hi, i am having a hard time solving this problem from chapter 16 problem 16.11A. its from the book of fundamental accounting.

thank you

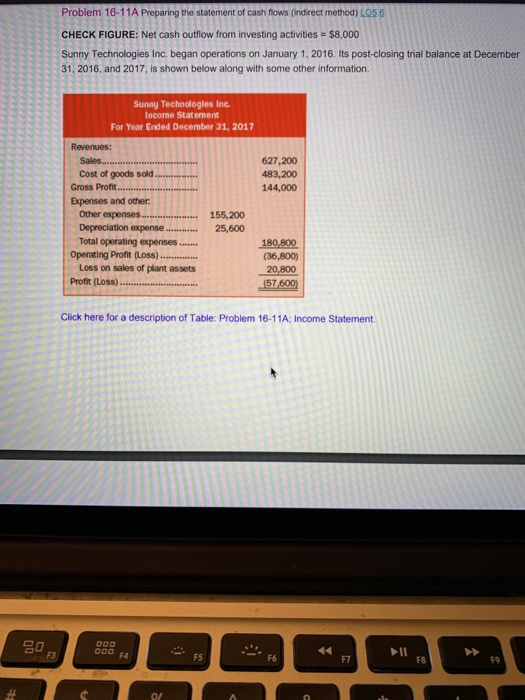

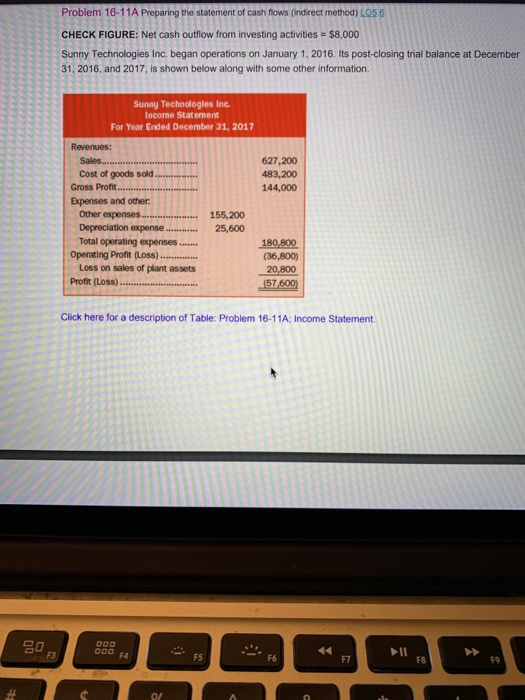

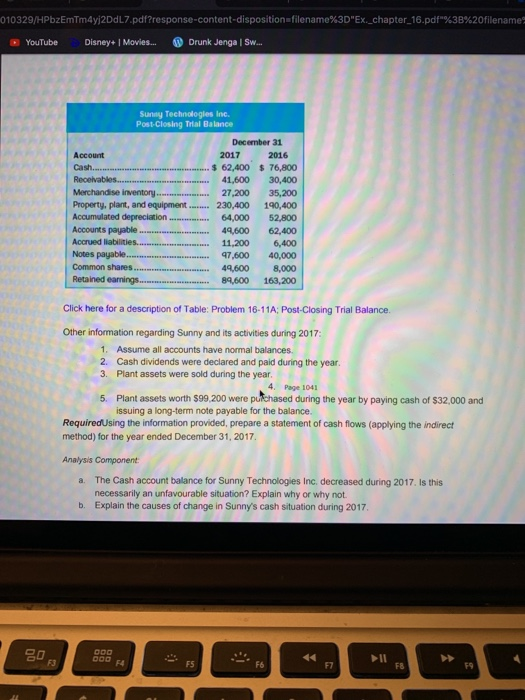

Problem 16-11A Preparing the statement of cash flows (indirect method) 05.6 CHECK FIGURE: Net cash outflow from investing activities = $8,000 Sunny Technologies Inc. began operations on January 1, 2016. Its post-closing trial balance at December 31, 2016, and 2017, is shown below along with some other information Sunny Technologles Inc. Income Statement For Year Ended December 31, 2017 627,200 483,200 144,000 Revenues: Sales... Cost of goods sold Gross Profit.... Expenses and other Other expenses. Depreciation expense ......... Total operating expenses...... Operating Profit (Loss)...... Loss on sales of plant assets Profit (Loss) 155,200 25,600 180,800 (36,800) 20,800 (57.600) Click here for a description of Table: Problem 16-11A; Income Statement 20 DOO GOD F4 F3 F5 F6 F7 F8 79 01 010329/HPb2EmTm4yj2DdL7.pdf?response-content-disposition=filename%3D"Ex._chapter_16.pdf"%3B%20filename YouTube Disney+Movies... Drunk Jenga SW... Sunny Technologies Inc. Post Closing Trial Balance December 31 Account 2017 2016 Cash $ 62,400 $ 76,800 Receivables... 41,600 30,400 Merchandise inventory .............. 27,200 35,200 Property, plant, and equipment....... 230,400 190,400 Accumulated depreciation......... 64,000 52,800 Accounts payable.... 49,600 62,400 Accrued liabilities. 11,200 6,400 Notes payable... 97,600 40,000 Common shares.... 49,600 8,000 Retained earnings... 89,600 163,200 Click here for a description of Table: Problem 16-11A: Post-Closing Trial Balance Other information regarding Sunny and its activities during 2017: 1. Assume all accounts have normal balances 2. Cash dividends were declared and paid during the year. 3. Plant assets were sold during the year. 4. Page 1041 5. Plant assets worth $99 200 were putehased during the year by paying cash of $32,000 and issuing a long-term note payable for the balance. Required Using the information provided, prepare a statement of cash flows (applying the indirect method) for the year ended December 31, 2017 a. Analysis Component The Cash account balance for Sunny Technologies Inc, decreased during 2017. Is this necessarily an unfavourable situation? Explain why or why not. Explain the causes of change in Sunny's cash situation during 2017 b 80 DOO F3 DO- 74 FS F6 F7 F8 F9 Problem 16-11A Preparing the statement of cash flows (indirect method) 05.6 CHECK FIGURE: Net cash outflow from investing activities = $8,000 Sunny Technologies Inc. began operations on January 1, 2016. Its post-closing trial balance at December 31, 2016, and 2017, is shown below along with some other information Sunny Technologles Inc. Income Statement For Year Ended December 31, 2017 627,200 483,200 144,000 Revenues: Sales... Cost of goods sold Gross Profit.... Expenses and other Other expenses. Depreciation expense ......... Total operating expenses...... Operating Profit (Loss)...... Loss on sales of plant assets Profit (Loss) 155,200 25,600 180,800 (36,800) 20,800 (57.600) Click here for a description of Table: Problem 16-11A; Income Statement 20 DOO GOD F4 F3 F5 F6 F7 F8 79 01 010329/HPb2EmTm4yj2DdL7.pdf?response-content-disposition=filename%3D"Ex._chapter_16.pdf"%3B%20filename YouTube Disney+Movies... Drunk Jenga SW... Sunny Technologies Inc. Post Closing Trial Balance December 31 Account 2017 2016 Cash $ 62,400 $ 76,800 Receivables... 41,600 30,400 Merchandise inventory .............. 27,200 35,200 Property, plant, and equipment....... 230,400 190,400 Accumulated depreciation......... 64,000 52,800 Accounts payable.... 49,600 62,400 Accrued liabilities. 11,200 6,400 Notes payable... 97,600 40,000 Common shares.... 49,600 8,000 Retained earnings... 89,600 163,200 Click here for a description of Table: Problem 16-11A: Post-Closing Trial Balance Other information regarding Sunny and its activities during 2017: 1. Assume all accounts have normal balances 2. Cash dividends were declared and paid during the year. 3. Plant assets were sold during the year. 4. Page 1041 5. Plant assets worth $99 200 were putehased during the year by paying cash of $32,000 and issuing a long-term note payable for the balance. Required Using the information provided, prepare a statement of cash flows (applying the indirect method) for the year ended December 31, 2017 a. Analysis Component The Cash account balance for Sunny Technologies Inc, decreased during 2017. Is this necessarily an unfavourable situation? Explain why or why not. Explain the causes of change in Sunny's cash situation during 2017 b 80 DOO F3 DO- 74 FS F6 F7 F8 F9