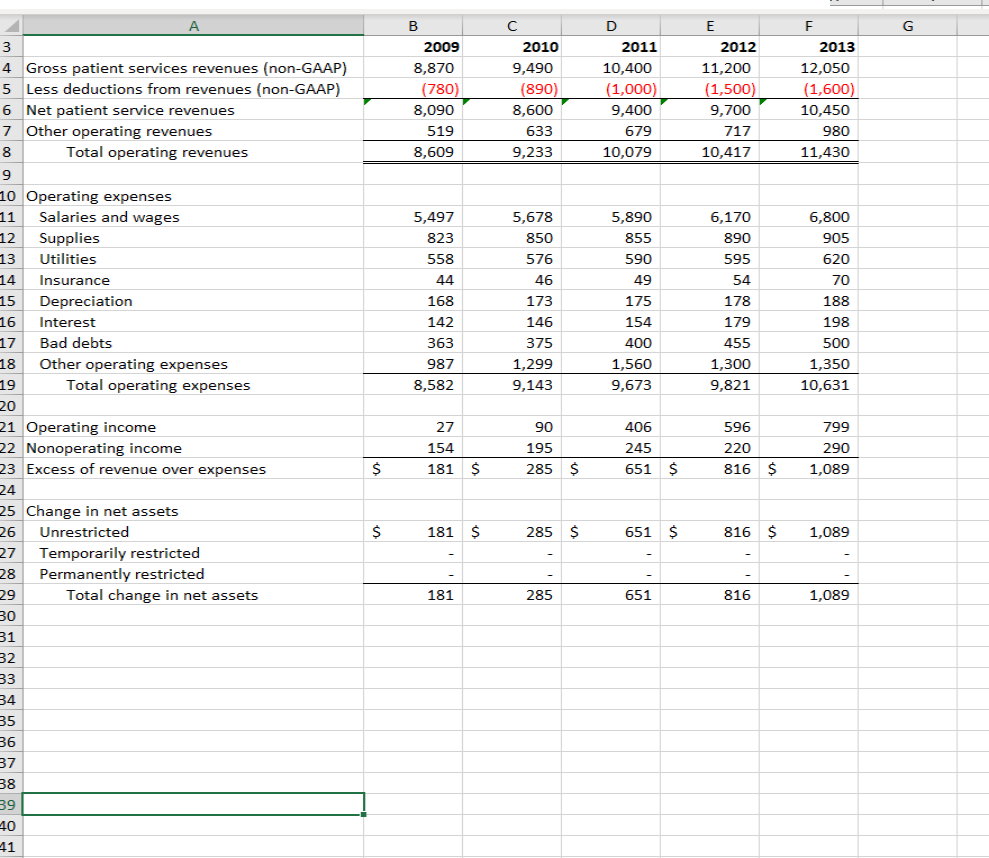

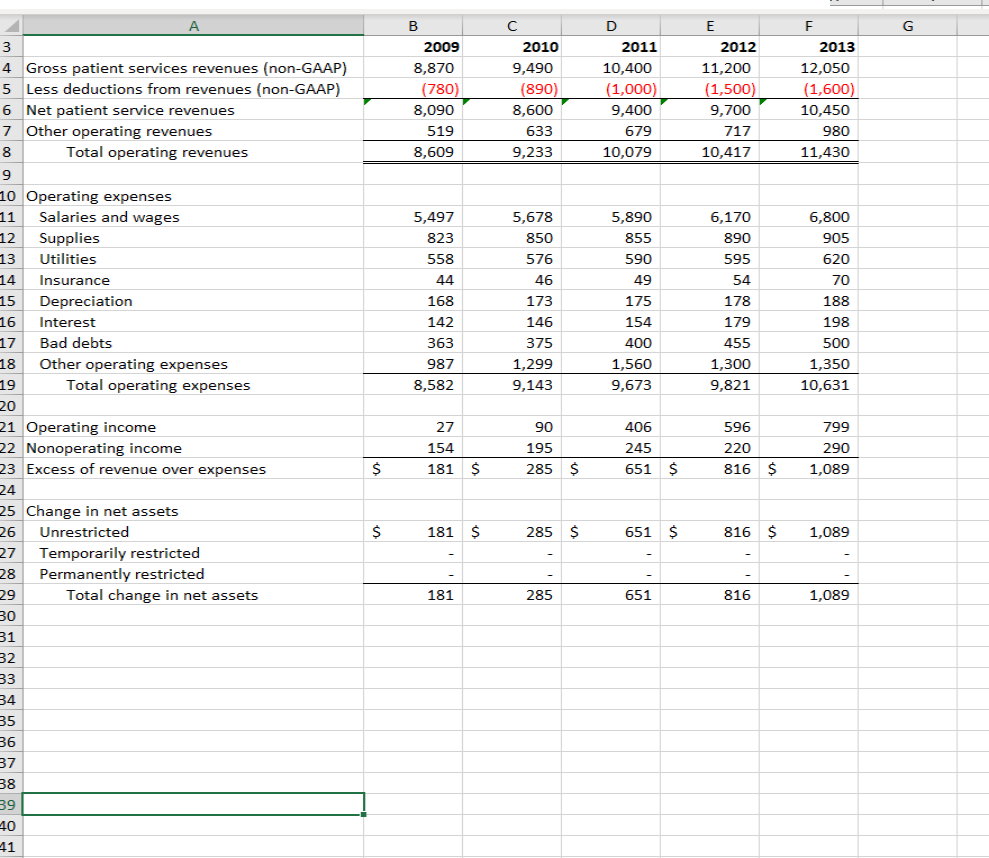

Hi, I am having problems finding calculating "times interest earned" for Jiranna Healthcare

I only need to know what to calculate and where to find it.

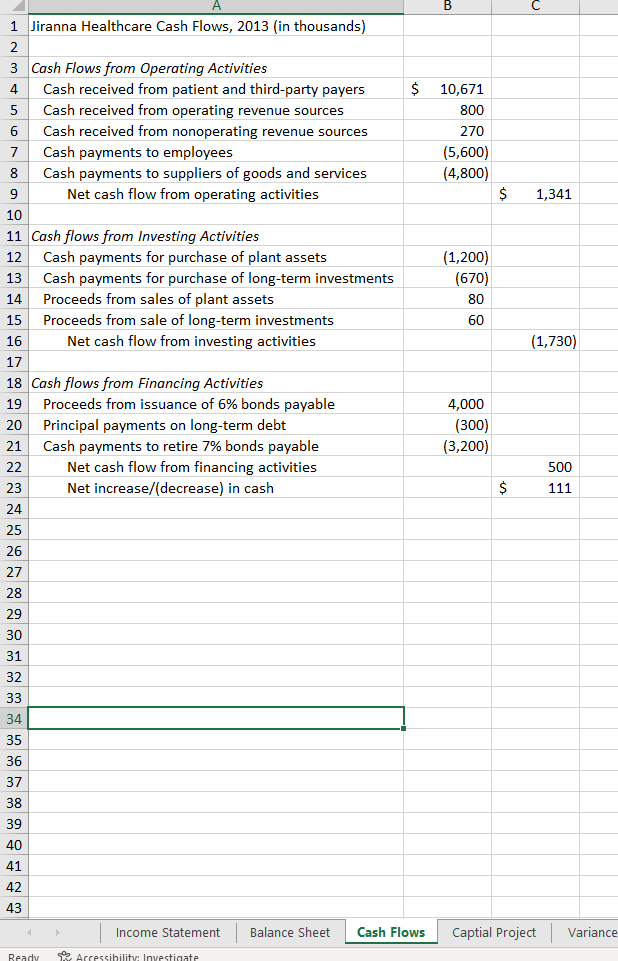

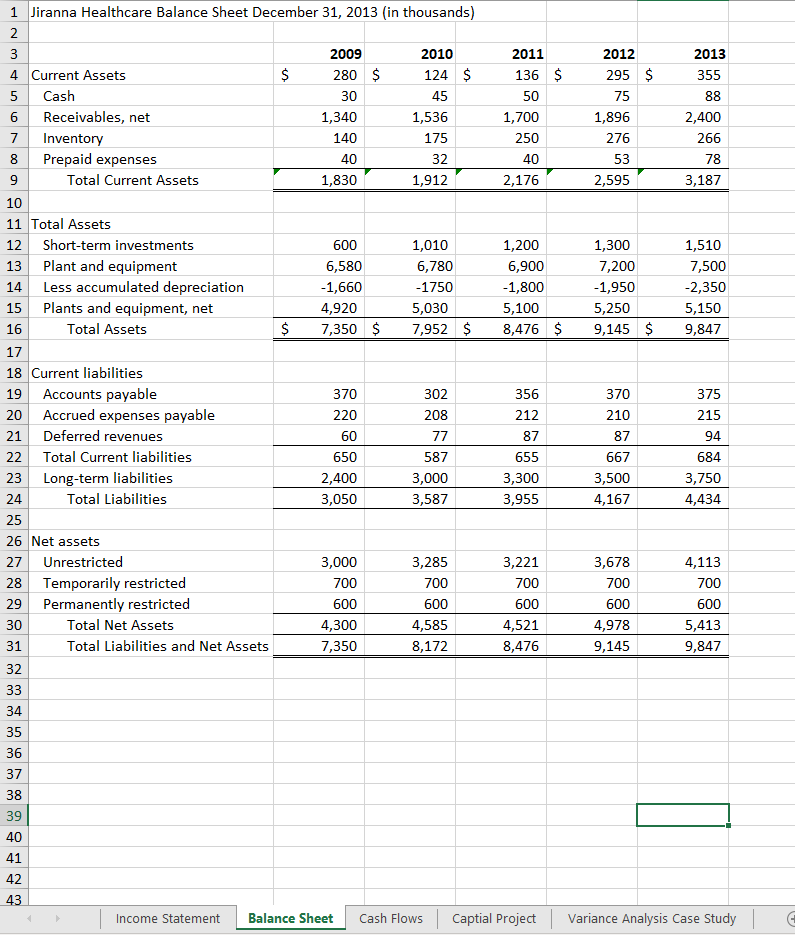

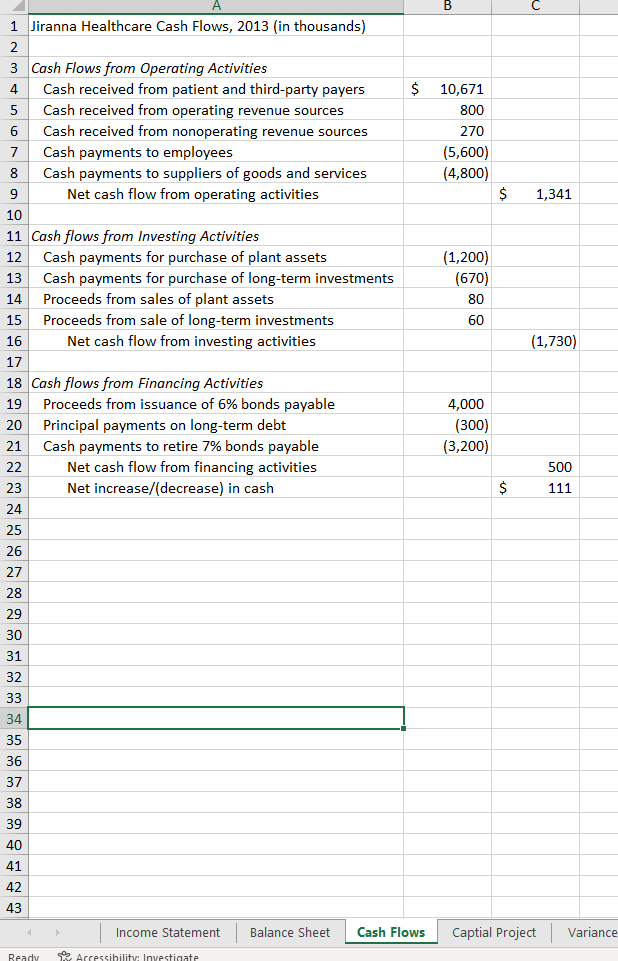

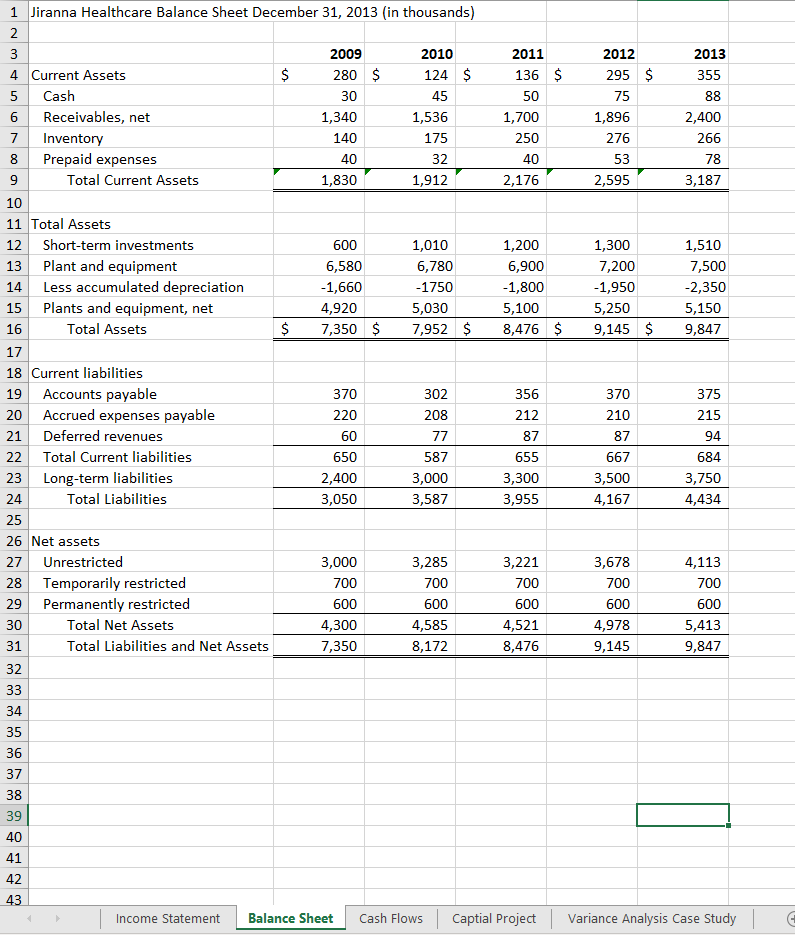

A G D 2011 B 2009 8,870 (780) 8,090 519 8,609 C 2010 9,490 (890) 8,600 633 9,233 10,400 (1,000) 9,400 679 10,079 E 2012 11,200 (1,500) 9,700 717 10,417 F 2013 12,050 (1,600) 10,450 980 11,430 5,497 823 558 44 168 142 363 987 8,582 5,678 850 576 46 173 146 375 1,299 9,143 5,890 855 590 49 175 154 6,170 890 595 54 178 179 455 1,300 9,821 6,800 905 620 70 188 198 500 1,350 10,631 400 1,560 9,673 3 4 Gross patient services revenues (non-GAAP) 5 Less deductions from revenues (non-GAAP) 6 Net patient service revenues 7 Other operating revenues 8 Total operating revenues 9 10 Operating expenses 11 Salaries and wages 12 Supplies 13 Utilities 14 Insurance 15 Depreciation 16 Interest 17 Bad debts 18 Other operating expenses 19 Total operating expenses 20 21 Operating income 22 Nonoperating income 23 Excess of revenue over expenses 24 25 Change in net assets 26 Unrestricted 27 Temporarily restricted 28 Permanently restricted 29 Total change in net assets 30 31 32 33 34 35 36 37 38 39 40 41 27 154 181 90 195 285 $ 406 245 651 $ 596 220 816 799 290 1,089 $ $ $ $ 181 $ 285 $ 651 S 816 $ 1,089 181 285 651 816 1,089 B $ 10,671 800 270 (5,600) (4,800) 9 $ 1,341 1 Jiranna Healthcare Cash Flows, 2013 in thousands) 2 3 Cash Flows from Operating Activities 4 Cash received from patient and third-party payers 5 Cash received from operating revenue sources 6 Cash received from nonoperating revenue sources 7 Cash payments to employees 8 Cash payments to suppliers of goods and services Net cash flow from operating activities 10 11 Cash flows from Investing Activities 12 Cash payments for purchase of plant assets 13 Cash payments for purchase of long-term investments 14 Proceeds from sales of plant assets 15 Proceeds from sale of long-term investments 16 Net cash flow from investing activities 17 18 Cash flows from Financing Activities 19 Proceeds from issuance of 6% bonds payable 20 Principal payments on long-term debt 21 Cash payments to retire 7% bonds payable 22 Net cash flow from financing activities 23 Net increase/(decrease) in cash 24 (1,200) (670) 80 60 (1,730) 4,000 (300) (3,200) 500 111 $ 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 Income Statement Balance Sheet Cash Flows Captial Project Variance Ready Accessibility: Investigate 2011 136 $ 50 1,700 250 40 2,176 2012 295 $ 75 1,896 276 53 2,595 2013 355 88 2,400 266 78 3,187 00 9 1 Jiranna Healthcare Balance Sheet December 31, 2013 in thousands) 2 3 2009 2010 4 Current Assets $ 280 $ 124 $ 5 Cash 30 45 Receivables, net 1,340 1,536 7 Inventory 140 175 8 Prepaid expenses 40 32 9 Total Current Assets 1,830 1,912 10 11 Total Assets 12 Short-term investments 600 1,010 13 Plant and equipment 6,580 6,780 14 Less accumulated depreciation -1,660 -1750 15 Plants and equipment, net 4,920 5,030 16 Total Assets $ 7,350 $ 7,952 $ 17 18 Current liabilities 19 Accounts payable 370 302 20 Accrued expenses payable 208 21 Deferred revenues 60 77 22 Total Current liabilities 650 587 23 Long-term liabilities 2,400 3,000 24 Total Liabilities 3,050 3,587 1,200 6,900 -1,800 5,100 8,476 $ 1,300 7,200 -1,950 5,250 9,145 $ 1,510 7,500 -2,350 5,150 9,847 220 356 212 87 655 3,300 3,955 370 210 87 667 3,500 4,167 375 215 94 684 3,750 4,434 25 3,678 700 600 4,978 9,145 4,113 700 600 5,413 9,847 26 Net assets 27 Unrestricted 3,000 3,285 3,221 28 Temporarily restricted 700 700 700 29 Permanently restricted 600 600 600 30 Total Net Assets 4,300 4,585 4,521 31 Total Liabilities and Net Assets 7,350 8,172 8,476 32 33 34 35 36 37 38 39 40 41 42 43 Income Statement Balance Sheet Cash Flows | Captial Project Variance Analysis Case Study