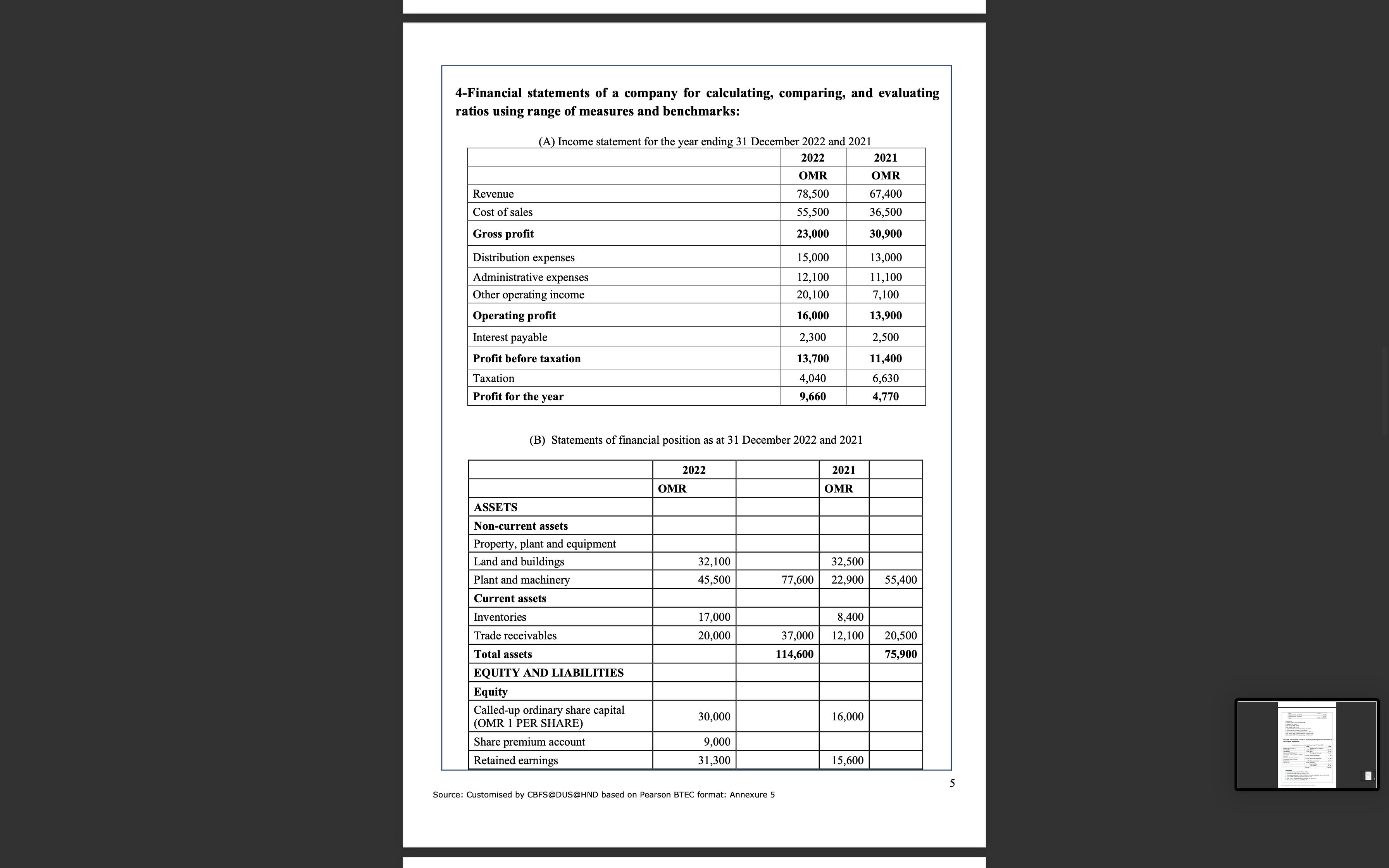

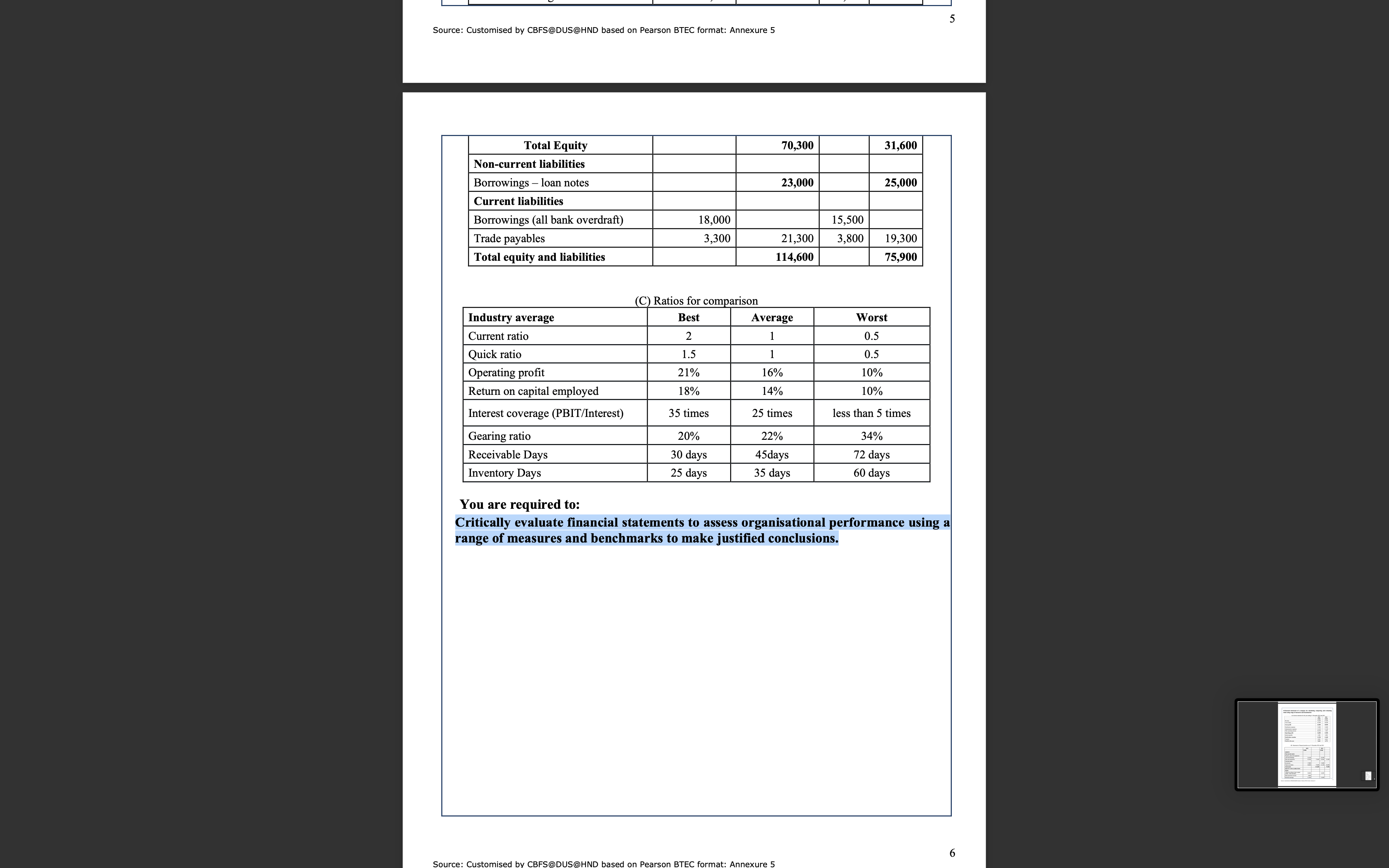

Assignment Brief and Guidance: The Scenario Accounting plays a vital role in running a business because it helps you to track income and expenditure ensure statutory compliance, and provide investors, management, and government with quantitative financial information which can be used in making business decisions. It is critical you keep your financial records clean and up to date if you want to keep your business afloat. Here are just a few of the reasons why it is important for your business, big or small! Your financial records reflect the results of operations as well as the financial position of your small business or corporation. In other words, they help you understand what's going on with your business financially. Not only will clean and up to date records help you keep track of expenses, gross margin, and possible debt, but it will help you compare your current data with the previous accounting records and allocate your budget appropriately. You are provided with the extracts relating to the preparation of financial statements of 1. Sole Trading Firm, 2. Partnership Firm, 3. Not-for-Profit Organisation and 4. a financial statement to calculate and interpret financial data. After studying the given extracts, you are expected to prepare final accounts for first three types of organisations and calculate and interpret the financial statements for the fourth organisation. 1-TB for preparing/producing financial statements of Sole trading firm: Source: Customised by CBFS@DUS@HND based on Pearson BTEC format: Annexure 5 Year-end Adjustments: 1. Inventory in trade at year-end was valued at OMR 40,500. 2. The accruals as at the year-end are as: a. Salaries and wages: OMR 3,850 b. Utility bills expenses: OMR 1,650 3. Rent of OMR 6,350 \& Insurance of OMR 2,300 prepaid for the year-end 2022. 4. The allowance for receivables is to be maintained at 5% of outstanding receivables at the yearend. 5. Depreciation is to be provided for as follows: a. Office building: 10% straight-line method. b. Furniture, equipment & vehicles: 15% reducing balance method. 2-TB for preparing/producing financial statements of Partnership firm: M/S Hussain and Hussain Partnership Firm Trial Balance for the vear ending 31 December 2022 Source: Customised by CBFS@DUS@HND based on Pearson BTEC format: Annexure 5 Adjustments: 1. Closing stock is valued at OMR 10,000 2. Salaries of the Partner: (a) H. Ahmed: OMR 35,000 (b) H. Sheikh: OMR 25,000 3. Profit should be shared equally between the partners 4. Interest allowed on capital is 4% per annum 5. The current account opening balance as on 1-1-2022 was: (a) H. Ahmed: OMR 85,000 less drawings of OMR 10,000 (b) H. Sheikh: OMR 57,500 less drawings of OMR 7,500 3-Receipts and Payments account for preparing/producing financial statements of Not-for-profit organisation: Receipts and payments account for the year ended 31st March 2022 Adjustments: 1. Subscriptions include OMR 1,960 for 2020-21. 2. Rent includes OMR 1,400 paid for March 2021. 3. Subscriptions amounting to OMR 11,200 have still to be collected for the year 2021-2022. 4. Rent of OMR 1,350 for March 2022 is still to be paid 5. OMR 1,200 is outstanding against a stationery bill for 2021-22. 6. The book value of the car was OMR 16,560. Source: Customised by CBFS@DUS@HND based on Pearson BTEC format: Annexure 5 4-Financial statements of a company for calculating, comparing, and evaluating ratios using range of measures and benchmarks: (B) Statements of financial position as at 31 December 2022 and 2021 Source: Customised by CBFS@DUS@HND based on Pearson BTEC format: Annexure 5 Source: Customised by CBFS@DUS@HND based on Pearson BTEC format: Annexure 5 You are required to: Critically evaluate financial statements to assess organisational performance using a range of measures and benchmarks to make justified conclusions

Assignment Brief and Guidance: The Scenario Accounting plays a vital role in running a business because it helps you to track income and expenditure ensure statutory compliance, and provide investors, management, and government with quantitative financial information which can be used in making business decisions. It is critical you keep your financial records clean and up to date if you want to keep your business afloat. Here are just a few of the reasons why it is important for your business, big or small! Your financial records reflect the results of operations as well as the financial position of your small business or corporation. In other words, they help you understand what's going on with your business financially. Not only will clean and up to date records help you keep track of expenses, gross margin, and possible debt, but it will help you compare your current data with the previous accounting records and allocate your budget appropriately. You are provided with the extracts relating to the preparation of financial statements of 1. Sole Trading Firm, 2. Partnership Firm, 3. Not-for-Profit Organisation and 4. a financial statement to calculate and interpret financial data. After studying the given extracts, you are expected to prepare final accounts for first three types of organisations and calculate and interpret the financial statements for the fourth organisation. 1-TB for preparing/producing financial statements of Sole trading firm: Source: Customised by CBFS@DUS@HND based on Pearson BTEC format: Annexure 5 Year-end Adjustments: 1. Inventory in trade at year-end was valued at OMR 40,500. 2. The accruals as at the year-end are as: a. Salaries and wages: OMR 3,850 b. Utility bills expenses: OMR 1,650 3. Rent of OMR 6,350 \& Insurance of OMR 2,300 prepaid for the year-end 2022. 4. The allowance for receivables is to be maintained at 5% of outstanding receivables at the yearend. 5. Depreciation is to be provided for as follows: a. Office building: 10% straight-line method. b. Furniture, equipment & vehicles: 15% reducing balance method. 2-TB for preparing/producing financial statements of Partnership firm: M/S Hussain and Hussain Partnership Firm Trial Balance for the vear ending 31 December 2022 Source: Customised by CBFS@DUS@HND based on Pearson BTEC format: Annexure 5 Adjustments: 1. Closing stock is valued at OMR 10,000 2. Salaries of the Partner: (a) H. Ahmed: OMR 35,000 (b) H. Sheikh: OMR 25,000 3. Profit should be shared equally between the partners 4. Interest allowed on capital is 4% per annum 5. The current account opening balance as on 1-1-2022 was: (a) H. Ahmed: OMR 85,000 less drawings of OMR 10,000 (b) H. Sheikh: OMR 57,500 less drawings of OMR 7,500 3-Receipts and Payments account for preparing/producing financial statements of Not-for-profit organisation: Receipts and payments account for the year ended 31st March 2022 Adjustments: 1. Subscriptions include OMR 1,960 for 2020-21. 2. Rent includes OMR 1,400 paid for March 2021. 3. Subscriptions amounting to OMR 11,200 have still to be collected for the year 2021-2022. 4. Rent of OMR 1,350 for March 2022 is still to be paid 5. OMR 1,200 is outstanding against a stationery bill for 2021-22. 6. The book value of the car was OMR 16,560. Source: Customised by CBFS@DUS@HND based on Pearson BTEC format: Annexure 5 4-Financial statements of a company for calculating, comparing, and evaluating ratios using range of measures and benchmarks: (B) Statements of financial position as at 31 December 2022 and 2021 Source: Customised by CBFS@DUS@HND based on Pearson BTEC format: Annexure 5 Source: Customised by CBFS@DUS@HND based on Pearson BTEC format: Annexure 5 You are required to: Critically evaluate financial statements to assess organisational performance using a range of measures and benchmarks to make justified conclusions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started