Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi hope you are doing well i dont know if this attachmed allow or not ?! help me to solve it ?! thank you Carla

hi

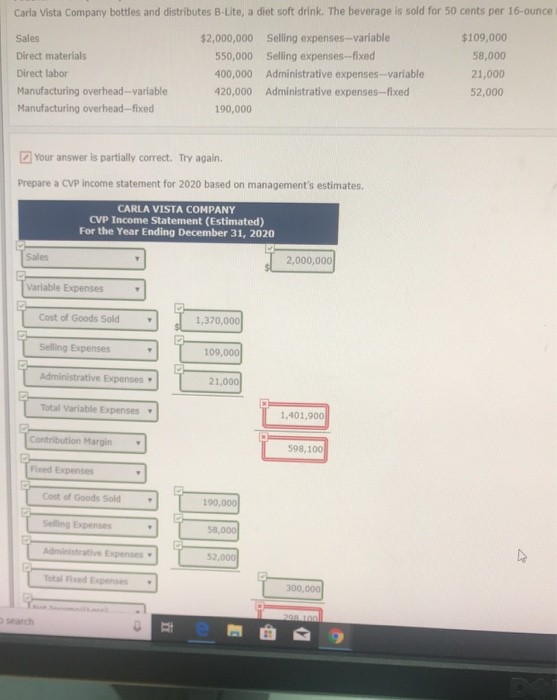

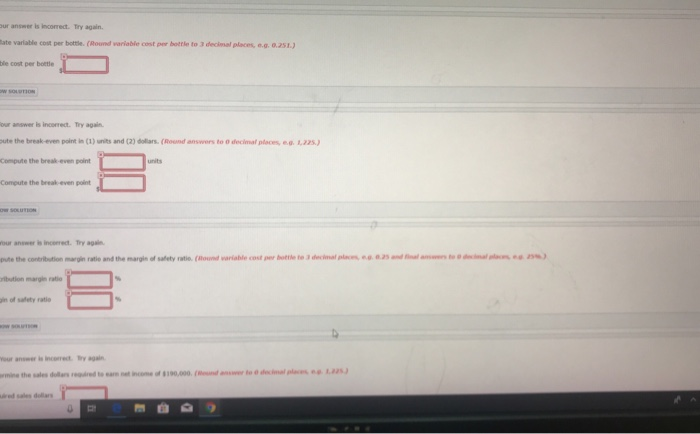

Carla Vista Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 50 cents per 16-ounce $109,000 $2,000,000 Selling expenses-variable Sales 58,000 550,000 Selling expenses-fixed Direct materials 21,000 400,000 Administrative expenses-variable Direct labor 52,000 420,000 Administrative expenses-fixed Manufacturing overhead-variable 190,000 Manufacturing overhead-fixed Your answer is partially correct. Try again. Prepare a CVP income statement for 2020 based on management's estimates. CARLA VISTA COMPANY CVP Income Statement (Estimated) For the Year Ending December 31, 2020 2,000,000 Sales Variable Expenses Cost of Goods Sold 1,370,000 Selling Expenses 109,000 Administrative Expenses 21,000 Total Variable Expenses 1,401,900 Contribution Margin 598,100 Fxed Expenses Cost of Goods Sold 190,000 Selling Expenses 58,000 Administrative Expenses 52,000 Total xed Expenses 300,000 298.100 osearch our answer is incorrect. Try again ate varlable cost per bottle. (Round variable cost per bottle to 3 declmal places, e.g. 0.251.) ble cost per bottle ow souUTION our answer is incorrect. Try again. oute the break even point in (1) units and (2) dollars. (Round answers to 0 decimal places, eg. 1225) Compute the break-even point units Compute the break even point ow SOLUTION our answer is incerect. Try again. to decimal lecs ee 2% pute the contribution margin ratie and the margin of safety ratie (ound variable cot per bottle te 3 decimal placesee 02s and fal am bution margin ratio gin of safety ratio wow souo Your anseer is incomect Try again 1225 mine the sales dollars required to earm net income of $190,000. (und answer to d decimal pleces ired sales dollas hope you are doing well

i dont know if this attachmed allow or not ?!

help me to solve it ?!

thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started